Summary

- Small-cap oil and gas equities are trading at a discount compared to large-cap peers.

- Share price underperformance and rapid fundamental improvement have rendered valuations more compelling.

- The prolonged bear market of 2014–2020 cleared the field of the worst-positioned small caps, leaving better management teams, capital structures, and assets in the public market.

- PTSD from this bear market may explain the valuation discount, creating an opportunity.

Trading at a Discount

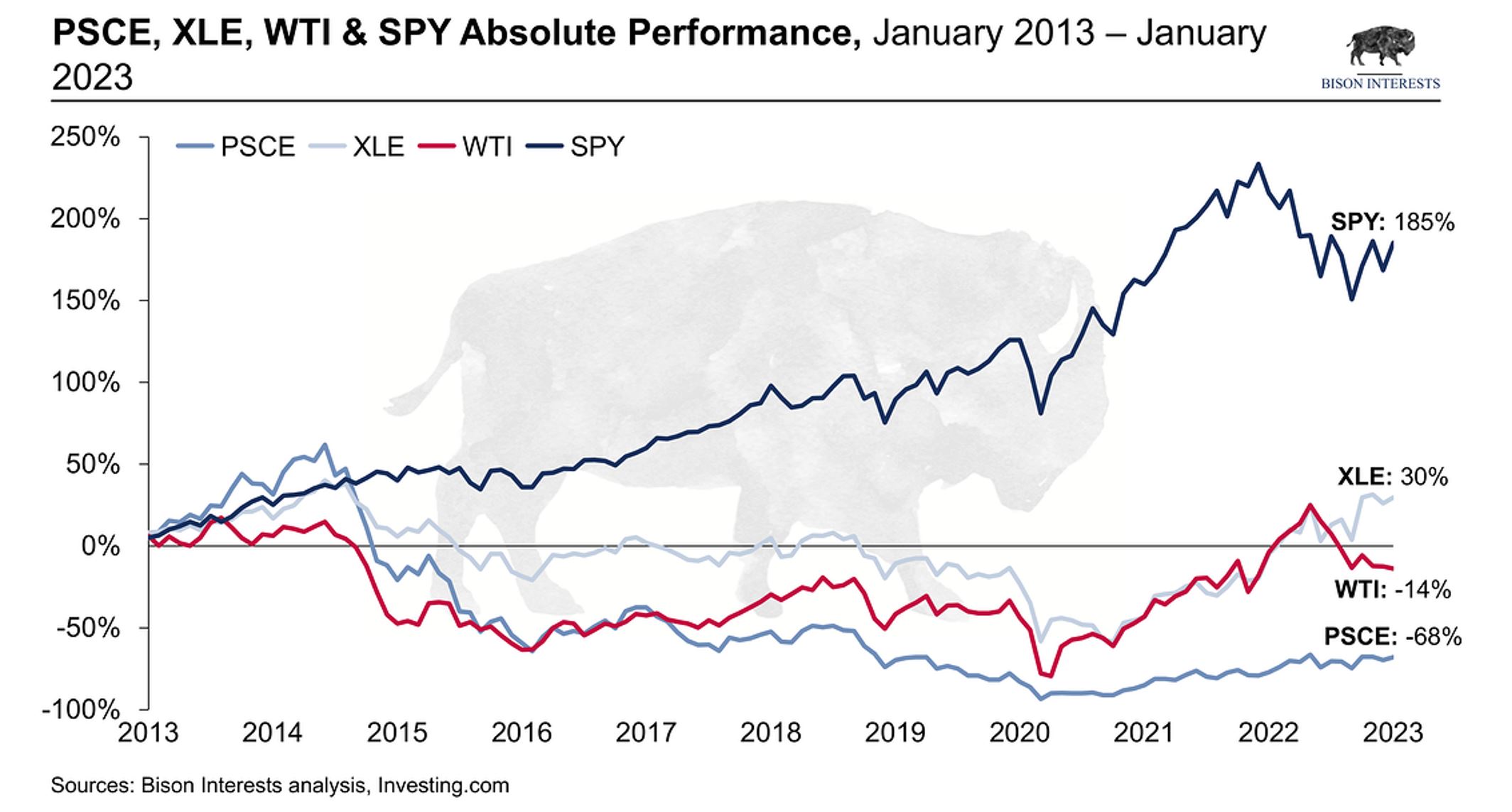

Small-cap oil and gas equities continue to trade at a material discount to larger-cap peers, despite compelling advantages. Alongside their cheapness, small-cap oil and gas equities, as proxied by the SmallCap Energy ETF (PSCE), have lagged larger-cap oil and gas companies (XLE), the oil price (WTI), and the broader market (SPY) over the last 10 years.

Small-cap oil and gas equity fundamentals have improved faster than those of their large-cap peers. Improving operating netbacks gave smaller producers free cash flow (FCF) to leverage rapidly rising oil prices, while equity valuations remained low, resulting in unusually high FCF yields. Share price underperformance and rapid fundamental improvement have rendered valuations more compelling, even after the rise in share prices from Covid lows.

Many of the worst-positioned smaller-cap oil and gas equities went bankrupt in the prolonged bear market of 2014–2020. This cleared the field to some extent, leaving mostly better management teams, capital structures, and assets in the public market.

The persistent valuation discount seen in small caps may be explained, in part, by cognitive dissonance experienced by oil investors in the prior downcycle, along with subsequent share price underperformance. In our view, this market PTSD presents a compelling opportunity.

