Summary

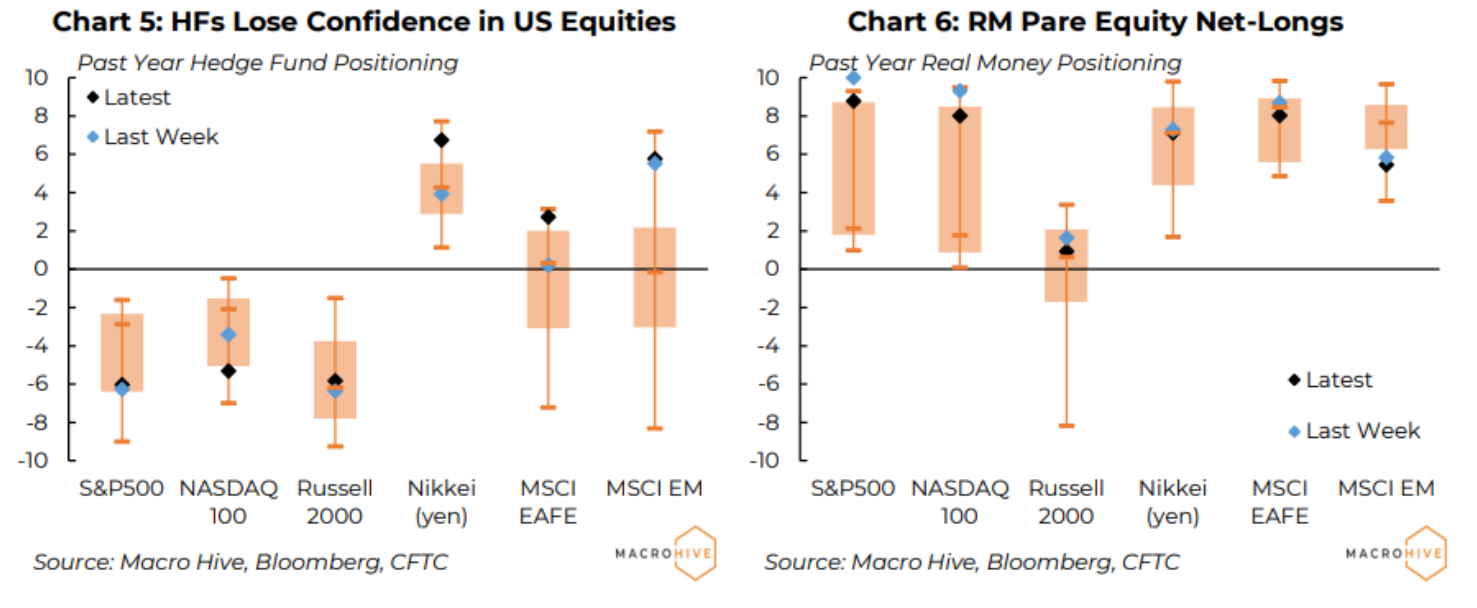

- Energy price passthrough to core inflation is a key issue for the Fed.

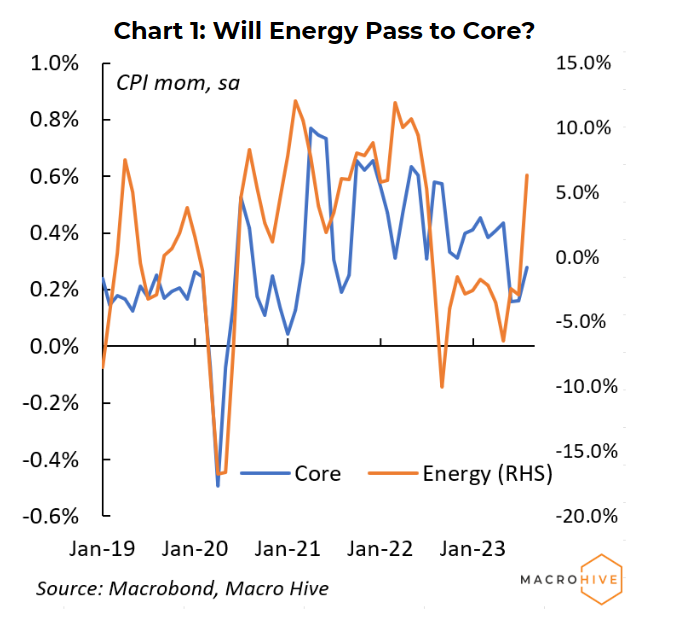

- Long EUR/SEK? We see two reasons to wait.

- A Xi-Biden meeting alone will not turn the tide for RMB.

