Bitcoin & Crypto | Monetary Policy & Inflation

Bitcoin & Crypto | Monetary Policy & Inflation

Technology innovations are changing the architecture of the monetary system and, with it, the traditional channels through which markets, agents and institutions interact. Consequently, the research agenda for central banks is shifting. And so are our Deep Dives.

Recently, we highlighted six key risks AI and ML pose for the financial sector. Today, we summarise the findings of a new BIS working paper on central bank digital currencies (CBDC). It investigates the motivations for retail CBDC issuance, the underlying trade-offs in their design, and their potential macroeconomic implications. I focus on the latter two.

CBDCs can be either for wholesale (i.e., by financial institutions) or retail use (i.e., by households and businesses – the public). They can also either be account-based or token-based and designed on either distributed ledger technology (DLT) or conventional technological infrastructures.

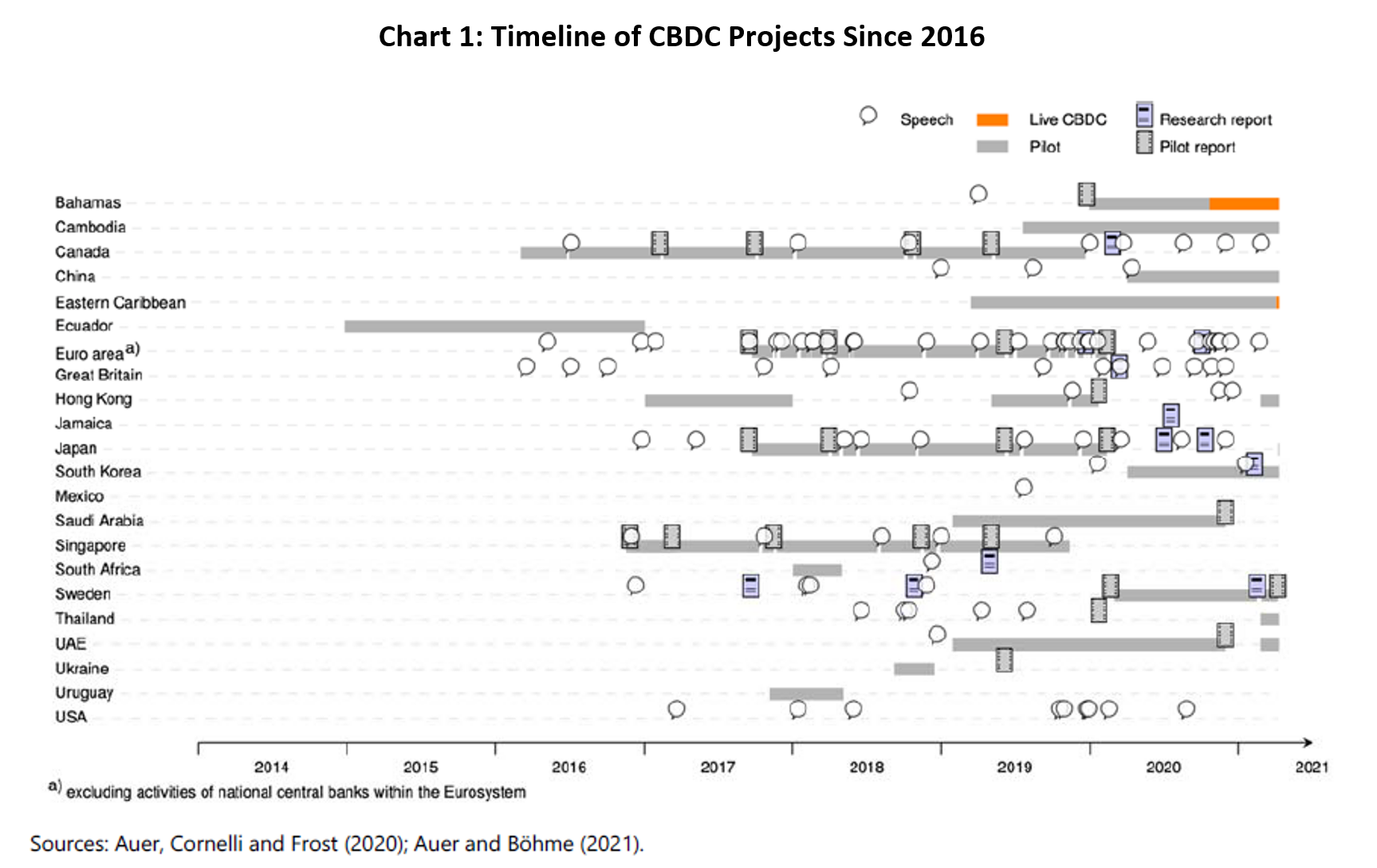

56 central banks have publicly communicated their research or development efforts. So far, most CBDCs being designed preserve the two-tier structure of the monetary system – with a division of labour between the public and private sector. Two have already launched a CBDC (Chart 1).

