Summary

- Equities investments may perform better in a recession than a passive portfolio approach.

- In particular, oil and gas equities may quickly recover and outperform the broader market in a recession, as they did following the Global Financial Crisis (GFC) in 2009.

- Small cap oil producers offer additional downside protection versus their large cap peers and the broader market. One candidate is Sandridge Energy.

Recession Risks

The risk of recession is on everyone’s mind. Interest rates continue to rise beyond the initial expectations of many market participants while inflation remains elevated. And with higher interest rates, the financial system is already starting to show cracks, as with the bank run on Silicon Valley Bank and subsequent chaos at Credit Suisse.

While timing the market is hard and unlikely to be successful, a passive portfolio approach tends to not perform too well in a recession. For this reason, an alternative approach of exposure to equities that may perform well in a downturn, or those that may recover faster than the broader market, is more compelling.

In a downturn, all asset correlations initially tend to converge as investors liquidate their portfolios to meet obligations. And while oil and gas equities will likely be no exception, we think these may quickly recover and outperform the broader market in a recession, as they did in the recovery from the GFC in 2009.

Price Side

Oil prices themselves may hold up better than expected in a recession due to strong fundamentals. Demand is rising steadily, and the world needs more oil, not less—even in a recession. For instance, global oil demand in April 2020—when many countries were on total lockdown—was estimated to be ~ 82 million barrels per day (MM bbl/d) by the International Energy Agency (IEA), only ~15% less than pre-Covid highs!

Supply Side

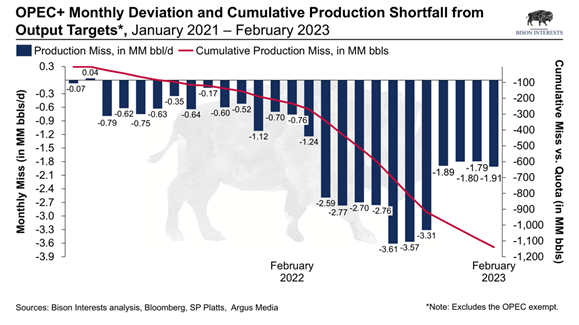

Persistent underinvestment, lack of drilling and exploration activity, declining well productivity and rising oilfield services costs, are driving higher production break-evens for producers. And the Organization of the Petroleum Exporting Countries (OPEC+) likely will not bail the market out this time, as it is nearly out of spare capacity and leaning towards additional production cuts:

Small Cap Downside Protection

And even if oil prices do not hold up, there are numerous small cap oil producers currently pricing in lower-than-market commodity prices. Simultaneously, these are trading at material discounts to both large cap peers and the broader market, while generating material cash flow. In our view, these ultra-low valuations for high-quality oil and gas producers offer additional potential downside protection.

Sandridge Energy Could Outperform in a Downturn

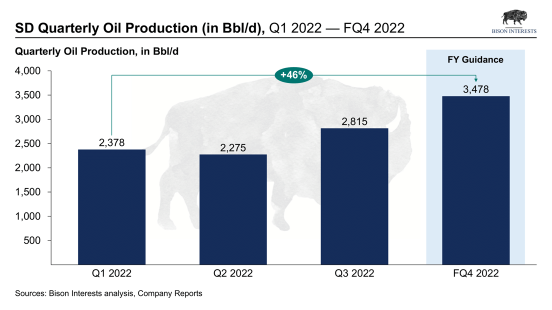

Sandridge Energy (NYSE: SD) could outperform in this environment. Sandridge has been rapidly increasing its oil production and has hedged a portion of its gas prices opportunistically, which may drive improving margins in subsequent quarters:

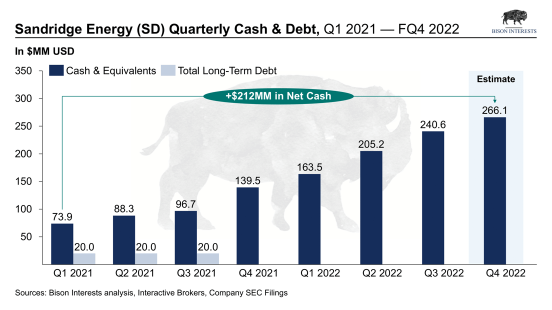

Ever since it emerged from bankruptcy, Sandridge has been rapidly paying down debt and building a substantial cash balance. As of the end of Q3 2022, Sandridge had ∼$6.5 in net cash per share, and we estimate it has built over $260MM in net cash as of the end of 2022:

Sandridge’s low valuation, commodity price hedges, and substantial cash flow offer downside protection in the event of a recession. And while Sandridge’s cash flow would likely suffer in a downturn and hedges would eventually roll off, these may potentially be mitigated by its low valuation.

What really sets Sandridge apart from the rest of the pack is the substantial cash balance it is looking to deploy to buy assets at depressed valuations in a downturn, which would be highly accretive to cash flow. If oil prices were to subsequently recover, Sandridge would emerge with significantly more production and a strong balance sheet. Sandridge has a board selected by Carl Icahn, its largest shareholder, and $1.6 billion in ‘tax shields’ to offset acquired cash flows. With a view that oil prices are headed structurally higher looking past current economic uncertainty, we are accumulating shares in companies like Sandridge.

Looking Ahead

Recession risks are certainly elevated, but one is not guaranteed. We believe it is better to focus on long-term equity fundamentals than to try to time the market, while also building exposure to companies like Sandridge that are well positioned to exploit a downturn.

We continue to see the compelling opportunity in deeply discounted and high-quality small cap oil and gas companies. In an upside scenario, these offer substantial torque to commodity prices, while also having the potential to catch-up to large cap peer valuations. And in a downturn, companies like Sandridge may deploy their accumulated cash on deeply discounted assets and materially outperform.

) investors, new inflows may drive a re-rate in line with large-cap peers and with the broader market. And even if this re-rate never comes to fruition, there are other paths to a successful investment outcome, notably buyouts, share buybacks, and dividends.

Josh Young is the Chief Investment Officer and Founder of Bison Interests – an investment firm that focuses on the publicly traded oil and gas sector. He has over 15 years of experience in investment management, 10 of which were focused on publicly traded oil and gas securities. Josh became Chairman of the Board of RMP Energy in 2017. After refreshing the board and management team and rebranding the company (Iron Bridge Resources), it was bought out at a 78% premium in 2018.

Photo Credit: depositphotos.com