Equities got a minor lift toward the end of the week after the Senate kicked the debt ceiling can down the road to early December when, coincidently, the government is scheduled to run out of money.

The S&P 500 is now down about 2.7% from its 2 September high and will probably continue to balance various headwinds against TINA – there is no alternative – for most investors. On the (likely) plus side, the Q3 earnings season opens next week with reports from the major banks. Yellow flags will come from rising energy prices and economic reports on inflation and retail sales.

With WTI oil trading near $80/bbl, it will be interesting to see if a) shale producers ramp up production from existing wells, and b) OPEC shows signs of blinking. Historically, as oil prices rise, some producers seek to increase revenue by ‘cheating’, while Saudi Arabia and others start producing more so that the marginal producer does not enter the market and push prices down. Oil price spikes have been self-correcting. Regardless, rising fossil fuel prices have reminded consumers that renewable energy sources are nowhere near able to replace fossil fuels, which, as we discuss below, has put a damper on clean energy-related ETFs.

The key point about inflation data will be how the Fed and other central banks respond. Will they stay their stated course, letting inflation run ‘hot’ for a bit to offset an extended period of sub-2% inflation and letting clearly transitory factors end naturally? Or do they resort to historical form? When the ECB raised rates in 2011 as European inflation neared its target, it ended poorly. Central bank messaging always matters, but sometimes more than others.

Retail sales will be the first full month read on whether and how ending extended unemployment benefits is affecting household spending.

We remain constructive on equities over the medium term but acknowledge technicals appear soft at this juncture.

Our Recommended ETF List Grows

We added one new position to our recommended ETF trades this past week:

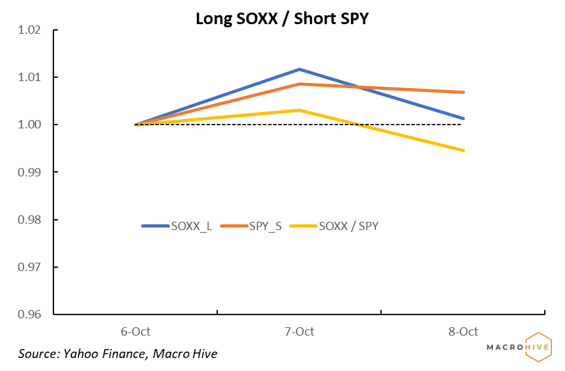

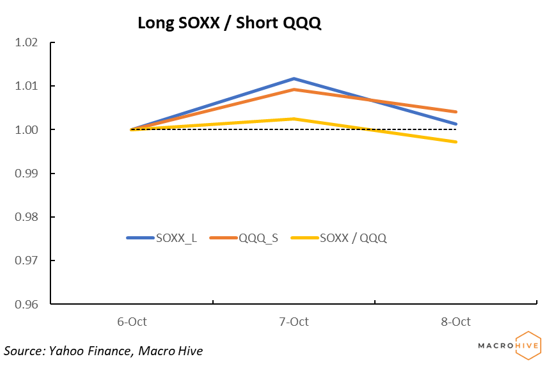

- Go long the semiconductor ETF SOXX versus either the S&P 500 (SPY) or NASDAQ 100 (QQQ). The industry is gaining pricing power for the first time in decades, and demand for digital technology will accelerate in coming years as electric cars and other technology become more widespread.

All our other positions remain unchanged:

- In the S&P 500, we stay constructive on growth versus value. We see little prospect of value outperforming while the labour market remains weak.

- Higher rates have supported financials recently, but we maintain our underweight in financials and banks in particular versus SPY. There is no indication bank lending is picking up.

- Homebuilders have struggled against the broader market, but underlying fundamentals remain robust due to low rates and tight housing supply.

- We stay negative on retail. It is losing a key source of support as extraordinary unemployment benefits expire and spending slowly returns to services.