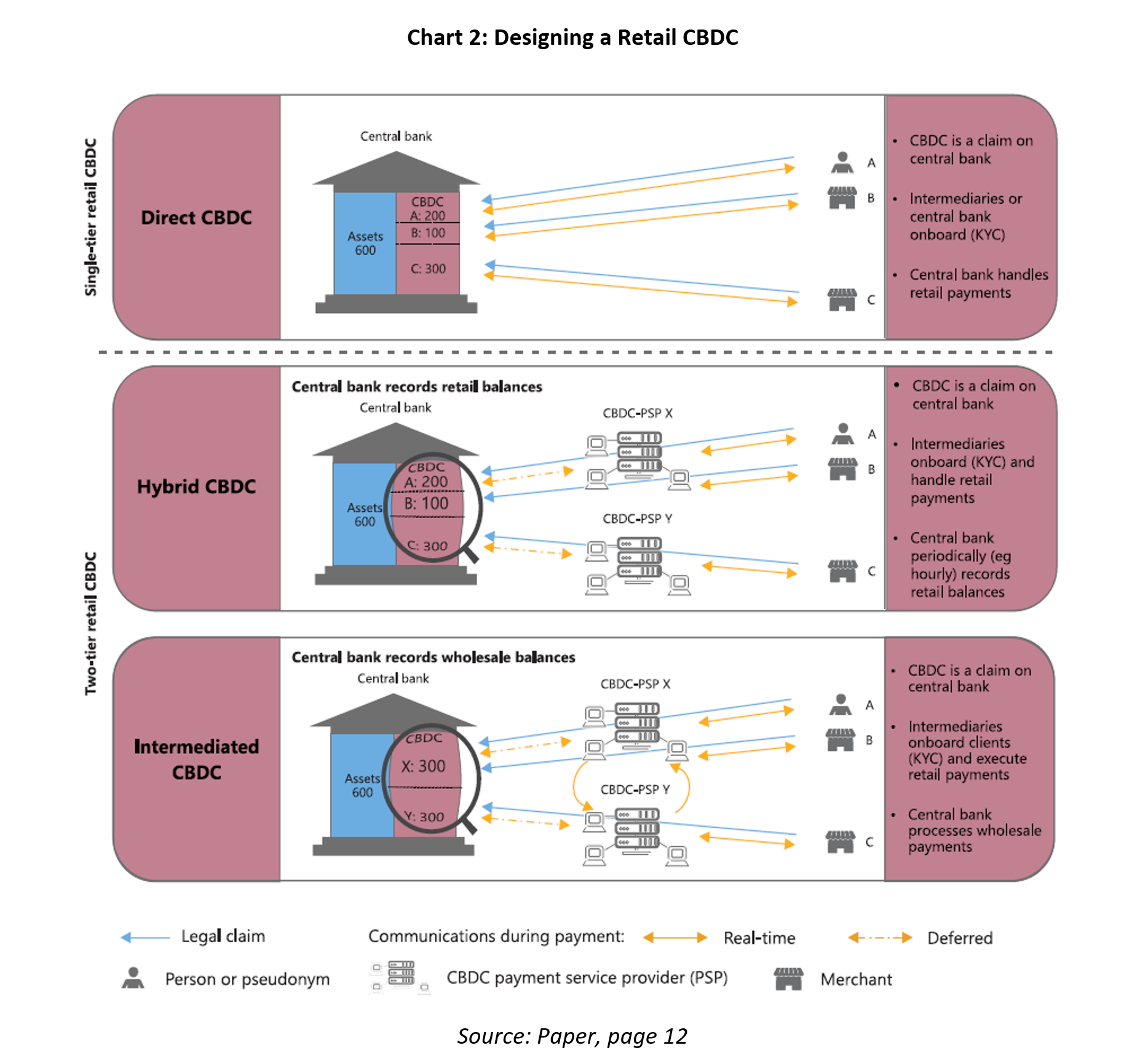

The paper discusses three potential retail CBDC architectures. The first is a single-tier retail CBDC, where users’ CBDC wallets are held with a central bank (Chart 2). In this case, private sector banks and non-bank payment service providers (PSPs) would need to allow users to transfer funds from a bank account, credit card or other payment services to a CBDC wallet. Users could then pay for items directly from their wallet using CBDC devices, cards or smartphones. This is the least likely and desirable design because it requires a large shift in the payments infrastructure from the private to public sector.

Another option is letting the private sector conduct all retail payments, while the central bank operates a backup infrastructure. The authors call this the ‘hybrid’ CBDC architecture, which combines the credibility of a direct claim on the central bank with the convenience of private sector payment services. Also, if a PSP fails, the central bank would honour claims, but this would require the public sector to hold information about people’s accounts at all times.

A third tier would not require information on retail transactions, as is currently the case. This ‘intermediate’ CBDC would need the central bank to record only the wholesale balances of the individual PSPs. The downside is that the central bank must honour claims of which it has no direct record. Consequently, to safeguard cash-like credibility, PSPs would require close supervision to ensure at all times that the wholesale holdings they communicate to the central bank add up to the sum of all retail accounts.

The paper also considers the optimal technology underpinning the CBDC architecture. Two forms of distributed ledger technology (DLT) are usable: a permissionless technology that is used in Bitcoin, Ethereum and other cryptocurrencies, and the permissioned variant, in which a network of known and vetted validators jointly augment a ledger.

