Commodities | Equities | ESG & Climate Change

Commodities | Equities | ESG & Climate Change

In its latest report, the International Panel on Climate Change (IPCC) was as blunt as possible. Global temperatures will be hotter, and some climate changes are already irreversible. Scientists accepted a temperature rise to +1.5°C is now unavoidable – damage limitation has become the goal.

The report makes clear that to have any chance of limiting the gain to +1.5°C, a concerted global effort to cut fossil fuel use and reach net zero by 2050 must start now – and removing large quantities of carbon from the atmosphere will be essential. Absent such effort, temperatures will likely rise by +2°C to +4°C.

We will see little action before the global conference on climate change in Glasgow in early November. Whatever is decided, it will take at least another election cycle in many countries before clear mandates to seriously address climate change emerge. And technology to remove atmospheric carbon does not yet exist.

Despite that gloomy outlook, the IPCC report will renew attention on clean energy. And it will surely attract new investment – if not yet on the scale needed to seriously limit carbon emissions.

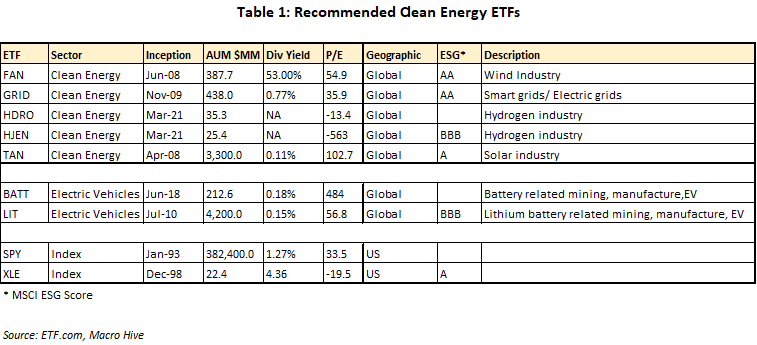

We recommend investors start investing in seven ETFs that focus on various aspects of clean energy (Table 1). These are close to pure sector plays. FAN and TAN focus on the wind and solar energy sector, respectively; HDRO and HJEN on the hydrogen sector; GRID on smart electric grid technology. Our underlying view is that as money starts to flow into the sector, the primary focus initially will be on developing the technology.

As we previously summarized, various clean energy ETFs exist that hold diversified portfolios of companies across the clean energy industry or that focus on companies producing clean energy. We are not negative on these companies; we just see more upside for now with ETFs focusing more on companies developing technology.

In the electric vehicle (EV) space, we favour LIT and BATT. Both focus on batteries, including mining necessary minerals, developing battery technology and EVs. Other ETFs in the EV sector focus more on aspects such as autonomous driving, navigation systems and EVs. Our view here is that much of this latter technology is still nascent and may take a decade or more to become mainstream. Also, before autonomous cars can be deployed at scale, governments must invest massively in smart road technology. No such thing appears to be on anyone’s radar – fixing potholes in a timely fashion is already too challenging, let alone figuring out how to enable autonomous driving.

Meanwhile, President Joe Biden is mandating higher mileage standards for cars and has set a goal of raising EV sales to 50% of auto sales by 2030. Clearly, coming years will see focus on developing straightforward EVs rather than those with new-age driver technology. The major car manufacturers are all committed to developing EVs; we struggle to imagine another Tesla somehow emerging against this competition.

The biggest stumbling blocks for getting people to buy EVs are battery life, battery supply, and charging infrastructure. Whoever ends up leading EV production, batteries will be key to their strategy. That makes LIT and BATT easy investment choices.

We also recommend hydrogen ETFs HDRO and HJEN as longer-term buy-and-hold investments. Hydrogen technology is further in the future than battery-powered EVs. The technology and infrastructure are less developed, and producing ‘green’ hydrogen at scale will require a more extensive renewable electricity network. Longer term, as EV sales rise, obtaining the minerals to make batteries on the scale required may become more difficult. And eventually, disposing of used batteries will raise environmental issues.

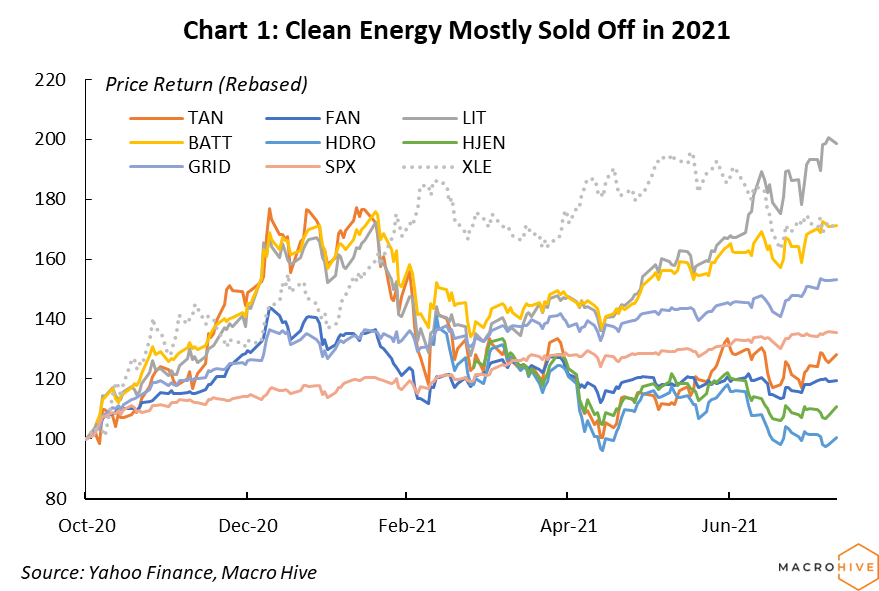

After the US election, our clean energy picks rallied sharply, far outperforming the S&P 500 (Chart 1). Come 2021, most sold off as it became apparent that a hoped-for omnibus $3.5+ trillion infrastructure bill would be lower in priority than the Covid relief bill and a bipartisan traditional infrastructure bill.

Battery ETFs LIT and BATT have since recovered, largely because of rising prices for battery-related minerals lithium and cobalt. The other ETFs are now underperforming the S&P 500. The worst performers are HDRO and HJEN. One negative catalyst for hydrogen ETFs may have been Honda’s decision in late spring to stop producing Clarity, its hydrogen-powered car. But, as noted above, we think hydrogen has a place as a future source of clean energy.

We reiterate our view that clean energy ETFs are a patient trade. They may occasionally catch a bid on favourable headlines, but they will also be vulnerable to selloffs as other headlines emphasize poor progress to limit emissions. But the sector will continue to grow and some point a far higher level of investment is coming.

We recommend investors start accumulating clean energy ETFs.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.