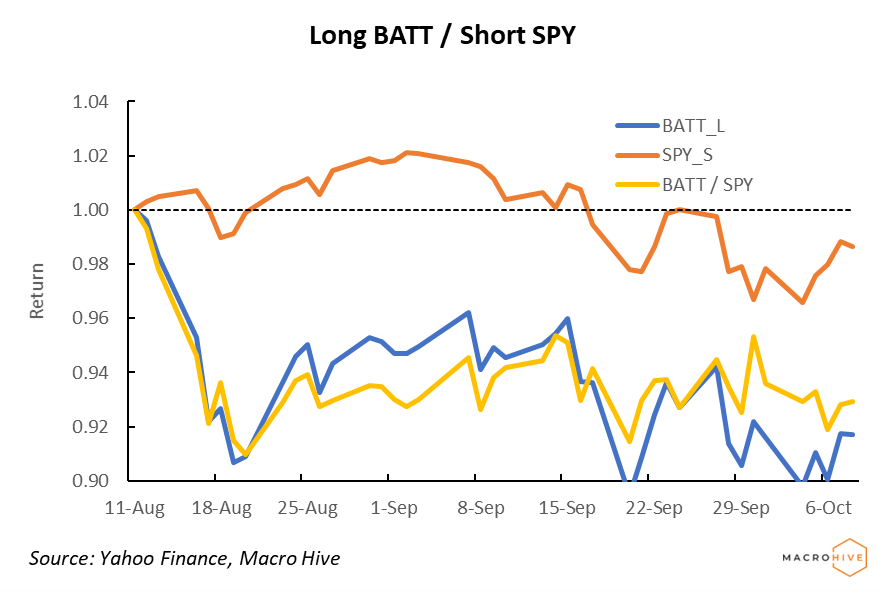

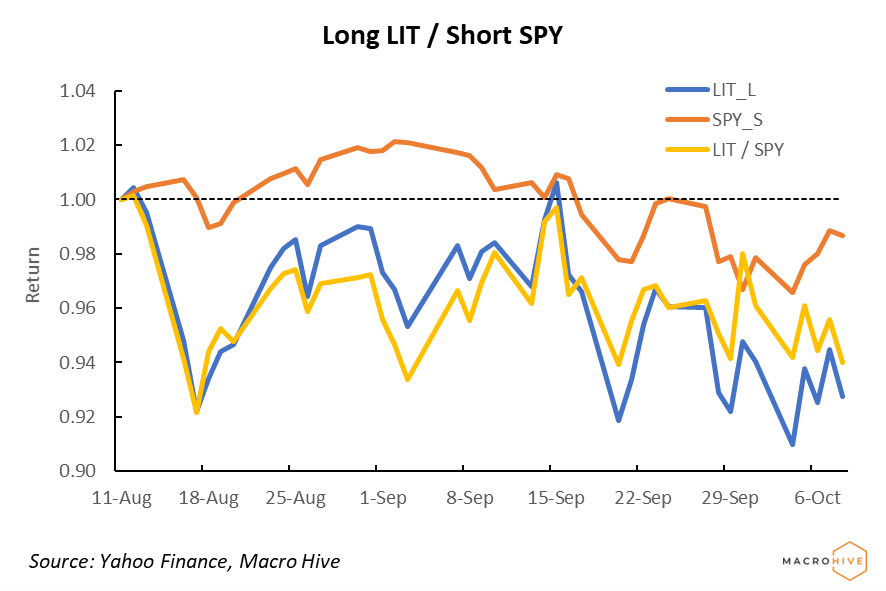

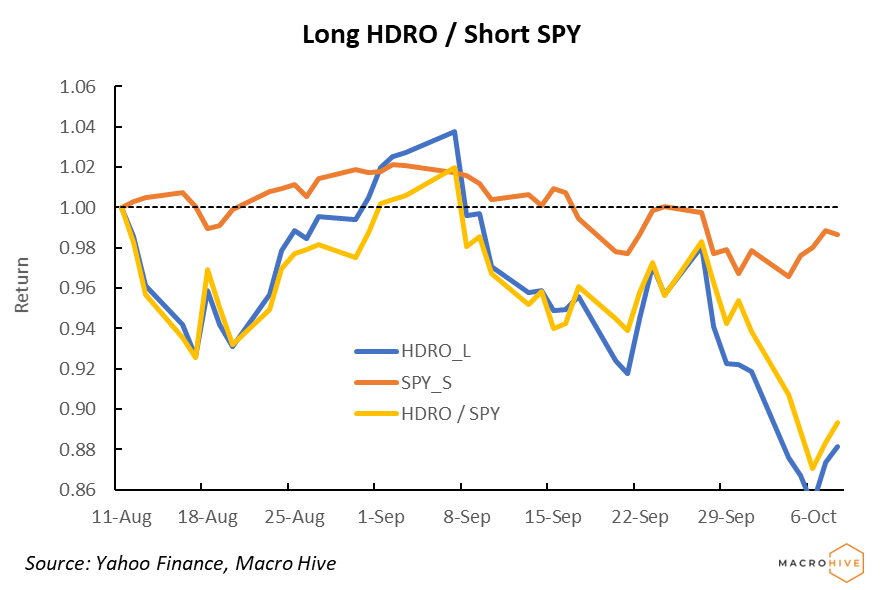

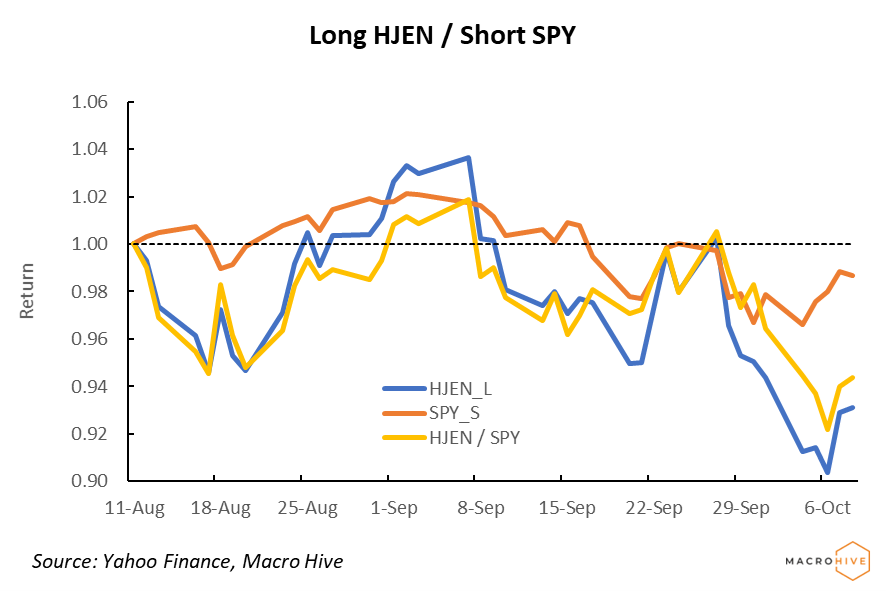

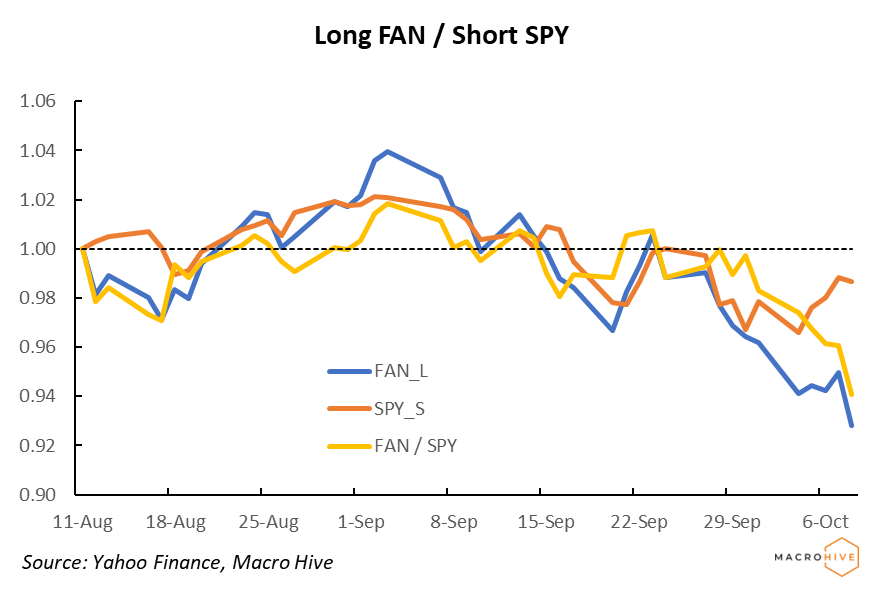

