To see more from Nikhil, follow him on Twitter and Substack.

Updated: 10 May 2022

Why ETH Price Could Hit $150,000 in 2023

Original argument (April 2021) Bitcoin has dominated the cryptocurrency space so far, but investors are turning their attention to ethereum. Prior valuation models based on inferior comparables (BTC Stock to flow, Payment networks, Metcalfe’s law, DCF model on YTD fees) result in a $30-50,000 base case for Ethereum. However, I believe a $150,000 price target is achievable by January 2023. I base this ethereum price prediction on the concept of the Ethereum Triple Halving. That is, I believe ethereum will have a sell pressure reduction equivalent to undergoing all three of Bitcoin’s halving events consecutively after the H2 merge to proof-of-stake.

Ethereum Price in 2022

Since I published my report, we have had a run of +60% for ETH in early May 2021, a -60% drawdown from May to July 2021, a +180% run from July 2021 to November 2021, and recently, a -65% drawdown from the November 2021 peak to now. And with all of that excitement, total performance is -3% as of early 2022: in other words, sideways. So you may ask, should I buy ethereum right now?

What Drives an Ethereum Price Prediction of $150,000? (Original Thesis, 2021)

There are four strong reasons for such a high ethereum price prediction following the triple halving: illiquidity drivers, demand drivers, the catalyst, and native adoption.

Illiquidity Drivers: Stake+DeFi is locked up now at a 12% market cap. Incentives will bring this to 30%. Fee burn removes the most liquid supply first. Negative stock to flow means no release valve through issuance. Yields cause ETH HODLing to go viral more than BTC HODLing ever could. Yield starts at 25+%. Yield is USD price-insensitive and attracts more staking and more illiquidity.

Enjoying this Exclusive? Sign up to our free newsletter for more.

Demand Drivers: There are new onramps for retail and institutional flows: Robinhood, Paypal, Venmo, and Futures. Funds already did the work to get access to Bitcoin, so access to Ethereum will be faster. US ETF timing is a wildcard. Massive relative to Canada ETF’s, so expect over $1 billion in capital inflows. At $1 trillion market cap, CTA flows, Risk Parity. ETF unlocks ESG, other discretionary.

Catalyst: The Triple Halving event is a known catalyst. EIP1559 happened on 5 August 2021. Proof of Stake (PoS) or ‘the merge’ is expected in H2 2022, though the exact date is uncertain. This is a 90% reduction in issuance equivalent to three consecutive bitcoin halving events.

Narrative Adoption: Price leads narrative. A rise in the ethereum price and the ETH/BTC ratio leads to narrative adoption. ETH is not BTC. It has an ultra-sound store of value, exploding active accounts and transaction volume, insanely low fees, and attractive DeFi and staking yields. Also, Visa accepts stablecoins, NFTs are fun, and its use-case is more intuitive than digital gold. Narrative potential means until searches for ETH are greater than those for BTC, the party is not over.

An Update on Illiquidity Drivers of ETH (February 2022)

