Why you need to be wary of such claims, and what we believe the future holds for bitcoin.

Be Wary of Market Gurus

You often hear market gurus saying some new asset is the next Amazon. That could be crypto assets like bitcoin or stocks like Tesla. Usually, the guru mentions the exponential benefits of network and flywheel effects. But they forget to mention the original Amazon was not such an easy call. If it were, then the guru, assuming they are in their forties, would be a billionaire. All they would have had to do was to invest $500,000 in Amazon stock after their IPO in May 1997. Maybe they did not have that much, but even a $50,000 investment would be worth over $100,000,000 today!

The guru telling you that market ‘XYZ’ is the next Amazon is likely not a billionaire. And when Amazon was in its infancy, they lacked the same conviction. The past looks clear and easy, but the future is very uncertain – hindsight is always 20/20. When you look at Amazon’s stock price since 1997, the upward price trajectory is obvious. But much harder to see are the uncertainties investors faced at each point.

Remember the Failures, Not Just the Successes

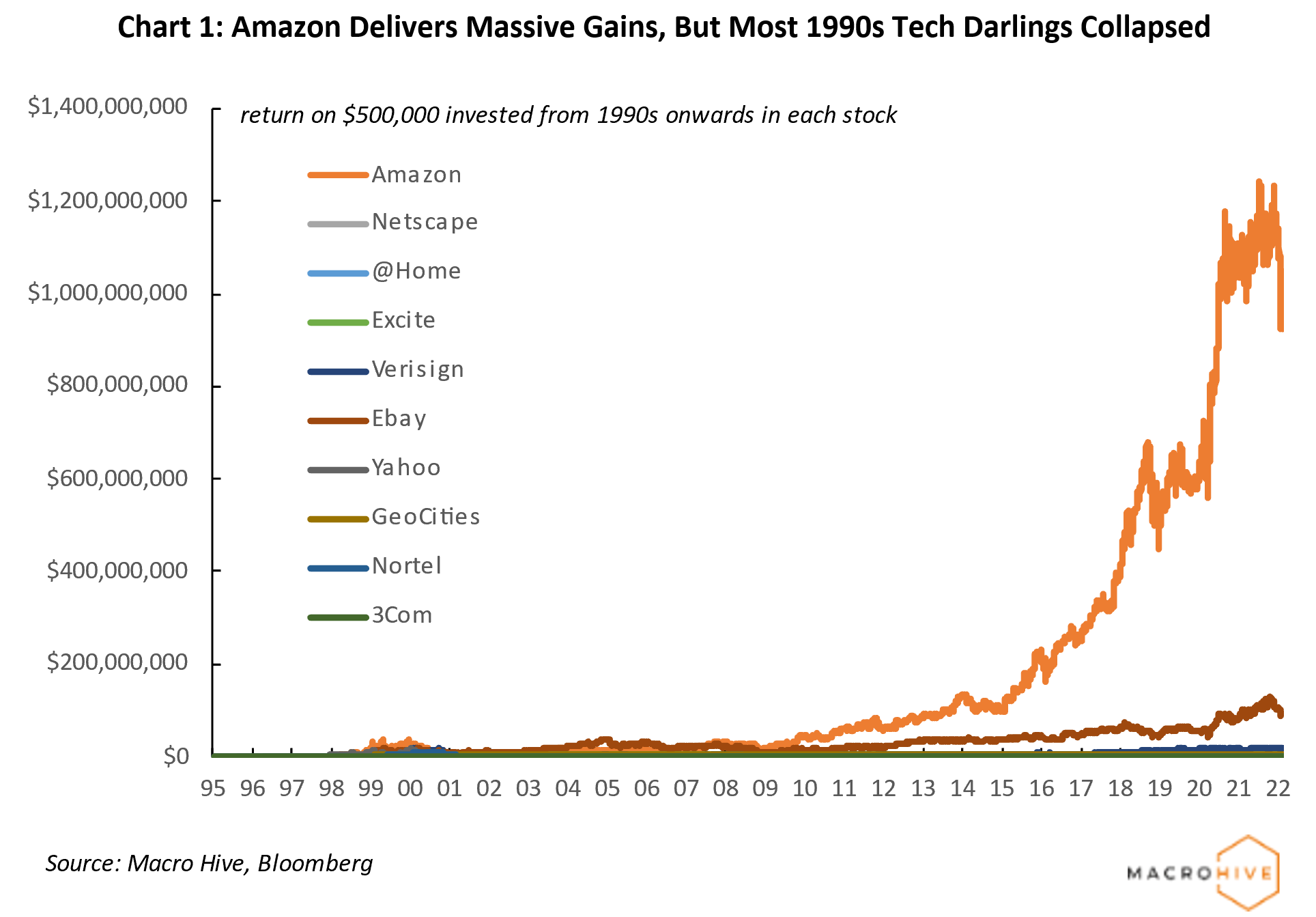

We can see this with the performance of other new darling tech stocks in that period. Companies like Yahoo, Excite and GeoCities were meant to revolutionise the internet. Meanwhile, broadband network providers like @Home, Nortel and 3Com were digitalising the communication networks.

