Summary

- A new Federal Reserve Bank of New York paper investigates the link between bitcoin and macroeconomic fundamentals.

- Contrary to popular belief, it finds news about policy rates and the economy hardly influence bitcoin’s intraday price movements.

- Despite bitcoin’s strong correlation to more traditional assets, the results imply its value fluctuates independently of key economic channels.

- With much macroeconomic uncertainty ahead, bitcoin may be a good short-term hedge against surprises.

Introduction

Bitcoin is rallying hard in 2023 – up nearly 50% year to date (YTD). An increased appetite for risk has supported many assets, with a more optimistic macroeconomic outlook the possible driver.

Why? Two factors broadly drive asset prices: fundamentals (e.g., a firm’s revenue) and market-wide information (e.g., economic growth). The former is micro, the latter macro. In times of greater uncertainty, as now, asset prices typically reflect more of the macro.

This emphasis on the macro over the last year or so has peaked investor interest in ‘news events’, such as payrolls, Consumer Price Index (CPI) prints, and monetary policy decisions. We have covered how to trade around such events in the past (e.g., CPI prints and Federal Open Market Committee (FOMC) meetings).

If traditional asset classes have been responding to better macroeconomic news, can that news also explain the recent recovery in bitcoin? A new Federal Reserve Bank of New York paper looks into how bitcoin prices move around macro events.

Surprisingly, the authors, who include the widely cited London School of Economics Professor Gianluca Benigno, find that bitcoin prices do not typically respond to monetary or macroeconomic news, unlike other US asset classes. The disconnect is puzzling and throws into question what drives bitcoin’s value.

A High-Frequency Perspective

The authors look at bitcoin prices in a 30-minute window around various macroeconomic announcements between January 2000 to December 2022. Itis a high-frequency perspective on how macroeconomic factors affect crypto and, should yield the most precise estimate of the impact of news.

The macroeconomic news events include data releases on industrial production, retail sales, the unemployment rate, nonfarm payrolls, net exports, the ISM Manufacturing Index, Producer Price Index (PPI), CPI and FOMC announcements. The measure of how unexpected the news was is the difference between the forecasted value by financial markets and the realised value.

Lastly, the authors look at the response of traditional US asset prices to news. These include US dollar exchange rates against both developed and emerging market currencies, precious metal prices and US stock prices.

Bitcoin Prices and Monetary Policy

The price of any asset depends on the expected discounted value of future values. Discounting values in the future requires a view on the interest rate. This is one reason to think about why most assets react to monetary policy news, especially bonds.

Bitcoin is no different, but the authors assume that the cryptocurrency is purely a speculative asset. That means it has no intrinsic value and is only determined by current and future interest rates. It should, therefore, react to news about future interest rates, but does it?

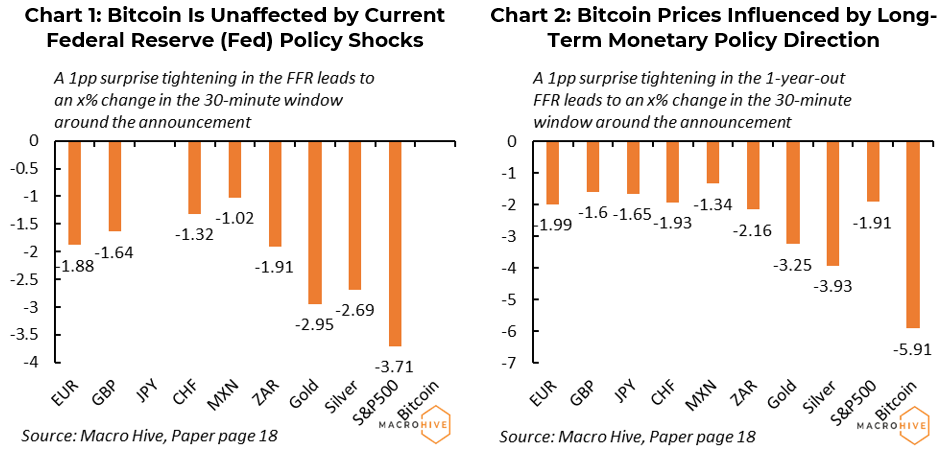

No. The authors regress unexpected changes in; (i) the current federal funds rate (FFR); (ii) the future FFR, and (iii) future large-scale asset purchases, on the percentage change in bitcoin prices (and other asset prices) in a 30-minute window around FOMC announcements.

They find that while news about the current target rate has a statistically significant effect on all asset prices (apart from USD/JPY), it has no impact on bitcoin prices (Chart 1 – the way to read the chart is as follows: a 1pp surprise tightening in the FFR leads to a 3.71% decline in the S&P500 in a 30-minute window around the FOMC statement).

This changes when looking at the future path of monetary policy (Chart 2). Here, an unexpectedly hawkish outlook on the future FFR leads, on average, to a much larger impact on bitcoin prices relative to other assets. So, while the current FFR has no impact on bitcoin, changes in its future trajectory does.

