Summary

- We tease out key assumptions behind today’s relatively high S&P 500 valuation using a modified capital asset pricing model and discounted cashflow framework.

- Temporary policy rate increases will have little impact on the SPX as long as investors believe they will not hurt the economy or earnings outlook – exactly what we see today.

- Investors are hoping for an eventual rate cut below the current 5.25% but have yet to price this in, suggesting they expect elevated inflation and dovish Fed policy to persist.

- The market assumes a long-term earnings growth rate that is conservative relative to the average experience of recent decades. That may limit downside risks. And even a minor upward revision will spark another upward leg in the equity rally.

Market Implications

- Equities will be on hold until we see whether the upcoming earnings season justifies another upward revision in earnings outlooks and a further rally.

Valuations Seem High…

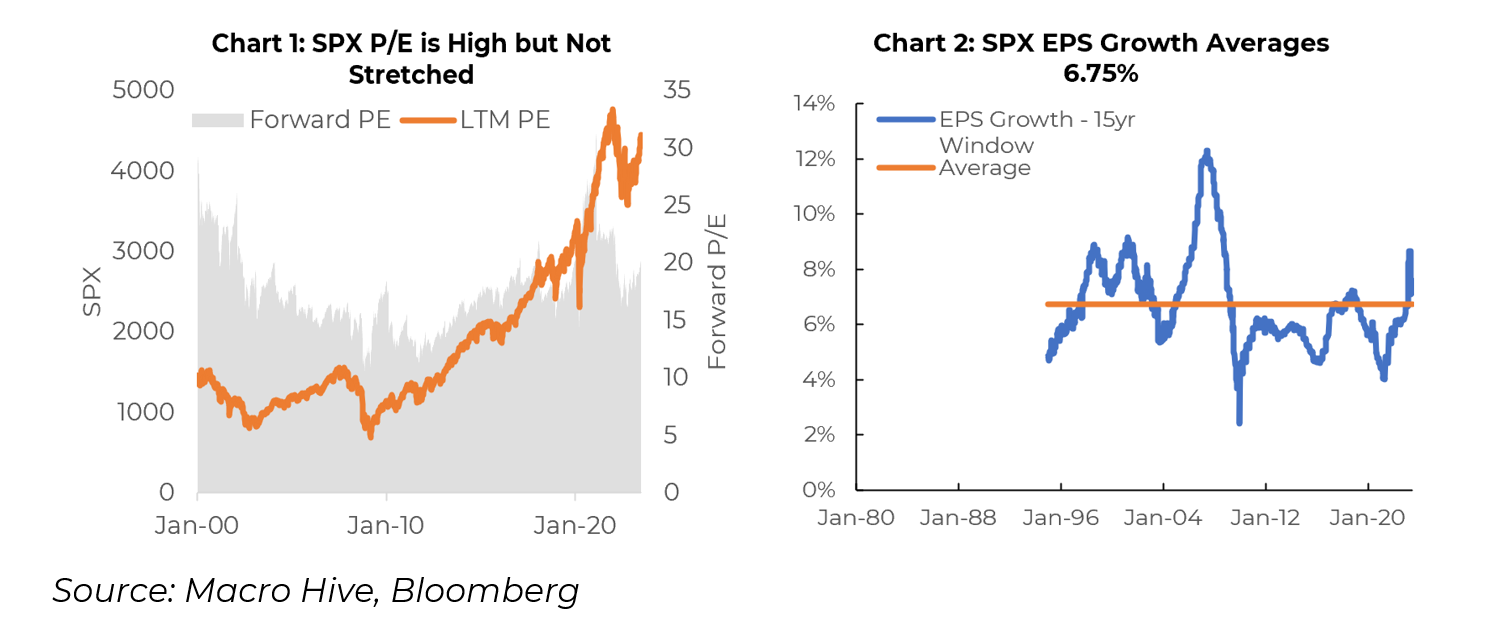

With the Fed poised to raise rates another two 25bp increments this year, investors are understandably nervous about equity valuations and recession risks. The S&P 500 (SPX) forward price/earnings (P/E) ratio is 20.8 – near the high of the past 20 years, excluding the unusual pandemic period (Chart 1). But it is short of bubble territory.

