China | Economics & Growth | FX | US

China | Economics & Growth | FX | US

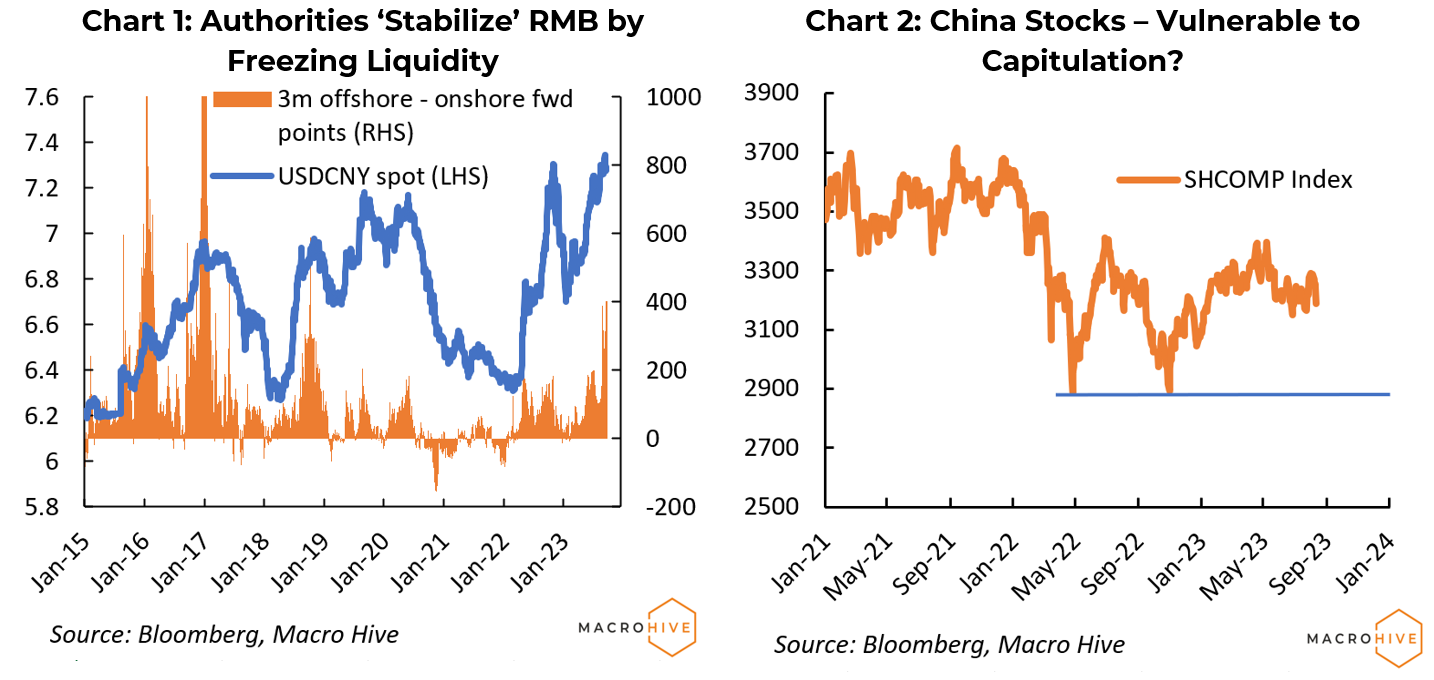

Chinese authorities have stabilized RMB by freezing liquidity and tried to lift stocks through forced buying (Charts 1 and 2). Investors can see through the façade and remain sceptical. Given depressed sentiment, it is worth asking: What could go right for China? A combination of data green shoots, a real commitment to repair business confidence and some luck with the dollar are necessary. We remain neutral on RMB but are tentatively positive on stocks.

