Asset Allocation | Monetary Policy & Inflation | US

Asset Allocation | Monetary Policy & Inflation | US

Many papers, and therefore various trading strategies, have tried to profit from patterns in how investors interpret Fed signals at FOMC meetings. However, new textual analysis methods are helping researchers understand why and when these patterns emerge.

A new Journal of Financial Economics paper claims to be the first to analyse price movements around FOMC statement releases and during the subsequent press conference. It uses deep learning algorithms to identify what words count for investors during FOMC announcements. These are the key conclusions:

The authors start simply. They look at the changes in asset prices during a 30-minute window (10 minutes before and 20 after) around the FOMC announcement at 14:00 Eastern Time. They compare these price changes with those during the subsequent press conference window, typically starting at 14:30 and lasting 55 minutes.

For this analysis, they only need the dates and times of the FOMC meetings and intraday data on asset prices. They consider 41 press conferences (four a year between 2011 and 2019, and after each policy statement since). And they collect data on federal funds futures (up to two years, 20 different maturities), Eurodollar futures (up to seven years, 30 different maturities), the S&P 500 index and its constituents, and seven of the major currencies against the USD.

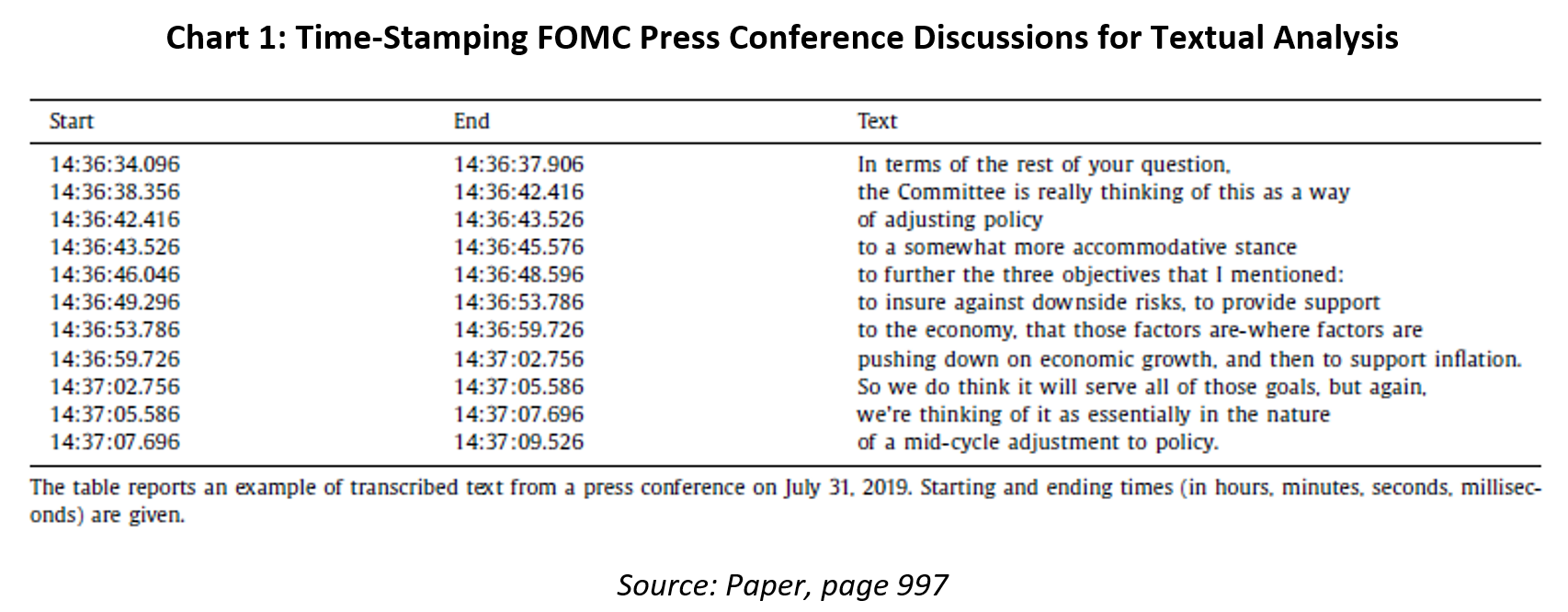

Next, they perform within-press-conference analysis. That is, they examine the relationship between time-stamped words and high-frequency asset prices. To get time-stamped words, they use the audio of the press conferences and convert it into an interpretable text through an end-to-end deep learning algorithm and a beam-search algorithm. They align then the audio and text within a three-second interval. An example is below (Chart 1).

