Bitcoin & Crypto | Monetary Policy & Inflation

Bitcoin & Crypto | Monetary Policy & Inflation

In complex systems like markets and economies, imbalances build up over time. They suffer frequent, if inconsequential, intermediate avalanches until fragility and connectivity reach a critical state and eventually an avalanche triggers a catastrophic return to equilibrium. This is the normal function. What is abnormal are outside agents trying to prop up imbalances in their critical states. Currently, various manipulations have accumulated – zero interest rates, unprecedented asset purchases by central banks, and all-time extremes of government debt after endless rounds of bailout and stimulus packages – making every effort to keep the increasingly fragile system from correcting. What market participants tend to consider Black or Grey Swans are merely the inevitable rebalancing of fragile systems.

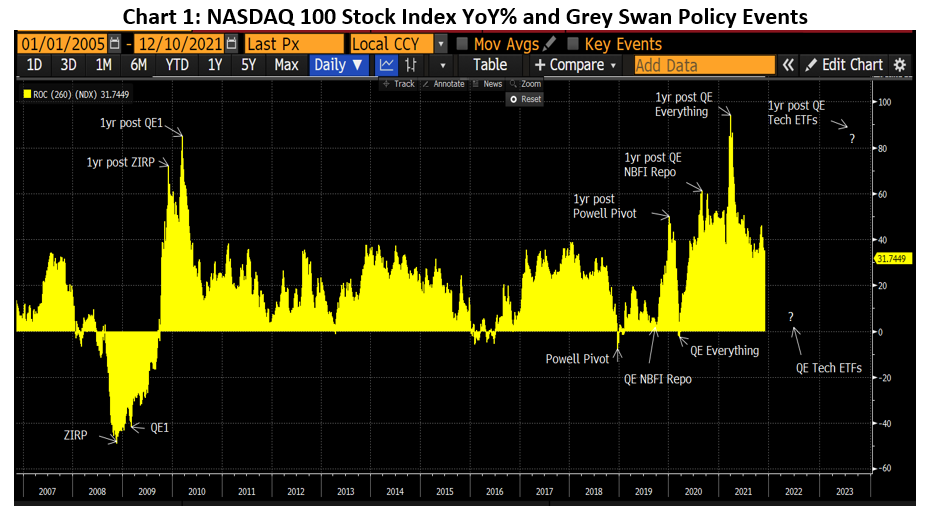

As Nassim Taleb so brilliantly puts it, “Black Swans are observer-dependent: a Black Swan for the turkey is a White Swan for the butcher”. The butcher knows the inevitable end-state of a plumped up sandpile. What we don’t know is what lengths outside agents will go to maintain ever greater levels of disequilibrium. Below we use the annual change of the NASDAQ 100 Index to visualize past Grey Swan events, focusing on the Federal Reserve as the principal outside agent (Chart 1). Market participants have repeatedly under-participated in the potential outsized compounding impact of these events. This is because they have generally been unprepared for, or overly cautious of, the inevitable connective series of avalanches that occur as unstable systems revert towards a more stable equilibrium.

The standard market solution is not risk management. Rather, it is risk reduction (i.e., a ‘balanced portfolio’) – foregoing upside to reduce downside. In a race car analogy, participants are driving at 60% capacity. They assume, based on a flawed extrapolation of recent historical frequencies, that there will be no upcoming corners sharp enough to make them crash. They are unprepared for a corner sharper than the 95th percentile of recent occurrences. So, they get wiped out when the Grey Swan of another unprecedented central bank intervention arrives. And should they survive the hairpin bend, they are overly cautious. They have too little power allocated to the engine to accelerate out of the corner – i.e., fully participate in the outsized scale of the aftermath of that intervention.

Black or Grey Swans are, by their nature, unpredictable. That is the whole point. The way to deal with them is to see to your convexity, to always have good brakes so that you can, safely, drive faster.

In Chart 1, we label the most recent Grey Swan event ‘QE Everything’ (it should really be QE Everything Fixed Income, but we were tight for space). Post its implementation, our chosen index of upside participation risk, NDX 100, rallied circa 100% over the next year.

What could be next year’s Grey Swan event? We propose the next phase of QE – labelling it ‘QE Tech ETFs’.

Central banks have seemingly lost control of the topside of their chosen measures of price stability, such as the CPI, with QE Everything spiking real yields to all-time lows. They now discuss backing away from the current slate of imbalance-supporting policies. Should the inevitable happen (a return to stable equilibrium) while price stability issues are still a societal (and political) concern, what can they do?

The uber-duration asset that likely gets hit the hardest is the high-flying tech stocks. They are a critical finger of fragility in market imbalances, and they risk triggering a chain reaction of connectivity. The Federal Reserve has repeatedly shown the willingness to do whatever it takes to preserve and grow the disequilibrium of market imbalances. The Fed may be reluctant to continue to manipulate interest rates lower. So, we can easily imagine it dialling up a whole new level of QE and, like it did across a range of debt products in 2020, firing up the printing presses to provide direct support to Tech ETFs.

Sound crazy? Sounds like a Grey Swan.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.