Summary

- We expect equities to settle into a trading range after last week’s hot CPI and PPI reports until investors develop new conviction about the timing of rate cuts.

- Both Adobe and Alphabet sold off last week on reports that OpenAI is now targeting Google Search and Adobe’s Creative Cloud. Clearly, the potential for AI-driven disruption is all but boundless.

- Whether these developments defuse the AI mania that has driven a few names higher may depend on Nvidia’s earnings report, due Wednesday after the close.

- Another beat is likely – but a lot of optimism is priced into the stock too.

- Retailers Home Depot and Walmart report Tuesday. Their outlooks will be key in shaping expectations about consumer spending in coming months.

What We Learned Last Week

Upward and Onward? It is becoming a mantra…we like equities, but are they not priced for perfection? We have highlighted that forward P/E ratios for the S&P 500 (SPX) and NASDAQ 100 (NDX) are at the highest since 2004 (ex-pandemic distortions) – and keep marching higher (Chart 1).

Think of it as a three-legged stool – where perfection is a trifecta of rate cuts, robust earnings, and a solid economy. Add to the mix elevated AI expectations.

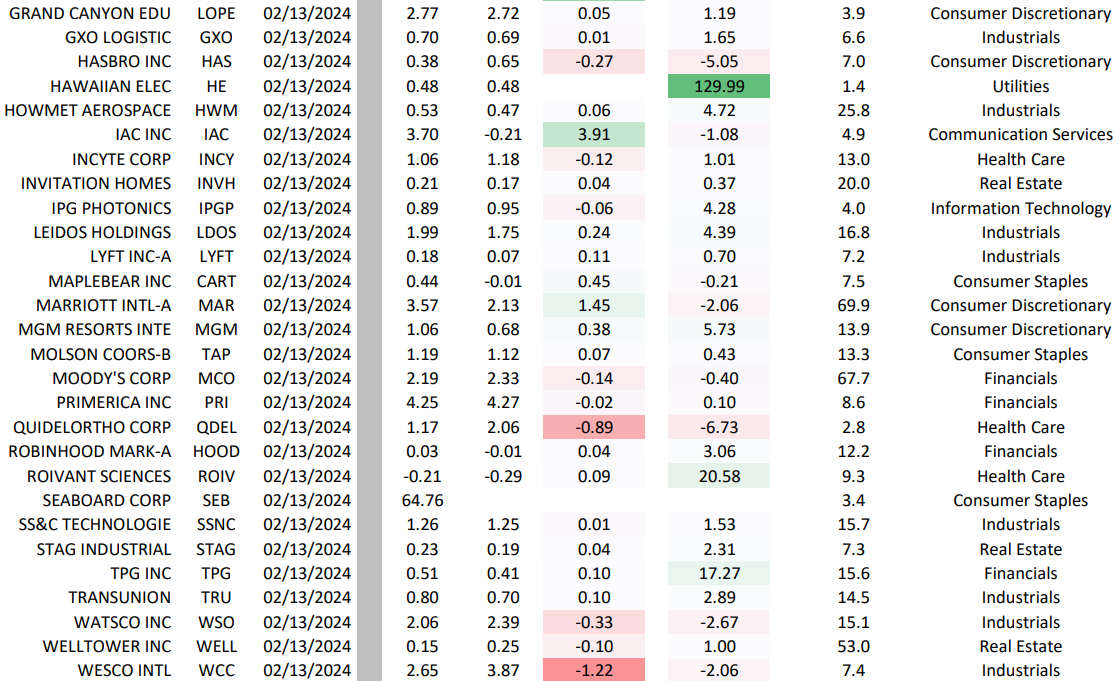

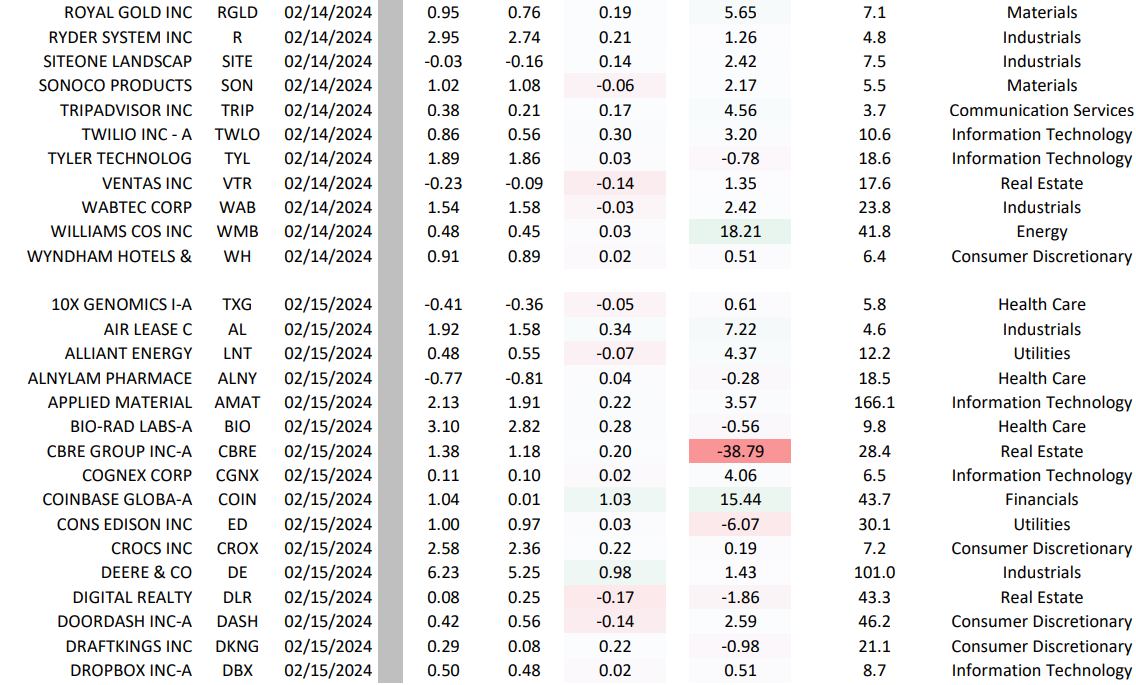

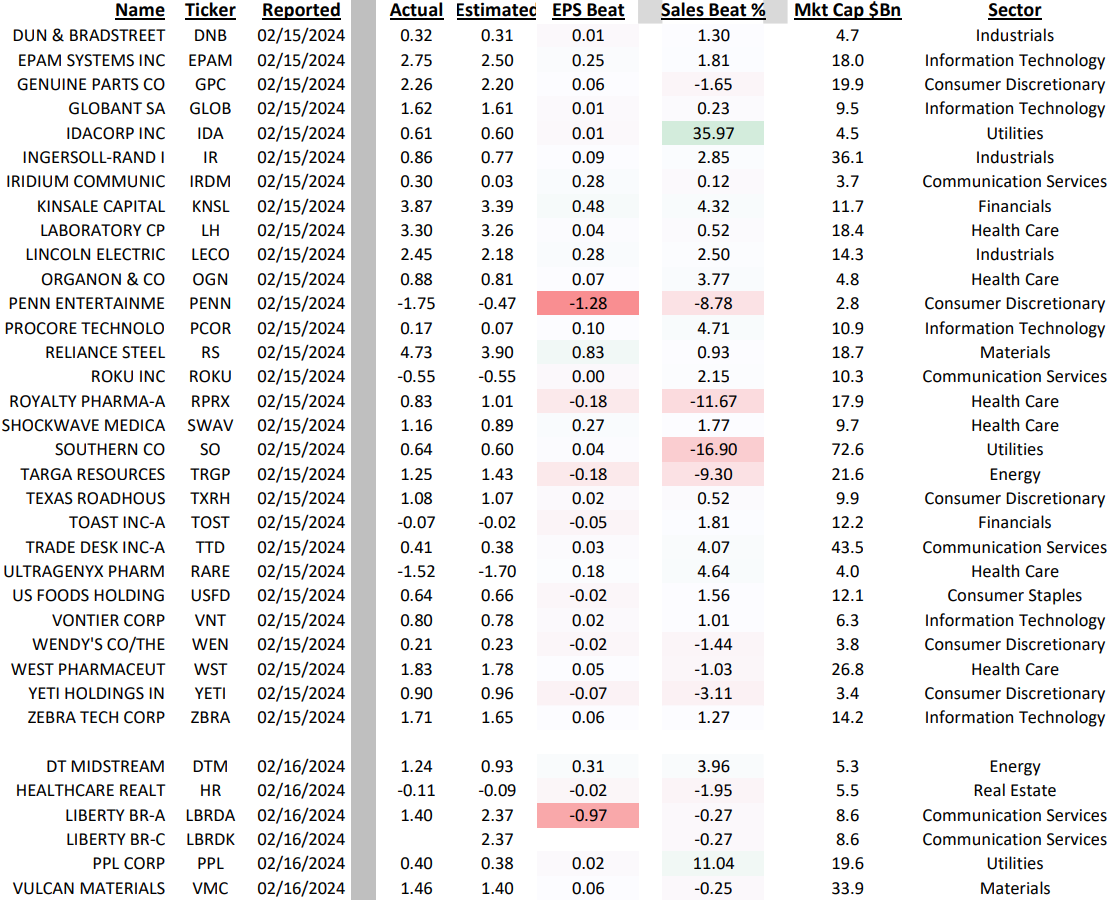

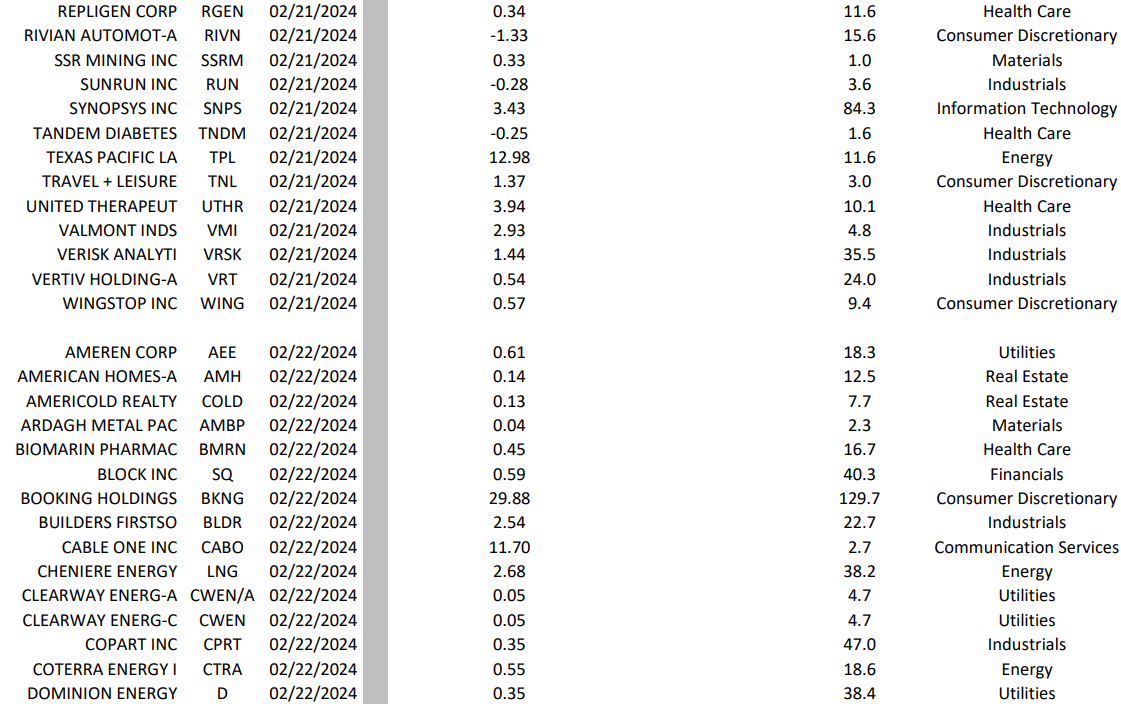

So far, earnings are holding up nicely and the economy is rolling.

That rate cut scenario is something else. Last week’s hot CPI and PPI data may not have knocked out the rate cut leg, but it is now shakier.