Lastly, the authors extract the useful information from these texts. They look for new words and sentences from one FOMC meeting to the next. In essence, this new information, which they call ‘news’, reflects any new guidance on rates or variation in the economic outlook.

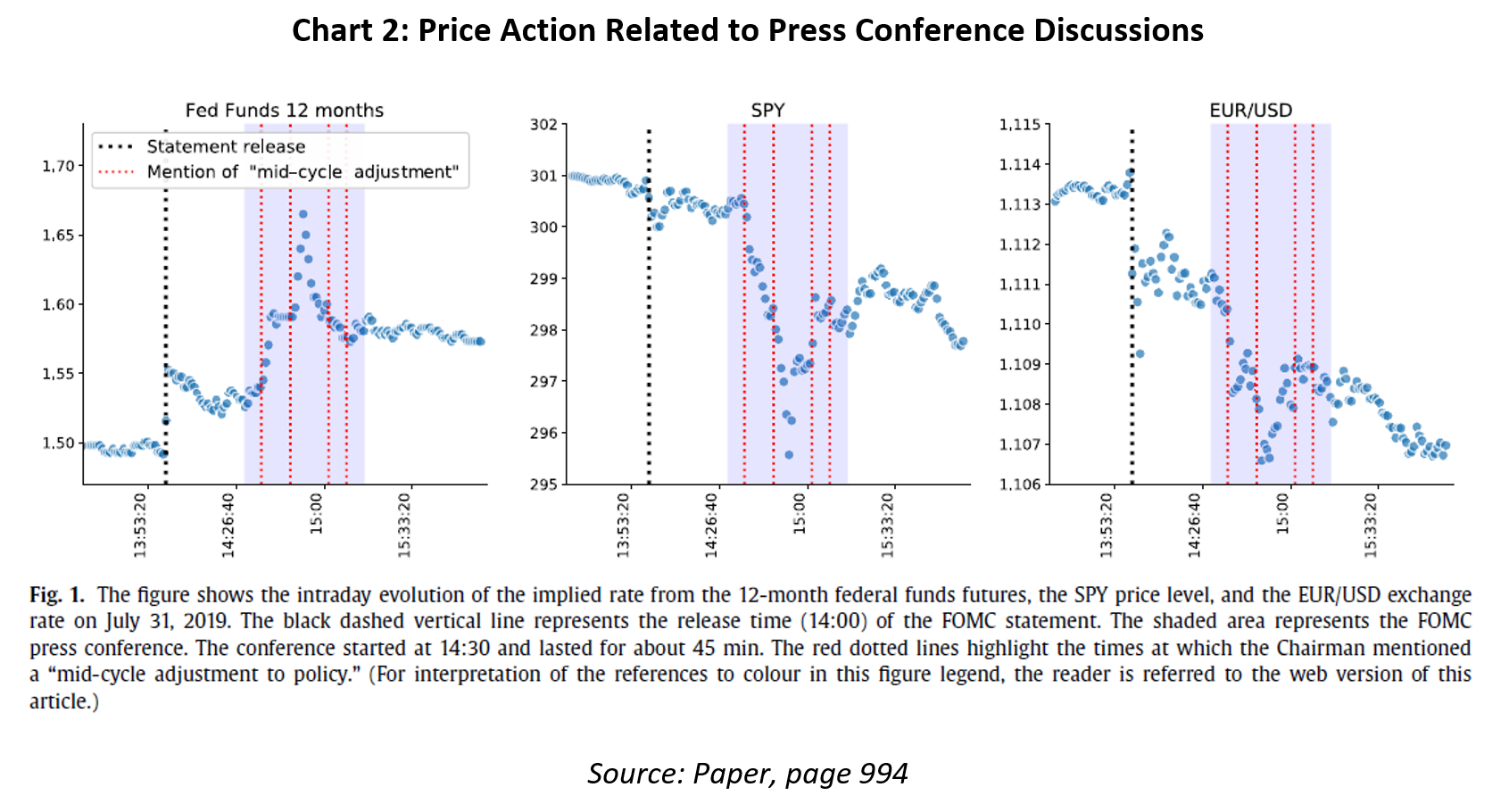

One example is in the July 2019 FOMC meeting. Markets expected a 35bps cut to the Fed funds rate, but it was actually cut by 25bps. In the statement, the Fed published this new sentence: ‘the Committee contemplates the future path of the target range for the federal funds rate.’ In the press conference, Chair Jerome Powell was asked to clarify this point. He restated the same sentence but also added, ‘The Committee is really thinking of this [current change] as a mid-cycle adjustment to policy.’ The mid-cycle adjustment comment signalled there was no plan for a series of rate cuts, which led to large moves in the 12-month Fed funds futures, SPY and EUR/USD (Chart 2).

The authors first show that the average price changes in stocks, FX, Fed funds and Eurodollar futures around press conferences and statements are similarly sized. That is, both events yield similar asset class movements in terms of standard deviation and absolute mean values.

Next, they show a correlation in price change direction. Asset classes whose prices rise during the FOMC statement also rise during the press conference. The correlation’s strength increases with asset maturity. For instance, the correlation between price changes is 40% for medium-term Eurodollar futures, but it goes as high as 58% for the 60-month maturity. For SPY, the correlation is 44%.

