Economics & Growth | Europe | FX | Monetary Policy & Inflation

Economics & Growth | Europe | FX | Monetary Policy & Inflation

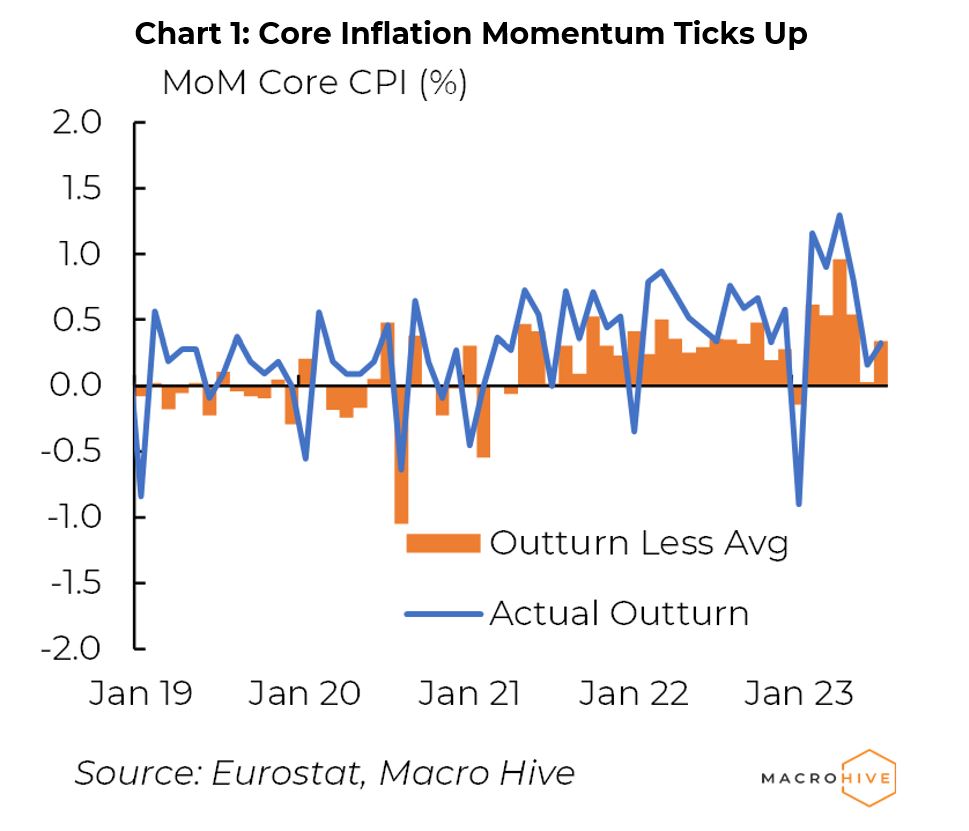

UK headline YoY inflation dropped 0.9ppt to +6.8% YoY on the back of (widely telegraphed) household energy price moves. However, this was a stronger print than consensus had forecast (+6.7% YoY). As we had warned, the strength came from the core reading (+6.9% YoY, cons: +6.8%), and within this from the rental space, which sees strong quarterly revisions (Chart 1).

The BoE should not take this hawkishly, however. It is roughly in line with their estimates, and they are focused on the details. We would fade the hawkish market pricing.

