Equities | Monetary Policy & Inflation

Equities | Monetary Policy & Inflation

The latest banking crisis in the US and Europe shows that the financial system still faces several risks, both old and new. Here are three that I am worried about.

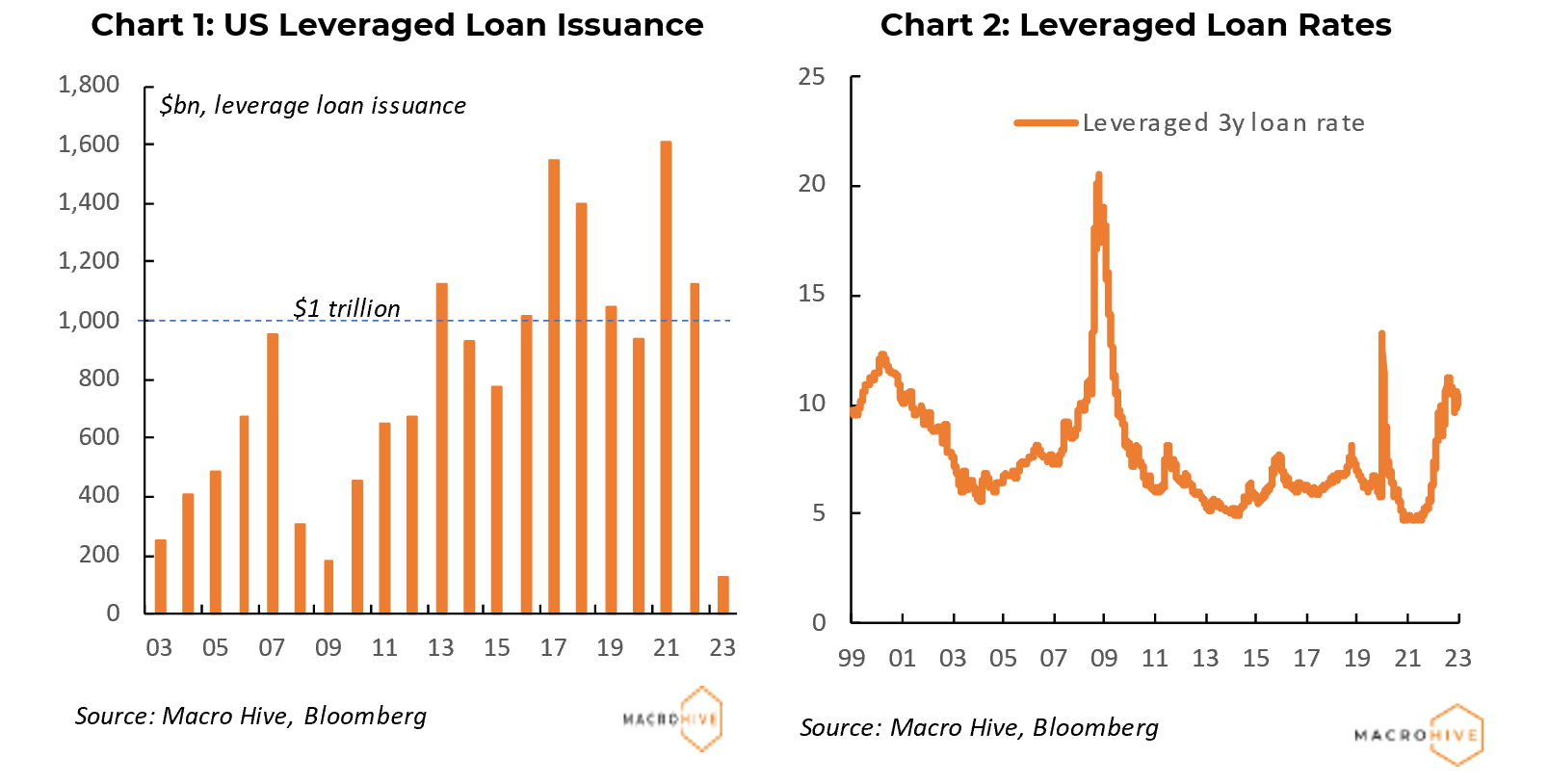

This relates to private equity as they are big users of leveraged loans to finance buyouts. Essentially, leveraged loans are loans given to companies with low credit quality. In 2013, US issuance crossed $1 trillion for the first time. Between 2016 and 2022, it averaged $1.2 trillion per year (Chart 1). Issuance has collapsed this year.

