Summary

- We pitched Russell 2000 (RTY) in early June on expectations that the selloff after the Silicon Valley Bank (SVB) collapse was overdone. It has rallied nicely since. Is it still a hold?

- RTY trades at a premium price-earnings (P/E) ratio to the S&P 500 (SPX), but it lacks exposure to the tech sector. Loss-making companies also weigh it down. It is unlikely to produce premium earnings growth in the current environment.

Market Implications

- RTY will perform in line with SPX at best, with significant downside risk in any selloff.

- We unwind our technical long position.

KRE and RTY Have Surged

Six weeks ago, we argued there was value in holding the regional bank ETF KRE and Russell 2000 ETF (IWM). We thought the post-SVB selloff in these sectors was overdone, and that regional banks Q2 earnings would surprise on the upside, benefiting both sectors.

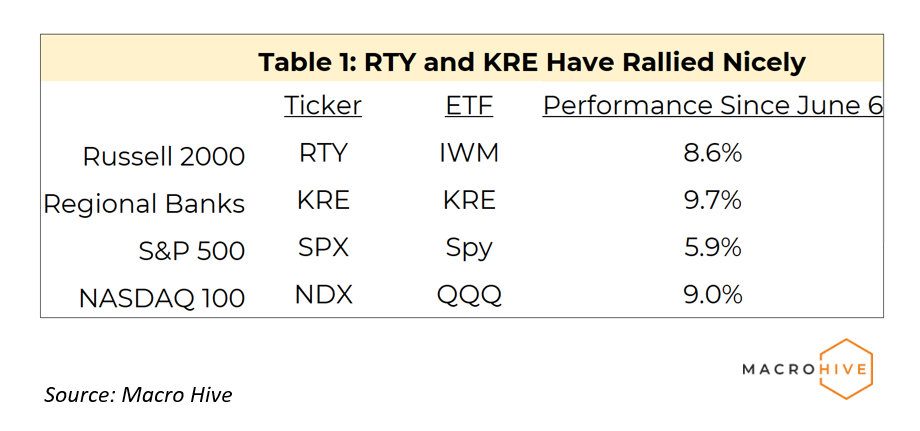

So far, RTY and KRE have outperformed the S&P 500 (SPX) handily and are roughly in line with the sky-rocketing NASDAQ 100 (NDX) (Table 1).

We pitched these trades as short-term technical opportunities. We still view KRE in that light and like holding the position for now.

But what about RTY? Is it poised to continue outperforming and deserving of a longer-term hold?

In short, we expect RTY to perform roughly in line with SPX going forward. Here is why.

