Equities | ESG & Climate Change | US

Equities | ESG & Climate Change | US

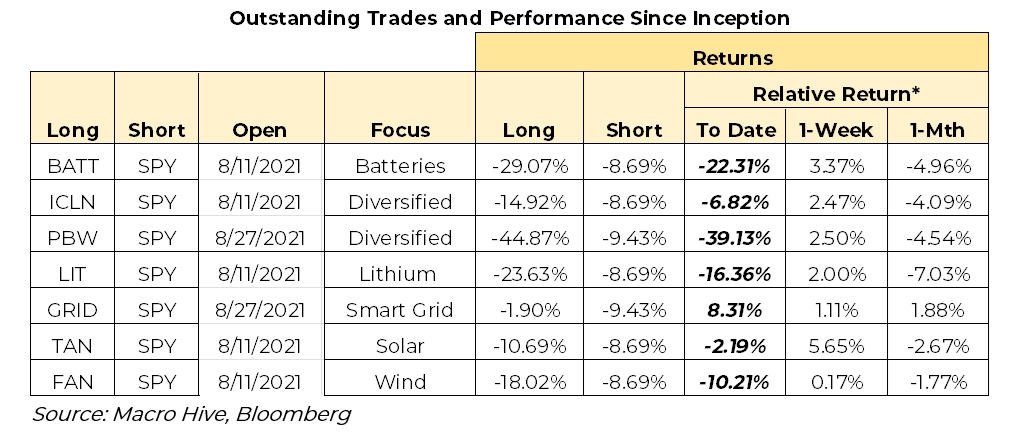

Our monthly updates of long/short ETF trades noted the clean energy sector has been a particularly weak performer (Table 1). The clean energy sector is down 12.7% since inception; excluding this sector, the portfolio is up 2.7%. Only one clean energy position, GRID, has posted a positive return since its inception.

In this article, we investigate why these ETFs have performed so poorly and ask whether the flow of money from the Inflation Protection Act will reverse the tide in the foreseeable future.

We focus on three positions: LIT, PBW, and GRID.

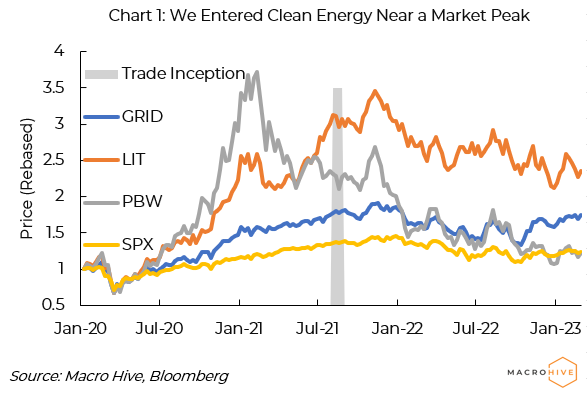

The first problem with our clean energy trades is that we entered them in August 2021 at what, in retrospect, was a market high point (Chart 1). These ETFs rallied further in November when the Intergovernmental Panel on Climate Change (IPCC) held its annual meeting in Glasgow, Scotland, to reaffirm the climate goals of the 2015 Paris meeting.

As is often the case with investing, timing is a key variable. Ongoing disappointments about progress on limiting climate change and the massive selloff of 2022 have weighed heavily on clean energy ETFs.

The Global X Lithium and Battery Tech ETF (LIT) is described as follows:

‘LIT tracks a market-cap-weighted index of 20–40 companies involved in the global mining and exploration of lithium or lithium battery production.’[1]

LIT tracks the Solactive Global Lithium Index (SOLLIT).

