Summary

- We continue to see tech company outlooks come up short, with hopes for an AI bonanza delayed to later this year. Investor disappointment helped fuel Friday’s equity selloff.

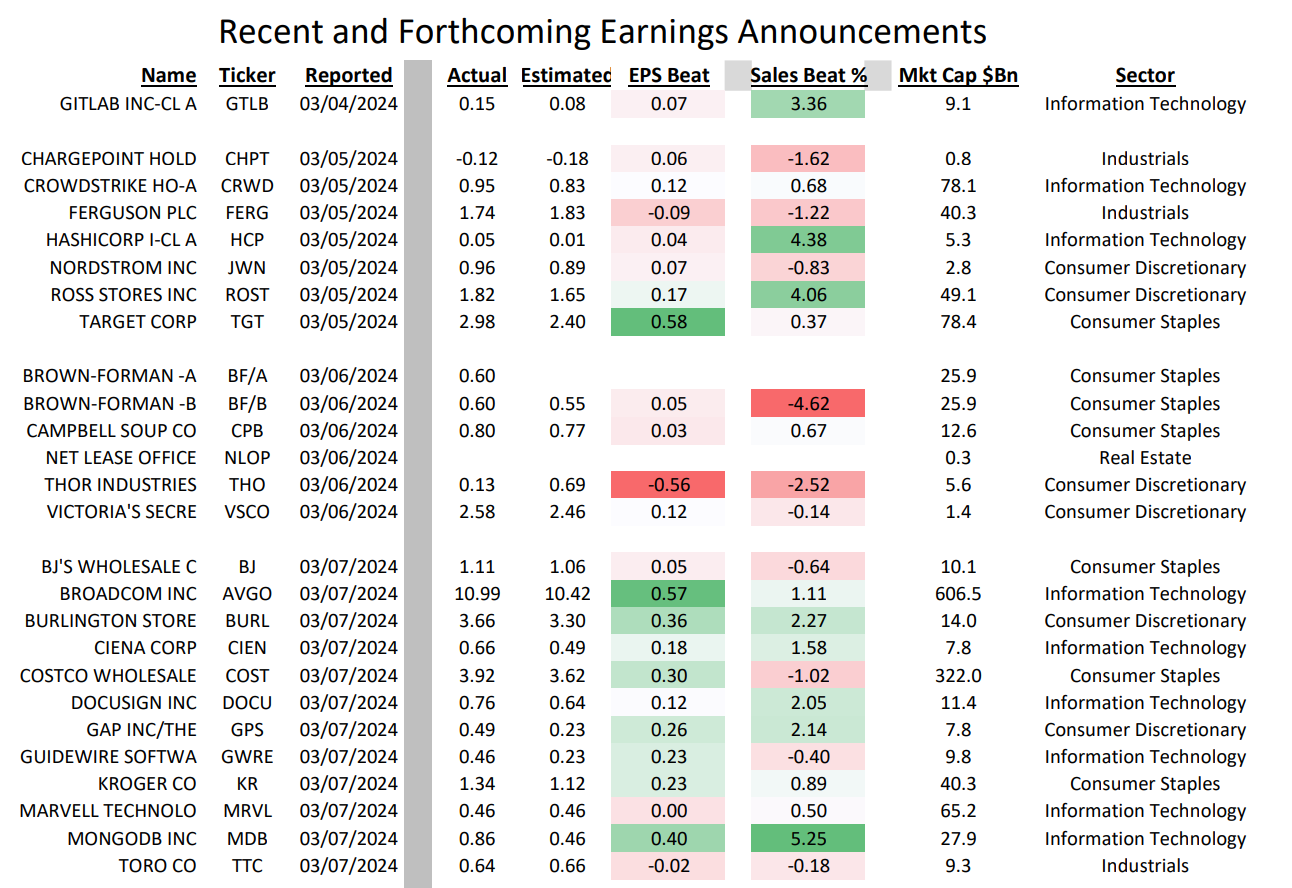

- In the retail sector, discount and off-price vendors report strong beats and good outlooks, while full price companies are struggling.