Private Market Transactions: The Best Is Yet to Come for Public Equities

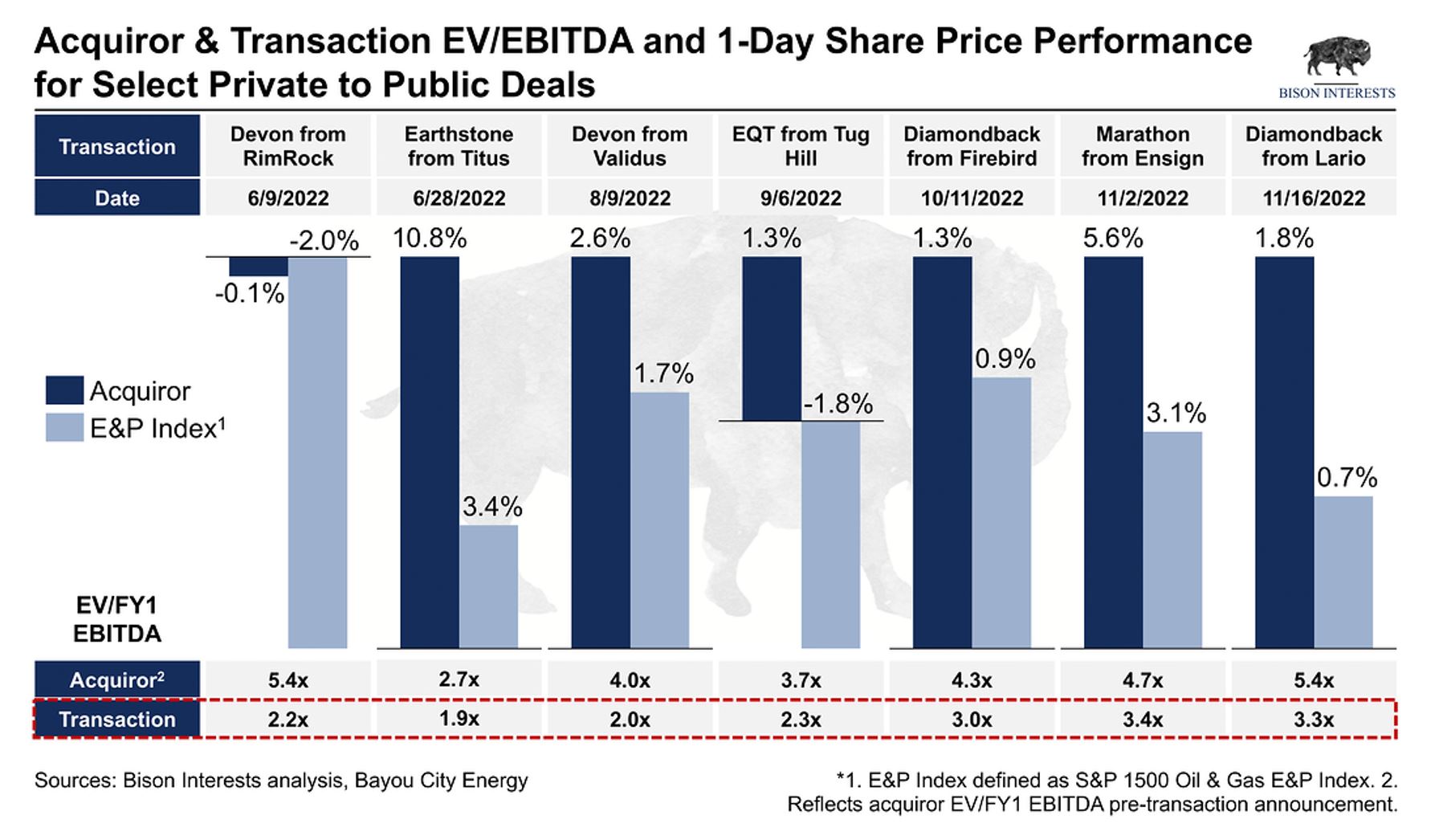

Larger operators clearly see what we are seeing, as they have been seizing the opportunity to buy smaller caps at lower multiples of cash flow, particularly on the private side.

As seen above, smaller companies are being acquired by larger operators at discounts to the larger company valuation multiples, which are highly accretive for the acquirors. The market seems to be embracing these accretive acquisitions, as indicated by the one-day share price outperformance for acquirors versus a relevant oil and gas benchmark.