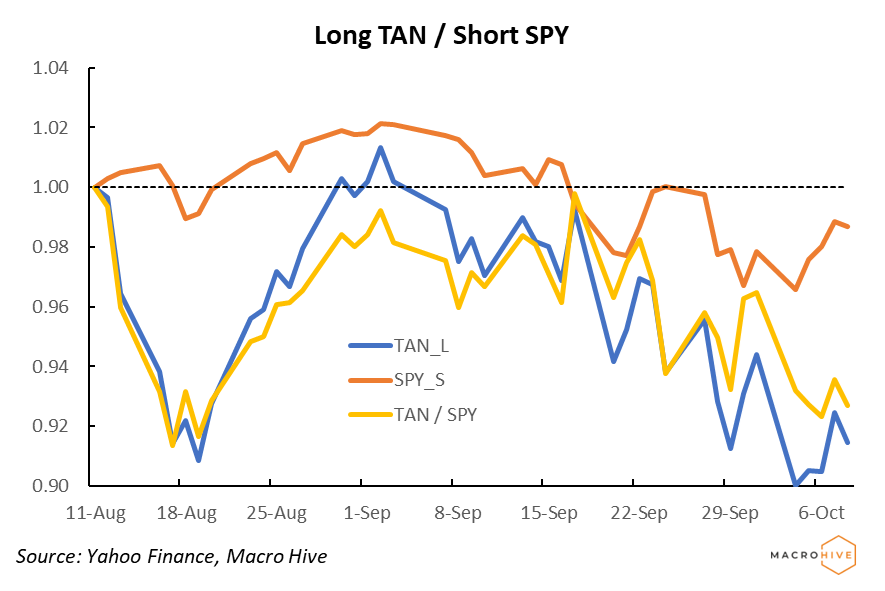

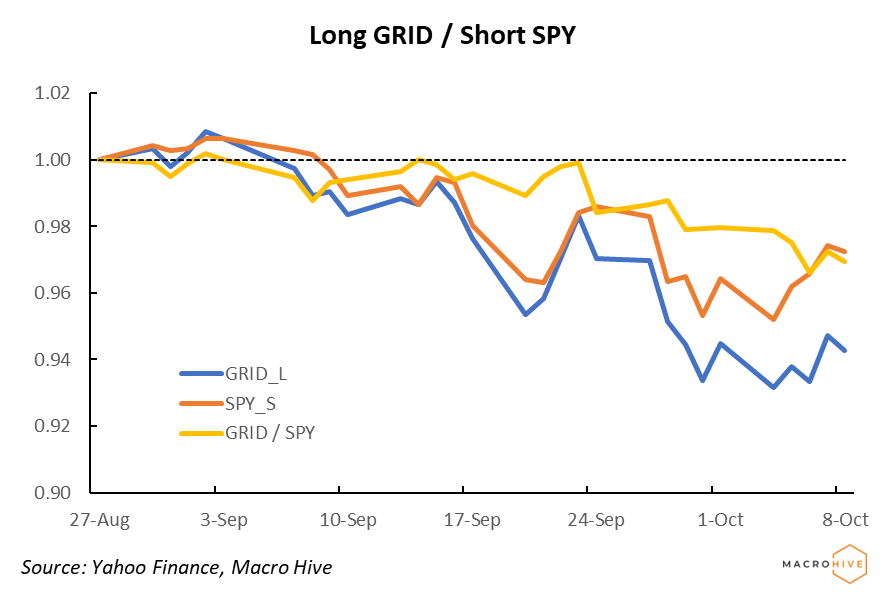

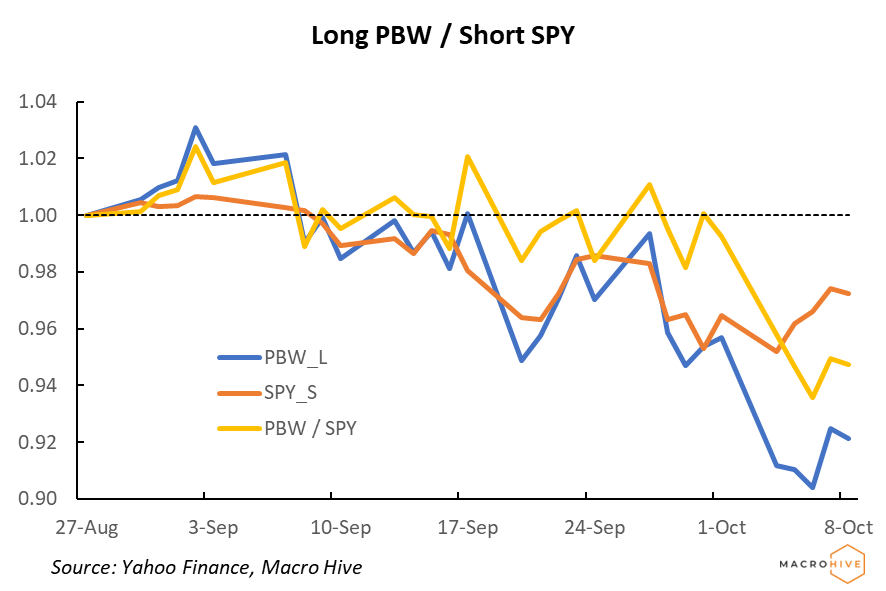

- Our clean energy ETF trades underperformed over the past week. The rise in fossil fuel energy prices has likely reminded consumers that renewables are nowhere near able to replace oil and natural gas. We stress clean energy is a longer-term and patient trade. With the COP26 meetings in November, they could soon catch a renewed bid.

