Economics & Growth | Europe | Monetary Policy & Inflation

Economics & Growth | Europe | Monetary Policy & Inflation

Since the global financial crisis, existential emergencies have plagued the euro area. First was the sovereign crisis of 2010-2012. Then came the refugee crisis that started in 2015 and culminated in Italy’s right-wing anti-EU party, Lega, entering government in 2018. Since COVID, those fears have disappeared – a huge EU-wide fiscal package in response to a common shock, the pandemic, has seemingly ironed over any intra-euro issues. However, all that could fall apart in 2022.

The latest COVID wave is making countries re-enact restrictions, which could eventually include cross-border movements. This will compromise the free movement of labour across the bloc. And if countries get used to having such control, removing those powers could become harder. This comes as refugees gather on the Belarus-Poland border and Turkey continues to require EU payments to keep refugees out of the EU.

The euro area’s political dynamics are also changing. Angela Merkel, who as chancellor of Germany became an expert in keeping the euro area together, has left office. Meanwhile, an unlikely coalition of the SDP, FDP and Greens won the recent election. The new coalition appears against an extension of pandemic fiscal packages while aiming to federalise the euro area further, something many countries may oppose.

Meanwhile, on 26 November, France and Italy signed their first-ever agreement, the Quirinale Treaty. It will see them cooperate bilaterally on EU issues ranging from the economy to migration. This new Franco-Italian axis of high-debt countries could rupture the Franco-German alliance, not least by loosening fiscal standards across the euro area.

On the economic front, significant divergences are appearing across the euro area. Germany’s core inflation (2.8%) is the highest since the inception of the euro area, whereas Italy’s is a moderate 1.2%. German debt is near 70% of GDP, while Italy’s is at 155%. In the November report on budget plans, the European Commission wrote:

‘Italy has been recommended by the Council to limit the growth of nationally financed current expenditure. This is not projected to be sufficiently ensured… In order to contribute to the pursuit of a prudent fiscal policy, the Commission invites Italy to take the necessary measures within the national budgetary process to limit the growth of nationally financed current expenditure.’

This could see the ECB torn between tapering to curb inflation or maintaining quantitative easing (in some form) to support high-debt countries.

And were all this not enough, French elections arrive in April 2022. Immigration could become a central battleground. While incumbent Emmanuel Macron is expected to win, polls reveal support for the far-right nationalist Eric Zemmour, heightening euro area break-up fears. Macron may even be willing to compromise the Schengen Area (visa-free travel zone) to capture votes from the far-right.

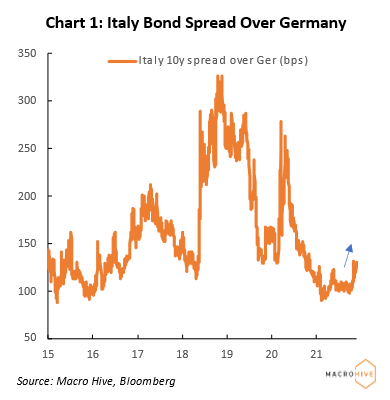

So, watch out for break-up risks, and keep an eye on Italian bond spreads (Chart 1).

Spring sale - Prime Membership only £3 for 3 months! Get trade ideas and macro insights now

Your subscription has been successfully canceled.

Discount Applied - Your subscription has now updated with Coupon and from next payment Discount will be applied.