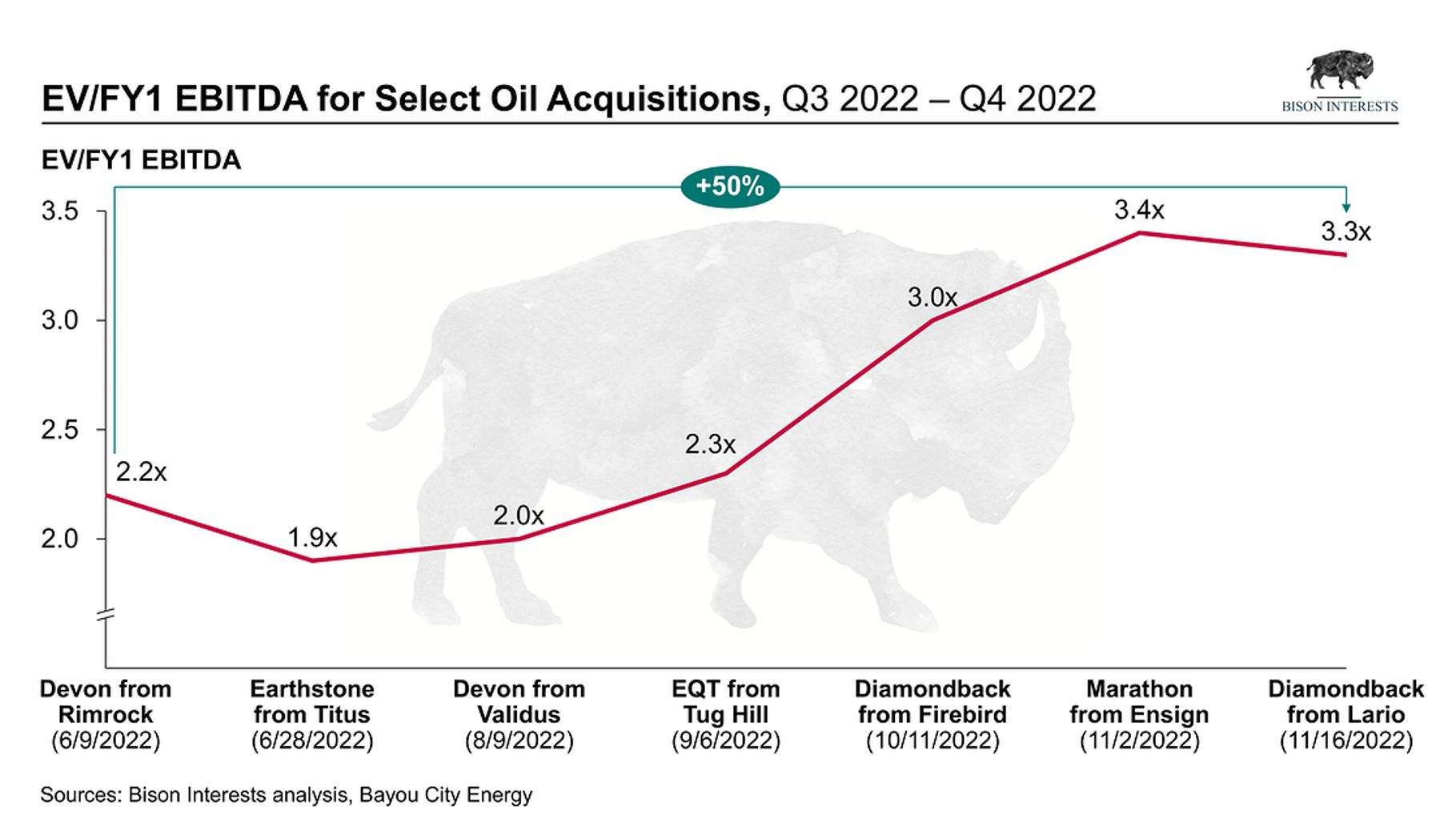

The transaction multiples paid for these acquisitions have been increasing notably. The transaction market has been heating up and value is being recognised by larger producers.

The increasing valuations paid in these deals may be a function of positive share price performance on the announcement of acquisitions. These positive market responses, along with rising transaction valuations, may be leading indicators of upcoming valuation increases for similarly sized small-cap oil equities. A potential catalyst to such a catch-up could be larger operators noticing depressed small-cap public equity valuations, who are looking to acquire those at similar metrics as recent private market transactions.