- Regardless of outlook, most retailers said the macro environment remains challenging, suggesting consumers are cautious about spending despite a strong labour market.

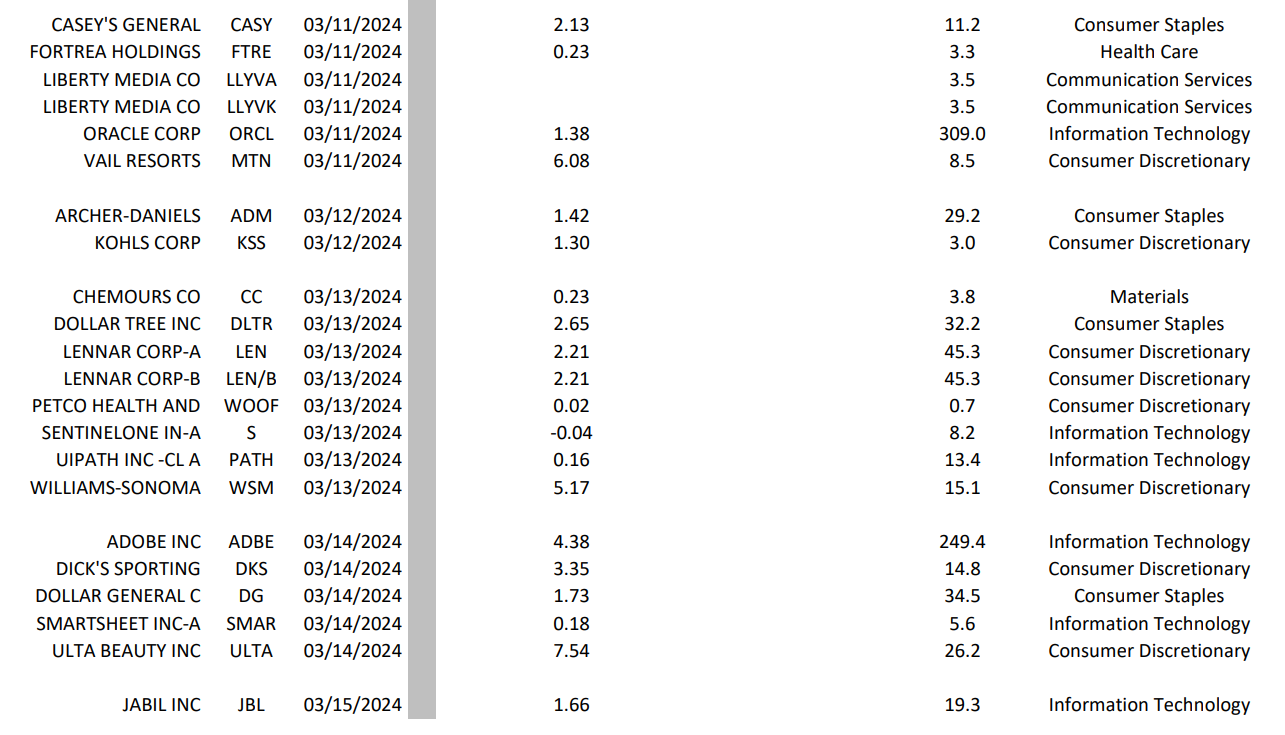

- Only 21 companies report earnings this week. Oracle and Adobe will hint at the outlook for broader AI revenue. Dollar General and Dollar Tree will report on who is shopping at their stores.

Market Implications

- After Friday’s selloff, investors will likely wait on inflation data (Tuesday) and retail sales (Wednesday) before revisiting expectations about Fed rate cuts.

What We Learned Last Week

Our Q1 earnings season themes remain intact. Tech companies not named NVIDIA still struggle to realise AI potential. Meanwhile, in the retail sector, discount vendors are doing well as full-price companies face sale declines.

