Summary

- In a disappointing week for companies pinning their hopes on AI, three major players cut their 2024 outlooks. It may be a while before AI becomes a widespread profitable business model.

- Most regional banks rallied modestly after the latest New York Community Bank (NYCB) revelations and writedowns, showing NYCB is on its own now. We expect most regional banks will recover as rates eventually fall.

- Friday’s labour market report will dominate the week. Meanwhile, some 35 companies are slated to report, including retail bellwethers Target Corp. and Costco Wholesalers. Together they should give a good idea of what consumers are buying these days.

- In tech, Broadcom and Oracle will provide more colour on how quickly AI might spread as essential infrastructure is built out.

Market Implications

- Markets may revise expectations about when the Federal Reserve (Fed) might start cutting rates after Friday’s labour market report.

What We Learned Last Week

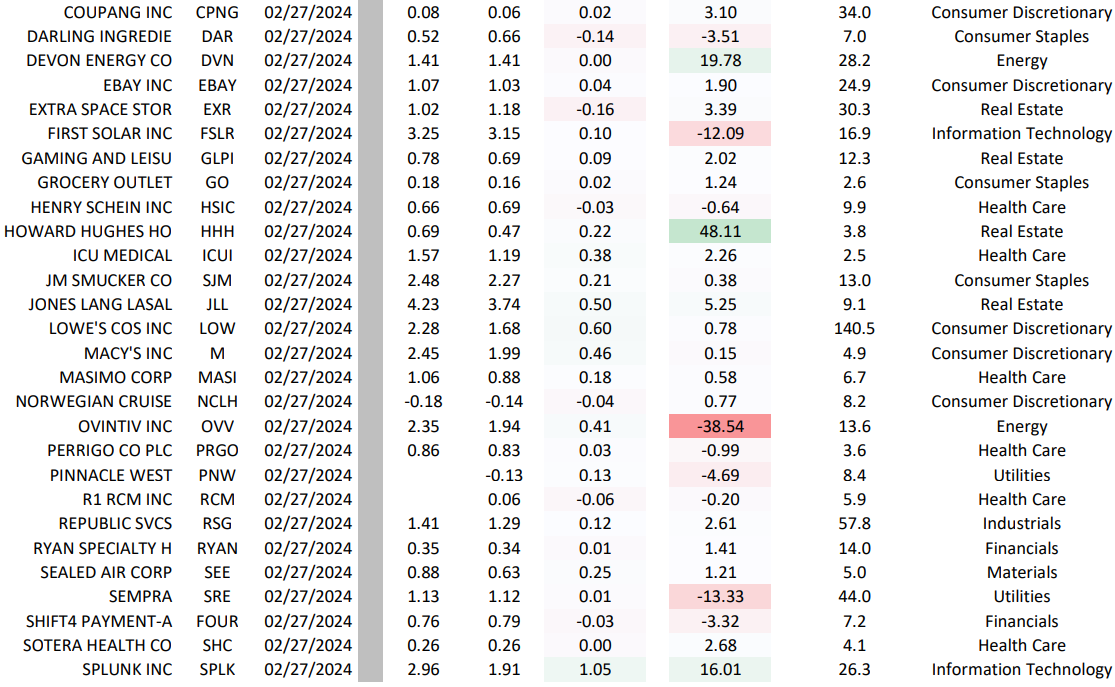

AI Hype Is Not Money in the Bank Yet – Company outlooks tell us the AI bonanza will likely be slow to spread beyond Nvidia (NVDA) and Advanced Micro Devices (AMD). Tech companies Snowflake (SNOW), Hewlett Packard Enterprises (HPE), and Salesforce (CRM) all reported solid beats. However, having hyped their growth potential from AI, the three also cut their 2024 outlooks to essentially the top of analysts’ expectations. The initial reaction was to sell off, although HPE and CRM soon recovered on the view that the companies were being conservative and managing expectations downward.

Last week, Intel (INTC) said AI gains would not start until late 2024 or in 2025. That was despite announcements of linkups with NVDA and Microsoft (MSFT).

