This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

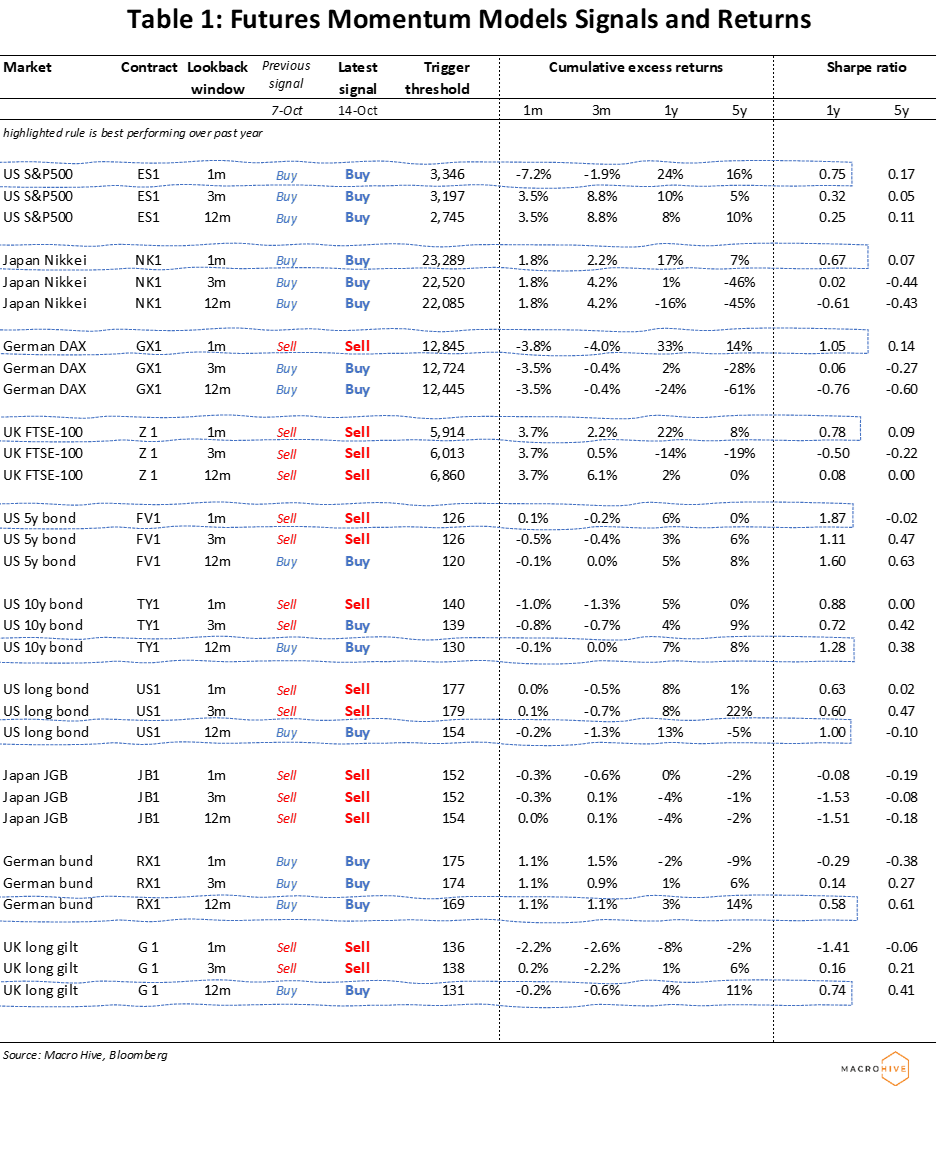

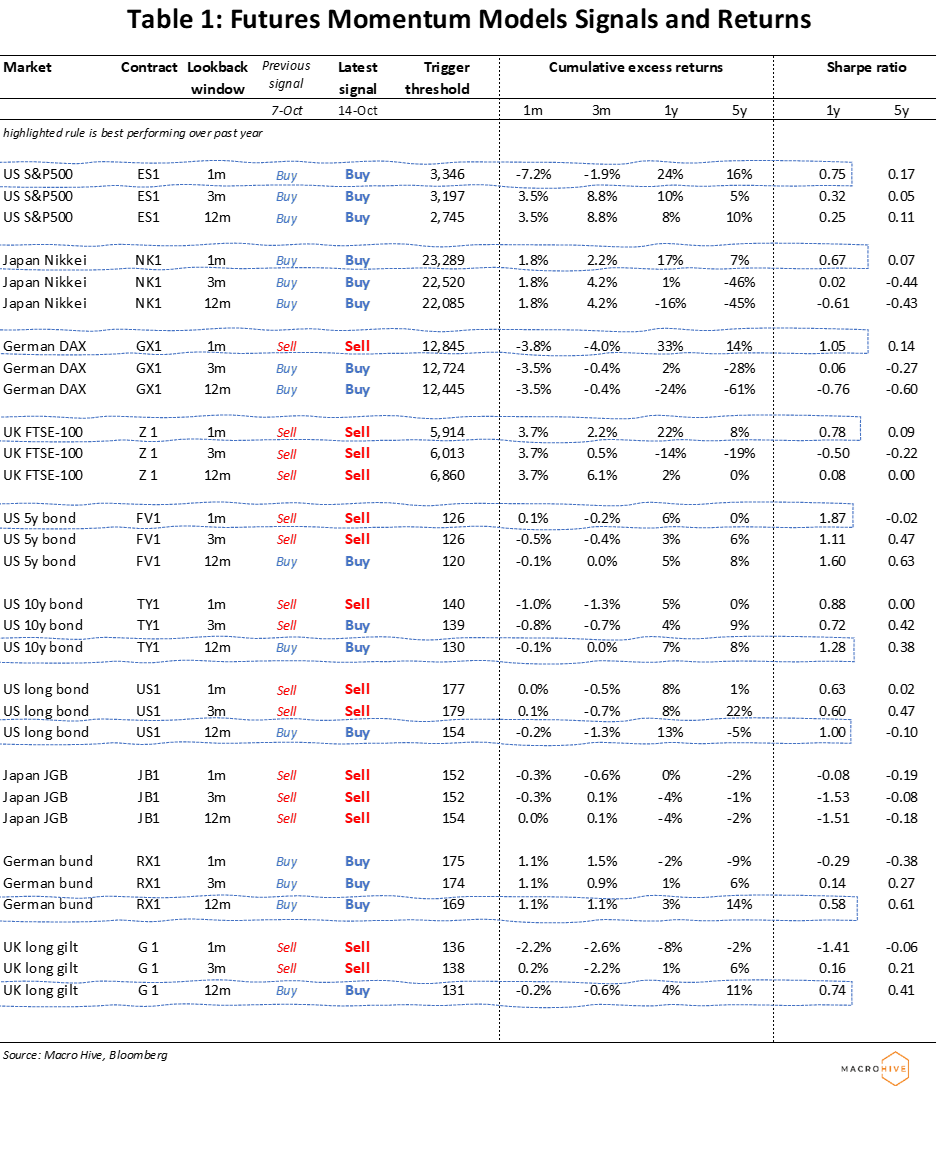

I’ve been building a bunch of momentum trading models using equity and rates futures. I’ve focused on simpler models to avoid data-mining issues. The basic strategy is to use returns (lookback windows) to give buy/sell signals. So, if the US stocks are up over the past 3 months, you buy, otherwise you sell (note I use excess returns). I’ll update weekly using Wednesday closes:

- Currently, all timeframes are giving a “buy” signal for the S&P500. The best performing version, the 1-month lookback, will trigger a sell signal if we get to 3,346. Nikkei also has all buy signals, while FTSE has sell signals. The DAX is mixed with a short-term sell signal.

- In rates, the 3m model has now switched to a buy signal for US 10y (TY). The short-term model remains a sell while the long-term model is a buy. The JGB signals are all sells, while Bunds are buys, while gilts re mixed.