AI Bonanza? Not Yet…

Broadcom (AVGO) and Marvell Technology (MRVL) are semiconductor companies. Both are expected to benefit from data centres and companies beefing up their technology to handle AI apps. Both posted earnings reports that beat expectations; both offered softer-than-expected outlooks. Both had rallied going into earnings; both relinquished those gains. MRVL said it expects to see more AI-related sales in H2. Meanwhile, AVGO said it expects AI-related chip and network sales will grow to 25% of its semiconductor revenue in 2024 versus 15% in 2023.

This follows similar announcements from various companies, included SnowFlake (SNOW), Hewlett Packard Enterprises (HPE), Salesforce (CRM), and Adobe (ADBE).

We do not doubt the growth will come. Nor are we surprised it may come slowly. Perhaps establishing the capacity to meet the demand is taking time. Or maybe potential customers are not ready to buy the equipment yet. HPE mentioned difficulties buying the graphical chips to produce AI-related products. You can imagine many companies and data centres are waiting to buy various equipment for the same reason.

Ciena (CIEN) is another networking equipment company that has not played up AI prospects. It said sales were slow because customers are still working off excess inventories. Various tech and industrial companies have made similar comments, leading us to think many companies are offering outlooks consistent with GDP growth in the 1.5-2.0% range.

Discount Retailers Gain

Retailer performance strongly indicates consumers are focused on value. Upscale Nordstrom (JWN) sees little growth in overall revenue in 2024; the only growing part of the business is its off-price Rack Division. TJX Maxx (TJX), which buys unwanted name-brand inventory and sells it at a discount, is booming. Discount department store Ross Stores (ROST) posted a large beat.

Meanwhile, full-price Victoria’s Secret is dealing with declining sales. Inflation is part of the problem; soft demand for intimate wear is another – post Covid, people are spending money to go out rather than have fun in the bedroom. Facing weak sales, Macy’s (M) announced plans to close around 100 stores. It is fending off a buyout offer from an activist investor.

Bellwether Target (TGT) finally turned the corner, getting its inventory problems under control. It announced plans to open up to 300 large-format stores in the coming decade. These would be significantly bigger than most TGT stores today.

Meanwhile, electronics and appliance retailer Best Buy (BBY) plans to close some stores and switch to a small-format scheme to reduce the risk of getting caught with outdated technology inventory.

One comment from many retailers across the price spectrum is that the macro environment remains challenging – another datapoint consistent with the 1.5%-2.0% GDP outlook.

