Monetary Policy & Inflation | US

Monetary Policy & Inflation | US

At the 3 May FOMC, the Fed clarified that the tightening cycle was not over but rather that the likelihood of future hikes had decreased. Chair Jerome Powell did not rule out a June hike and stressed that forthcoming decisions would be made ‘meeting by meeting, based on the totality of incoming data’.

Since then the data shows no progress on disinflation, growth remaining above trend, and no obvious growth impact from the credit crunch. Yet Vice Chair (VC) Philip Jefferson has signalled that the Fed was likely to ‘skip’ a hike at the June meeting (Jefferson’s 31 May speech).

In my view, this signals a move towards a more dovish reaction function, that reflects the growing influence of doves within the FOMC, partly because of Governor Jefferson’s VC nomination. Over the past few weeks, VC nominee Jefferson’s comments turned dovish from hawkish, despite a spate of strong data prints.

The nomination of Adriana Kugler to replace Governor Jefferson, is likely to further solidify the position of the doves within the FOMC. Professor Kugler, like San Francisco Fed President Mary Daly, is a labour economist, and could therefore be focus more on the employment than on the inflation side of the Fed’s mandate.

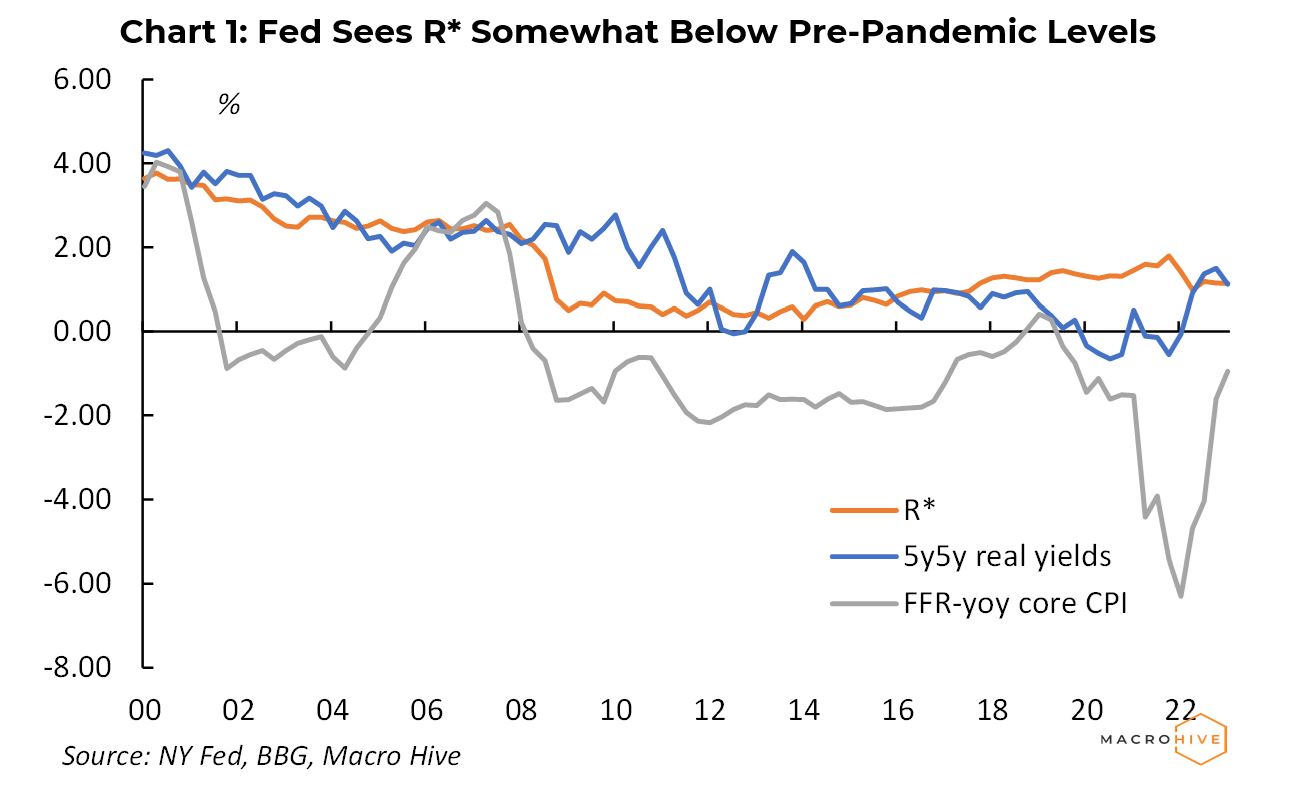

Yet another sign of greater FOMC dovishness is New York Fed President John Williams’ contention that there is ‘no evidence that the era of very low natural rates of interest has ended.’ His current estimate of R* is 1.1%, about 25bp below its level in Q4 2019 (Chart 1). Furthermore, Williams projects that, based on Blue Chip forecasts of inflation, GDP, and interest rates, R* will fall below zero by the end of 2024.

Williams has not explained how the current stance of monetary policy relates to his estimates of R*. In particular, he has not explained which measure of inflation he prefers to assess the real interest rate. For instance, the 5y5y TIPS yield is currently 1.4%, but the more prosaic Federal Funds Rate (FFR) minus headline CPI is only 0.2%.