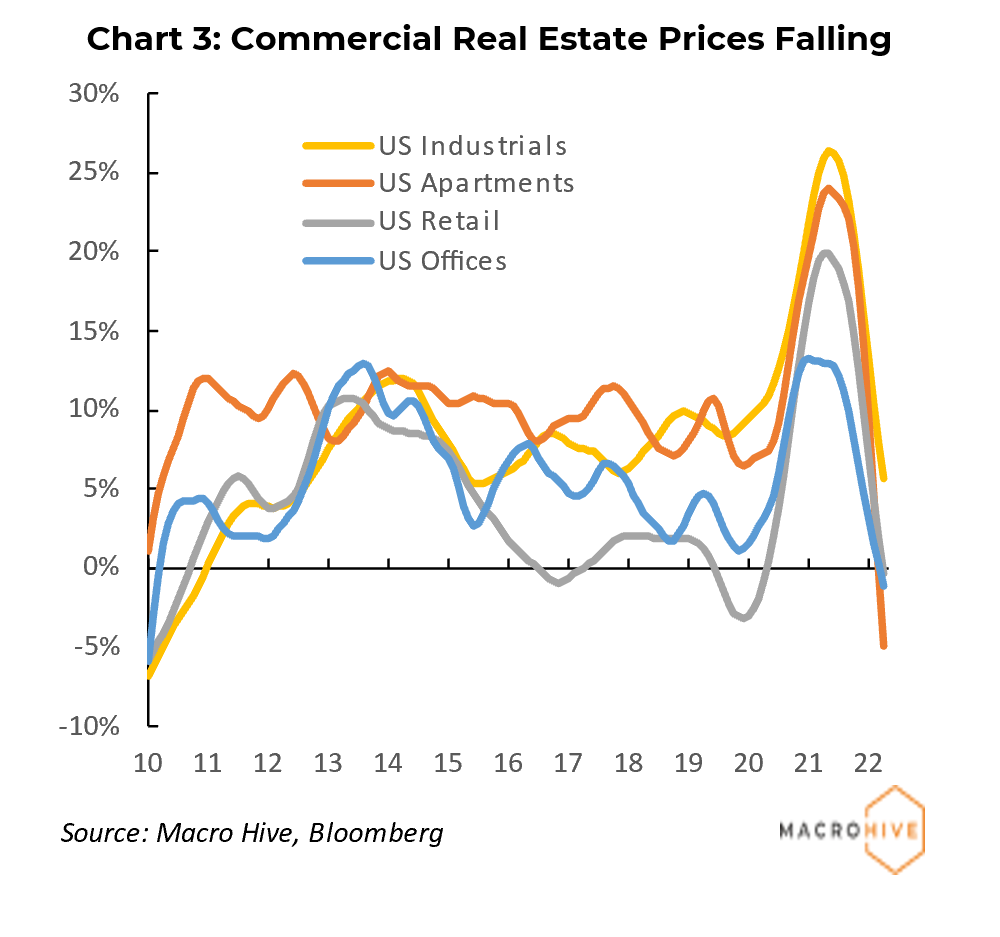

Anytime yields are low, real estate does well. The monetary and fiscal stimulus after the COVID-19 pandemic saw commercial real estate prices surge. Between March 2021 and March 2022, US industrial unit prices jumped 25%, apartment block prices jumped 23%, retail units jumped 20% and even office blocks rose 13% (Chart 3). The trouble is that price gains are moderating and, in some cases, turning into annual declines (apartment blocks and offices). This could prove problematic for banks with exposure to these sectors.

