Economics & Growth | Europe | FX | Monetary Policy & Inflation

Economics & Growth | Europe | FX | Monetary Policy & Inflation

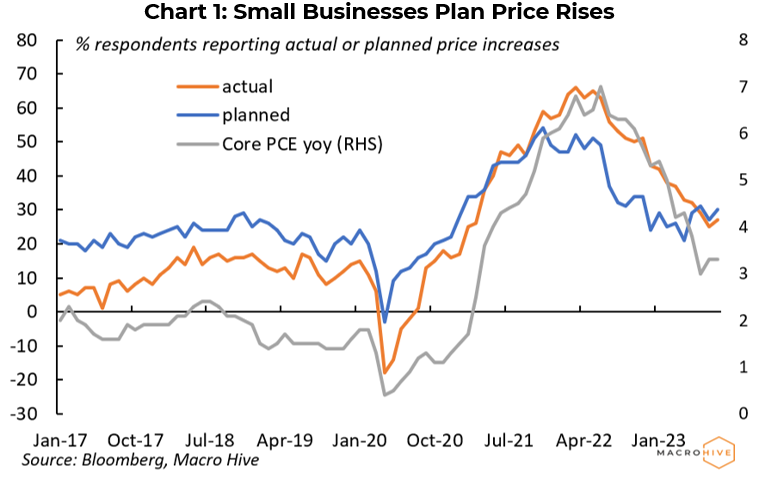

Dominique extracted a few insights from the NFIB (small business association) survey. Respondents reporting planned or actual price increases had been declining since the Q1 2022 peak. But since April 2023, the share of respondents planning price increases has rebounded (Chart 1). Historically, the planned series has led the actual series by one to three months, so we should find out soon whether small firms will follow through. If this is the case, consumer price inflation could rebound.

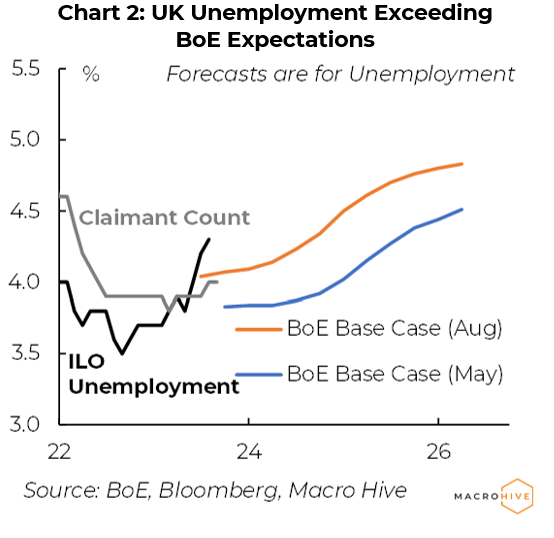

UK ILO unemployment rose again to 4.3% in July, in line with consensus. This remains a considerably faster loosening of the labour market than the BoE’s last MPR forecasts (Chart 2). We are now at an unemployment rate the BoE had not expected to see until Q3 2024. This aligns with our longstanding expectation that the BoE’s forecast for labour market loosening was much slower than realistic.

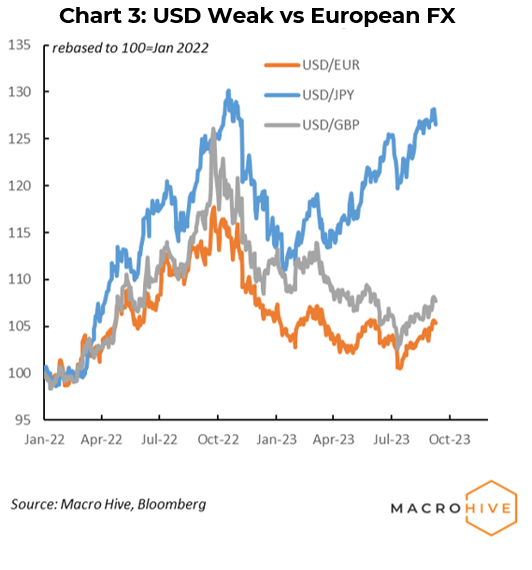

We remain bullish the dollar overall, especially against European currencies. We outlined our view in the last Macroscope piece. We add that while the USD has strengthened a lot against the JPY this year, it has not against the EUR or GBP (Chart 3). So there is more upside for the USD against European FX.

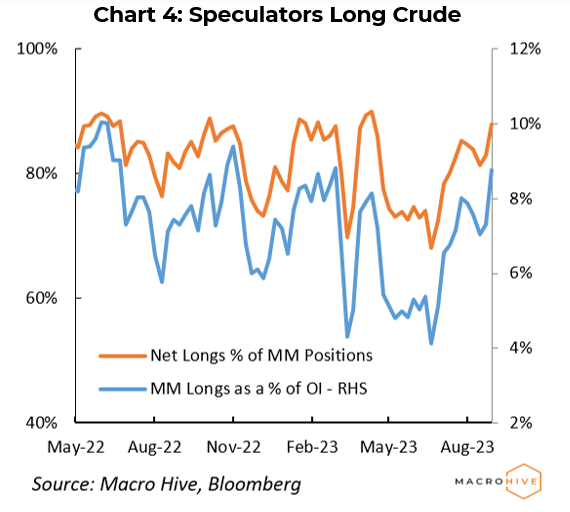

Brent rose by 2% last week to $90.65. Despite higher front-month futures, X3Z3 calendar spreads narrowed by $0.13, signalling the rally had been driven by speculative flows as opposed to further tightening on the supply side. The latest CoT data shows that managed money longs as a percentage of total managed money contracts are back at the 90th percentile, while managed money longs as a percentage of open interest is around the 60th percentile (Chart 4). We still see further upside to around $95 by the end of September.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.