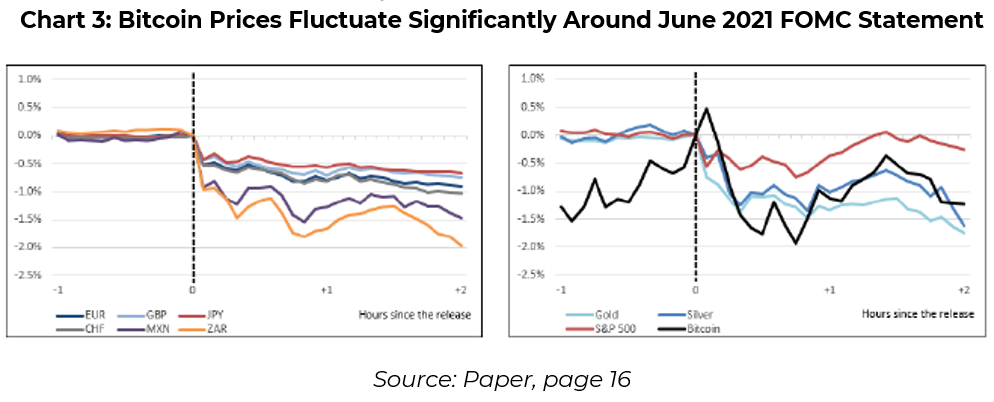

A good example of the above results can be seen around the 16 June 2021 FOMC statement (Chart 3). Bitcoin prices reacted more aggressively than other assets around the rate rise. However, this reaction is less centred on zero – making it less obvious that the announcement was the cause. This is reflected in the regression results above, where the coefficients on bitcoin were less statistically significant.

Bitcoin Prices and Macroeconomic News

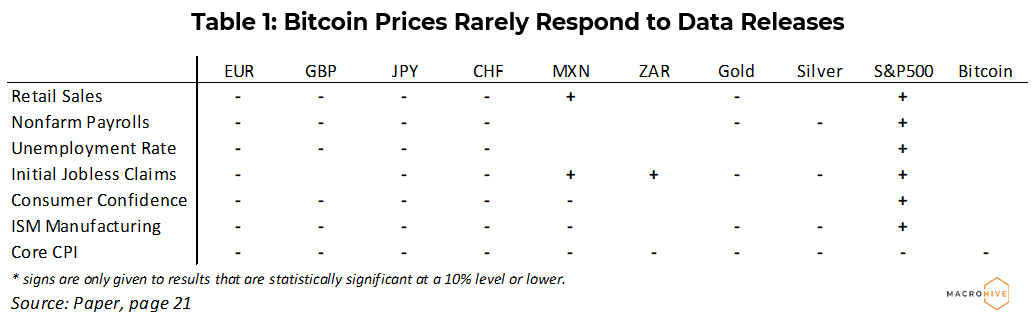

The authors run the same exercise, but this time looking at asset price reactions 30-minutes around macroeconomic, rather than monetary policy, news releases. The results are even clearer (Table 1).

Bitcoin prices only respond to core CPI data releases that are either unexpectedly high or low, and nothing else. Most other assets respond in a statistically significant way to surprises around macroeconomic data releases.

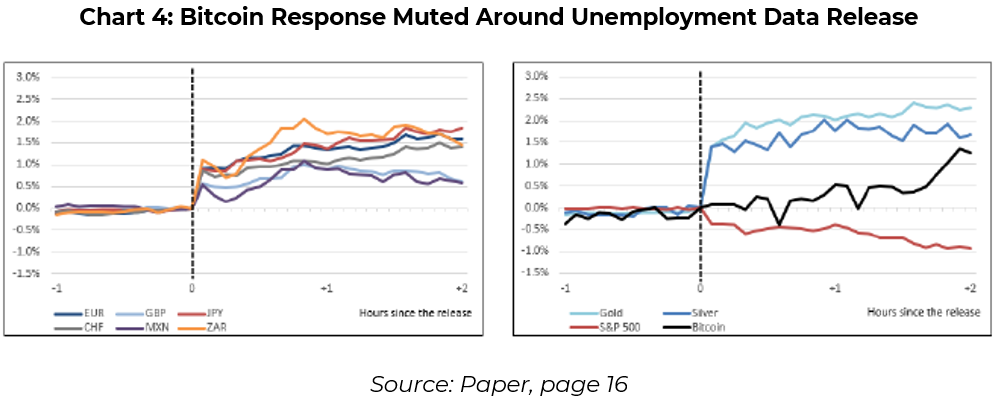

Chart 4 is another example of the results, this time around the 3 June 2016 unemployment rate announcement. Here we see how bitcoin prices remained relatively stable around the release, with the prices of other assets responding more notably.

Bottom Line

While bitcoin operates independently of traditional economic systems, you would expect its value to be subject to the same market forces and economic conditions as other assets. It turns out from the paper, that this is not necessarily the case.

When looking at macroeconomic data releases, bitcoin prices rarely react immediately. Though some evidence exists that bitcoin prices may respond to the long-term trajectory of monetary policy, even there the authors do not find the sharpest correlation.

Perhaps then, bitcoin’s relatively muted price action around macroeconomic news events provides a good hedge against surprises. Although, I expect that given cryptos close long-run correlation with risky assets, prices will ultimately move in a similar direction.

Lastly, the authors point out that the results undermine the valuation approach they took for bitcoin. Speculative assets should, in theory, move based on the interest rate. So, either bitcoin’s intrinsic value (e.g., scarcity) is so large that changes in the discount rate do not influence its value, or investors’ speculative positions in bitcoin are not linked to the macroeconomy (e.g., regulation).

Sam van de Schootbrugge is a Macro Research Analyst at Macro Hive, currently completing his PhD in international finance. He has a master’s degree in economic research from the University of Cambridge and has worked in research roles for over 3 years in both the public and private sector.

Photo Credit: depositphotos.com