Does this make sense given the rate outlook?

In this analysis, we combine a capital asset pricing model and discounted cashflow framework to tease out key market assumptions behind today’s high valuations. We focus on the SPX.

Among our key findings:

- Markets assume further mooted rate hikes will have little impact on the economy or earnings.

- Investors are hoping for eventual rate cuts below the current 5.25% but are yet to price them in, probably because they do not expect the current Fed policy trajectory to corral inflation soon.

Our Methodology Is Intuitive

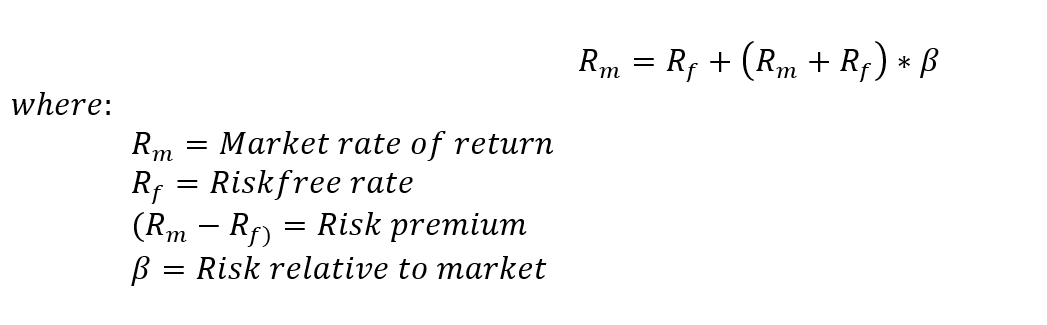

We derive a market-required rate of return using a capital asset pricing model framework:

In the discounted cashflow analysis, we project quarterly earnings cashflows out 100 years. Over the first three years (or 12 quarters), we vary cashflows and discount rates to reflect different scenarios about recessions and Fed policy and related growth rates and interest rates. Beyond that period, we hold the growth rate and policy rate constant. Practically, we can glean little further insight from projecting specific recession scenarios more than a few years out.

A key assumption is the long-term growth rate. Over the past 40 years, the 15-year moving average of the SPX earnings growth has mostly been 5-8% (Chart 2). The average growth rate since 1995 has been about 6.75%. Given that period reflects the best and worst of times, and everything in between, we take it as a reasonable starting point for the long-term average growth rate.

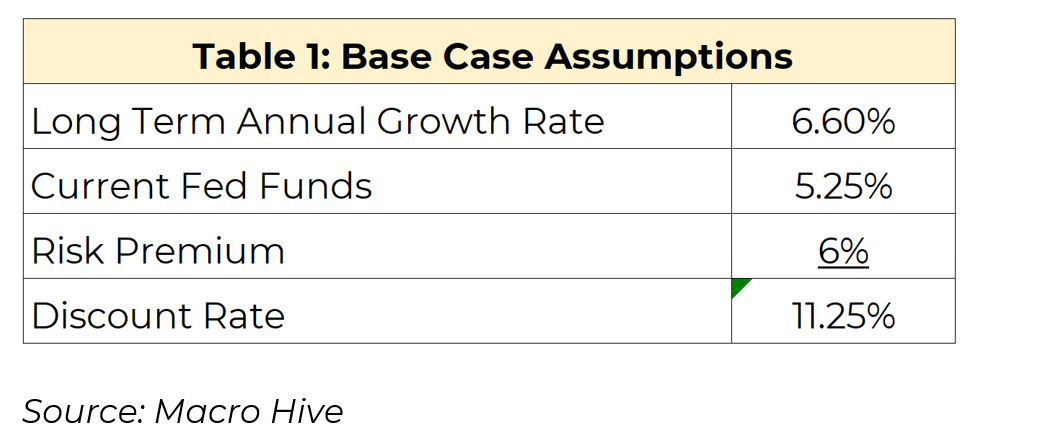

When this analysis was completed, the SPX was at 4,505 (14 July 2023), and the latest trailing quarterly earnings was $53.50. The following base-case assumptions generate cashflows that discount back to SPX at 4,505:

We take the current Fed Funds rate as the risk-free rate. The equity risk premium is commonly assumed to be 5-6%; we set it at the high end given the concerns about Fed policy and a slowing economy; that gives an all-in discount rate of 11.25%.[1]

We think these parameters are reasonable; none seem extreme. Together, they imply that the SPX is near fair value. If, for example, the assumed growth rate was very high (e.g., 8% or more) or the risk premium very low, we would probably conclude that the market was overvalued.

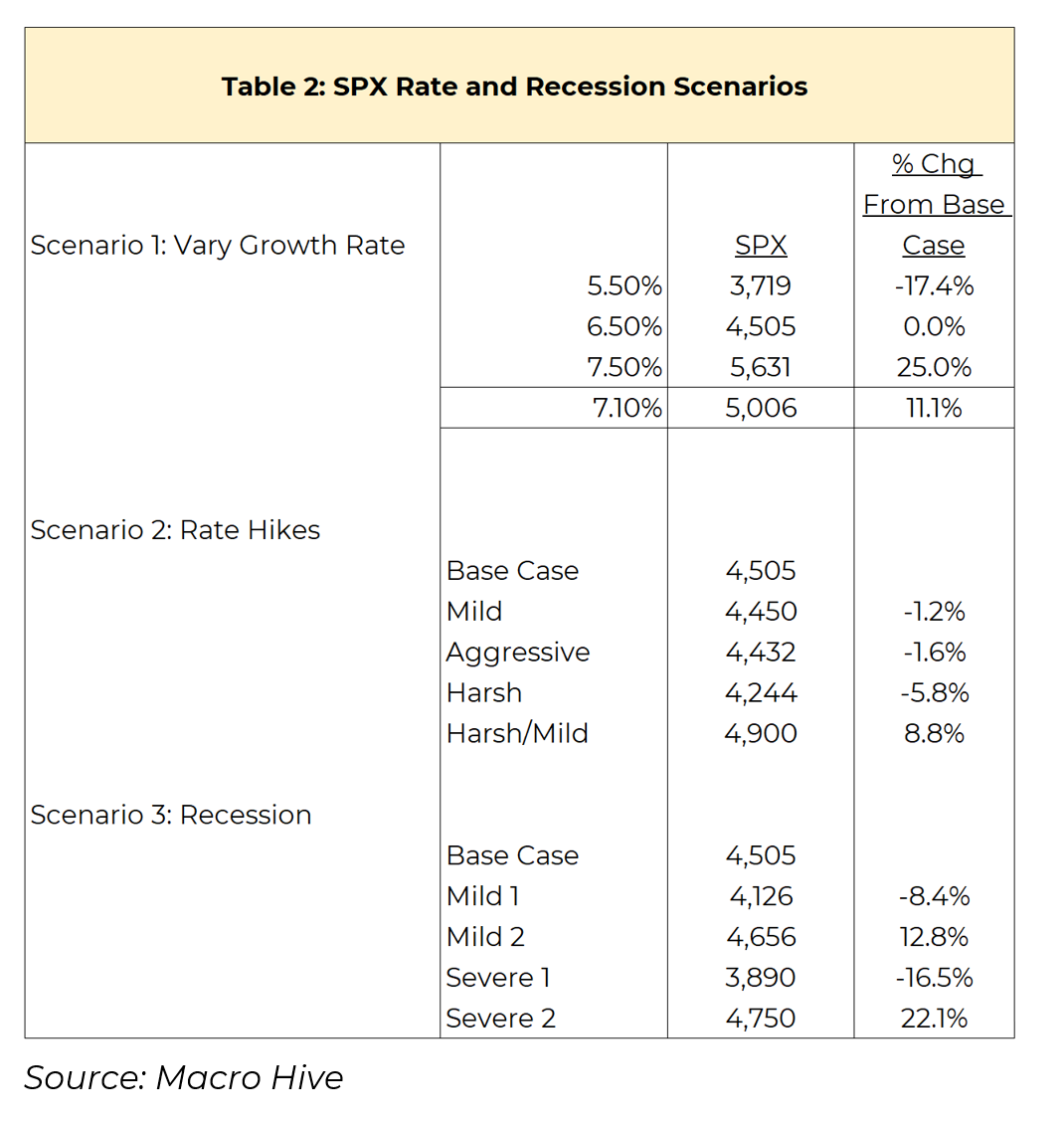

We then examine the impact on SPX valuations of several rate and growth rate assumptions. As noted, growth rates and policy rates revert to long-term trends after three years. We summarize our findings in Table 2.

The Long-Term Growth Rate Matters!

Shifting the long-term earnings growth rate is dramatic. When we set it to 5.6% and 7.6%, the implied SPX level drops to 3,719 (-17.4%) and rises to 5,631 (+25%), respectively.

The expected growth rate could drop, for example, if unions win more power and companies face higher wages that they cannot pass through to customers; or if the effective corporate tax rate increases by eliminating all tax preferences.