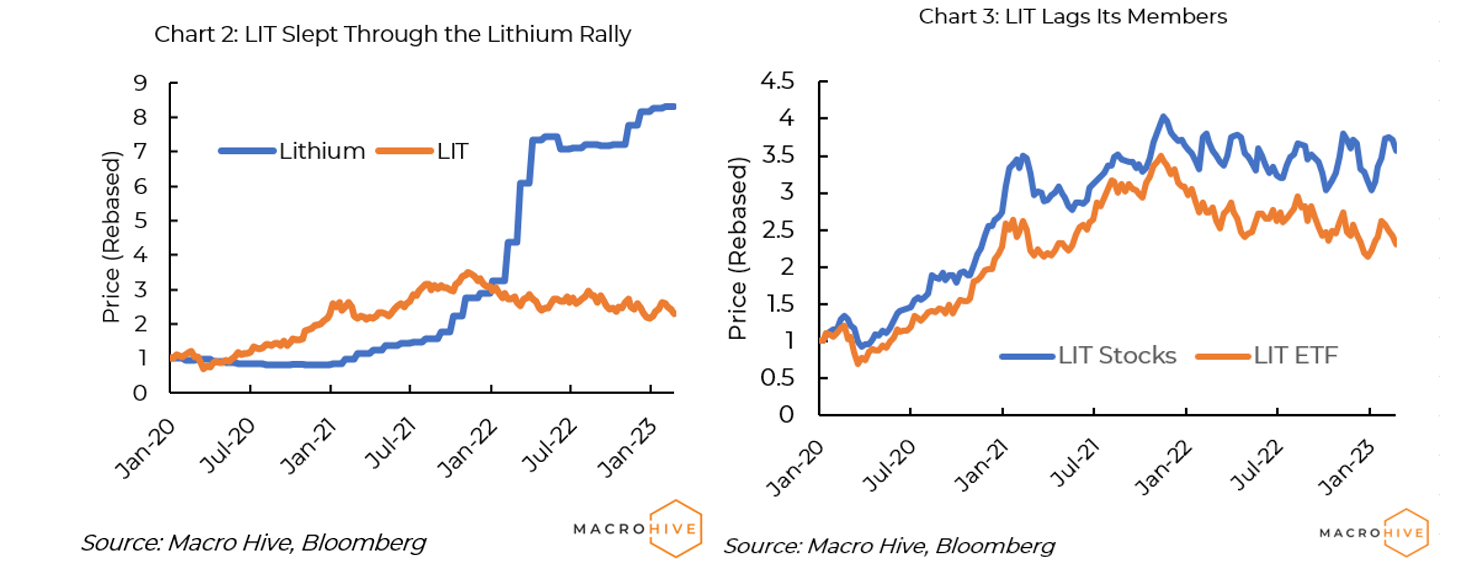

To say LIT has underperformed this marketing statement, or indeed the underlying stocks, would be an understatement. Most damning, when we entered the trade, the mineral lithium was starting a rally where its price would more than quadruple (Chart 2). Meanwhile, LIT dropped by a third. Clearly, LIT has little influence over the price of lithium.

We tried to recreate the performance of the underlying stocks in LIT. Unfortunately, we only have data on the current holdings and shares. Assuming that had been constant over the past three years and since August 2021, the underlying stocks outperformed by 50% (Chart 2). Clearly, the composition of LIT has changed significantly over time. Our point here is that the lack of transparency makes it difficult to understand what has driven the performance of LIT over time.

Other factors may have contributed to underperformance. About 25% of the index is Chinese companies. The Shanghai Shenzhen CSI Index has underperformed the S&P 500 by about 10.7% since the inception of this trade.

Electric vehicle makers have also underperformed badly since November 2021. Tesla (5% of LIT) is down about 11%; Rivian and Lucid, each about 2% of LIT, are down 82% and 60%, respectively. Only 14 companies (27% by market cap) have posted positive returns since August 2021.

LIT’s performance is clearly unmoored from the obvious markers that one might reasonably expect to drive performance – namely the price of lithium and the historical performance of current underlying stocks.

The problem is the lack of transparency about what is happening with LIT. In our view, it is the responsibility of the ETF provider to provide that data. If investors have to investigate every stock in the ETF to try to understand LIT, they will surely be better off investing in the individual companies that show the most promise.

The Invesco Wilderhill Clean Energy ETF (PBW) seeks to

‘…go beyond just industry pure-plays like wind, solar, biofuels, and geothermal companies, to include companies based on their perceived relevance to the renewable energy space. PBW holds only US-listed companies that are perceived to benefit from the transition toward clean energy and conservation. PBW follows a tiered, equal-weighting structure and caps, each holding at 4%.’[2]

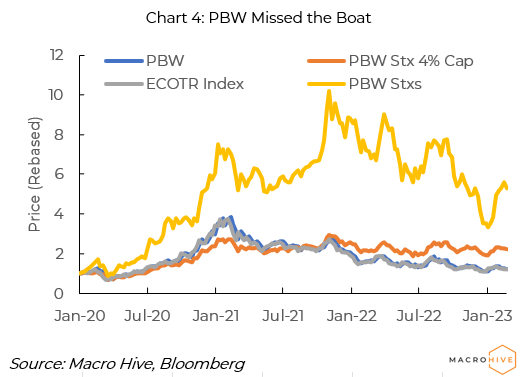

PBW tracks the Wilderhill Clean Energy Index (ECOTR), which also caps all exposures at 4%. As Chart 1 illustrates, PBW has gone through boom and bust. It boomed after the election in 2020 and again in late 2021, probably on the strength of its US-centric portfolio. It has since collapsed, leaving our long PBW/short SPY position down 39.1% since August 2021. What went wrong?

The first big problem with PBW is that the largest component of ECOTR on an unweighted basis is Tesla, with a 65% weighting! However, in the index and ETF, TESLA has a 1.8% weighting. In Chart 4, we compare the performance of PBW with the underlying index and underlying stocks of the index, unweighted and using an arbitrary approach to capping larger positions at 4%. The ETF provider, Invesco, provides no transparency about the composition of its ETFs, including PBW. The only available information is the current composition of the underlying index.

We can see that PBW tracks the index basket of stocks closely. When we model the current stocks in the index on a weighted and unweighted basis, they far outperform PBW. Clearly, the index composition has changed over time, although there is no transparency in how.