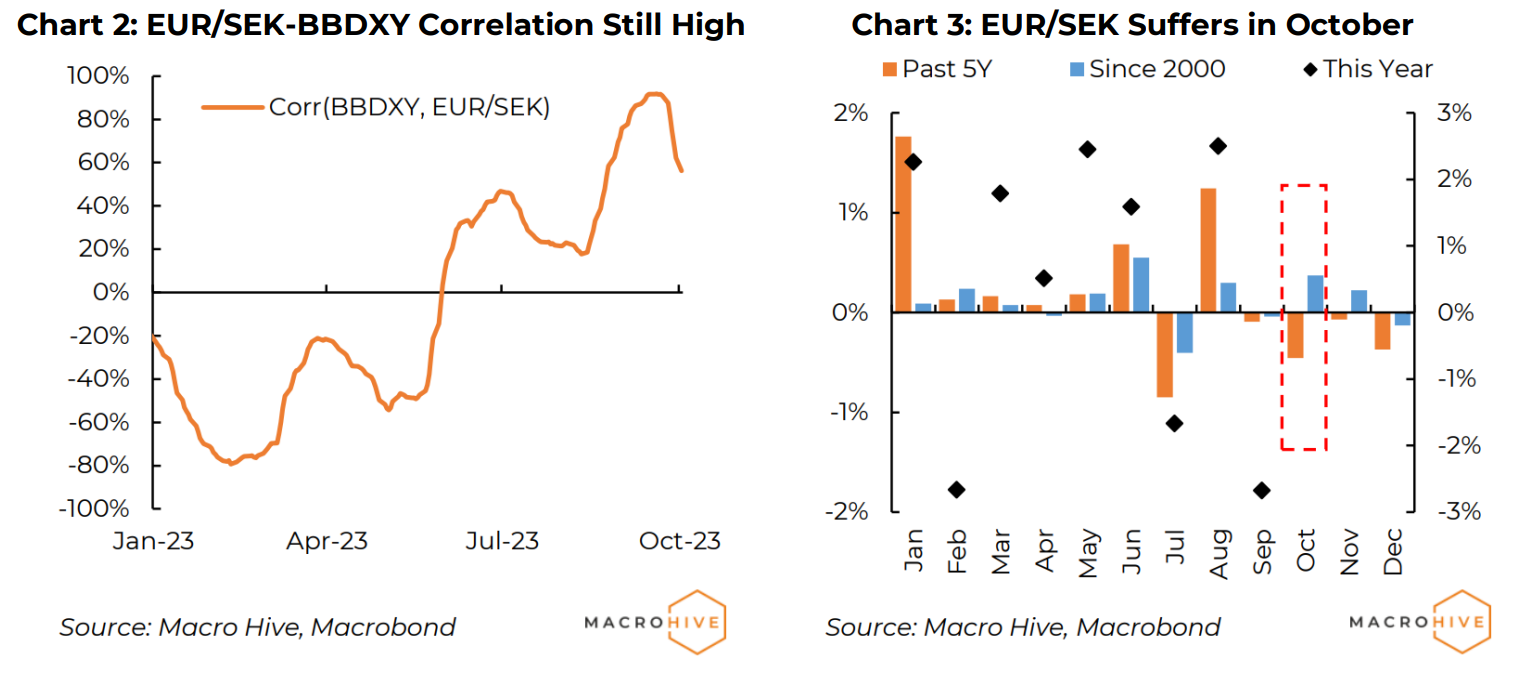

- In equities, hedge funds see the US underperforming DM, EM and the Nikkei.

Fed Has Eyes on Energy

Energy price inflation is over 5% MoM and appears set to turn positive YoY, based on an undersupplied market and despite the current (likely temporary) pullback. The risk for the Fed given the very low unemployment rate and strong, accelerating growth is that the high energy prices could pass through to core inflation (Chart 1). Evidence of this will likely come only after a few months of data. Meanwhile, risk management suggests the Fed will stick to its current plan for an extra 2023 hike.

Not the Time for Long EUR/SEK (Yet)

We are bullish EUR/SEK even after the Riksbank began hedging FX reserves. Still, we wait to go long EUR/SEK for two reasons. First the correlation with USD persists, and we expect dollar momentum can slow in the near term. Second, EUR/SEK seasonality over the past five years suggests downside pressure in October.

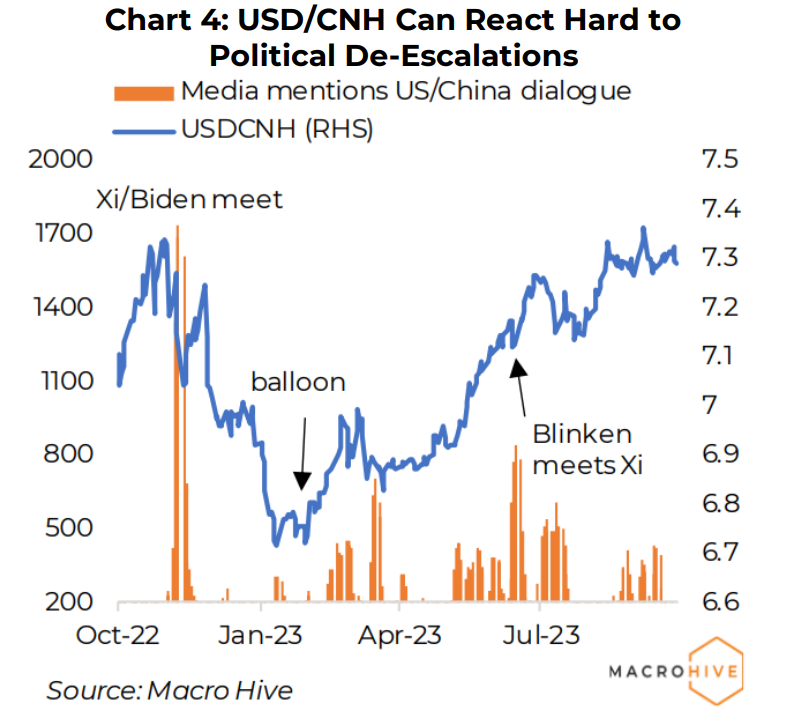

Xi-Biden Meeting Will Not Turn Tide for RMB

A meeting between Xi and Biden is on the cards for mid-November. Major de-escalations are typically a short-term positive catalyst for RMB (Chart 4). However, a Xi-Putin meeting in mid-October is confirmed, and we expect China to continue skirting the West’s red lines. Diplomacy alone will not turn the tide for RMB. Foreign sentiment depends on data turning, the Party’s narrative coherently shifting from security to economy, systemic risk stabilising, and the broad US dollar changing course.

Fading Confidence in US Equities?

According to positioning data, hedge funds continue to position for US equities to underperform those across DM, EM and the Nikkei (Chart 5). Meanwhile, real money funds pared net-longs across the equity universe (Chart 6).