According to the paper, economic and environmental costs make the permissionless option unlikely. Instead, most central banks are considering decentralisation in the form of ‘permissioned’ DLT. Here, a network of preselected entities verifies transactions and updates the ledger (rather than unknown validators in the permissionless world). Each ledger is jointly managed by different entities that do not trust each other’s data and independently verify each new transaction.

The cost of the permissioned DLT is time. Each update of the ledger must be harmonised between the nodes of all entities (consensus mechanisms), which involves multiple rounds of communication. There are also financial costs in the form of high enough rents. According to the paper, without giving validators proper incentives, their records cannot be trusted because they cannot commit to verifying trades and they can accept bribes to incorrectly validate histories.

Digital applications are currently generating troves of data on our habits, creditworthiness, behaviours and beliefs. Cash, though, is anonymous. Electronic cash in the form of a CBDC should also provide anonymity, but full anonymity is unlikely: central banks will want to avoid illicit transactions, money laundering, terrorism financing, etc. Central banks can engineer systems to have greater privacy than private sector systems, but there are costs involved, and adequate designs require public review and oversight.

Ultimately, central banks have less incentive to abuse private consumer data. Surveys show users generally trust public authorities and traditional financial institutions more than big techs. However, keeping all consumer retail data away from the private sector would require a one-tier payment system (discussed above), which central banks do not want. Moreover, holding everyone’s private data would create a ‘honeypot’ of data for hackers. Instead, central banks must design a CBDC that hides sensitive information from the private sector.

