Anyone watching equity markets yesterday surely noticed the Russell 2000 Index (+3.6%) robustly outperform the S&P 500 (+2.3%) and NASDAQ (-1.9%). Joe Biden’s election victory and Pfizer’s encouraging Covid-19 vaccine announcement together offer a promising prospect: normalization at last for smaller companies hit disproportionately hard by pandemic-related economic restrictions.

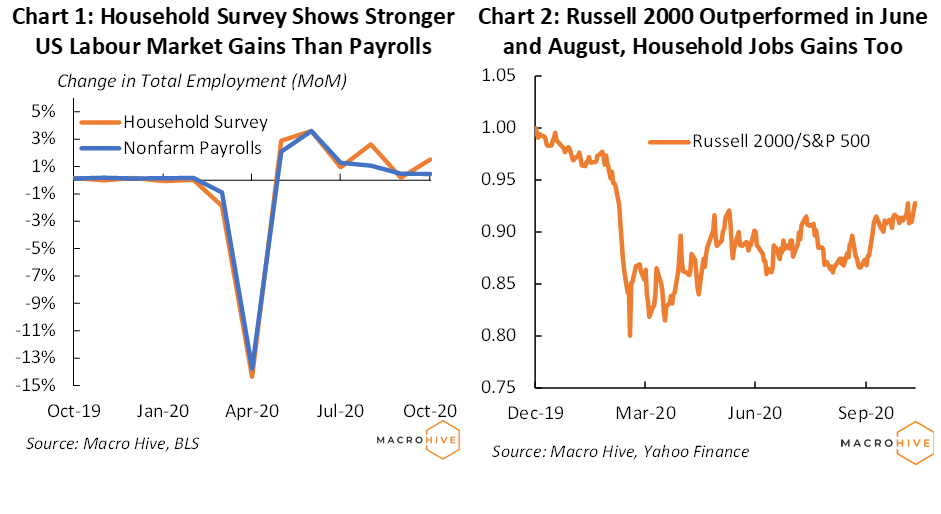

Less noticed might have been the October labour market report. The broader-based Household Survey showed total employment increased 1.5% in October, versus 0.45% for the widely followed Nonfarm Payroll Survey (Chart 1). Normally these surveys move roughly in parallel. The Household Survey includes non-payrolls workers, including freelancers, gig workers, and, of course, farm workers. Stronger job growth in this sector is another indication the US economy is opening up and activity is improving at smaller businesses.

The Household Survey also outperformed in May and July (reported early June and August), contributing to a spike in the Russell 2000 (Chart 2).

Despite these gains, the Russell 2000 has still underperformed the S&P 500 by 7% on a year-to-date basis. There is room for it to continue outperforming so long as the labour market keeps improving and we carry on getting positive Covid vaccine news.

That said, this momentum trade remains vulnerable to setbacks. Most of the labour market gains are coming from recalling furloughed workers. Structural unemployment remains high and has shown little improvement so far in the recovery. Without gains here, the recovery risks stalling or settling in for a period of slow growth as recalling furloughed workers runs its course. This would hurt smaller companies and the Russell 2000. The question, then, will be whether Congress responds with further stimulus.

Trading Views

Short term – Modest overweight Russell 2000. In coming weeks, the Russell 2000 may continue outperforming on a confidence bubble.

Medium term – Russell 2000 is vulnerable to selloffs as inevitable setbacks emerge. These selloffs should present buy opportunities for buy-and-hold investors especially if there is a prospect of further stimulus to offset economic weakness.

Over a 30-year career as a sell side analyst, John covered the structured finance and credit markets before serving as a corporate market strategist. In recent years, he has moved into a global strategist role.

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)