Likewise, a higher growth rate could occur if there is a tax cut or a permanent decrease in some key cost, such as energy.

Note, our long-term growth rate of 6.6% is conservative relative to the experience of recent decades. If investors increase the projected growth rate, equities will rally further.

Note also that a comparable one percentage point change in the discount rate (whether due to a change in the Fed Funds rate or equity risk premium) will have a similar impact – assuming the growth rate is unchanged.

The key takeaway here is that a change in the long-term growth rate or discount rate will significantly impact the SPX.

Raising Rates Has Little Impact

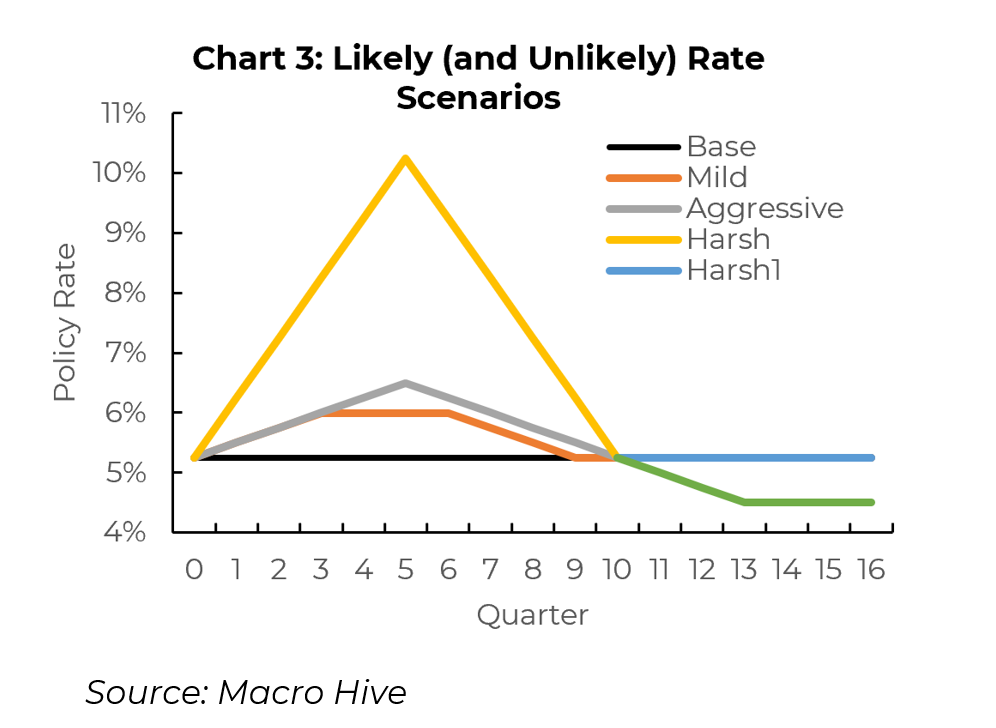

We now examine the impact of raising the Fed Funds rate. We assume, for now, that the Fed policy rate does not affect the earnings growth rate. Our scenarios are as follows (Chart 3):

Mild – the Fed funds rate rises in 25bp increments to 6%, stays on hold for a year, then falls back to 5.25%, again in 25bp increments.

