Economics & Growth | Europe | FX | Monetary Policy & Inflation

Economics & Growth | Europe | FX | Monetary Policy & Inflation

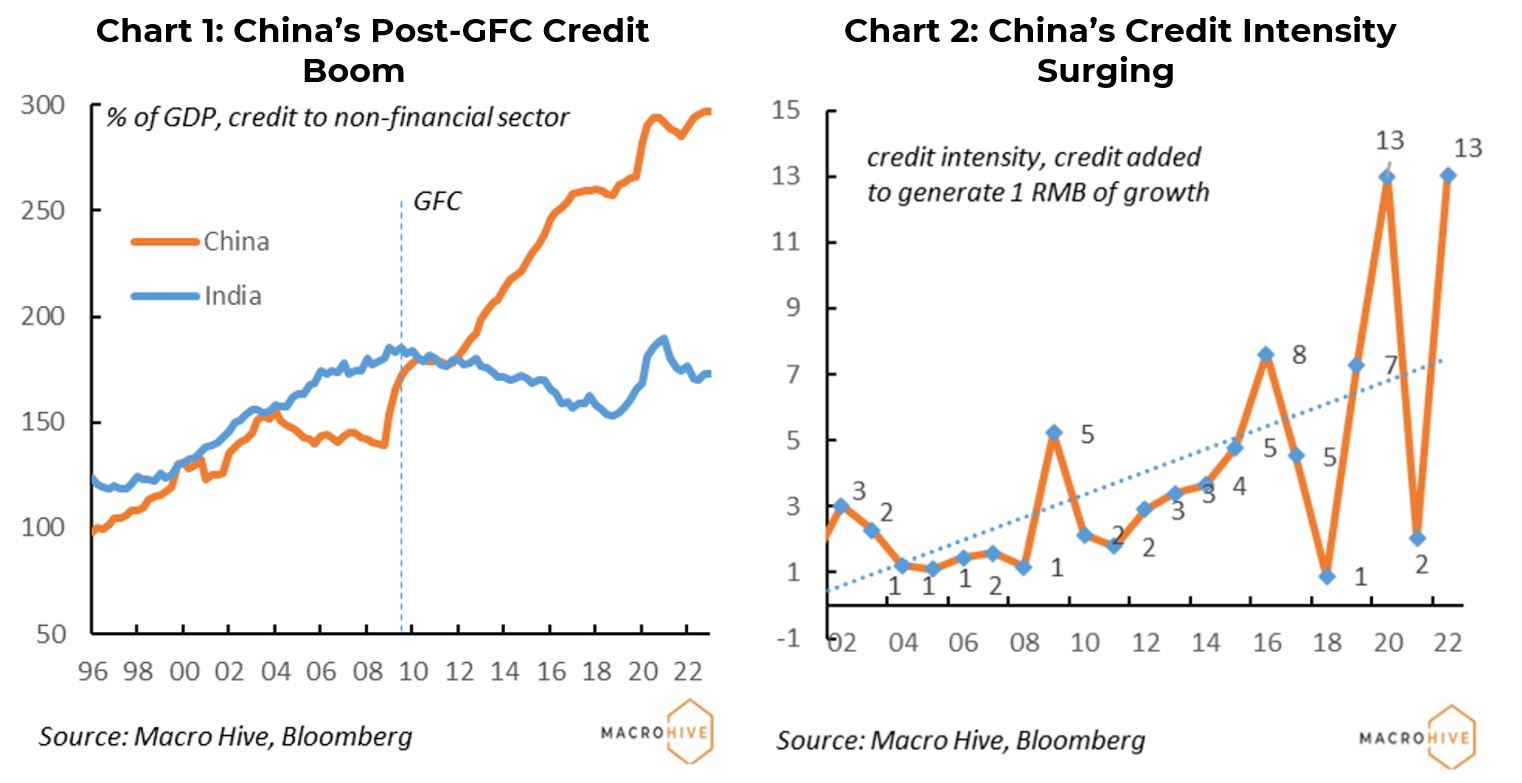

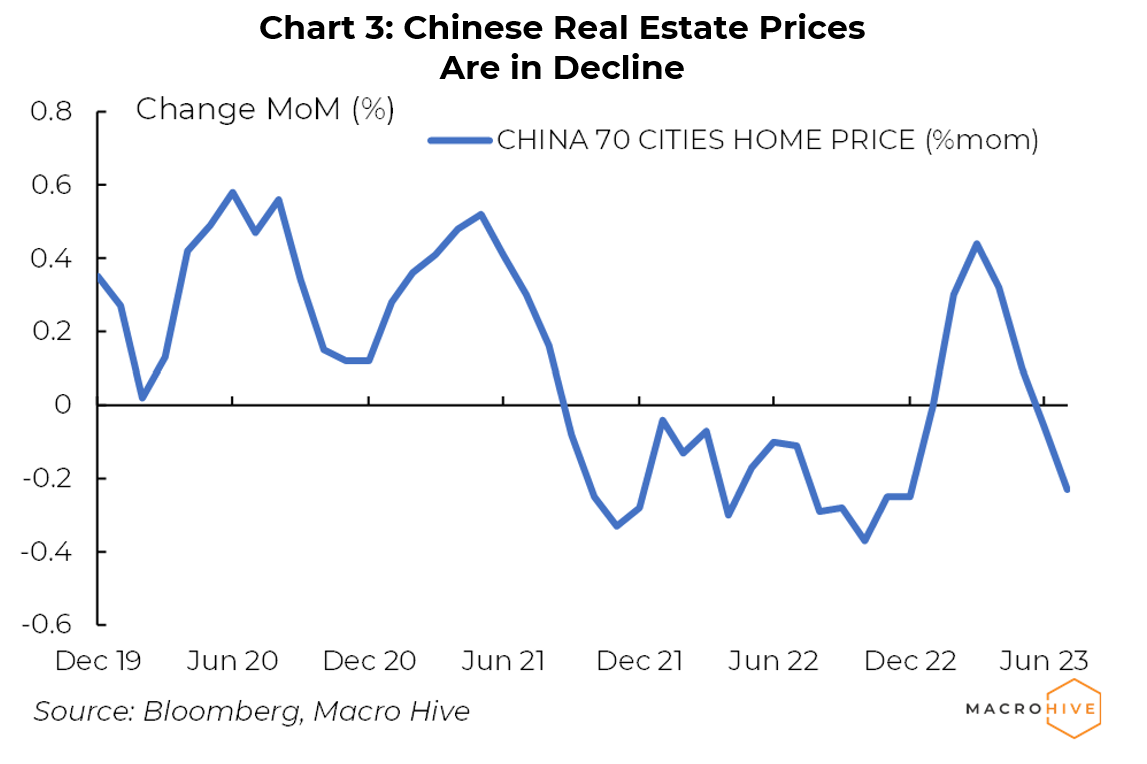

China has undergone a credit boom since the GFC. This means more lending and debt issuance than ever before. As a share of GDP, the rise has been way bigger than (say) India (Chart 1). Meanwhile, Chinese growth has been less than pre-GFC. This means the economy’s credit intensity has surged: last year, it took 13 RMB of credit to generate 1 RMB of growth (Chart 2). Before the GFC, it was one to one. This helps explain why Chinese policymakers have failed to boost growth this year.