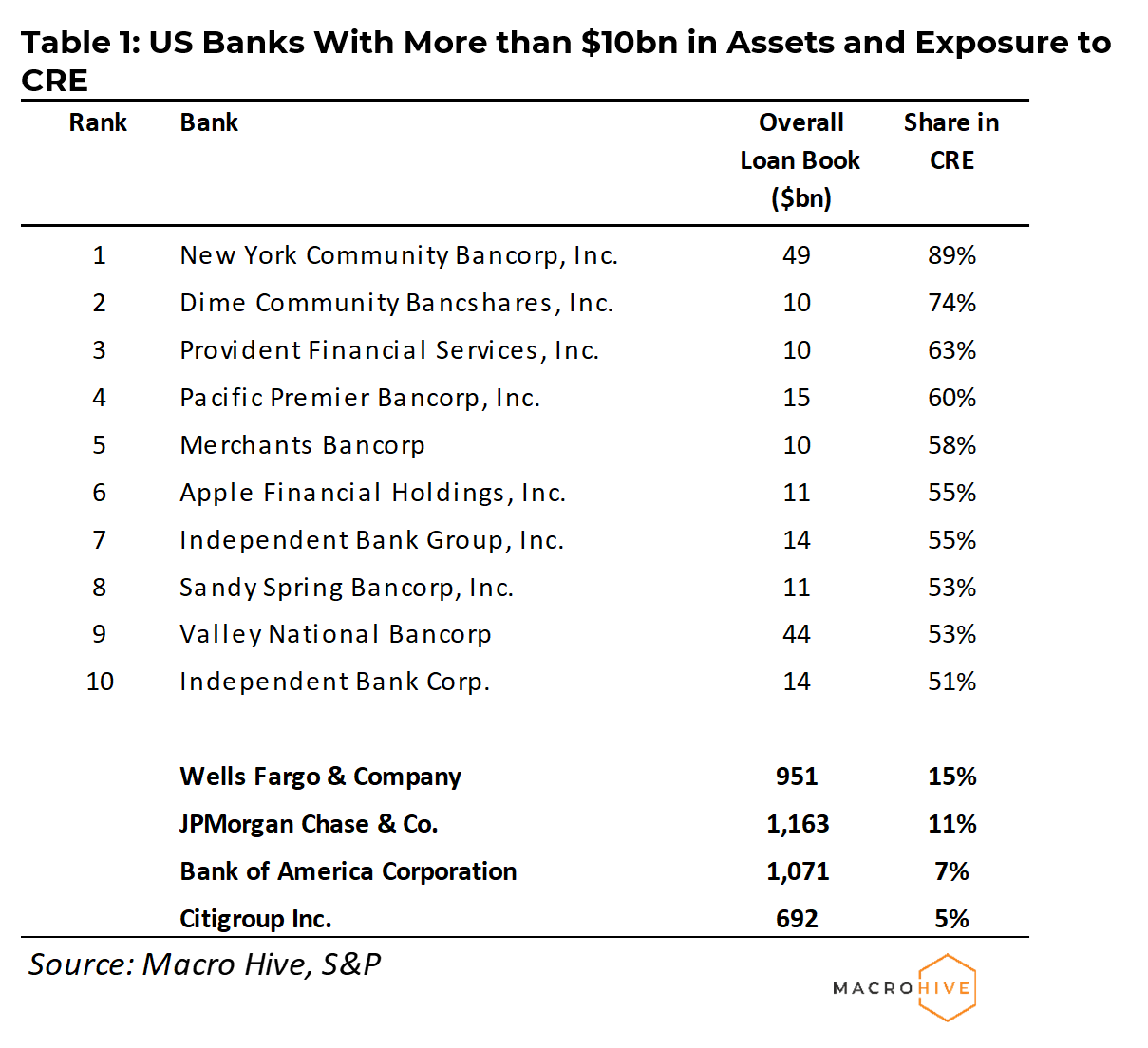

Screening US banks, we find smaller banks have a larger share of their loan book exposed to CRE. Notable banks include New York Community Bancorp (they also just bought some assets of failed Signature bank), and Valley National (Table 1). Both have loan books of around $40bn with more than half in CRE. Meanwhile, the larger banks like JP Morgan, Citi, and Bank of America have exposures less than 15% of their books to CRE. Europe has similar issues, notably the Nordic markets.