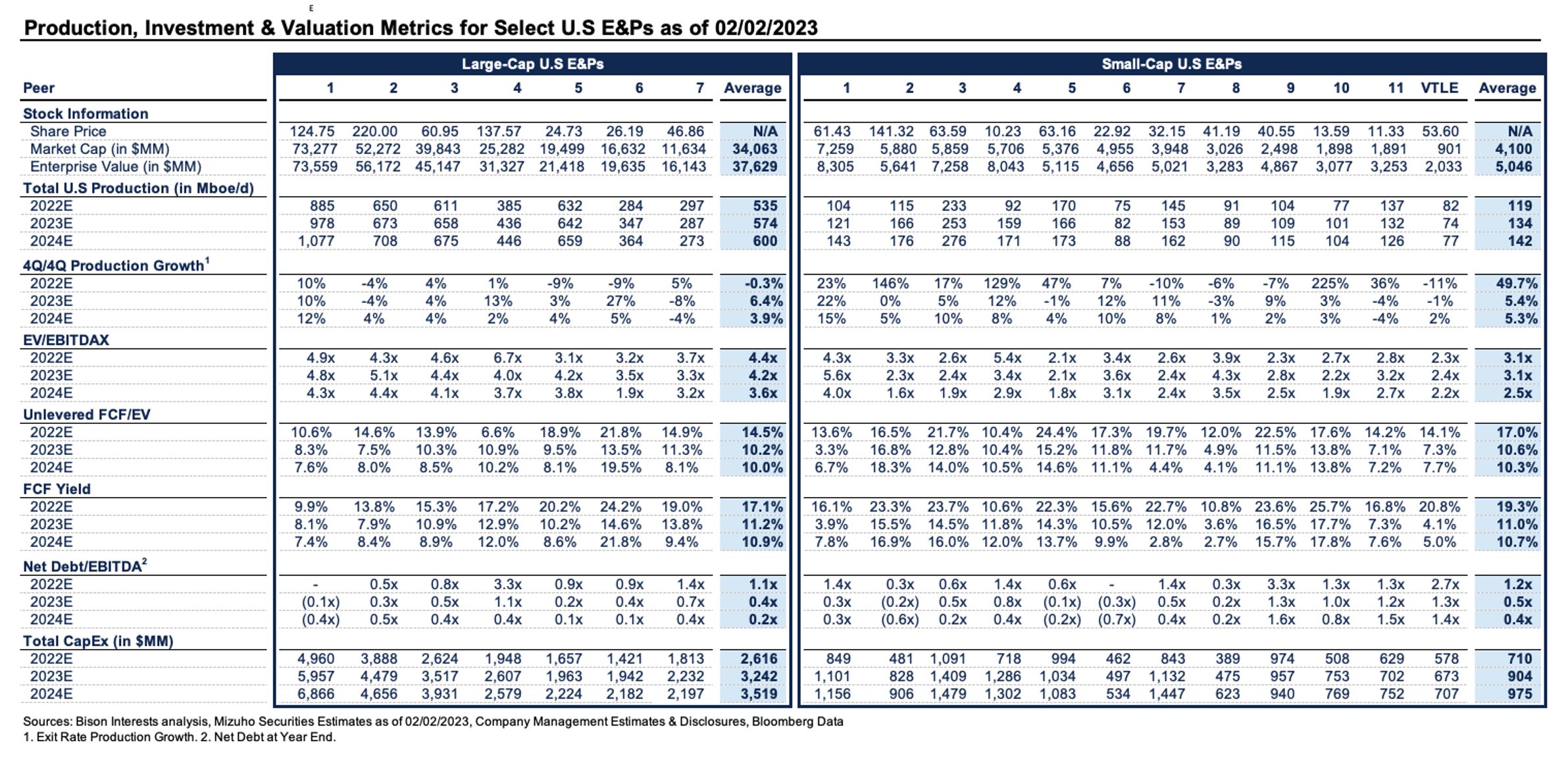

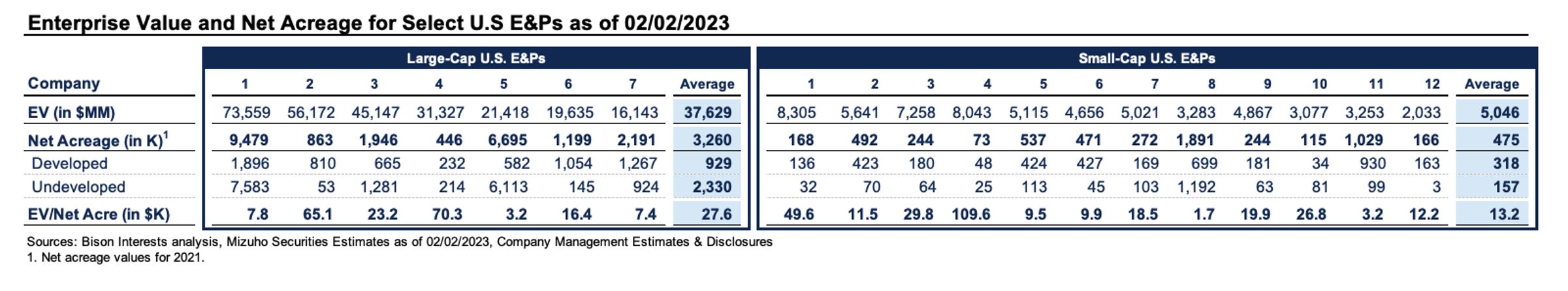

The valuation discrepancy between small- and large-cap equities in the U.S. and the associated opportunity is illustrated in the table below.

U.S. small-cap exploration and productions (E&Ps) are discounted versus large-cap peers, particularly based on enterprise value (EV)/EBITDA, as seen above. And while small caps generally have similar levels of debt, they are generating more cash flow, resulting in higher EV/FCF and FCF yield on equity.

Smaller oil producers have been experiencing higher FCF growth than larger caps due to more oil price leverage and relatively faster production growth – attractive attributes in acquisitions that are already compelling on valuation and in public market revaluations. And it helps that management teams seem to have learned from previous downcycles, exhibiting capital discipline despite higher prices.