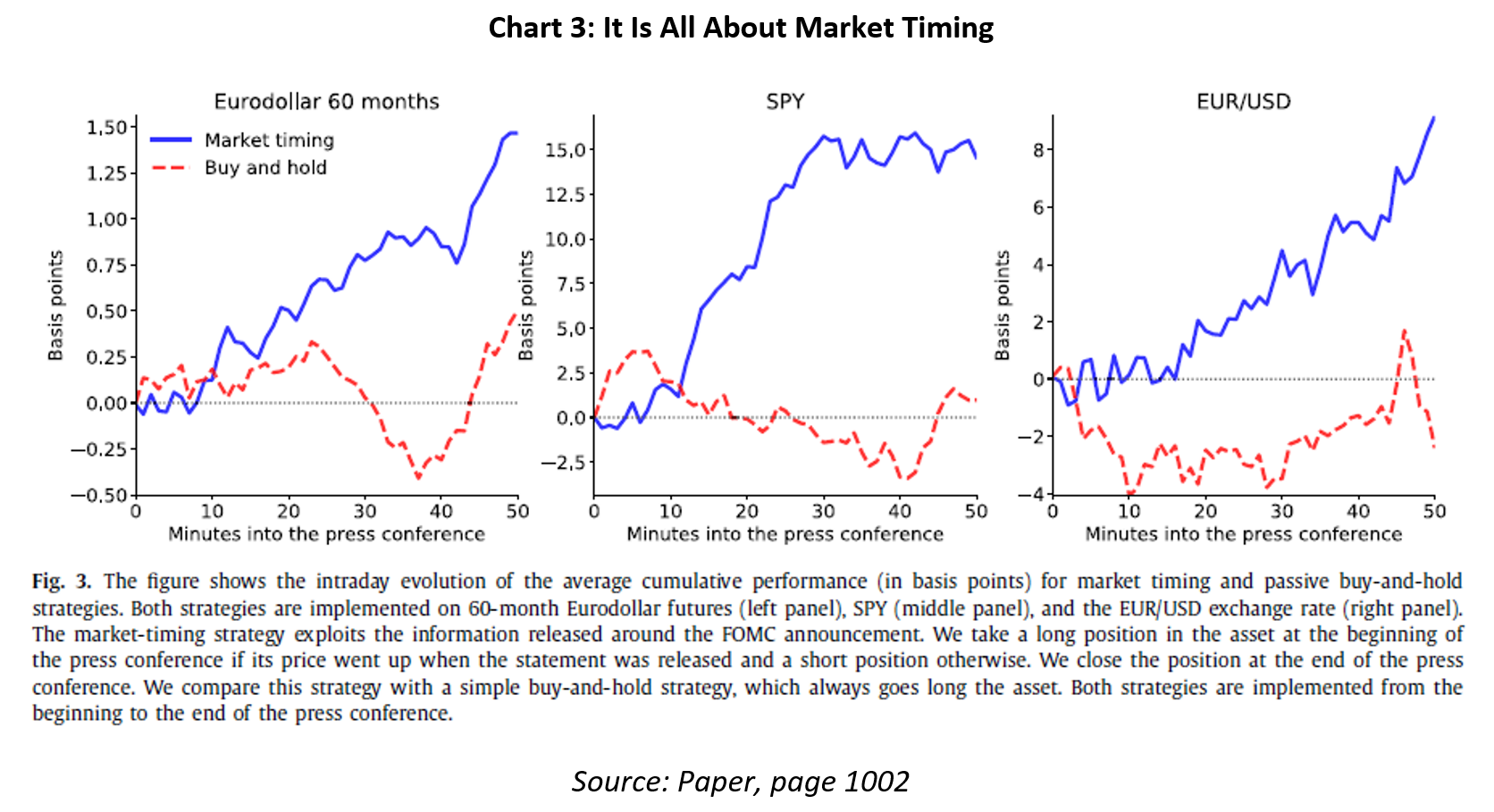

How valuable is this correlation? To find out, the authors devise a simple trading strategy. For every asset, take a long position at the beginning of the press conference if its price went up when the statement was released and a short position otherwise. Then, close the position at the end of the press conference. They compare this ‘active strategy’ with a simple buy-and-hold strategy in which they buy the asset regardless of the information received at the statement release.

The active strategy boasts a large increase in the Sharpe ratios (SR). For the SPY, the SR ratio rises 34% relative to the buy-and-hold strategy. The mean pointwise cumulative intraday returns are also far higher for the 60-month Eurodollar futures, SPY, and the EUR/USD exchange rate (Chart 3). The SPY seems to react rapidly, but after 20 mins into the Q&A session, the cumulative returns stabilise. For the other two assets, the cumulative returns show a steadily growing pattern from minute 10 to the end.

Next, the authors introduce the time-stamped words to uncover what is driving these highly correlated price movements.

Generally, investors are not too interested in the first 10 minutes of the press conference. Instead, prices begin to move similarly to the preceding 14:00 statement once the chairman faces questions about changes in that statement relative to the last FOMC meeting. Price changes are especially large during the first three questions of the press conference, when attendees typically ask about new information in the statement – the element the authors refer to as ‘news’.

The average price variation when the chairman discusses news is about 14% larger than for other topics covered in the press conference. For stocks, if the price dropped around the statement, then 40% of its subsequent price fall during the press conference happens while the chairman is discussing this news – most of which is contained in the first 12 press conference questions.

These price and trading volume variations are generally largest for long-maturity assets. They do not hold for short-term assets. According to the authors, this reflects that new elements of the FOMC statement contain updated information given by the Fed on its long-run outlook for rate guidance and the economy. When the chairman focuses on the future, variations in asset prices peak.