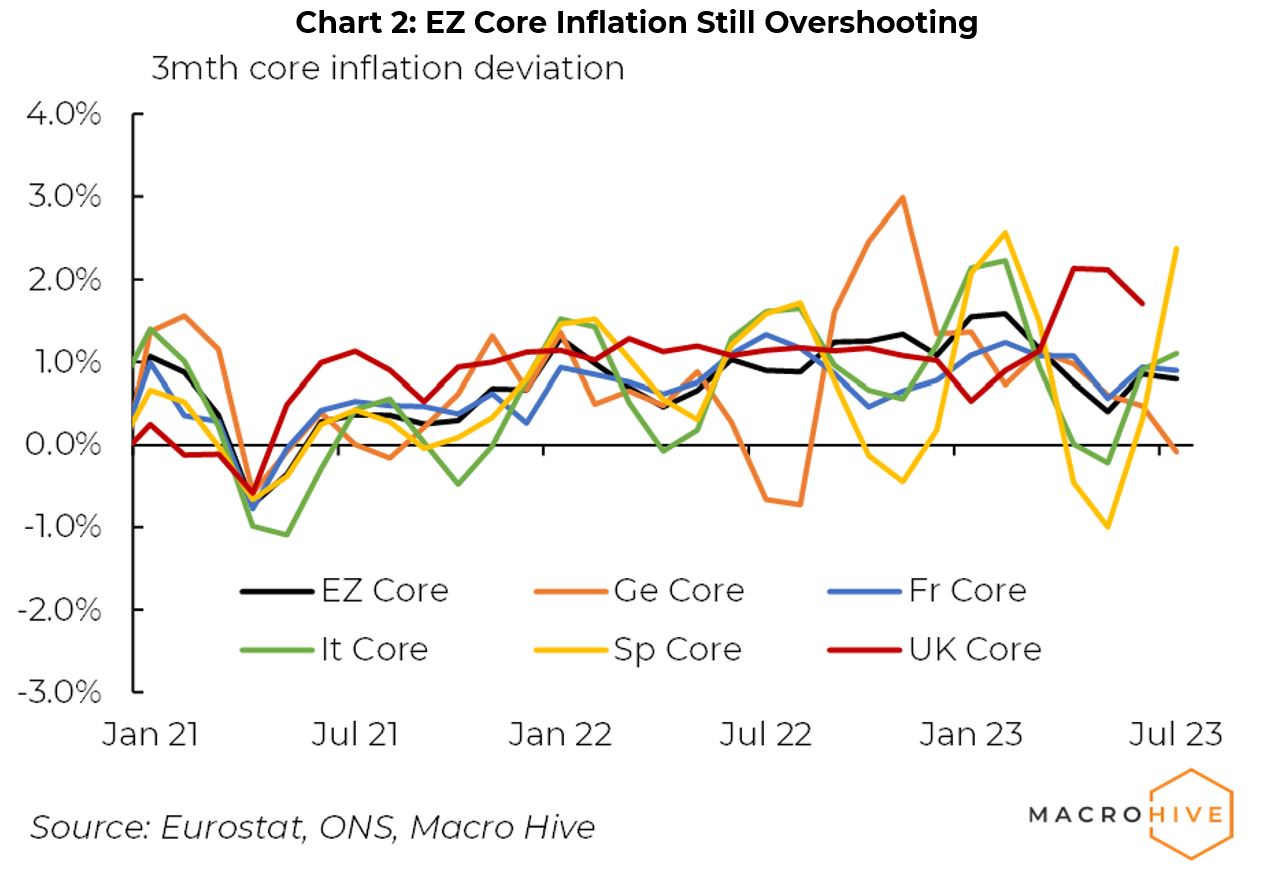

In the Eurozone, the key question is whether core inflation and wage-intensive services are normalising. Unequivocally, the core readings have remained significantly above typical levels (Chart 2). For the Eurozone, this equates to a +0.8ppt 3m/3m deviation, or about +4.2% annualised – significantly above target. Troublingly, this number is suppressed by the June German train subsidisation and shows little sign of returning to normal beyond that.

