Summary

- With the Fed preparing for the next policy meeting in May, the big question is whether inflation is subsiding.

- Reading inflation since COVID has been difficult because the US economy has undergone a sectoral shock.

- The key to understanding its trajectory is to recognize the divergence within the CPI components.

Still Recovering From COVID

The recent US CPI report showed a large drop in the headline rate of inflation from 6% in February to 5% in March. Declines in food and energy drove much of this, since core inflation remained sticky around 5.6% (in February, it was 5.5%). Reading inflation since COVID has been a challenge because the US economy has undergone a sectoral shock. Lockdowns led to a goods boom and services bust; the re-opening has seen the reverse.

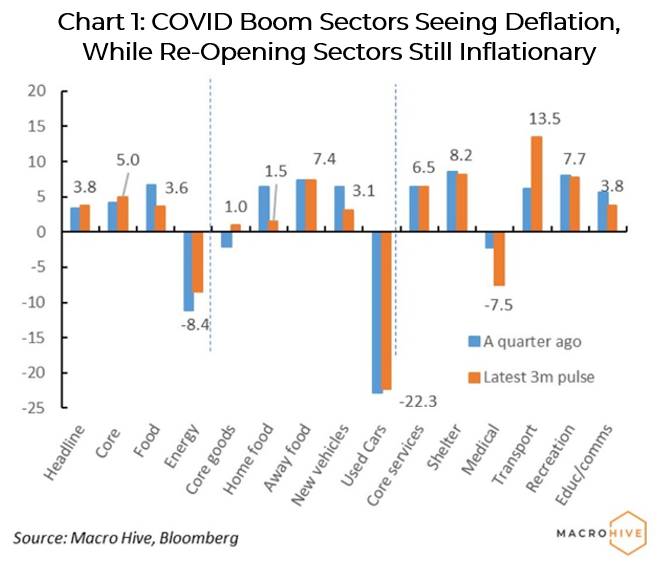

The breakdown of CPI components shows that this continues to be the case. The inflation pulse for energy, food at home, used cars, and medical services continue to show deflationary pulses (Chart 1). These were sectors that boomed during lockdown. On the other side, we continue to see inflationary dynamics in food away from home, shelter, transport, and recreation.

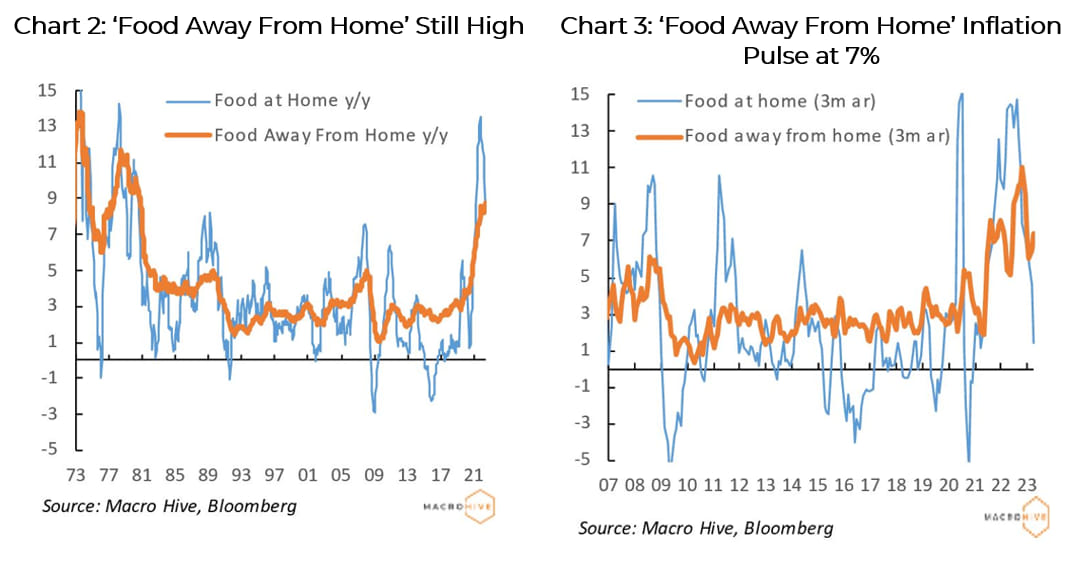

This divergence is visible in the less discussed food component. The Bureau of Labour Statistics bundles ‘food at home’ with ‘food away from home’ (restaurants). Yet different dynamics can drive these components. Notably, households that feel comfortable with their income are more likely to go to restaurants, which in turn leads to higher restaurant prices.

Looking at YoY changes in both components since 1970, ‘food at home’ exhibits high volatility while ‘food away from home’ is smoother (Chart 2). Notably, the ‘food away from home’ measure has yet to fall, suggesting inflationary pressures remain. The 3-month pulse in these components confirms this – it shows ‘food away from home’ is stabilising around the 7% mark (Chart 3).

A Final Word…

These divergent inflation dynamics are likely to persist through 2023. To see how we are allocating in this complex environment, please see our recent Asset Allocation report.

Bilal Hafeez is the CEO and Editor of Macro Hive. He spent over twenty years doing research at big banks – JPMorgan, Deutsche Bank, and Nomura, where he had various “Global Head” roles and did FX, rates and cross-markets research.

Photo Credit: depositphotos.com