Critiques of Small-Cap Oil Investment Thesis

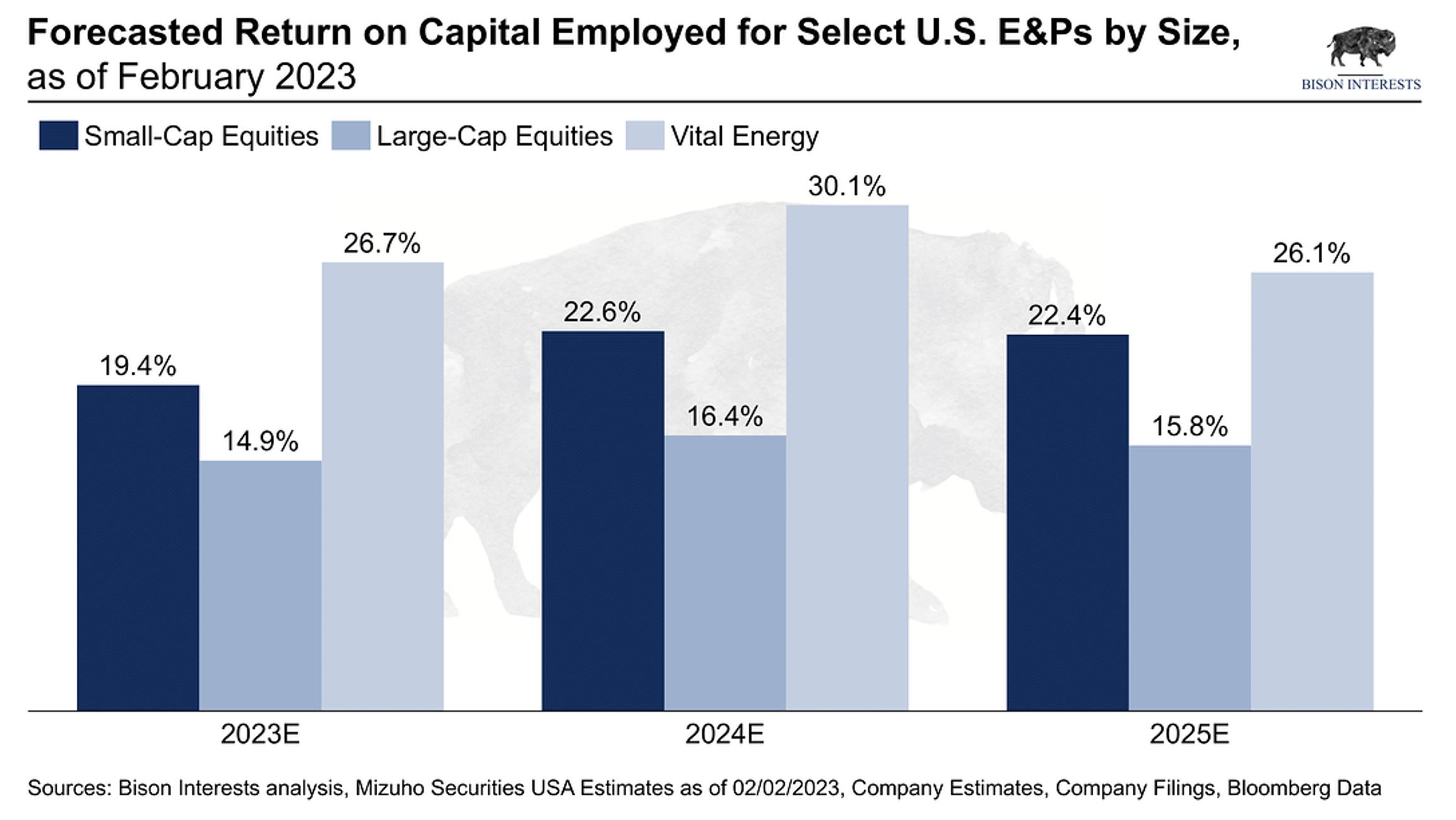

There are several critiques of small-cap E&P equities worth addressing, as they highlight the attractiveness of the opportunity. The first is related to perceived asset and management quality. One prevailing argument is that larger caps are generally better capital allocators, and thus should command a premium for generating higher returns on capital over time. However, material differences in forecasted returns on capital employed (ROCE) between peer groups indicate the contrary, with Vital Energy (VTLE) – a Bison portfolio position we recently shared our thesis on publicly – leading the pack.

Incidentally, the investment bank providing these estimates has taken a bearish view on small-cap oil and gas equities. One explanation for this improved ROCE phenomenon among small caps is that many of the poorly managed small-cap E&Ps with weak balance sheets and poor returns went bankrupt in prior downcycles, with the better-managed ones surviving.