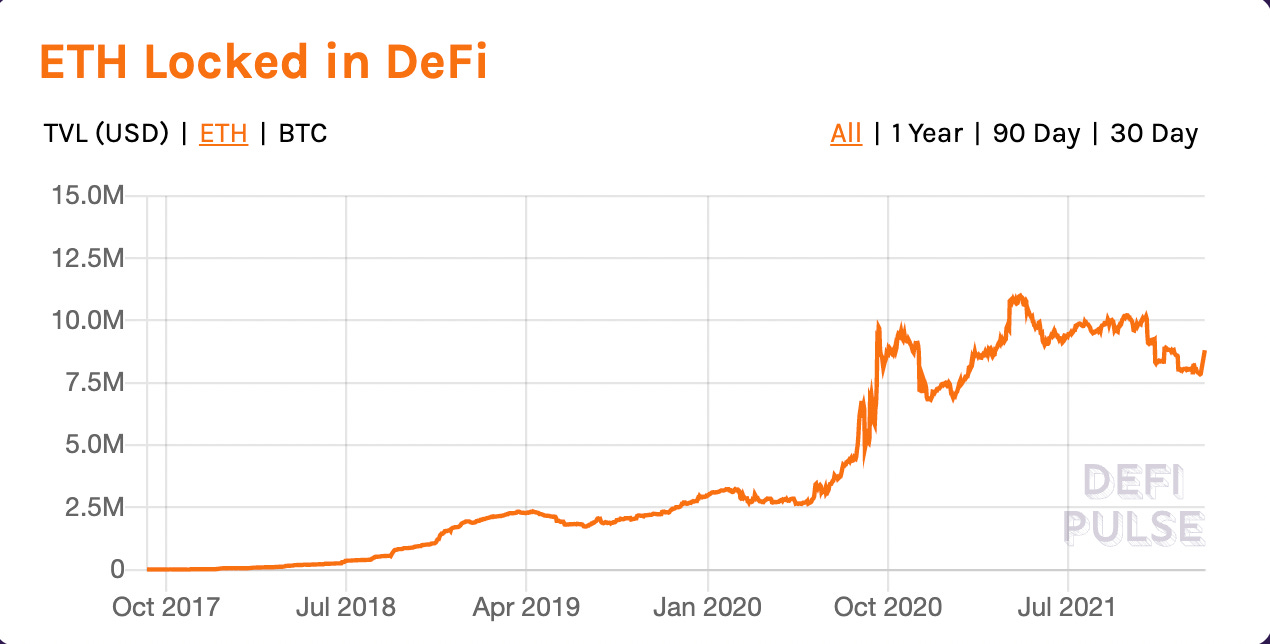

ETH in DiFi

When I first wrote my report, 10.8M ETH were locked in DeFi. Today, that has declined to 8.8M (-19%). Indeed, ETH locked in DeFi has hit a plateau (Chart 1).

Why has DeFi on ethereum slowed? It is impossible to prove, but it is likely a mixture of ETH Layer 1 gas fees being too high and the emergence of alternative Layer 1 solutions such as Solana and Avalanche in the past few months to funnel away excess capital that balked at those fees.

So what’s next? The rise of ethereum’s Layer 2.

As Layer 2 rises, the cost of participating in DeFi will fall by orders of magnitude. This will increase the potential user base for DeFi on ethereum and allow it to challenge alt-L1’s for their users. Up until this point, ethereum has not been competing for those users at all.

That is about to change. I see no reason that ETH locked in DeFi has a hard ceiling here. If anything, the value proposition of decentralized finance on ethereum will only get stronger as the rollup solutions mature. And we should see the uptrend renew in the near future as fees approach 0 and focus shifts to improving UX and onboarding new users.

Staked ETH

When I first wrote my report, 3.94mn ETH had been staked. Today that has increased to 9.1mn (+130%) ETH staked in the Beacon Chain.

I expect this trend to continue for the next few months. And it will likely accelerate into the merge as reduced uncertainty around the merge date reduces the cost of locking up capital.

Another big change since my initial report is the maturation of multiple major staking derivative protocols. I wrote about Lido Finance fairly extensively in my report addendum, where I discussed the likelihood that I had dramatically underestimated the amount of Ether that would be staked. Now, however, we have also seen the rise of decentralized solution RocketPool to go along with centralized exchange staking solutions in Kraken and Coinbase.

The current model is that ETH supply will cap out at around 120mn after the merge. That means 7.5% of all future ETH supply is currently staked. Expect that to quintuple over the next year (accelerating after the merge).

Catalyst: An Update on EIP1559 and the Merge (February 2022)

EIP1559 Is Working Better Than Expected

EIP 1559 is burning 70% of fees – that is wild. When you go to the market to buy unstaked ETH, the pool of liquid ETH is $4bn smaller because of the burned ETH that is not being recirculated from miners back into the market. Now obviously, things have been rough in the entire crypto market. But recognize that for an asset with a market cap of $300bn, removing $4bn from circulating supply has implicitly reduced the damage. In other words….things could be worse.

We can see with ultrasound.money that:

- The current issuance rate is 5.4M ETH per year.

- The current burn rate is 3.5M ETH per year.

- After the merge, issuance will drop to 0.5M ETH per year.

When Will the ETH Merge Happen?

The triple halving is the merge to proof of stake. So as you can imagine, the delays in the merge are… mildly frustrating. However, I am just an investor. The real work is done by the builders, and I can respect how hard and high stakes their job is. The current due date is September 2022.

