Economics & Growth | Equities | US

Economics & Growth | Equities | US

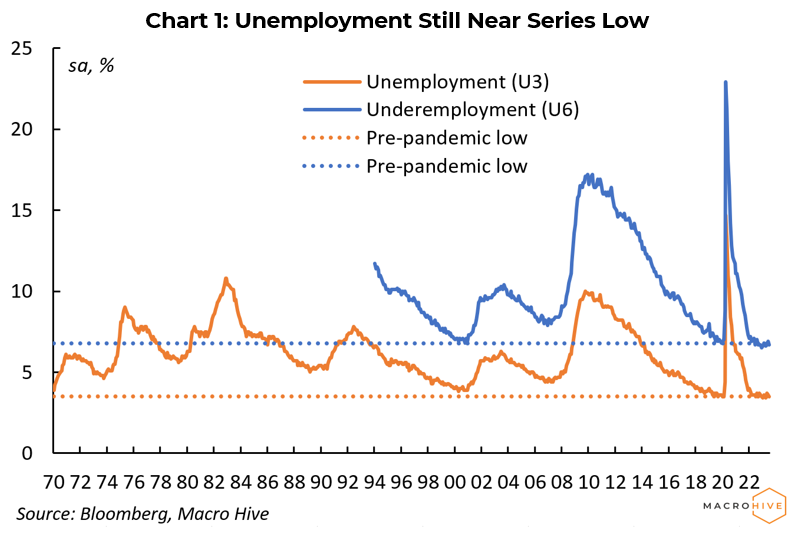

With labour demand still growing faster than labour supply, the July data continued to indicate a very tight labour market. Unemployment at 3.5%, vs 3.6% expected and 3.6% in June, remained near its post-1970 lows (Chart 1). This is also true for U6, the broader unemployment measure that includes workers marginally attached to the workforce as well as part-time workers for economic reasons.

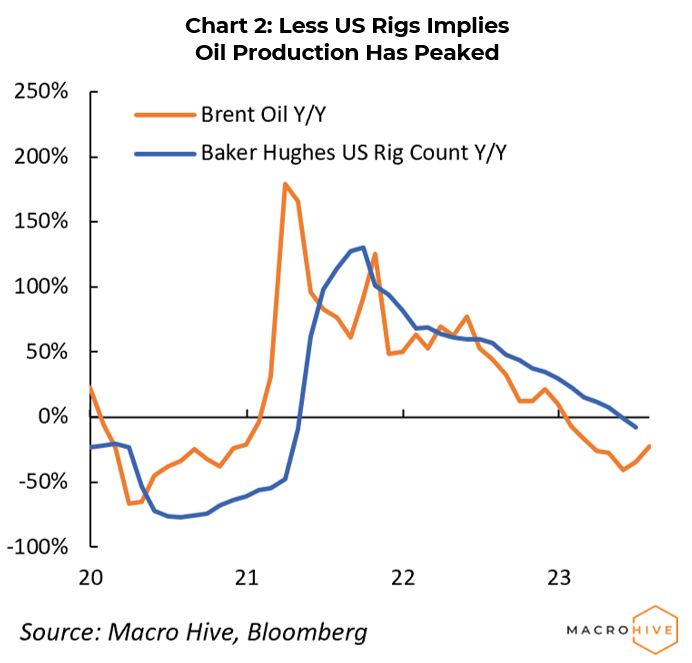

Evidence suggests US crude production has peaked for 2023 at 12.7–12.8mn b/d over the last couple of months. For example, the oil rig count is a leading indicator (by 6-8 months) and is sitting around 529, down almost 100 since late last year (Chart 2). Declining production provides OPEC+ with more market power as the US has been the largest source of global supply growth this year.