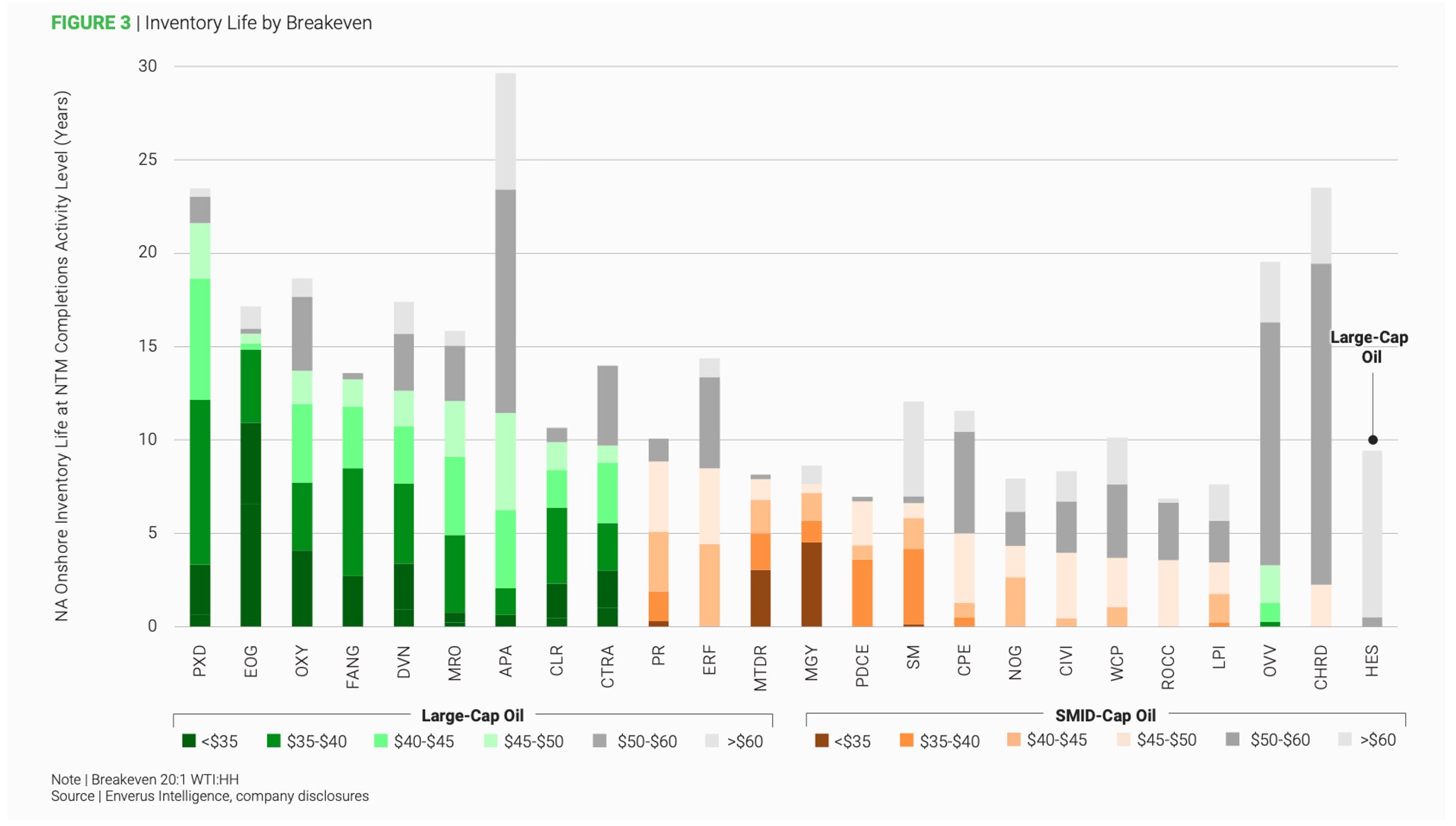

Another potential point of contention is the difference in inventory life and quality, which could drive the valuation discrepancy between small and large caps.

As seen above, large caps have more depth of inventory with lower commodity price break-evens, which may justify the valuation premium for some. And given their inventory depth, large-cap operators are more likely to remain profitable in a low-price environment and realise some downside protection as well.

This consensus is biased towards reserve bookings and penalises smaller producers who report smaller proved reserves. However, smaller producers have a higher cost of capital than their large-cap peers; and they often prioritise acreage they can develop in the near term in reserve bookings, rather than fully booking their inventory. And even with significantly less acreage than large caps, small-cap equities are still markedly cheaper.

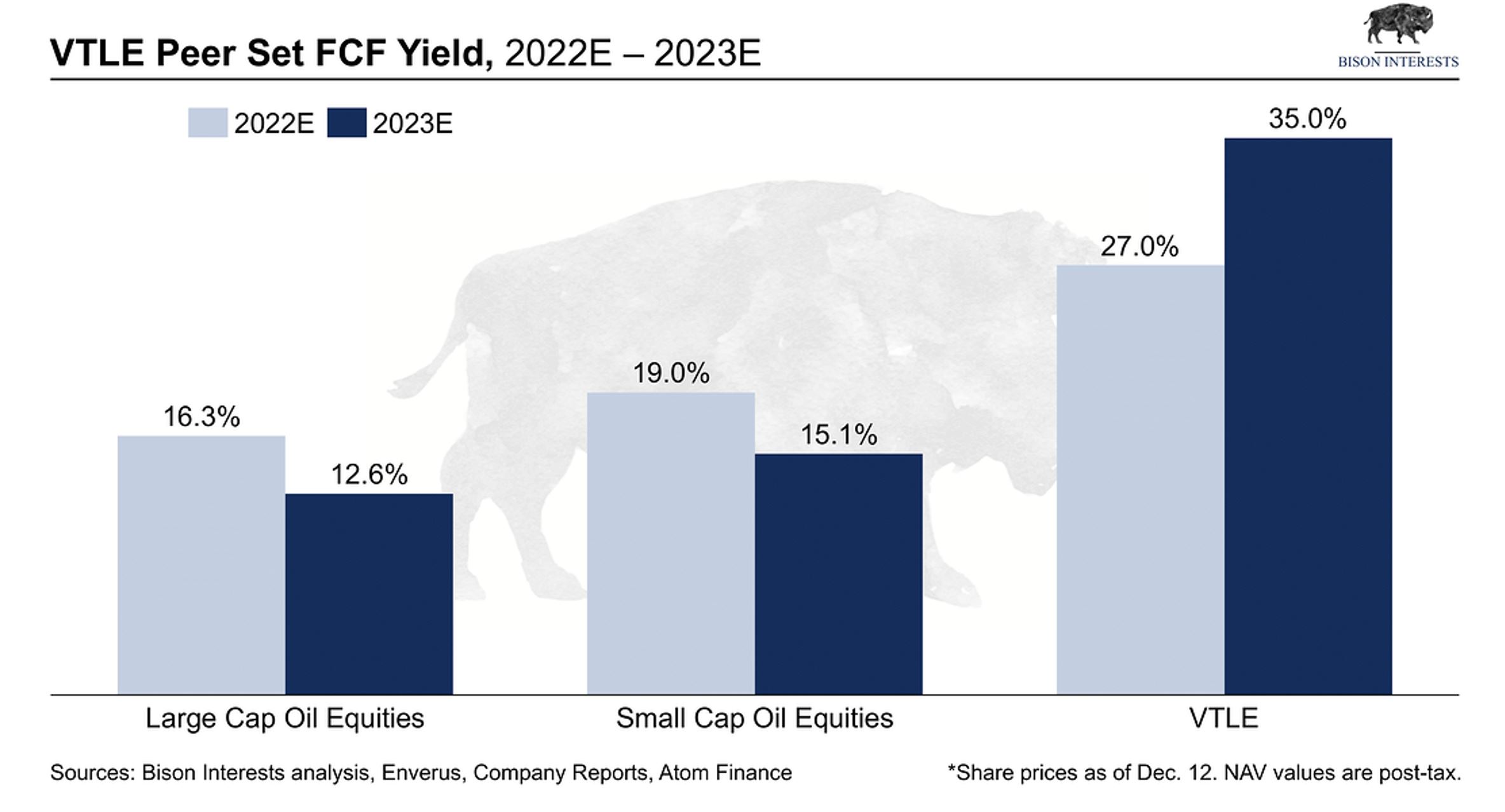

Despite smaller, lower-quality inventories, VTLE’s free cash flow yield is projected to increase materially in 2023 as Vital actively buys back shares and retires debt. In addition, both large- and small-cap peers are projected to become more expensive in consensus estimates. VTLE may have ~130% upside if its free cash flow yield were to trade in line with peers.