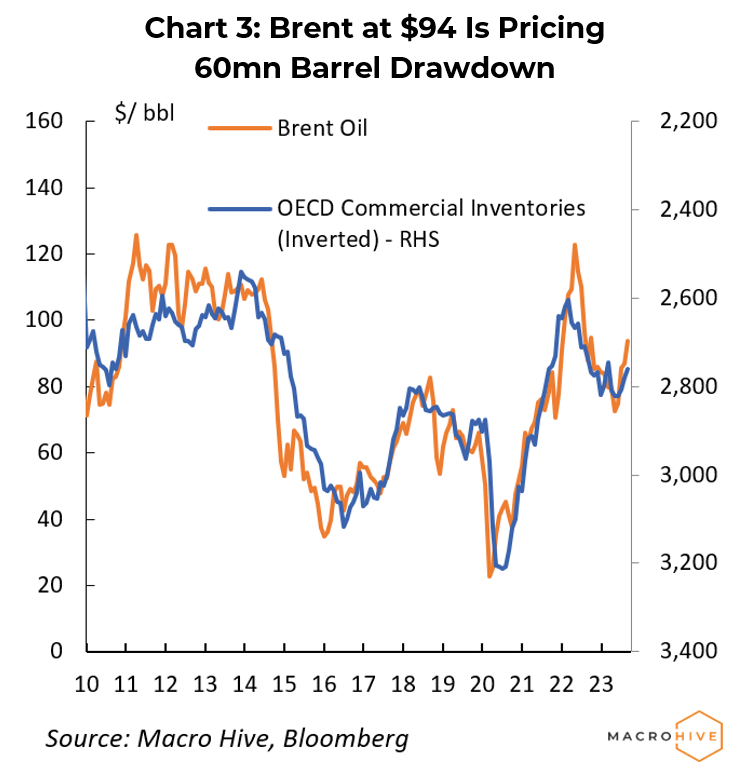

We think Brent at c.$94/bbl is pricing in another 60mn drawdown in OECD commercial crude inventories (Chart 3). Historically, the average draw when global demand exceeds supply by 1mn b/d is around 28mn barrels a month. Given extended positioning, larger-than-expected inventory draws will be necessary to push Brent much higher. We will look to fade upside above $100/bbl.

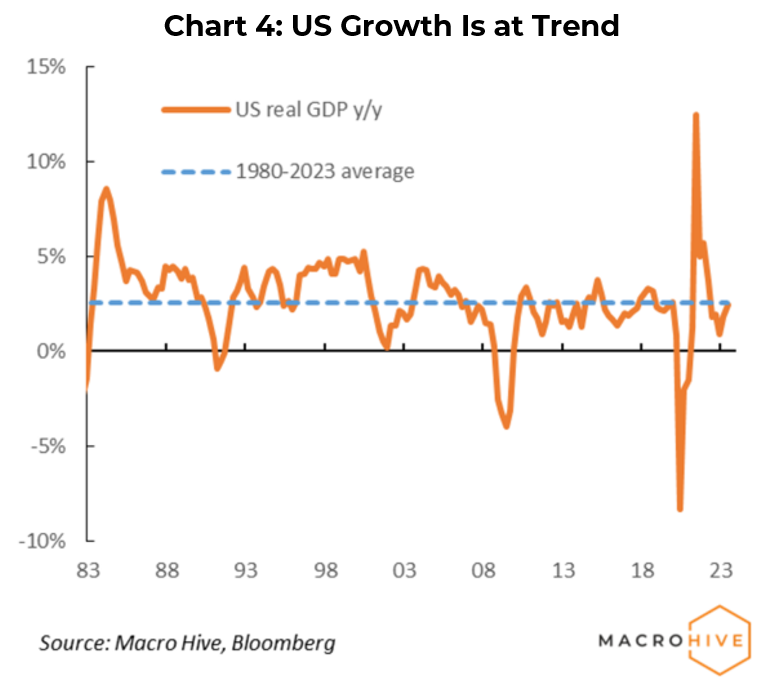

For all the focus on the US business cycle, and the possibility of a recession, the clearest characterization of the economy is that it is at trend. The last GDP print (Q2) has growth at 2.5% (y/y). And guess what the average growth rate of the US has been since 1980? 2.6%. So, after the growth collapse in 2020 and sharp rebound in 2021, the US economy is settling down to trend growth. Moreover, nowcast estimates for Q3 – whether Atlanta Fed (4.9%) or NY Fed (2.3%) – have it around trend too. Here are four other things you probably did not know about the US economy.

