Economics & Growth | Europe | FX | Monetary Policy & Inflation

Economics & Growth | Europe | FX | Monetary Policy & Inflation

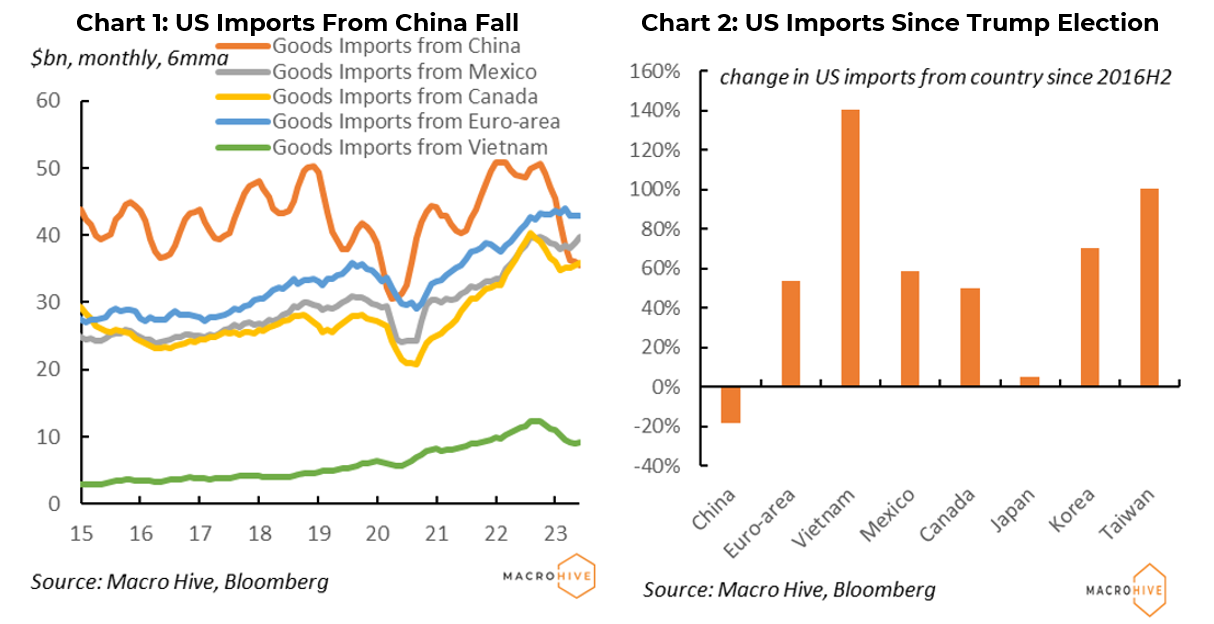

US imports from China have dropped from #1 to #4 (below the euro area, Mexico and Canada) recently (Chart 1). Versus 2016, when President Trump was elected, US imports are up 50-60% from the largest trade partners but down 20% from China, with the largest rise being Vietnam (Chart 2). This suggests a structural shift away from China particularly in the space of low-cost manufacturing.

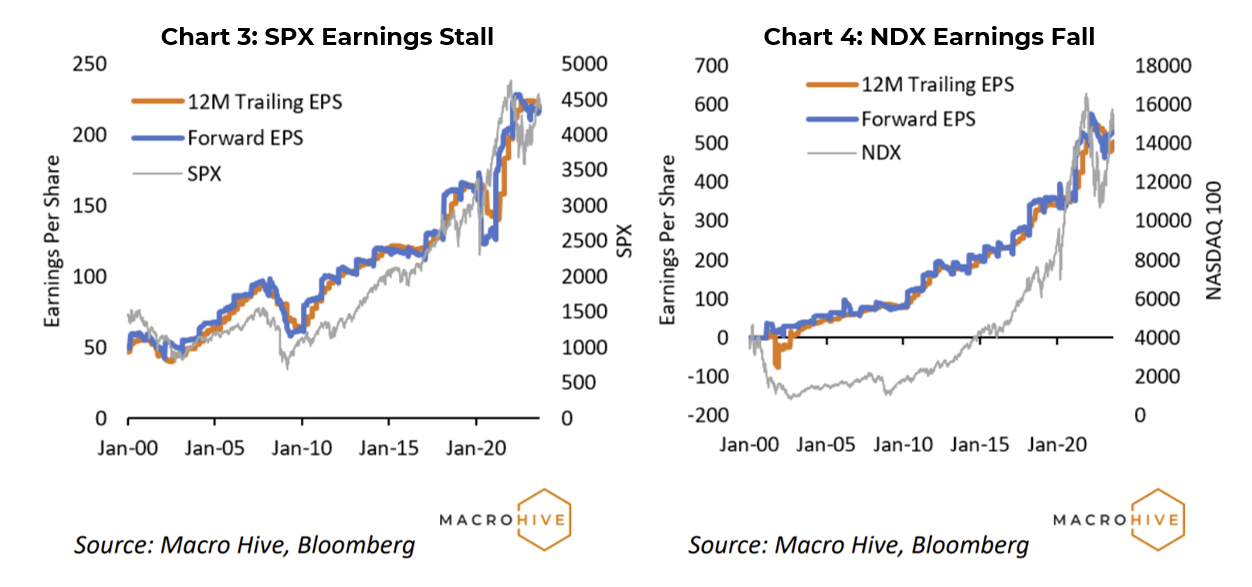

We think equities will continue to trade in a narrow range for the foreseeable future due to a lack of earnings growth. Trailing and forward earnings for the S&P 500 (SPX) have been flat for the past year (Chart 1) and falling for the NASDAQ 100 (NDX) (Chart 2). As John asks, how can either index maintain a rally if earnings growth has stalled?