We think the coming AI bonanza is real, but companies and investors were too optimistic about how quickly it might happen. Incorporating AI into business models is tough – whether producing software and hardware to enable AI or creating products that embody AI. It will happen over the next few years, not the next few months or quarters.

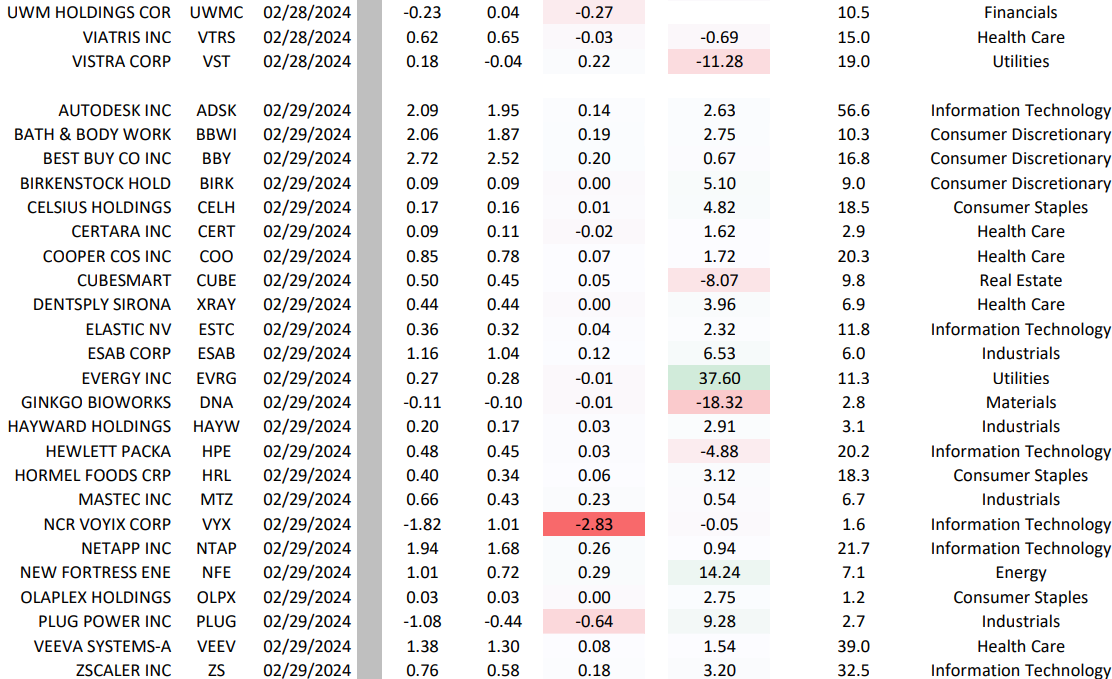

Regional Banks Shake off NYCB Woes – When NYCB reported its latest round of writedowns and problems with internal controls on 1 March, we expected the worst for regional banks and the regional bank ETF KRE. But even as NYCB dropped 22% from the 29 February close, most other regional banks rallied modestly and KRE rose 0.5% (Chart 1). NYCB is on its own.

Last Friday’s performance reassures us that the regional bank sector will recover as rates fall. Apart from the selloffs after the Silicon Valley Bank collapse a year ago and after NYCB reported earnings in late January, KRE and community bank ETF QABA have largely traded on the 10Y Treasury yield (Chart 2). Regional banks will be under a cloud for much of 2024 due to concerns about opaque commercial real estate (CRE) exposures. But barring significant new negative developments, they should rally as rates eventually drop.

Also, large bank ETF KBWB has been unfazed by NYCB’s problems. Large banks are more diversified than regional banks, with the latter more directly exposed to rising rates. CRE is only about 7% of large bank assets, versus 30% for regional and community banks.

We expect regional banks to outperform large banks as rates fall.