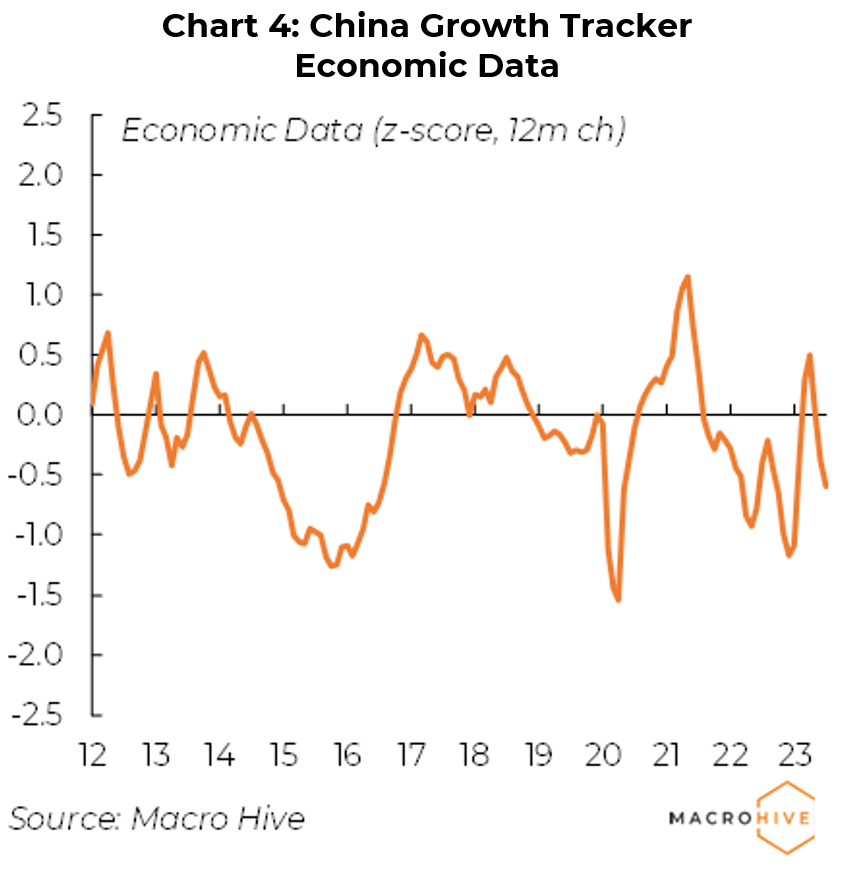

The real estate sector, which had been a growing bubble for many years, lost steam after the government made it harder for developers to leverage using customer downpayments. That triggered a housing market slowdown. The lower home prices triggered a chain reaction through other sectors of the economy as real estate investments constitute a large percentage of China’s GDP. Home price growth has been in negative territory over the last few months (Chart 3).