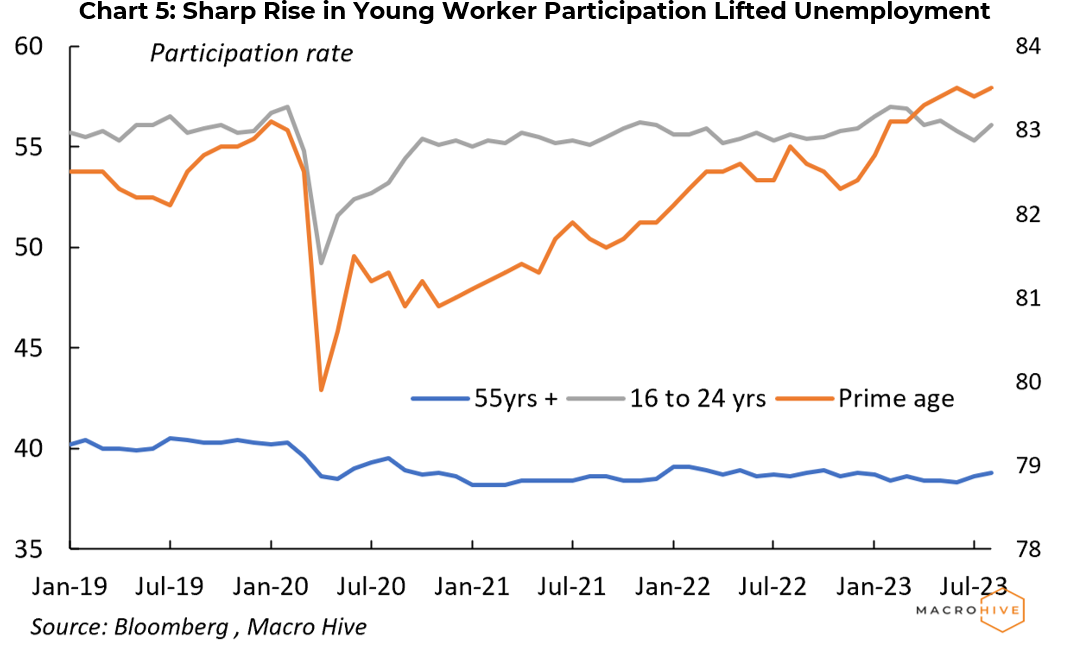

The latest US labour market data showed unemployment rose by 30bp and underemployment by 40bp to 3.8% and 7.1% in August. Increased unemployment reflected a large increase in labour supply. The labour force (i.e., employed plus unemployed) increased by 736,000 in August, against an increase of 152,000 in July. The increase in labour supply reflected an increase in participation rate across all age classes – the largest of which was the 16 to 24yrs old bracket, which increased by 0.8ppt to 56.1% (Chart 5).

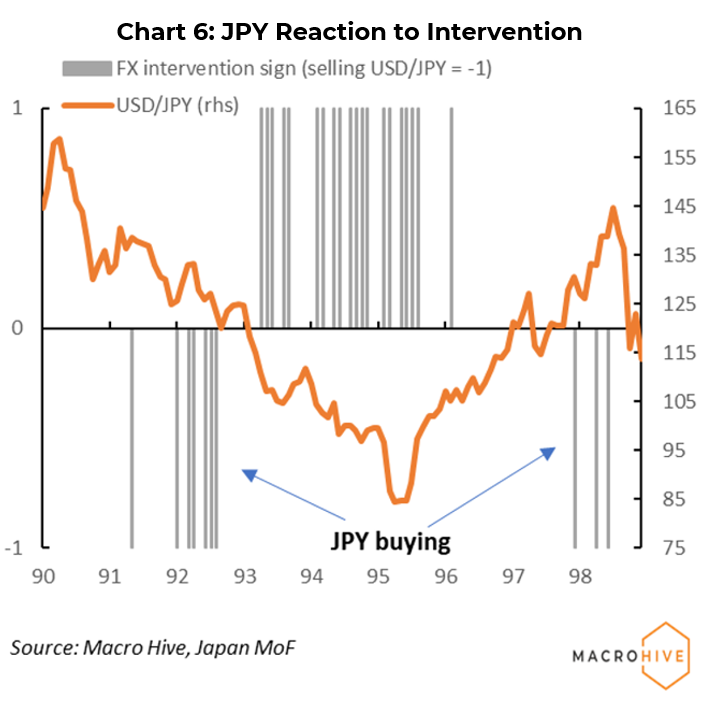

Japanese officials have started verbal intervention on the JPY; actual intervention could follow. But importantly, intervention does not always work. While last year’s intervention marked the high in USD/JPY, previous JPY buying interventions have been less successful.

In the early 1990s, USD/JPY was already trending down, so JPY buying was simply reinforcing an existing trend. Meanwhile, in the late 1990s, JPY buying did not stop USD/JPY rising over 10% before the big USD/JPY carry unwind in late 1998 (Chart 6). For this and other reasons, we are reluctant to sell USD/JPY.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.