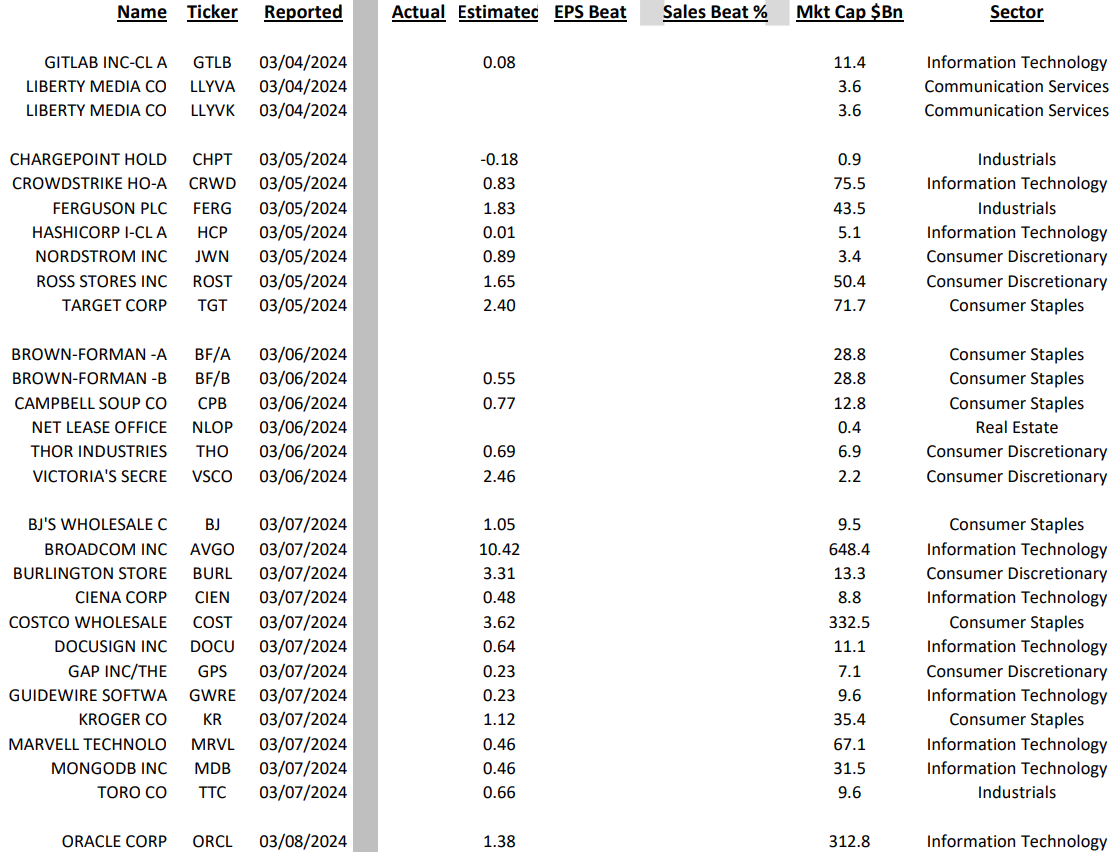

The Week Ahead

Earnings season slows drastically, with only about 35 companies in our Russell 1000 reporting. The focus is on big retailers Target Corp. (TGT), Costco Wholesalers (COST), and Kroger (KR). In tech, Broadcom (AVGO) and Oracle (ORCL) have talked up their AI opportunities but have not delivered. If last week’s reports are any indication, we guess that gold rush will happen two or three quarters ahead.

Meanwhile, Friday’s labour market report may update market views on when the Fed might start cutting rates. Until then, they will likely be in wait-and-see mode.

Among earnings reports this week:

Monday

Gitlab Inc. (GTLB)

Tuesday

- Crowdstrike Holdings (CRWD)

- Nordstrom Inc. (JWM)

- Ross Stores Inc. (ROST)

- Target Corp. (TGT)

Wednesday

- Brown-Forman (BF/A)

- Campbell Soup Co. (CPB)

- Thor Industries (THOR)

Thursday

- BJ’s Wholesalers (BJ)

- Broadcom Inc. (AVGO)

- Costco Wholesale Corp. (COST)

- The Gap Inc. (GPS)

- Kroger Co. (KR)

Friday

- Oracle Corp. (ORCL)