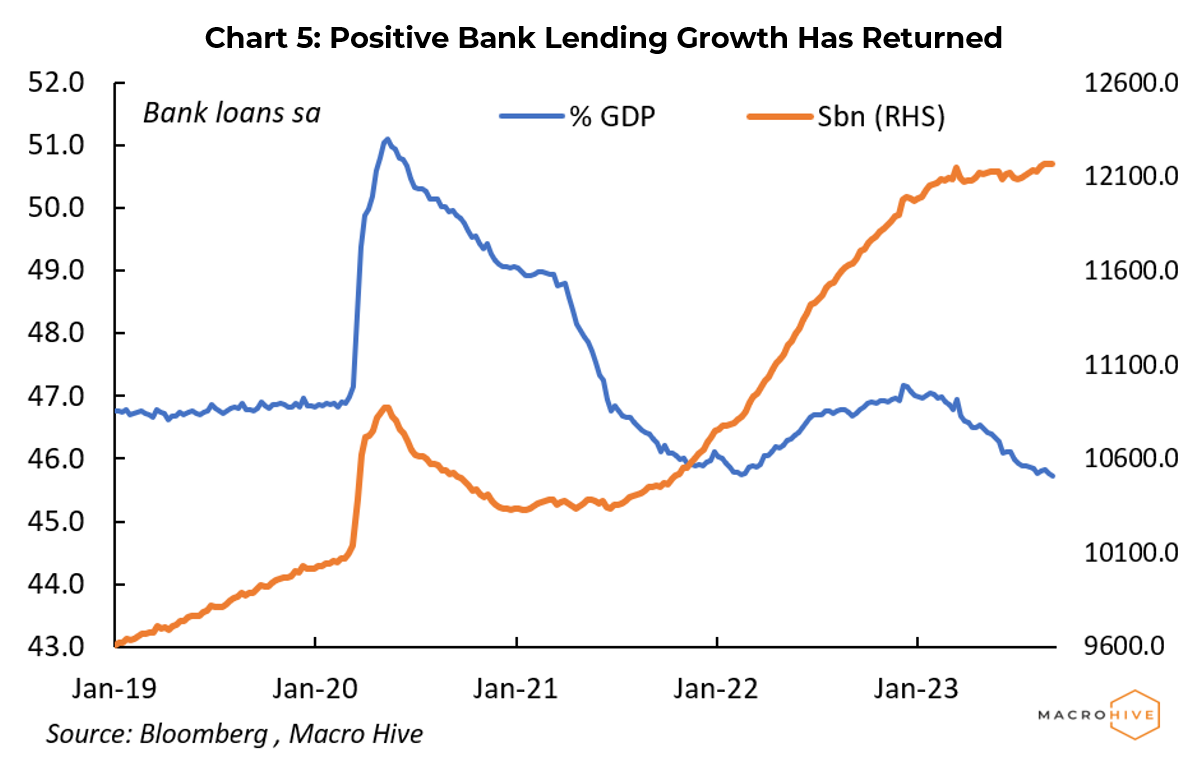

Positive bank lending growth has resumed since July (Chart 5). Prior to that, bank lending had been flat since the March banking failures. Relative to GDP, bank credit has been falling since end-2022 and remains below its pre-pandemic level. But importantly, despite the higher cost of funding, small banks’ credit growth has been stronger than large banks’. This is possibly because support to banks is working so well that it is impeding the transmission of monetary tightening.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.