Last year, we explained that the macro-financial impacts of CBDCs depended crucially on how central banks decide to use them. In this Deep Dive, we cover the impact of CBDC issuance on (i) commercial banks and aggregate lending or investment, (ii) financial stability, and (iii) monetary policy.

The impact of CBDCs on the banking system

The theory goes as follows. In the status quo, banks hold deposits, which they use to pay some (digital) transactions where sellers refuse cash. These deposits are a cheap and preferable source of funds for banks because they pay a relatively low interest rate. However, when an interest-bearing CBDC is issued, banks must adjust the remuneration on their deposits to stop deposit holders converting them to the CBDC.

The first impact – deposits become a more expensive source of funds for banks. Then, in a competitive market, banks cannot buffer the shock so pass it onto borrowers. Aggregate lending and investment falls. However, in a less competitive market, banks enjoy a buffer that they can use to offset the increase in the cost of funds. In this case, introducing a CBDC improves things, if the CBDC rate is not too high. A CBDC interest rate of 0.30-1.49% has been found to increase bank intermediation.

Overall, by offering a CBDC, the central bank induces commercial banks to make their deposits more attractive and increases the costs of funds for commercial banks. And so, the literature finds CBDCs can improve allocative efficiency if their remuneration rate is not too high.

The impact of CBDCs on financial stability

Being a liability of the central bank, a CBDC is a safe substitute for commercial bank deposits. So, in a crisis, the availability of a CBDC could induce deposit holders to shift their holdings from the commercial banking system to the CBDC. Essentially, a CBDC increases the probability of a systemic bank run.

A more realistic way of reducing financial instability is offering an interest-bearing CBDC. While individuals would then be more likely to shift to a CBDC in a crisis, they would not shift to cash, which would be more harmful. Also, the digital nature of the CBDC would warn the central bank a run was occurring. They could then either proclaim a bank holiday or lend funds to the institutions undergoing a run.

Some suggest central banks could stop bank deposits from being freely converted to a CBDC. The authors argue this is unlikely. While it would make CBDCs more innocuous for financial stability, they would distort payment efficiency in all states of nature where financial fragility is not an issue.

The impact of CBDCs on monetary policy

The digital nature of CBDCs can also give the central bank information on the economy. And being digital, they are also, almost de facto, programmable. This should increase the monetary policy tools. Also, a CBDC lets a central bank implement monetary policy directly, rather than indirectly through the banking channel. This is because all firms in the economy can access the central bank lending facility, not just banks.

Other research has investigated what the CBDC deposit rate should be. One suggestion is that holding CBDCs should be costless, such that the lending rate should be equal to the deposit rate. Also, central banks could use the CBDC rate as their main policy tool. With the disappearance of cash, that interest rate could be set to (any) negative levels, eliminating the ‘zero lower bound’ on nominal rates. This would help establish better inflation targets at all stages of the business cycle.

On the other hand, central banks could move to price-level targeting instead of inflation targeting. Then, CBDC transfers could make price-level targeting easier to implement. This could benefit lower-income households and small businesses, which typically lack sophisticated financial planning advice or complex financial instruments that can help insure against such risks.

A key downside of CBDCs is that they amplify international spillover shocks. Recently, though, research has shown that if the CBDC possesses specific technical features, such as flexible adjustment of the remuneration rate on the CBDC, these risks could be dampened.

CBDCs are already here, and research on their design, technology and implementation is quickly expanding. The BIS’s message is that the implications are broadly positive and that the many concerns about data privacy and anonymity can be overcome in design. From a central bank’s perspective, CBDCs are exciting. They offer a wider set of policy tools, reduce the risks associated with private sector alternatives, and provide a real-time overview of the economy.

Yet, the paper says little about the cross-border dimension of CBDCs. No doubt the international monetary system will become murkier, with difficulties regarding traceability and transparency. Different countries will also have different data privacy concerns, which makes accepting CBDCs across borders challenging. So we are seemingly still far from a digitally integrated global financial market, leaving the door open for decentralised cross-border payment alternatives to capitalise in the meantime (e.g., Bitcoin).

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.