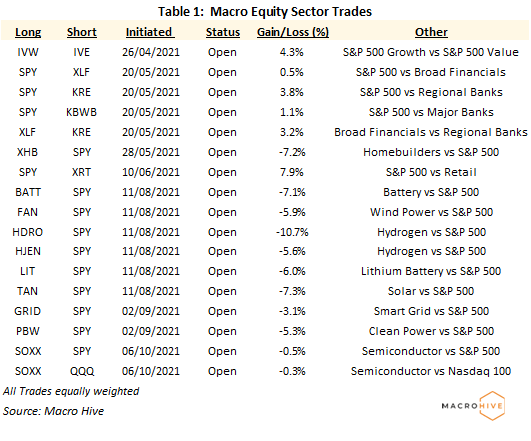

Table 1 shows the performance of our sector trades since inception.

We summarise our latest thinking on each sector view in the remaining sections.

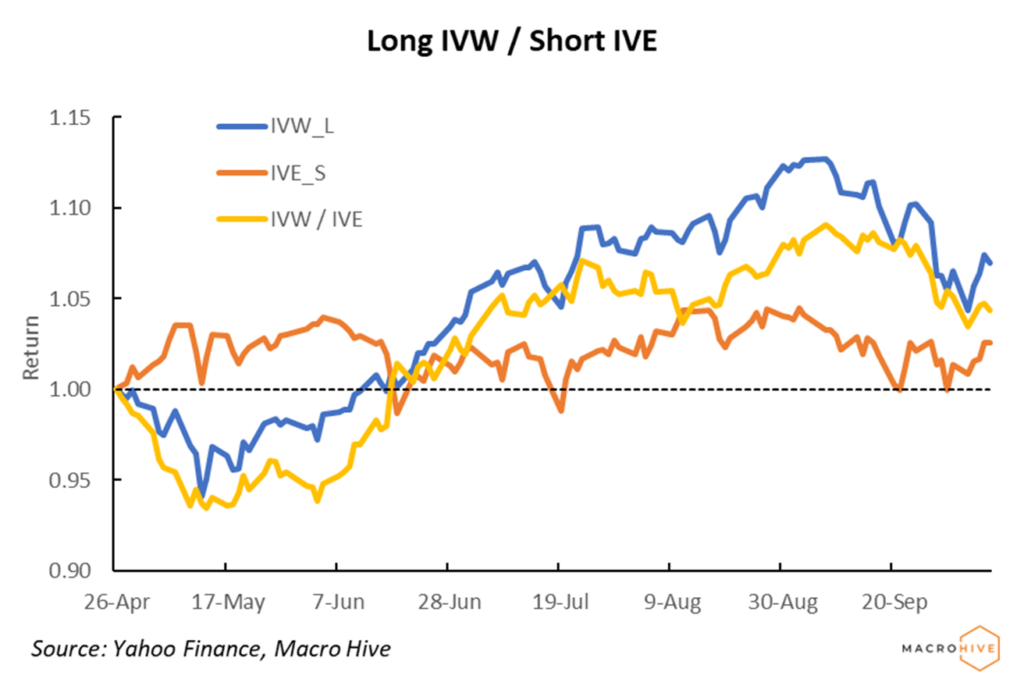

S&P 500 Growth (L) vs Value (S)

Initiated 26 April 2021 Growth and value have seesawed over the past month, but value will continue to struggle while businesses cannot hire enough workers. For smaller companies to thrive, we need sustained improvement in labour force participation. The latest NFP report was hardly encouraging there.