About That Friday Selloff…

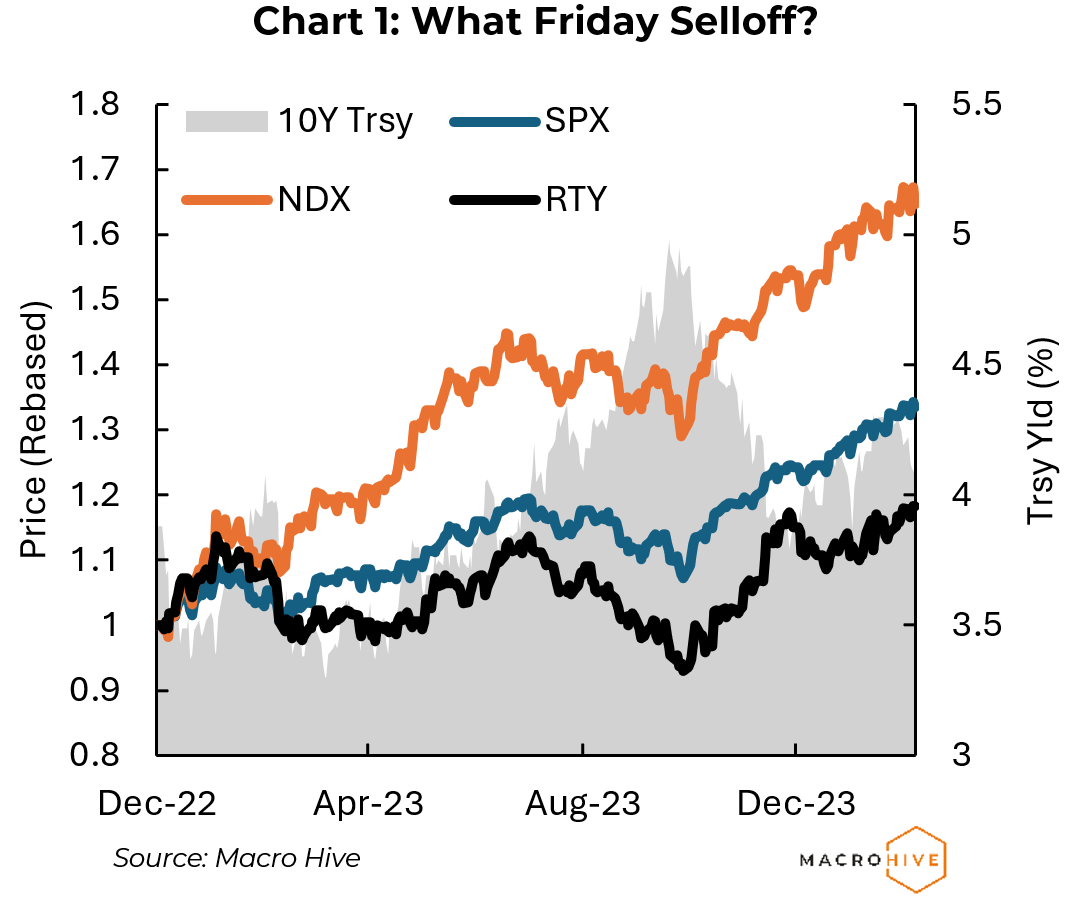

The labour market report was initially tagged as a Goldilocks event: strong hiring as good for growth, and a moderate wage increase as good for inflation and Fed rate cuts. Both S&P 500 (SPX) and NASDAQ 100 (NDX) initially rallied, then sold off, leaving them down 0.6% and 1.5%, respectively, on the day.

The soft outlooks from AVGO and MRVL did not help. But more importantly, there really was little in the report to inspire confidence about rate cuts sooner rather than later. And Tuesday’s CPI report will be the hard data that matters.

Meanwhile, the Russell 2000 (RTY) was little changed on the day. When SPX picks up a sniffle, RTY tends to come down with flu. But not this time – this selloff was primarily a tech event and will likely give investors a window to add to positions.

Also worth noting – over the past year, the SPX had 37 similar or larger one-day declines; the NASDAQ has had 16. So, these things do happen. Indeed, against the gains of the past year, Friday’s selloff barely registered (Chart 1).

The Week Ahead

Only about 21 companies report this week, but it is an interesting mix.

On the tech side, Oracle (ORCL) and Adobe Inc (ADBE) will refresh their AI-related outlooks. ADBE may address any potential threat that Open AI’s text-to-video product Sora poses to its creative suite products.

Discount retailers Dollar General (DG) and Dollar Tree (DLTR) will provide more colour on what consumers are buying and where.

And homebuilder Lennar (LEN) will likely report solid demand for its new homes.

We expect investors will wait on Tuesday’s CPI data and Wednesday’s retail sales data before revisiting and maybe revising expectations about Fed rate cuts. The move back into tech could start sooner.

Among key reports this week:

Monday

- Oracle Corp (ORCL

- Vail Resorts

Tuesday

- Archer-Daniels (ADM)

- Kohls Corp (KSS)

Wednesday

- Dollar Tree (DLTR)

- Lennar Corp (LEN)

Thursday

- Adobe Inc (ADBE)

- Dick’s Sporting Goods (DKS)

- Dollar General Corp (DG)