Nevertheless, his view that the era of low R* has not ended provides cover for the Fed’s dovishness. In addition, his expectations of R* falling by about 125bp by end-2024 could suggest greater 2024 rate cuts than the 75bp in the March SEP. Incidentally, I share the BIS misgivings on the empirical and logical foundations of R*.

I do not expect much change to either statement or median dots. On the statement, I expect only highly nuanced changes to the first paragraph on the economic assessment and no changes to the paragraphs on credit crunch dangers and policy stance.

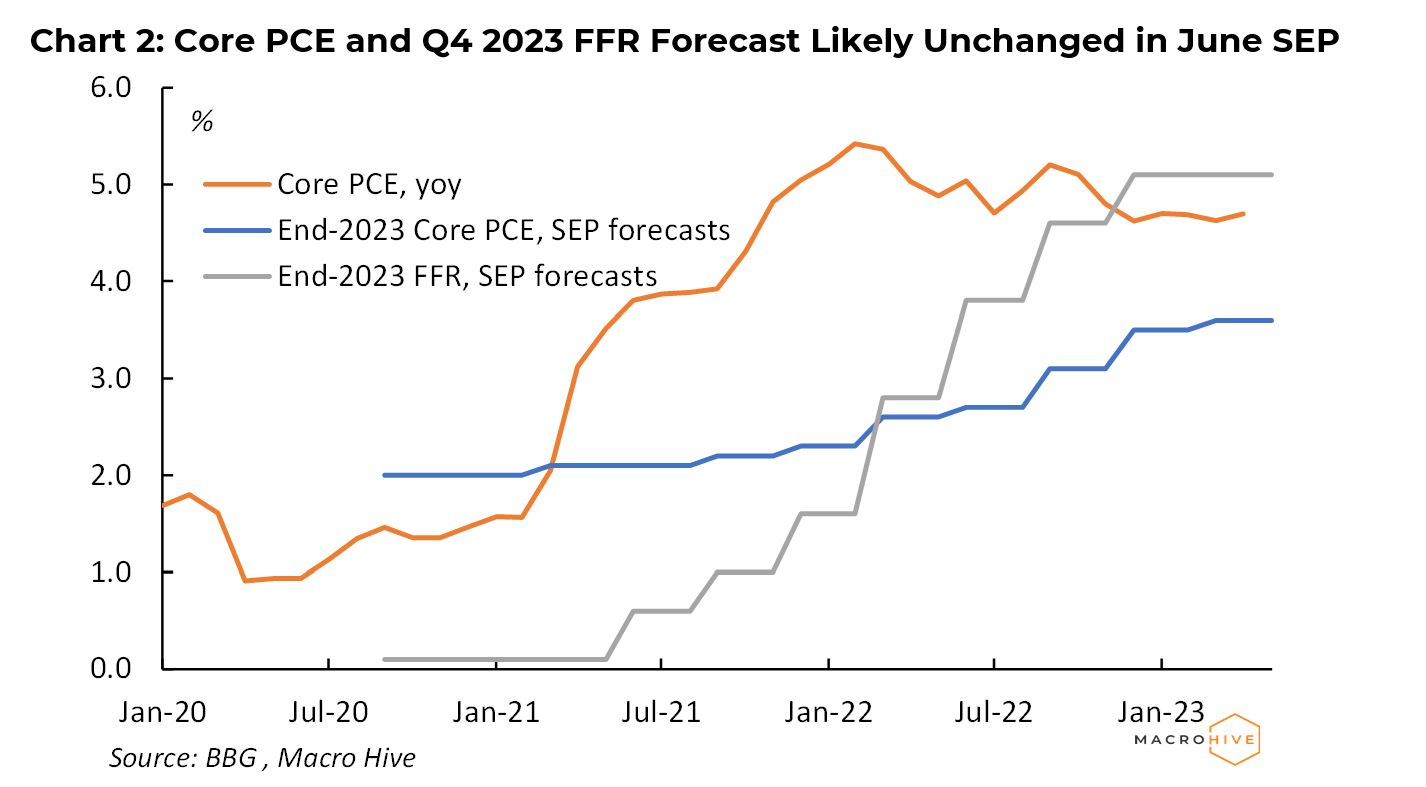

On balance, I do not expect an increase in the median dot. This is because such an increase would have to be based on an increase in the FOMC forecast of Q4 2023 core PCE, currently 3.6% (Chart 2). I give a less than a 10% chance that core PCE will converge to that level, from currently 4.7%, but I do not think the FOMC is likely to admit defeat yet. I see greater chances of an upward revision to the core PCE forecast and to the 2023 FFR in the September SEP.

As FOMC members have repeatedly stressed, rate cuts this year are inconsistent with the slow disinflation path envisaged by the FOMC. And I agree.

At the same time, the market is pricing about an 80% chance of a full hike between the June and the July meetings. Based on the Fed’s greater dovishness, I see the odds as closer to 55%.

Because I do not expect significant disinflation over the remainder of the year, I still expect the Fed to hike two more times by end-December.

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.