The second big problem for PBW is that of its 74 equity positions, 50 are loss-making. To say that equity investors have little interest in loss-making companies in the current rising-rate environment would be an understatement.

Apart from holding a lot of losers, there is little information on why PBW has performed so poorly. The ETF manager provides a quarterly report (the latest version runs 137 pages), but it provides no insight into that key question. That said, it does provide an impressive analysis of the current energy and clean energy market. We suggest investors interested in this sector use it to identify quality names among the dross and stick with single names rather than hold PBW.

PBW is highly diversified, with many small holdings. When new technologies are emerging, we typically see many startups emerge. A few may be very successful. Some with innovative technologies may be acquired by more successful companies. The rest will go bust.

It is a bit like a venture capital fund. But a venture capital fund makes a significant effort to identify companies, technologies, and management teams that have the best chance of succeeding. It might end up with a portfolio of two dozen companies. PBW, however, simply appears to hold a bit of everything in the hope something sticks. It is hard to see how the few eventual winners can offset so many likely losers.

The First Trust NASDAQ Clean Edge Smart Grid Infrastructure Fund (GRID) has a simple mandate:

‘GRID tracks a market-cap-weighted index of global equities in the smart grid and electrical energy infrastructure sector.’[3]

The underlying index is the NASDAQ OMX Clean Edge Smart Grid Infrastructure Index (QGRD).

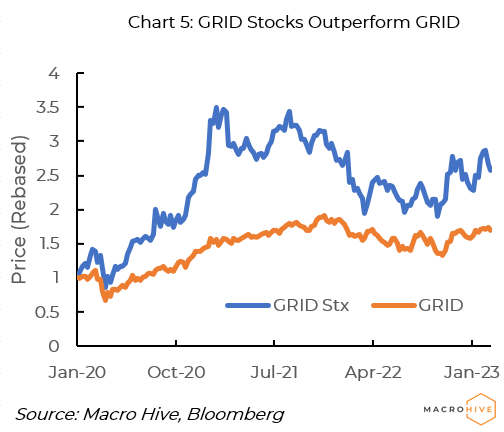

As with LIT and PBW, there is a large discrepancy between the historical performance of the current stocks that make up GRID and the GRID ETF (Chart 5). Again, we have no transparency on how or why the index composition has changed over time.

But, unlike PBW, the vast majority of GRID holdings turned a profit in the past year – 69 out of 74 (93%). Unlike PBW, which mostly holds small, little-known companies, GRID holds various S&P 500 companies active in various aspects of clean energy and the grid – including IBM, General Electric, Oracle Corp, and Nvidia, as well as major utilities across the globe.

GRID may not offer massive upside, but it should perform in line with the broader market. Similar to ESG funds, it may make an investor feel good about their portfolio, but it is basically a market portfolio.

What about the Inflation Reduction Act, which targets climate change? It will provide an estimated $400bn over a decade – 0.1% of an estimated $300tn of GDP over that span. Much of that money will be in the form of tax credits, so this amounts to a small and gentle nudge.

In coming years, it will primarily benefit companies that sell consumer products that qualify for tax credits. It may take years for that benefit to spread to trickle-down companies that provide the clean technology inputs to make those consumer products.

In short, we do not look for an influx of money that could send clean energy ETFs soaring any time soon.

In the interest of time, we did not closely investigate all the ETFs listed in Table 1. But the three we did analyse lay out the key reasons why most clean energy ETFs have performed poorly.

Some of these are systemic factors. These include:

Then there are issues related to the ETFs themselves. The quality of transparency makes it difficult to understand what is driving their performance.

Granted, if we spent enough time (and money on data), we might gain more insight into these issues. But, in our view, if the ETF provider wants to attract investors, it is incumbent on them to provide this kind of transparency.

Investors seem to agree. ETFs sound great in principle, but when push comes to shove, they are remarkably unpopular. The largest ETF by far is SPY, which tracks the S&P 500. The market cap of SPY is $359bn, a hair’s breadth more than 1% of the S&P 500 market cap. The major SPX ETFs together are less than 3% of the SPX.

The clean energy ETFs we examined here are far less popular on a relative basis. LIT, PBW, and GRID have been gathering assets for over a decade, but their market caps are only 10–20 basis points of the market caps of the underlying indices. For all the fuss about ETF products, the vast majority of investor money goes into single-name stocks.

We entered these trades on the strength of systemic factors that we expected would gain momentum. We were overly optimistic about the clean energy transition and did not foresee the impacts of Covid. We were also naïve about the nature of ETFs and how many are effectively black boxes that make it difficult to understand what is driving their performance.

Going forward, we will only recommend ETFs where the underlying index is well known, such as SPX sectors, or where equity holdings follow well-defined rules.

All things considered, we see little upside for clean energy ETFs for at least the next couple of years.

We suggest investors interested in clean energy investments focus on individual companies rather than clean energy ETFs, where there is little transparency about how they are managed.

[1] https://www.etf.com/LIT#overview

[2] https://www.etf.com/PBW#overview

Photo Credit: depositphotos.com

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.