AI Disruption Shows No Respect – We also got an AI shakeup. Late in the week, OpenAI announced Sora – a tool that can convert text prompts into video. Adobe (ADBE), one of the past year’s highflyers based on how AI might enhance its Creative Cloud, dropped 10% (Chart 2). Another OpenAI tool aims for the search market – market leader Alphabet shed 5.5% on the week.

Our point being, AI has arrived – but picking winners and losers is not a sure thing. For now, companies providing hardware to enable AI are the winners. The Philadelphia Semiconductor Index (SOX) has outperformed the NDX 9% since ChatGPT debuted in November 2022. AMD is up 125%; Nvidia (NVDA) has more than tripled. Those big gains may be winnowed down as other companies catchup, but that will take time.

AI Software Is the Big Kahuna – Who wins the battle to provide the software tools is another matter. Tech titans (e.g., Bill Gates), when pressed on their monopoly positions, often reply that their positions are precarious and could be replaced with the next great thing. We got a hint of that prospect this past week.

To give some idea of how big the AI software business could be, consider this nugget from one earnings call. Farm equipment manufacturer Deere & Co. (DE), talking up prospects for sales growth, said it is developing autonomous tractors and crop sprayers that incorporate AI to identify weeds.

DE lacks the inhouse AI and programming expertise to develop that technology. Imagine how many possibilities there are for AI-enabled, well, everything. Perhaps a whole industry will emerge to create all those endless AI apps. Or maybe some software companies separate from the herd and become the dominant AI app providers.

Then there is the question – who captures the economics? For example, The New York Times has sued Microsoft (MSFT) for using copyrighted news articles to train its AI products. MSFT and other AI developers may have to pay royalties to access data that hitherto has been effectively free. This could make the ultimate winners and losers, and the future of AI, quite different from the winner-takes-all model the tech sector has used to develop over the past few decades.

Equities Hit a Trading Range – Putting these strands together, we expect equities will settle into a trading range at least until investors develop new conviction about when rate cuts will start. And there might be more rotation among current and potential AI players, which limits the overall upside for now.

The Week Ahead

The AI hardware sector gets a huge reality check when NVDA reports earnings on Wednesday. Over the past three quarters analysts have woefully underestimated NVDA revenue and earnings, unable to buy into the fantastical guidance from the company ( proven correct). We expect NVDA will surprise on the upside again. But tremendous optimism is priced into the stock, so it must be a huge beat to maintain the NVDA rally.

Meanwhile, retail earnings begin with Home Depot (HD) and Walmart (WMT) reporting on Tuesday. Given the strong holiday shopping season, earnings should be good – the question will be consumer spending outlooks.

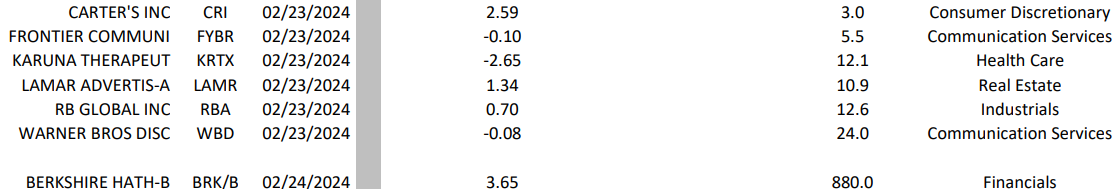

Key reports include:

Tuesday

- Caesars Entertainment (CZR)

- Home Depot (HD)

- Medtronic PLC (MDT)

- Public Storage (PSA)

- Toll Brothers (TOLL)

- Walmart (WMT)

Wednesday

- Analog Devices (ADI)

- Garmin Ltd (GRMN)

- Lucid Group Inc. (LCID)

- Nvidia (NVDA)

- Rivian Automotive (RIVN)

Thursday

- Booking Holdings (BKNG)

- Dominion Energy (D)

- Intuit Inc. (INTU)

- Planet Fitness (PLNT)

Friday

- Warner Brothers Discovery (WBD)

Over a 30-year career as a sell side analyst, John covered the structured finance and credit markets before serving as a corporate market strategist. In recent years, he has moved into a global strategist role.