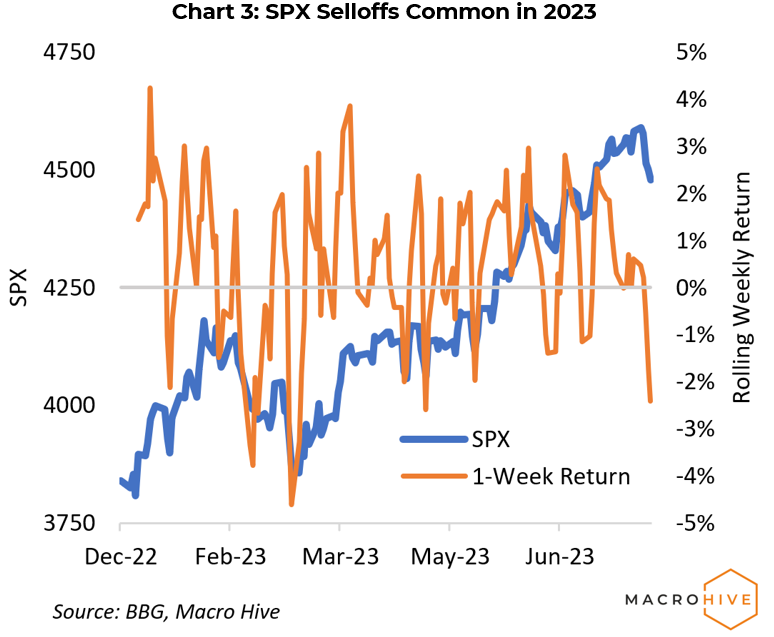

Equity selloffs always spark worries about whether this is the start of something worse – but so far last week fits the pattern of other selloffs during the 2023 rally (Chart 3). We expect equities to plateau for now – in other words, no rising tide to lift all boats. Company outlooks are sufficiently mixed that it is difficult to sustain much upward momentum.

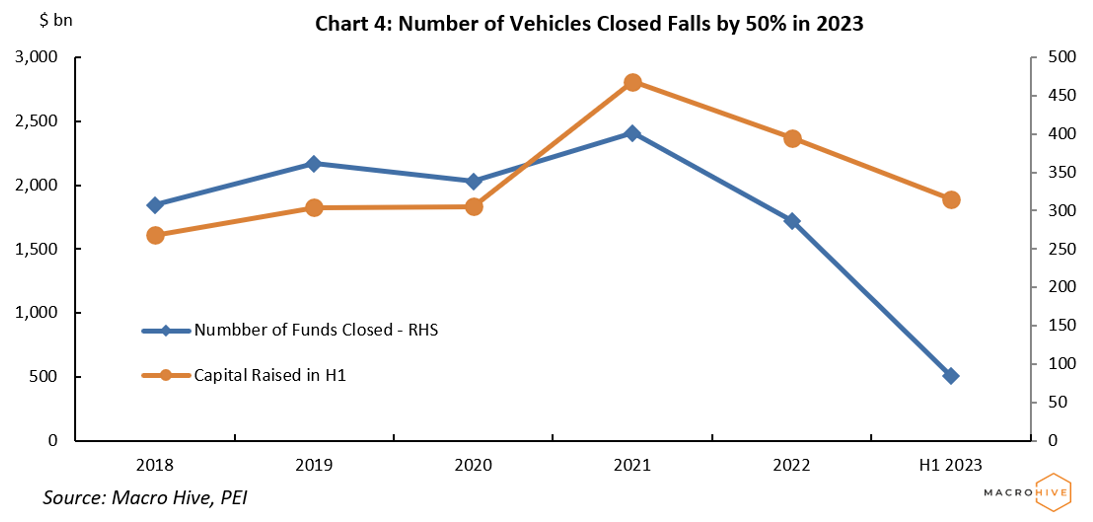

Private markets are still recovering from the sharp drawdowns in public markets last year, driven by the rapid increase in interest rates. This has resulted in a sharp slowdown in deal-making. Private Equity International finds that fundraising dollars raised by private equity funds globally reached $315bn this year versus almost $400bn this time last year. Further, just 508 vehicles were closed during the first six months, 466 fewer than last year (Chart 4).

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.