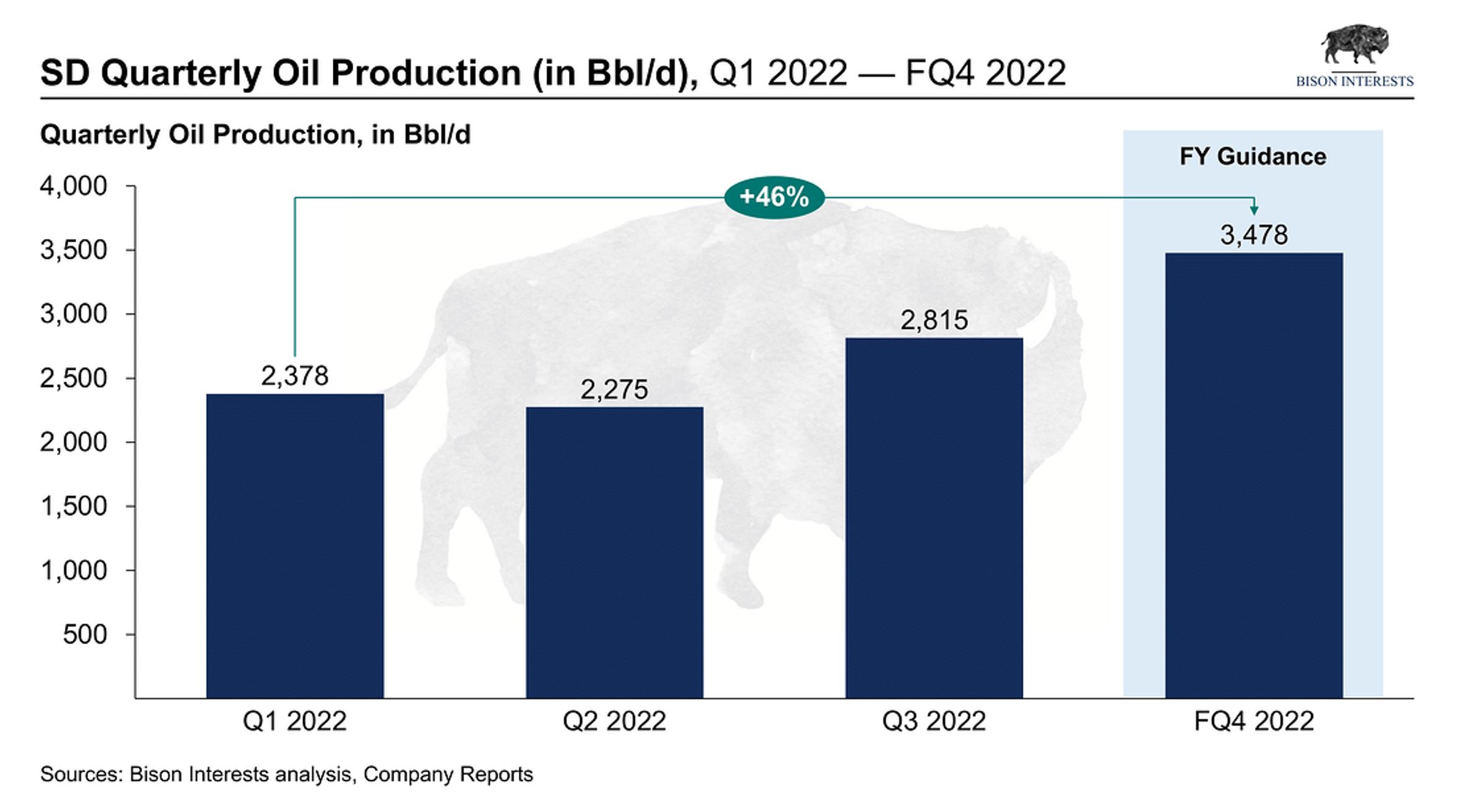

Sandridge Energy (SD) – a Bison portfolio company for which we recently shared an update – is a prime example of a small-cap producer with under-booked reserves. Sandridge had limited undeveloped reserve bookings after its bankruptcy emergence and management changes, which may have led to a belief that it would struggle to grow production, particularly of oil. However, in Sandridge’s hundreds of thousands of acres, it has managed to find sufficient development inventory to grow its oil production by nearly 50% in 2022, as per management guidance, while also generating substantial free cash flow.

Lastly, some might argue that operational scale is needed to combat inflationary pressures. However, the bulk of inflation experienced by E&Ps has been in oilfield services, particularly rigs, pressure pumping equipment, labour, and other specialised equipment. The simplest way to mitigate cost inflation is not through scale but through minimising the re-investment that is necessary to maintain production – at least from an investor perspective. Incidentally, some small-cap producers have lower production decline rates than large caps, which allow for lower reinvestment requirements to maintain production and reduce the impact of cost inflation.