Yet most went bankrupt or were acquired and later shut down. Had you invested your $500,000 in any of those stocks, you may have gone bankrupt (Chart 1). And even the surviving startups from that era like eBay or Verisign would have given you less than 10% of the Amazon gain.

The moral of the story is that you should be suspicious of any guru that claims they know the next Amazon. But more than that, when looking at historic price charts, understand that they hide the true uncertainty of the market at each point in time. So be wary of charts that only show gains across time.

What Is Next for Bitcoin?

So where does that leave us with the ‘Amazon’ of our time: bitcoin (and crypto markets more generally)? We think crypto markets are a worthwhile long-term investment. The technology can capture market share on some existing markets like payments and stock trading while creating new markets like valuable scarce digital assets.

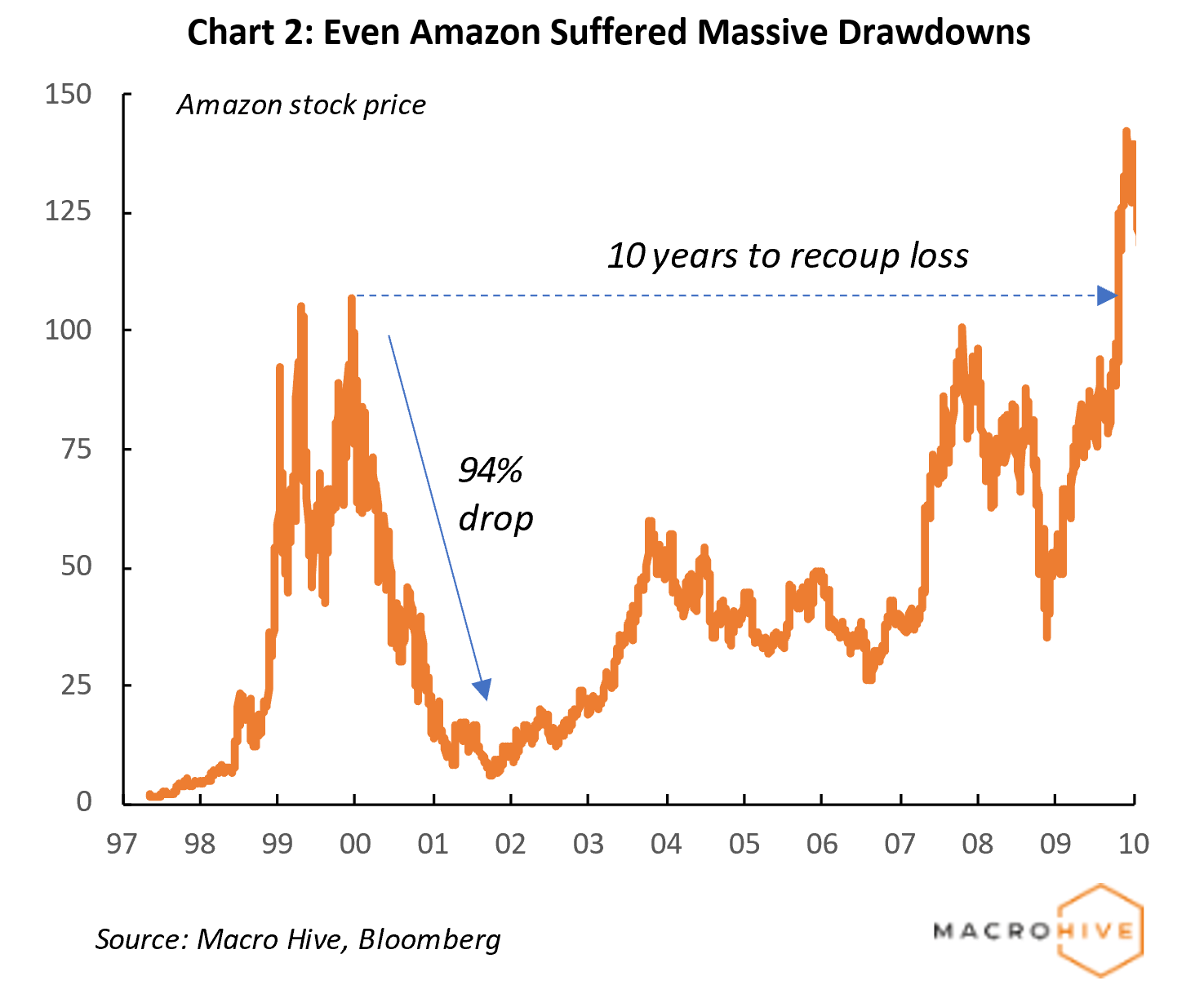

Also, remember that even Amazon suffered large drawdowns that took years to recover from. Indeed, in 2000, the stock fell 90%, and it took 10 years for the price to recover (Chart 2). So, your exposure to bitcoin needs to be appropriately sized so that you can survive 50% to 80% drawdowns.

But major drawdowns also provide good entry levels for exposure. Our metrics suggest that we are getting closer to that point, so we would consider accumulating exposure. However, we would not go max long in an environment of rising central bank rates and falling global growth momentum.

Bilal Hafeez is the CEO and Editor of Macro Hive. He spent over twenty years doing research at big banks – JPMorgan, Deutsche Bank, and Nomura, where he had various “Global Head” roles and did FX, rates and cross-markets research.