RTY Mostly Tracks SPX

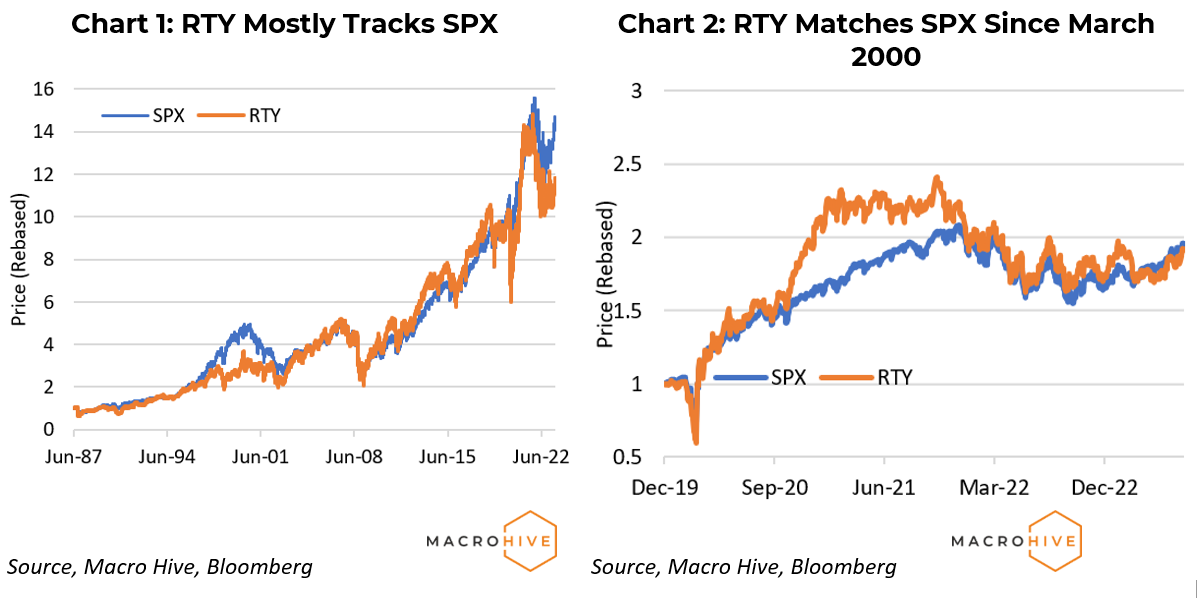

Over time, RTY has performed roughly in line with SPX (Chart 1). It trailed in the late 1990s during the dot-com bubble, as most RTY companies were not internet-oriented, and it has lagged in 2023 as tech companies have led the market higher.

RTY is more volatile than SPX, selling off more during recessions and downturns, but outperforming during boom times. This pattern is particularly evident since early 2020. During the March 2000 selloff RTY fell 15% more than SPX, then rallied strongly after the 2000 election (Chart 2). We rebased the SPX and RTY price as of March 2000 to better illustrate the relative performance of the two indices since then. RTY started to weaken in late 2021, then essentially tracked the SPX since early 2022. Depending on the reference point (31 December 2019 vs 20 March 2000), RTY has lagged or matched SPX.

Earnings Hopes Are the Magic Sauce

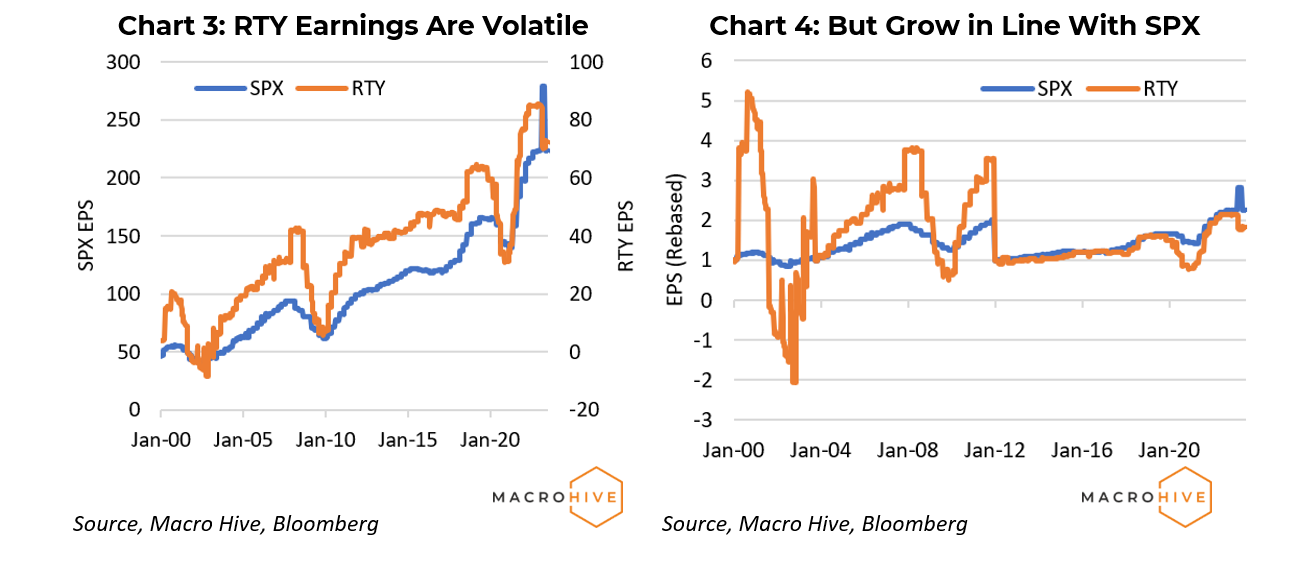

As we often argue, earnings are the primary driver of equities, and that goes far in explaining why RTY is more volatile than SPX. During recessions, RTY earnings have collapsed far more than SPX, only to rebound strongly during recoveries (Chart 3). When we rebase earnings to make them directly comparable, we can see that RTY earnings grew strongly during the 2003-2007 period, and after the global financial crisis (Chart 4). We then rebase earnings again in 2012, and it is apparent that RTY earnings growth since then has been, at best, in line with SPX.