Ultimately, the merge is the crux of the entire thesis. It fundamentally changes the supply/demand structure of the ETH market, moves ETH into a deflationary regime, creates incentive for staking demand, and cements ETH’s geopolitical grade security status.

When I first presented this argument, I was expecting a November 2021 merge. My timeline of January 2023 was based on one-year runway post-merge to build up demand for staking and allow for narrative development. If the merge happens in September 2022, I will be targeting a similar timeline. It would not be surprising, as a result, if my thesis does not fully play out until July 2023, or even early 2024 depending on how late the merge actually happens.

Possible Delays to the Ethereum Merge

The obvious con of having the merge delayed is macro risk. If we enter into a heavily inflationary environment with the duration trade completely zonked, the potential for ETH mania reduces substantially.

On the other hand, there actually are real silver linings to delaying the merge. When the merge happens, per my thesis, I expect the price to rise. And with price, narrative will follow. However, at the center of any narrative is a core of fundamentals, and crypto fundamentals are changing constantly.

If the merge happened in November 2021, it would have been before Layer 2 development got off the ground. If the merge happens in June 2022, it will happen as L2’s fully onboard the full suite of DeFi primitives and finish the build-out of CEX bridges and direct fiat onramps. A narrative built on stronger fundamentals can run farther, and I think the narrative in January 2023 could be one where ethereum begins to be synonymous with the security layer of crypto. Full stop.

Why I Am Bullish Ethereum?

I am bullish on Ethereum. Until the merge happens, the timeframe is uncertain and could delay past my January 2023 target.

As we wait, there are many narrative catalysts, including the rise of Layer 2s (their adoption, buildout, and eventual token drops), a transition from infrastructure to product, ultra-sound money, and improved user experience.

Once the merge happens, there will be a strong structural demand for Ether and an incredibly enticing staking yield alongside the growth of the staking derivative industry.

Behind all of this are billions in venture investment and organic community funding for products in the pipeline that we have yet to see and an army of ETH developers working full time to build, build, build.

Buyer beware! The Triple Halving May Be Volatile

A $30,000-50,000 base case for the Ethereum price implies a $3.5-5.5tn market cap, which investors could sustain in the long term given fundamental network value. A $150,000 peak, however, implies a $16tn market cap, which is unlikely to be sustained past the short term. Illiquidity produces upside volatility just as easily as it seeds downside volatility.

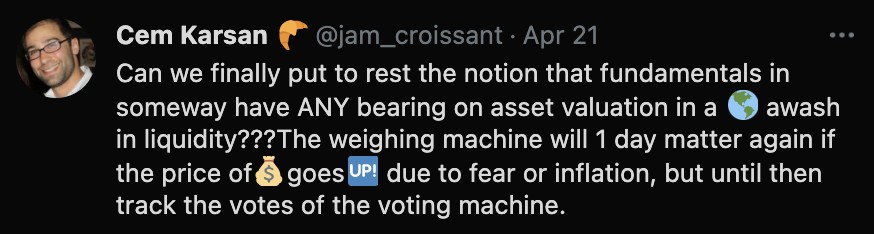

April 2022 Update on Ethereum Volatility: From mid-2021, Ethereum volatility started moving sideways, rather than inclining steeply as it had done in the years before. Also, Ethereum’s trading volume as a percentage of market cap has been falling since around June 2021. One explanation could be that investors are trading less due to the bearish macro backdrop. Crypto seems to trade more like a risky asset, and the Ethereum and NASDAQ correlation is commonly above 80%. We explore more in our 21 April 2022 analysis of ethereum volatility.

For all the latest on ethereum and cryptocurrencies, including price forecasts and in-depth modelling, check out our crypto analytics.

FAQ

→ What Is the Triple Halving?

Ethereum’s triple halving event is a merge of EIP-1559 and the proof-of-stake ETH 2.0, which would drop sell pressure by 90%. That is the same impact as three halvings of the world’s most popular cryptocurrency, bitcoin.

→ When Is Ethereum Halving?

Developers expect that the Ethereum triple halving will happen in September 2022. EIP-1559 has already seen implementation, so we are just waiting for the launch of ETH 2.0 (or ‘The Merge’). The migration to proof-of-stake will cut ETH inflation from 4.3% annually to 0.43%. The exact ETH triple halving date is unknown.

If you have not already checked out our tracker series for Ethereum, you can find it here.