Aggressive – The Fed Funds rate rises in 25bp increments to 6.5%, stays on hold for six months, then drops to 5.25% in 25bp increments.

Harsh – The Fed Funds is raised in 1-point increments to 10.25% each quarter, then reduced to 5.25% in 1-point increments.

Harsh/Mild – This is the same as the Harsh scenario, but the terminal rate is 4.5%.

We note the following points.

- The mild and aggressive scenarios are reasonable given current inflation and Fedspeak. Neither has much impact on the SPX, dinging it by only 1.2% and 1.6%, respectively. If markets do not expect rate cuts to hurt earnings, they will only modestly impact the SPX.

The harsh scenario is obviously unrealistic given current inflation levels and ongoing Fedspeak, but it illustrates two key points.

- In the first version when the policy rate is expected to return to 5.25%, the SPX takes a modest 5.8% hit but remains above 4,200

- If markets seriously expect the projected terminal rate to be lower than 5.25% when the rate hikes start (for example, because the Fed and market believe inflation is under control), equities could rally even as rates start to rise toward 10% (again assuming earnings growth is unaffected)!

These results help explain why equities have rallied in 2023 even as the Fed raised rates. Markets have become more confident that the Fed’s mooted policies will not hurt earnings or the economy. However, markets are not yet pricing in a terminal rate below 5.25% despite all the talk in the business press about eventual rate cuts.

Recession Bite Depends on Policy Response

Obviously, in the harsh scenario above, markets will start taking the threat of recession more seriously. Here we consider two basic recession scenarios and hold the policy rate constant to isolate the impact of recession expectations.