Value Outperforms Over Time

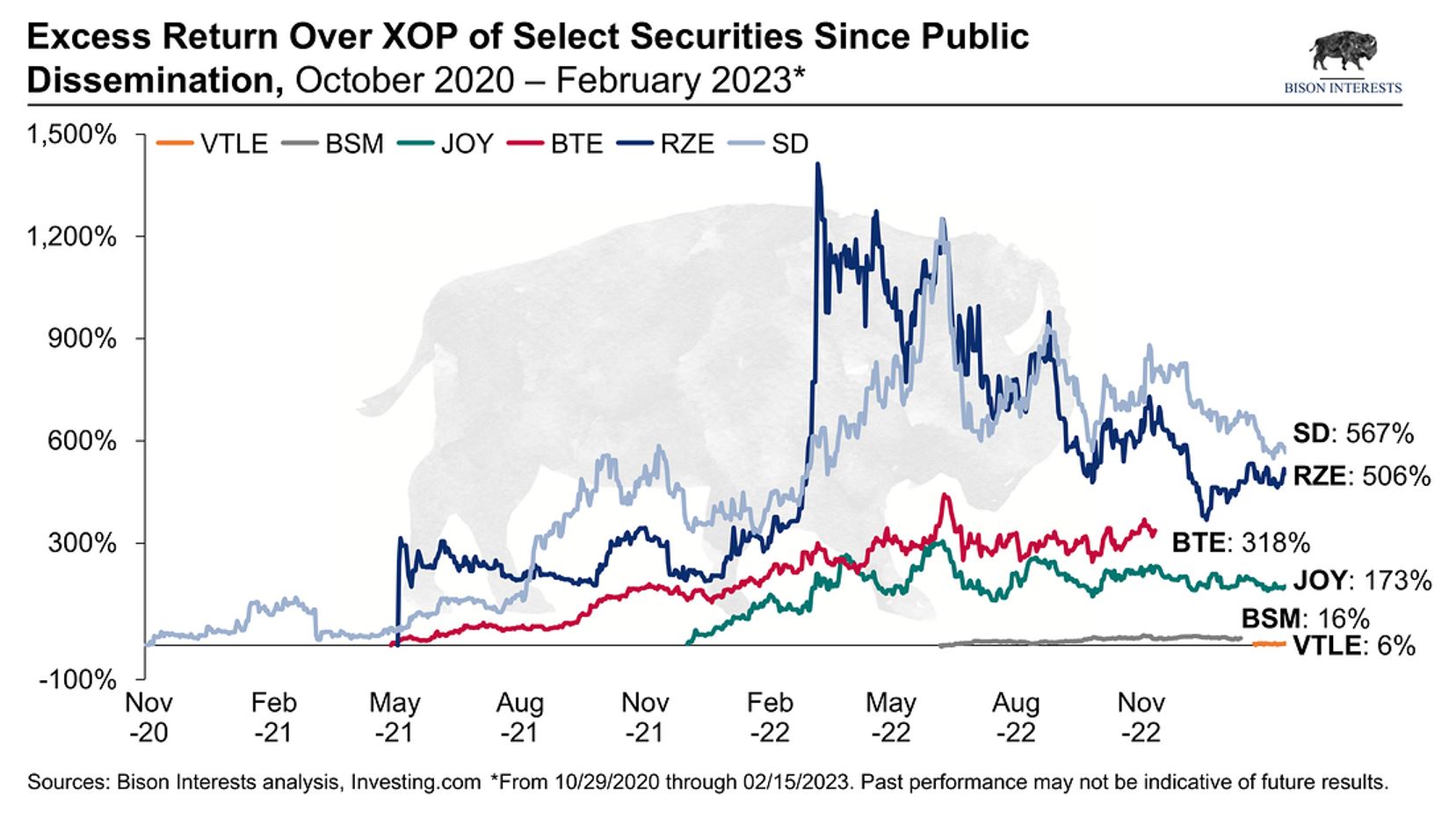

Undervalued stocks tend to outperform over time across a variety of market environments. The last 10 years have been tough for oil and gas equities, particularly small caps. However, certain undervalued (in our view) publicly disclosed Bison positions have meaningfully outperformed the oil and gas equities ETF XOP since they were disseminated over the past few years.

At the time we disclosed each of these, we believed that these companies were trading at a meaningful discount, offering deep value. And even with many of these small-cap equities having seen their share prices appreciate significantly since Covid lows, they still trade at a discount to large caps, as shown above. This is promising for the smaller-cap oil and gas equities space, as the low valuations in the space may drive further outperformance as they ‘catch up’ with larger producers and the broader market.

Looking Ahead: Smaller-Cap Oil Equities May Re-Rate

Even with many small-cap equities’ share prices rising, the valuation discount persists. In our view, this valuation gap is likely to close over time as there is a broader realisation of rapid fundamental improvements in small-cap oil producer equities compared to large-cap peers, particularly as oil prices rise.

As small-cap equities continue to generate significant FCF and continue to pay down debt, they may opt to return the excess in the form of buybacks and dividends, attracting a whole new set of yield-focused investors and pushing valuations higher. Some analysts are forecasting small-cap equities to generate more FCF relative to their enterprise value than large caps over the next two years. And with a greater proportion of that FCF not yet allocated, these may opt to return it to their investors.

As small-cap oil equities cash flows become too costly to ignore, even among yield and ESG-focused (environmental, social, and governance) investors, new inflows may drive a re-rate in line with large-cap peers and with the broader market. And even if this re-rate never comes to fruition, there are other paths to a successful investment outcome, notably buyouts, share buybacks, and dividends.

Josh Young is the Chief Investment Officer and Founder of Bison Interests – an investment firm that focuses on the publicly traded oil and gas sector. He has over 15 years of experience in investment management, 10 of which were focused on publicly traded oil and gas securities. Josh became Chairman of the Board of RMP Energy in 2017. After refreshing the board and management team and rebranding the company (Iron Bridge Resources), it was bought out at a 78% premium in 2018.

Photo Credit: depositphotos.com