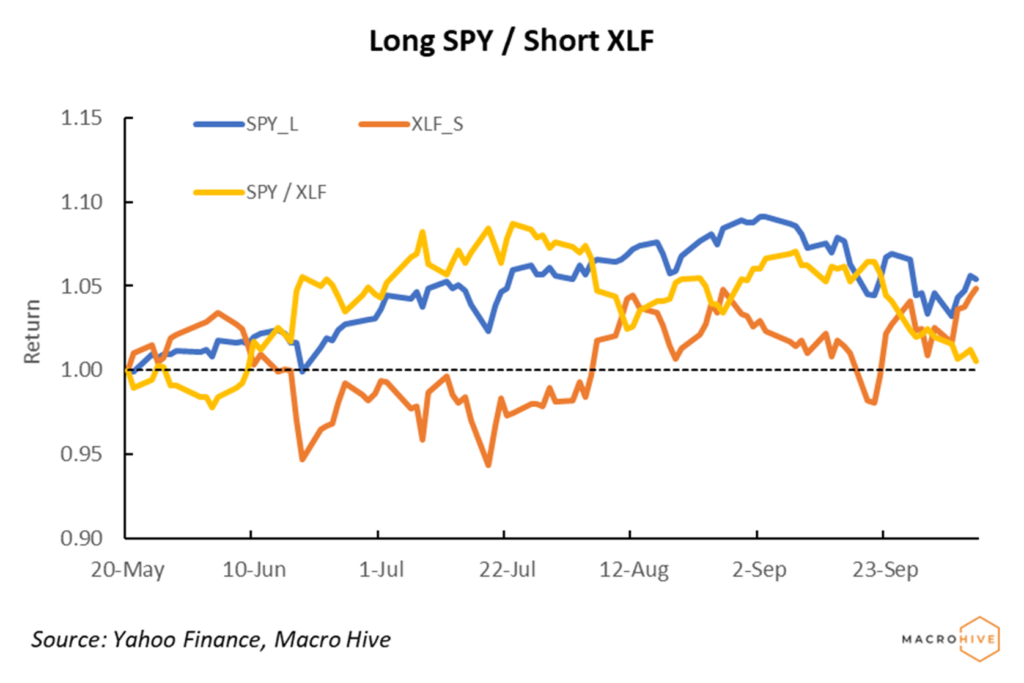

SPY vs Financials

Financials bounced back as the 10-year Treasury rose above 1.5%. We remain negative on financials, partly because we expect no sustained rise in rates and because bank loan portfolios show no sign of growth. (Long SPY / Short XLF)

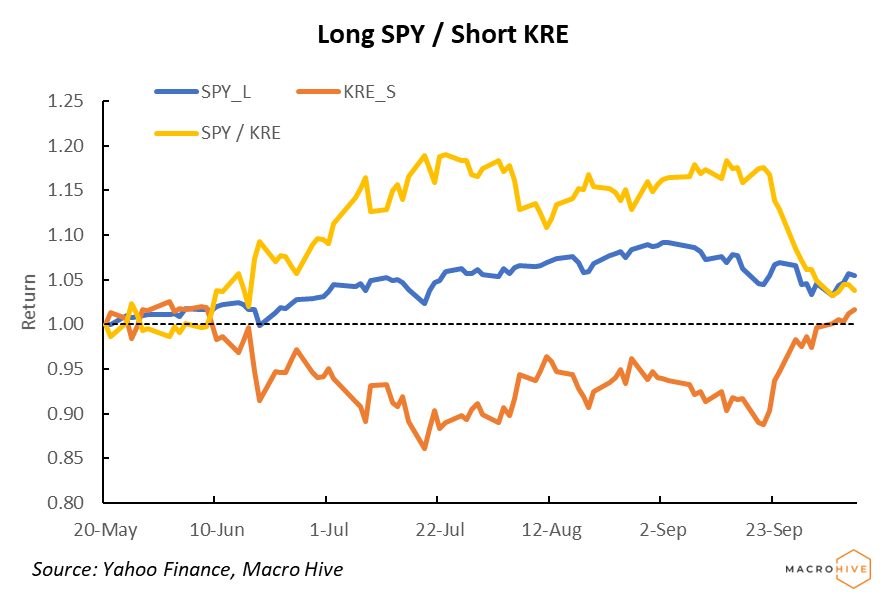

We are particularly bearish on banks, as they bear the brunt of the Fed’s QE policy.

Regional banks (KRE) have performed particularly poorly, down 17.4% so far, as they struggle to grow their loan portfolios in the face of weak demand (Long SPY / Short KRE).