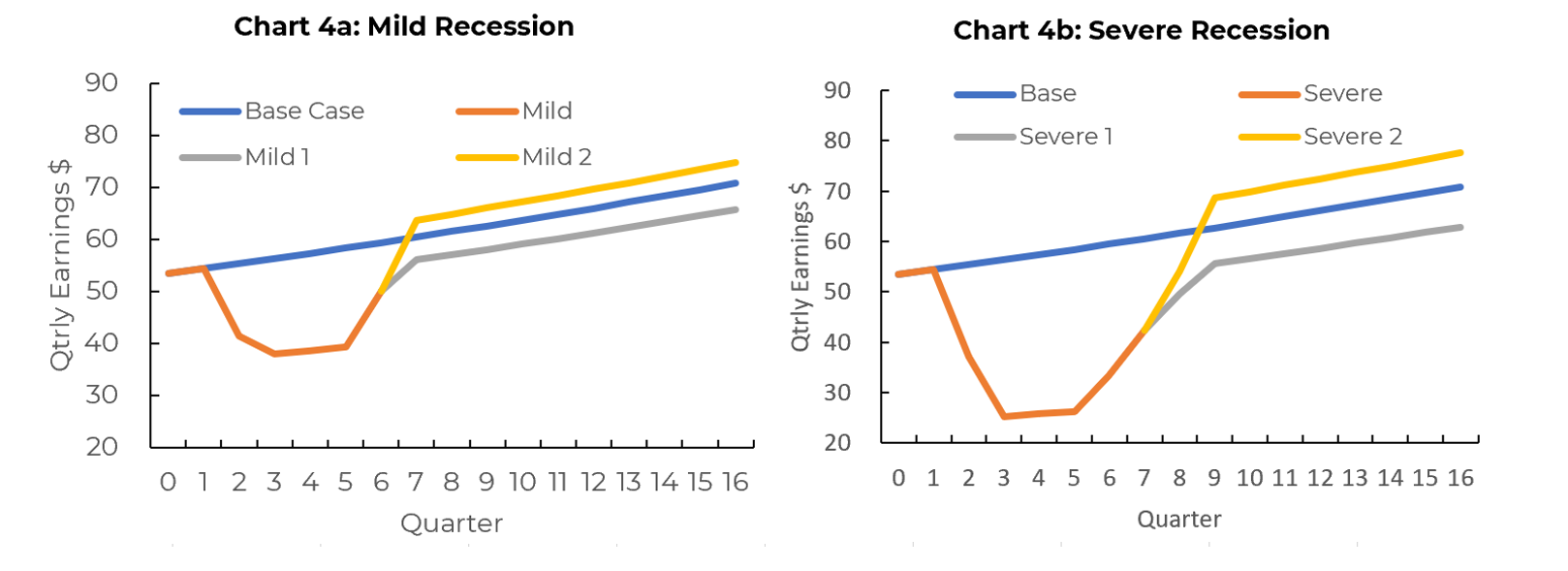

Mild Recession – We assume earnings drop by a quarter.

Severe Recession – Earnings drop by about half.

We also look at two variations of each one: where earnings recover to less than the level before the recession then resume trend growth; and to above the pre-recession level (Charts 4a/4b).

The impact on valuations is significant. When earnings fail to fully recover before resuming trend growth, the SPX is hit by 8.3% and 16.5% in the mild and harsh scenarios, respectively. If the recovery is stronger, the SPX rallies by 12.9% and 22.1%, respectively.

Finally, a recession will likely be in response to higher policy rates. In this framework, the impact of the rate and recession scenarios is additive. If we combine the harsh 1 rate scenario (return to 5.25% terminal rate) and weak recovery, SPX falls 18.6% to 3,669; combining the harsh 2 rate scenario (lower terminal rate) and strong recovery, SPX rallies 15.4% to 5,197.

What could cause a stronger versus weaker recovery? If the government provides generous support and the Fed embarks on more quantitative easing, like after the Covid shock, the economy and earnings could easily rebound to a higher level. If Congress responded as it did in the years after the financial crisis, with spending cuts, the recovery could well get off on a weak footing.

Some Disclaimers Are in Order!

These are simple deterministic scenarios. We assume markets are presented with each one and adjust instantly. In reality, as circumstances change there is much uncertainty about what the consensus scenario is going forward. Market selloffs and rallies tend to be overdone as investors extrapolate short-term trends too far into the future.

For example, in the harsh/mild recession scenario where SPX rallies, it will most likely initially sell off, if only because there is no information about likely government responses. As policy responses unfold, markets will soon settle on new and higher trading ranges.

The point estimates we provide in Table 2 are best viewed as target fair value SPX levels today, should the market expect these various scenarios to unfold.

Key Takeaways

- Equity earnings tend to grow over time. Recessions and various geopolitical shocks will drive selloffs, but over any time horizon beyond a few quarters the underlying growth rate tends to reassert itself.

- Short sellers beware! Short trades are short-term trades!

- Short-term changes in policy rates matter only if they are likely to feed through to earnings.

- Today, markets see little risk that further mooted rate hikes (two more 25bp increments) will have much impact on the economy or earnings.

- If press reports are any indication, investors are clearly hoping for eventual rate cuts below the current 5.25%. Our analysis suggests they have yet to price in that scenario. Presumably, they expect inflation to remain persistent and the Fed dovish, making it difficult to cut rates in the foreseeable future.

[1] There is a case for setting the risk-free at the 10-yr Treasury yield given the long duration of equities. Given the 10-yr Treasury rate is near 3.9%, that would imply an equity risk premium of 7.35%. For this analysis, the primary variable is the all-in discount rate; the choice of risk-free rate and equity risk premium is a matter of optics and reference.

Over a 30-year career as a sell side analyst, John covered the structured finance and credit markets before serving as a corporate market strategist. In recent years, he has moved into a global strategist role.

Photo Credit: depositphotos.com