RTY Trades at a Premium Valuation

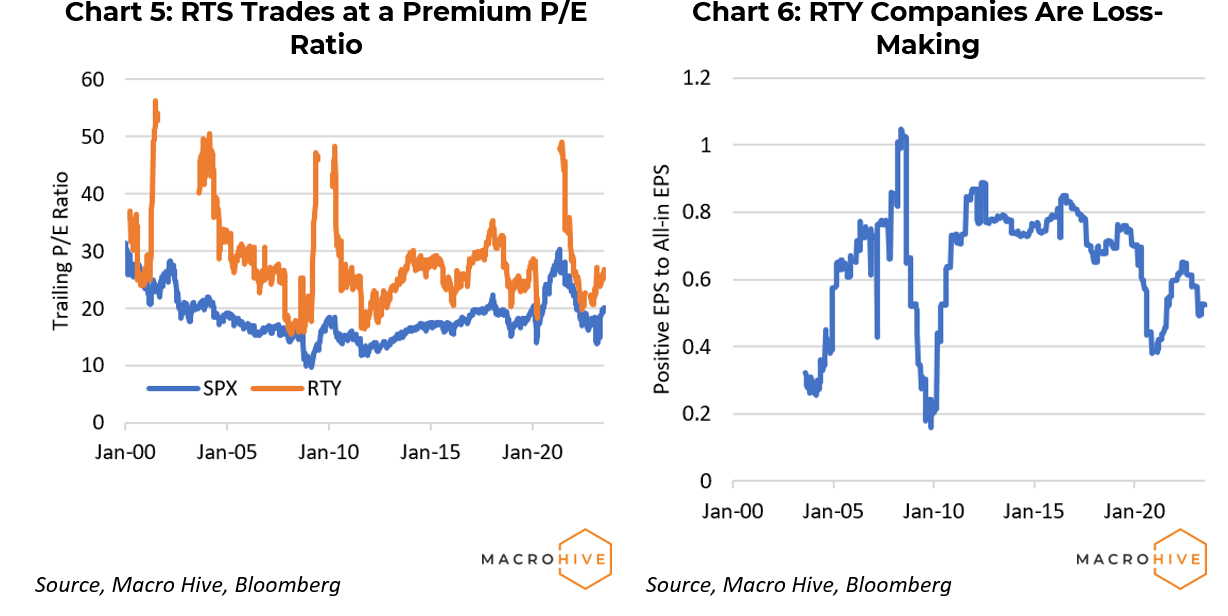

Still, RTY has mostly traded at a significant P/E ratio to SPX (Chart 5). We present trailing P/E here; data quality for forward P/E is less consistent but exhibits a similar profile. RTY now trades at a significant valuation gap to SPX.

A premium P/E might have made sense before 2008, but there appears to be little justification for it over the past decade. Apparently, investors keep hoping that RTY companies are on the verge of an earnings surge – but the only time it materializes is after a sharp drop in earnings when a low base magnifies the gain.

Many RTY Companies Are Loss-Making

One key reason why RTY earnings growth is elusive is that loss-making companies are rising. We compute the ratio of EPS of all companies to the EPS of companies with positive earnings, and that is trending down – it has been in a downtrend for the past decade (Chart 6). A similar ratio for the SPX has been near one for the past two decades, implying that most companies in the index make at least some profit.

We do not see the current environment as conducive for loss-making RTY companies to return to profitability en masse. Given a tight labour market, rising costs of labour and raw materials, and stretched consumers, surging profitability is not on the cards for smaller companies at this point in the business cycle.

RTY Is Market Perform at Best

We see little prospect of RTY outperforming SPX for the foreseeable future. At best, it will continue to perform in line with SPX. Downside risk is significant in any downturn given RTY’s premium P/E ratio. If investors were to wake up and cut its P/E valuation from the current 27 to 20, RTY could drop by more than a quarter.

Between that risk and the SPX exposure to the tech sector, we currently favour SPX.

Over a 30-year career as a sell side analyst, John covered the structured finance and credit markets before serving as a corporate market strategist. In recent years, he has moved into a global strategist role.

Photo Credit: depositphotos.com