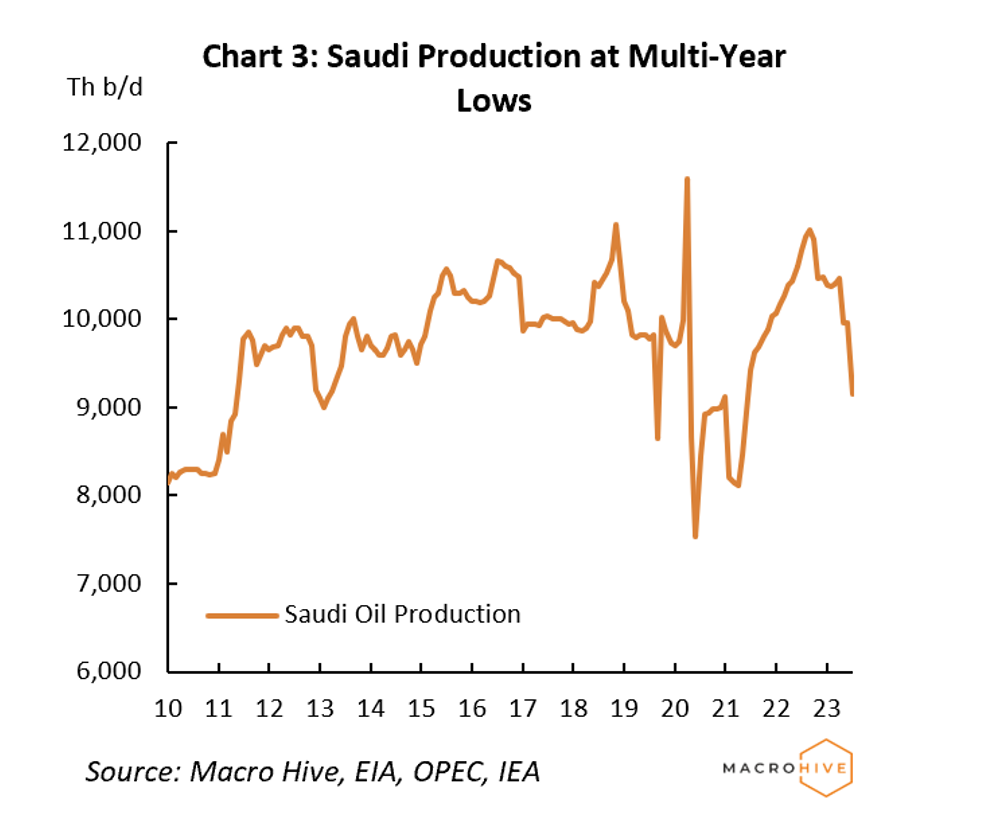

OECD inventories have fallen below 2790mn barrels from 2822mn barrels in May thanks partly to OPEC+ supply cuts. For example, Saudi Arabia’s production is now at a multi-year low following an additional 1mn b/d cut (Chart 3).

Given the extraordinary level of production cuts required to tighten the oil market, further price increases make extending production cuts less likely. We characterise this market as being in an unstable equilibrium. And investors should consider what happens when OPEC+ production cuts reverse or if Russia starts ignoring quotas.

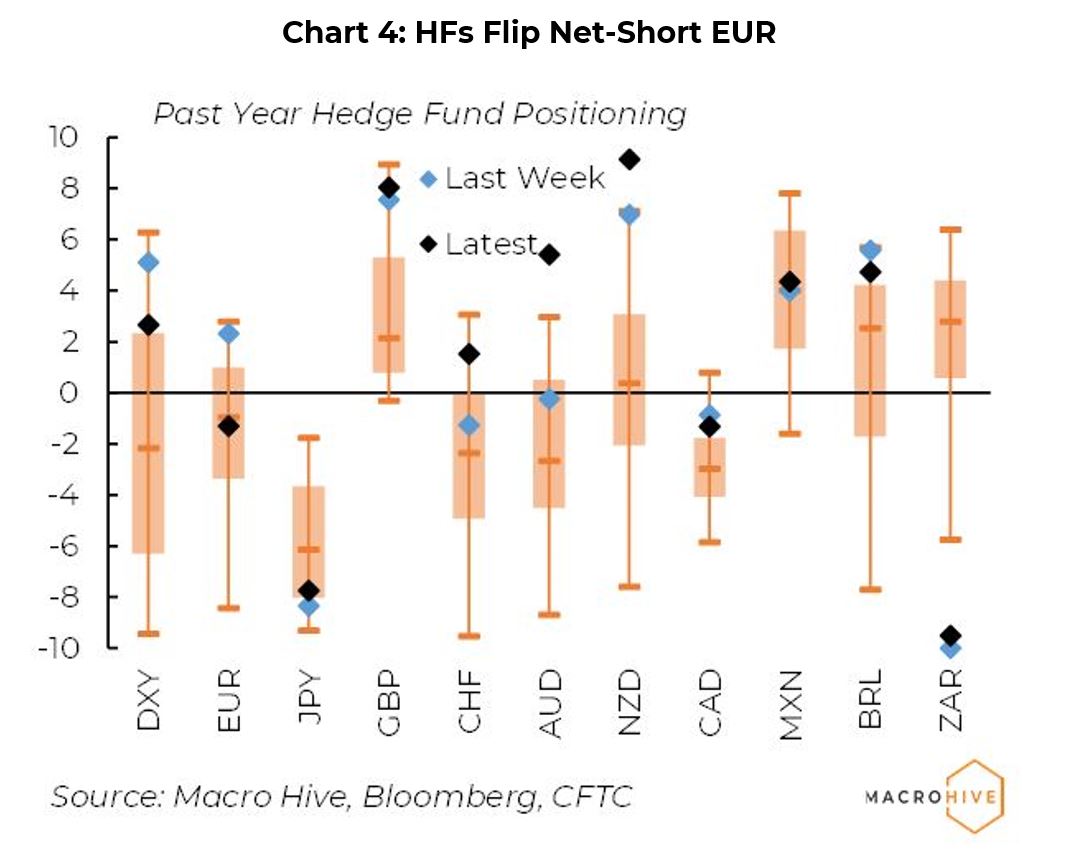

Hedge funds further pared DXY net-longs this week, with the index approaching the upper limit of a descending triangle, and flipped net-short on EUR and net-long on CHF. However, we see positives in our call for EUR/CHF higher over the next couple of months. Meanwhile, hedge funds dove into new AUD and NZD net-longs – Ben disagrees with hedge funds on AUD (Chart 1). Elsewhere, they remain in extreme ZAR net-shorts.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.