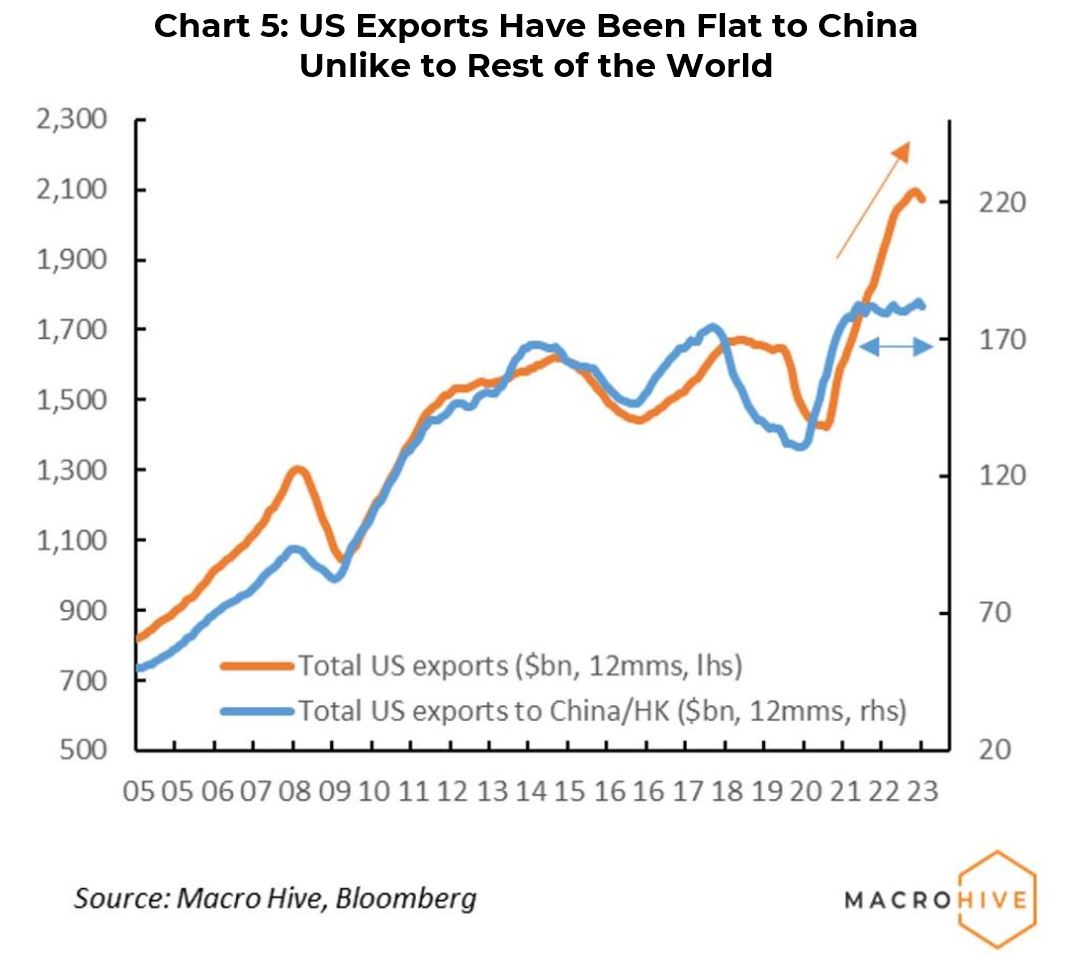

Chinese economic data continues to disappoint with industrial production, retail sales, and investment all weaker than consensus has expected. The widespread China pessimism is reflected in our economic data-based China growth tracker, which is down 22 points through July (Chart 4: June: -0.38; July: -0.60).

US exports to China have been weak in recent years, even as US exports have surged to the rest of the world (Chart 5). This is quite different to the pre-COVID period when China was actually a source of demand for the US. This suggests China’s economic weakness is unlikely to spread to the US.

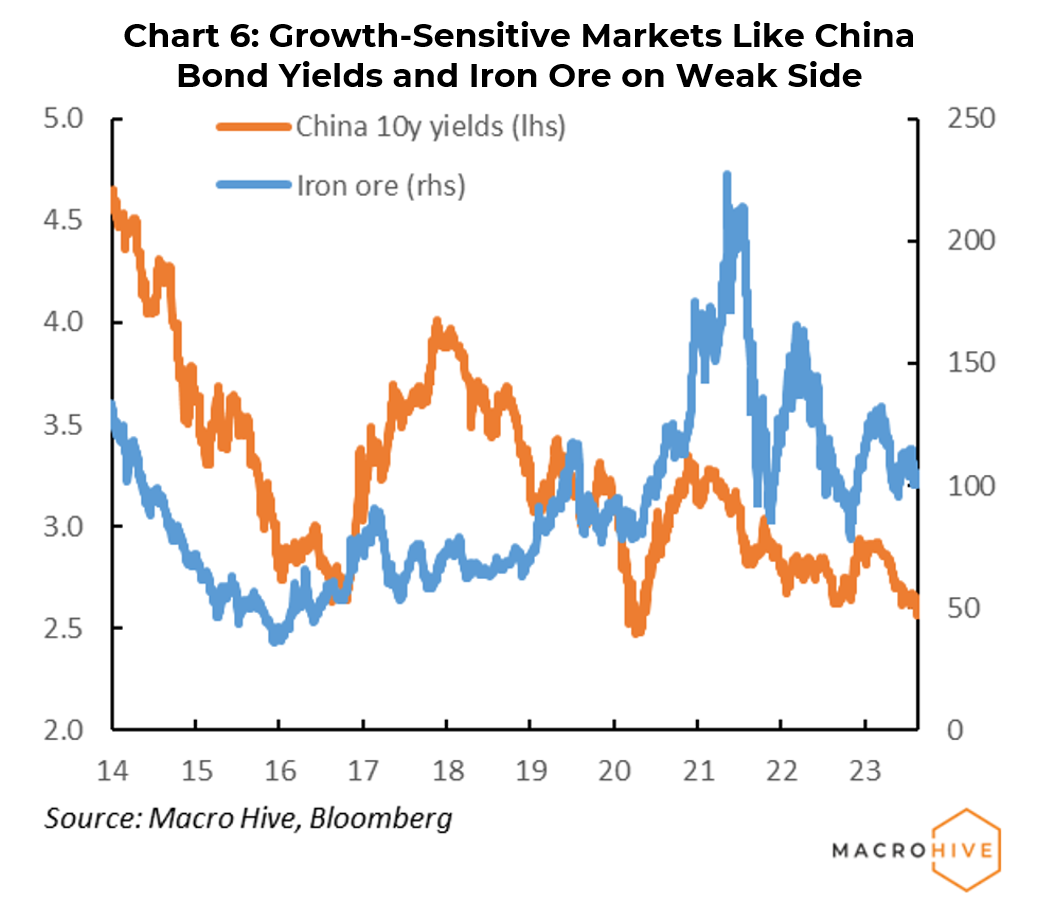

One challenge with the China slowdown theme is that markets have been pricing weakness. China bond yields have been falling, and iron ore prices have broadly been consolidating (Chart 6). Nevertheless, if the slowdown persists, these markets could continue to fall. Our bias would therefore be long China rates and bearish metals.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.