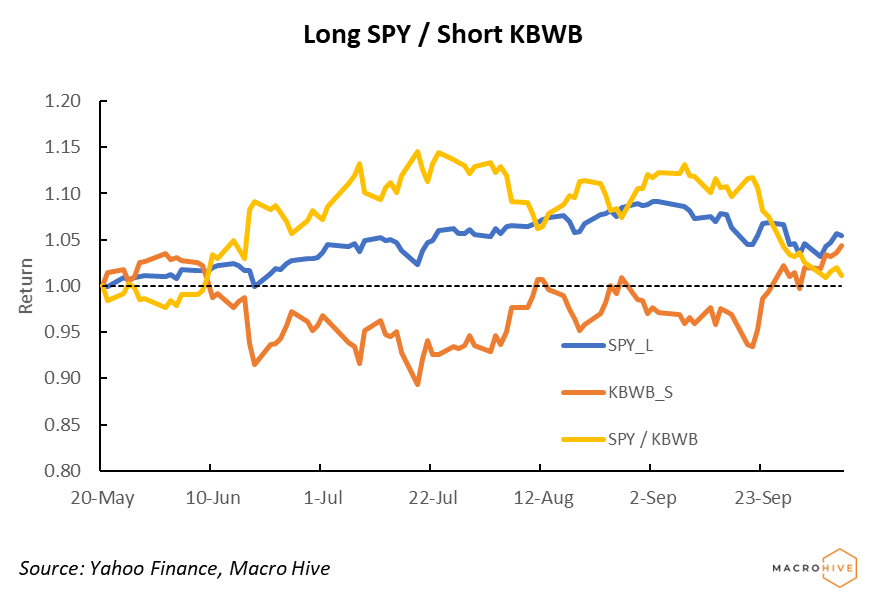

Major banks (KBWB) have performed somewhat better than regionals due to their more diversified revenue streams, particularly investment banking and trading. Still, they will be among the first to report earnings in the coming week (Long SPY / Short KBWB).

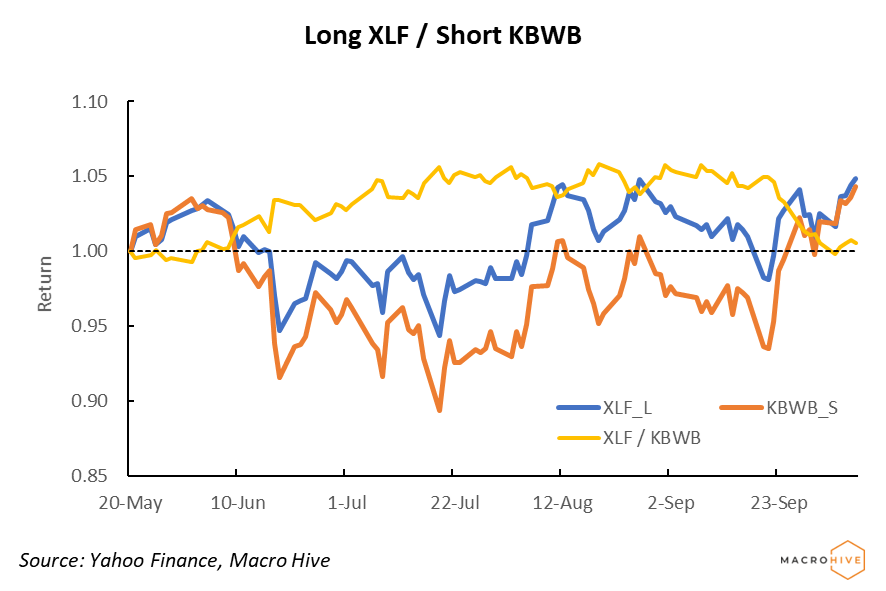

For investors interested in a long/short trade within the financial sector, we suggest being long broad financials, which includes banks, insurers, asset managers and payment companies, and short banks, whether majors or regionals (Long XLF / Short KBWB).