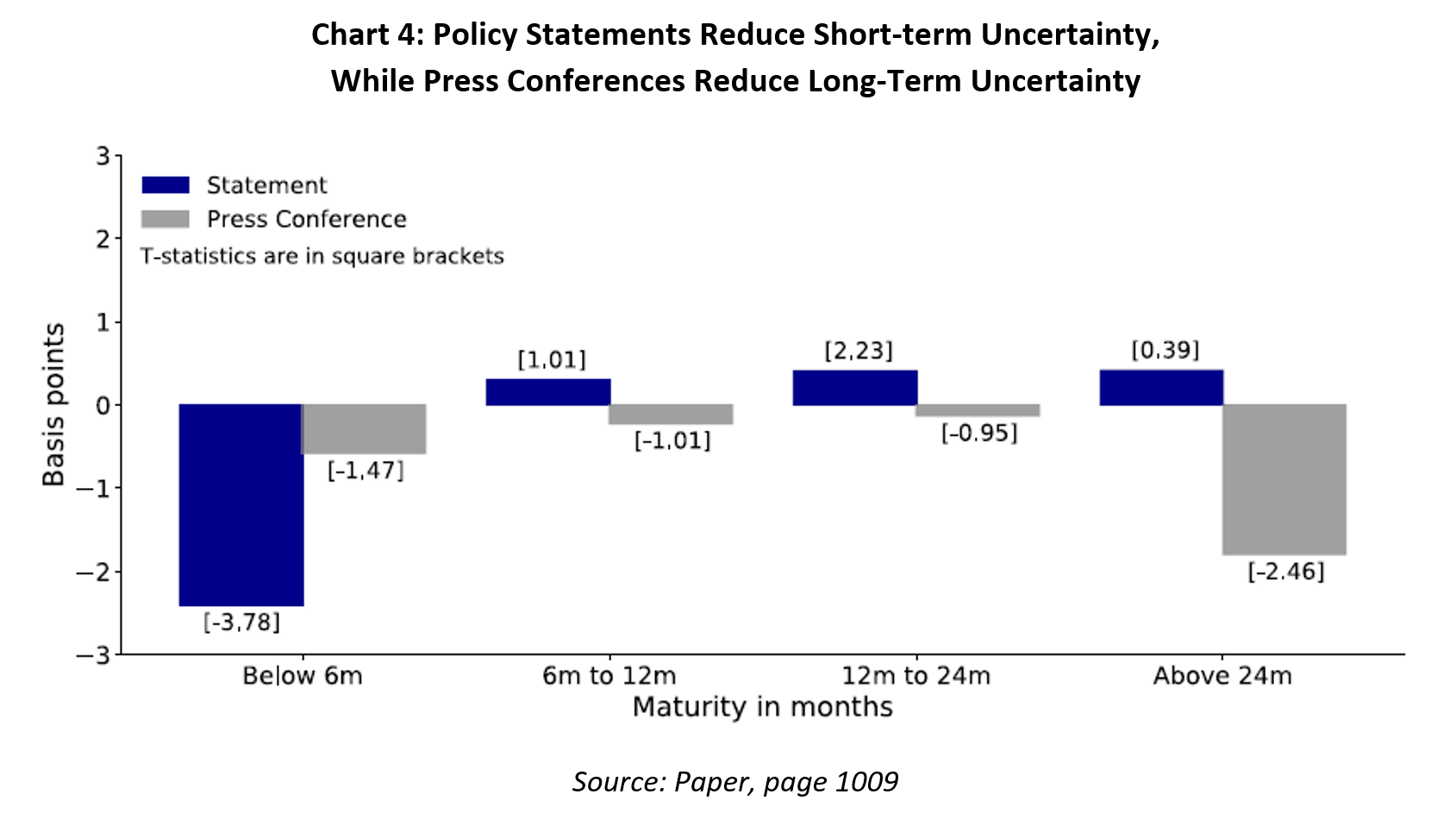

The last part of the analysis focuses on the Fed’s ability to provide useful information on the path of monetary policy decisions, that is, forward guidance. The authors ask to what extent information released during the FOMC press conference reduces investors’ uncertainty about future monetary policy decisions.

For this exercise, they use at-the-money options on Eurodollar futures, which are among the most actively traded exchange-listed interest rate options in the world. From the tick-by-tick best-of-book trade and quote data, they compute the implied volatility for each option contract.

Overall, they find the release of the policy statement substantially decreases investor uncertainty about monetary policy for the short term only. Relative to the average value before the press conference, the implied volatility for short-term contracts drops by about 7.5%. For maturities above six months, the policy statement has no impact (Chart 4). On the other hand, the press conference successfully reduces monetary policy uncertainty for all maturities, especially those above two years.

The paper has two main conclusions. First, robust patterns in longer-maturity assets make trading smartly around FOMC meetings potentially profitable. Much of the price action comes during the press conference, especially during the first few questions, which typically cover information not mentioned in the previous FOMC release. Price variation also peaks when the chairman discusses the Fed’s long-term outlook on rates and the economy.

Second, the Fed can guide expectations. The market hangs on its every word, and data on implied volatilities shows the press conference is generally helpful in reducing investors’ long-term uncertainties.

Perhaps most fascinating, though, is how the authors document the interplay between the statement release and the associated press conference.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.