Asset Allocation | Bitcoin & Crypto

Asset Allocation | Bitcoin & Crypto

Bitcoin and the crypto revolution are no longer nascent. With the length of the blockchain continuing to grow and decentralised finance gaining ground over traditional finance, this new asset class is reshaping the investment landscape.

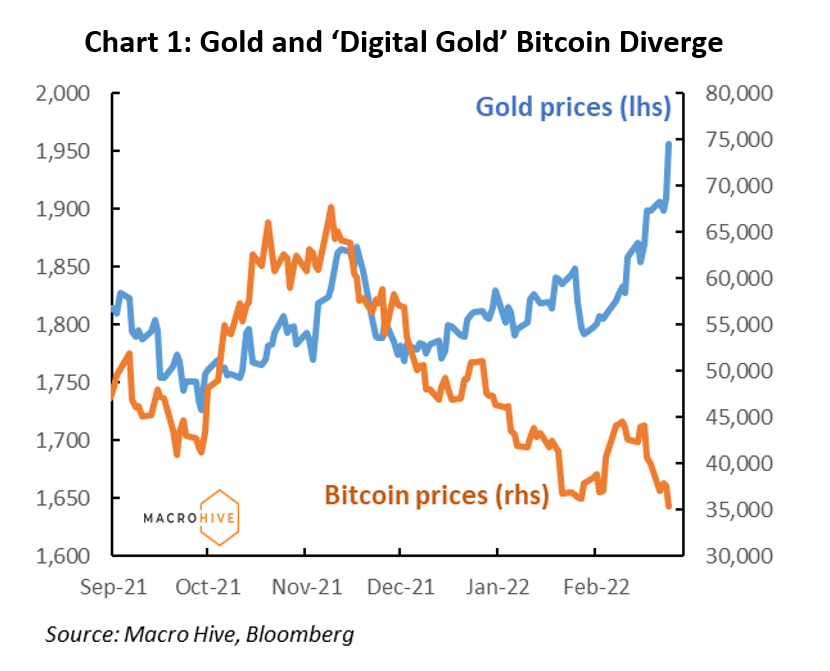

About 22% of Americans own Bitcoin. Yet a larger proportion (24%) still do not know how cryptocurrency works. And recent geopolitical upheavals (the Russia-Ukraine conflict) and exogenous macroeconomic threats (the Covid-19 pandemic) have proven crypto is still volatile and highly responsive to wider risk sentiment. Despite some having touted it as becoming a safe-haven asset like gold, the pair are moving in opposite directions (Chart 1).

So, should you have it in your portfolio? Or is it just too risky…

Founder and CIO of Senda Digital Assets Tania Reif switched to investing in crypto from top macro hedge funds like Soros Fund Management and Laurion Capital in 2019. Reif remembered hearing about bitcoin for the first time:

‘When bitcoin comes along and it has this digital scarcity and it has this ability to transact without trust [i.e., trustless], the ability to transact without a centralised way of verifying the transactions, but it’s really a decentralised system to verify the transactions and it looked that it was going to be a game changer in the world at the time.’

And with the huge liquidity injection that came with the pandemic, crypto caught a tailwind. On 12 March 2021, Bitcoin – a strong barometer for the health of the crypto scene – hit $61,283, up 226% from $18,811 just four months earlier.

Yet by October, the currency had barely reached a new high: $67,000. And between those peaks, it had suffered a 70% correction, as we covered in our crypto tracker at the time. Crypto was taking over, but it was also taking casualties. In July 2021, one corporate investor posted $299mn in losses after a crypto crash.

To invest in crypto, we must first understand it. Crypto tokens are unlike any traditional asset class. And they are all different. Just because you understand bitcoin does not mean you know how ethereum works. As Reif puts it, ‘It’s not the case that you can say, “Well, I understand bitcoin. Now that I understand bitcoin, I’m going to invest in uniswap because that’s just bitcoin for DeFi.”’

Each currency has different underlying protocols and technology. That impacts how they trade, their volatility, and how you can value them. Some are more like stocks, others commodities, and others currencies. And each token has a unique structure of supply. We explore the basics in our Explainer series, covering blockchain and distributed ledgers. And we also track how different themes within crypto function.

Yet if you can learn those differences, there are considerable opportunities available. As Founder, CEO and CIO of Morgan Creek Capital Management Mark Yusko argues,

‘It’s the greatest wealth creation opportunity I’m going to see in my lifetime. It will create more wealth than the internet. It’ll create more wealth than the mobile net. It is the greatest innovation of this century.’

Why? Primarily, Yusko argues, because it entails a macro revolution for the world of finance. And a key innovation is decentralisation and the ability to assign property rights to digital assets. ‘In a decentralised world, a creator can now create art, music…whatever you want. Now you can monetise that traffic.’ That innovation could create a new digital economy.

Yet risky coins and Ponzi schemes are prevalent. As Yusko explains,

‘There are thousands of coins, tokens. Now everyone talks about crypto, they’re not cryptocurrencies – there’s only about a dozen, like Bitcoin, Ethereum, Zcash, Dash. And a cryptocurrency is something that is a medium exchange or store of value. It is a use case of blockchain technology, whether it’s a layer one or layer two, it’s a finite set. Then you have utility tokens. Utility tokens are maybe the worst thing ever. They give you no claim on cash flows, no equity ownership. They’re not debt. They’re basically literal utility.’

Such coins, like meme coins, often enjoy meteoric rises before crashing back to Earth, leaving investors burned.

With the crypto landscape so volatile and diverse, managing risk in a portfolio is critical. That essentially means position sizing and diversification – as with any other kind of investment.

One of the best pieces of investment advice we have heard recently comes from Ari Paul, co-founder and CIO of Blocktower Capital, a crypto and blockchain investment firm. As Paul says,

Risk is only sizing. So, if you think bitcoin is too risky, you could size it at 0.1% of your portfolio or 0.001%. Too risky is never a reason not to own an asset. If something is positive expected value, risk adjusted, and relatively low correlation, you have to own it. That’s peak portfolio management 101.

At Macro Hive, we think crypto markets are a worthwhile long-term investment. But with the potential for massive drawdowns, ensure you appropriately size your exposure to coins like bitcoin and ethereum. Otherwise, crypto may claim another casualty.

For the latest insights into crypto dynamics, check out our weekly analysis.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.

Thanks this is a very interesting article!

With the US executive order in place, is there scope for further countries to implement something similar? Say the UK, France (other G7 members) if so, what would the implications of this be?