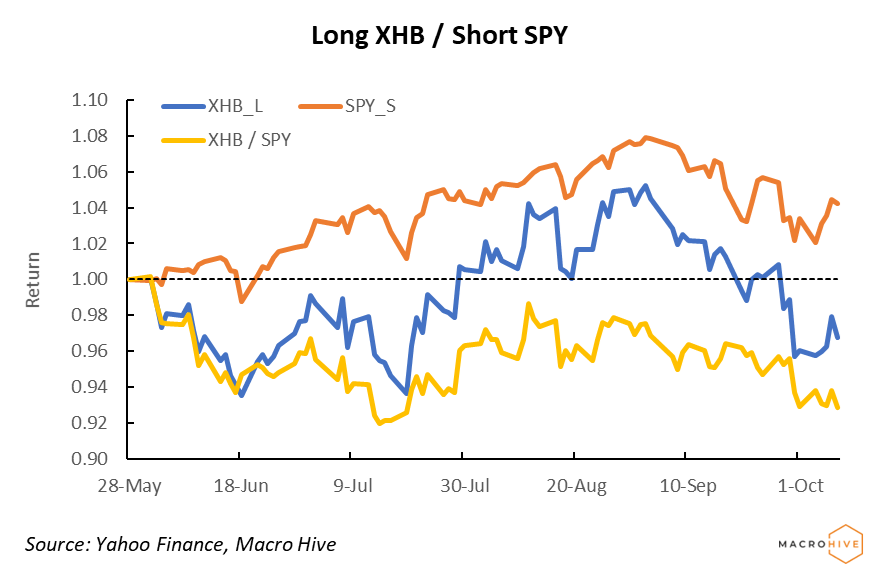

Long XHB / Short SPY

Initiated 28 May 2021 We recommended going long homebuilders on the strength of the housing recovery, low rates, and a housing inventory shortage. We view the softness in homebuilders as an opportunity to add to positions. There is some risk of rising mortgage rates when the Fed slows purchases of MBS, but underlying fundamentals are still attractive.

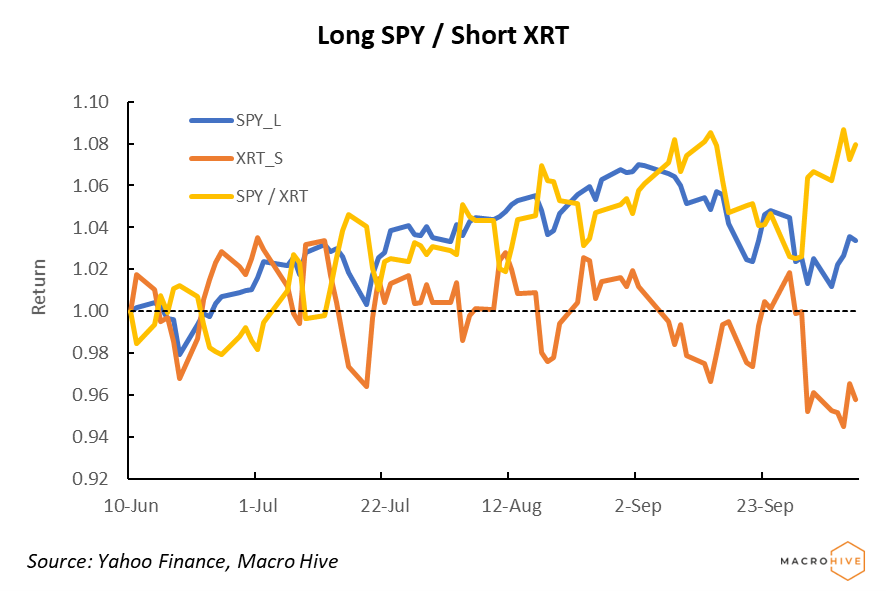

Long SPY / Short XRT

Initiated 10 June 2021 Retail sales received a huge boost during the pandemic because people needed stuff, generous unemployment benefits gave them money to spend, and spending on services collapsed. Those benefits are expiring, which should hurt retail sales especially as employment is rising too slowly to offset the loss of income. Consumption spending is also slowly returning to services.

Clean Energy

After the IPCC report on climate change came out, we proposed several trades in the clean energy sector. They all initially underperformed but, apart from BATT, are recovering or little changed.

Battery ETFs invest in the full battery supply chain, from mineral mining to processing to battery research and manufacturing. LIT focuses on the lithium sector and benefited this past week from an 11.7% surge in lithium prices.

We view weakness as a buy opportunity.

We recommend investors start accumulating positions in clean energy ETFs. Prices will likely be volatile to the upside and downside as new technologies emerge and government support remains unclear. Over the coming decade, we see significant upside in this sector.

Long SOXX / Short SPY or QQQ

The semiconductor industry has been in the news frequently in 2021 due to tight supplies that have hamstrung the auto industry particularly. This stems from a surge in demand for digital consumer products since the pandemic hit in March 2020.

The industry is enjoying pricing power for the first time in 30 years. Further, demand is likely to remain strong in coming years as electric vehicles and other clean energy technology come online.

We think semiconductors can outperform the broad equity (SPY) and tech (QQQ) markets over the medium term.

Over a 30-year career as a sell side analyst, John covered the structured finance and credit markets before serving as a corporate market strategist. In recent years, he has moved into a global strategist role.

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)