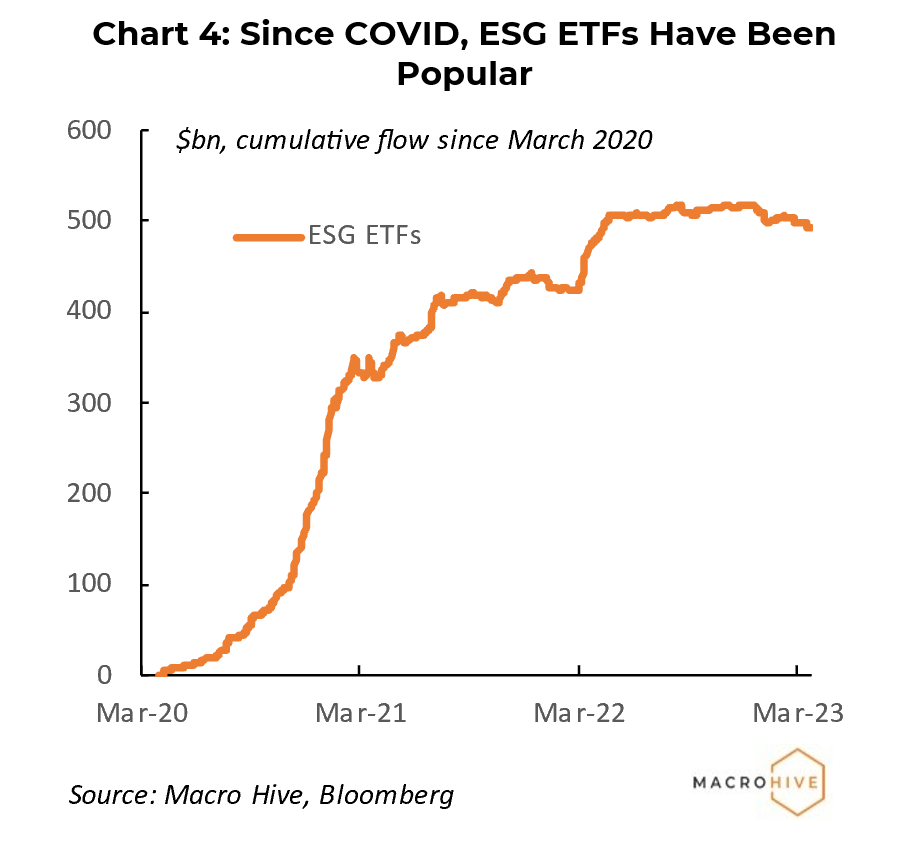

This may seem odd, but aside from performance issues, there are regulatory and legal risks around greenwashing. Many funds may have classified themselves as ‘ESG’ but may not meet independent verification. Already, news sources suggest MSCI is in the process of reclassifying companies.

The trouble is that there has been a surge of inflows into ESG funds. Focusing on exchange-traded fund (ETF) markets, we find that since the starting of COVID, almost $500bn of flows have gone into ESG ETFs (Chart 4). Were these flows to reverse, asset managers could suffer losses, which in turn could induce other outflows. Moreover, if ESG ratings were to be found to be ‘manipulated’ this could become the next big financial scandal.

The era of low interest rates is over. We are now in a high rates environment, which is set to continue in the short and medium term. Time has become expensive again, and with it, long duration investments are increasingly unattractive. Accordingly, we stick to our recommendation of overweight cash outlined in our most recent Asset Allocation.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.