Summary

- Markets get another indication of the outlook for rate cuts when the Personal Consumption Expenditures (PCE) report arrives on Thursday.

- Nvidia (NVDA) surprised on the upside yet again – clear evidence that the investing community still does not understand the AI phenomenon.

- Consumers remain strongly inclined to spend on experiences rather than stuff, but some companies in the travel space sold off on overly inflated expectations.

- About 125 companies report this week, including various retailers and several tech companies that have hawked their AI-related growth potential.

Market Implications

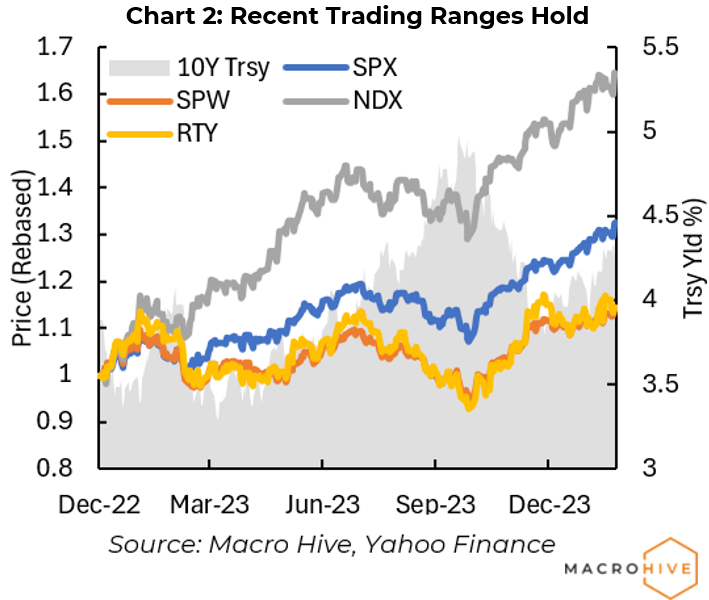

- Whether equities break out of recent trading ranges depends on whether the PCE delivers conviction that rate cuts could come sooner rather than later.

What We Learned Last Week

The week’s big lesson (and now hardly surprising) was that analysts (and investors) were again behind the Nvidia curve, with big misses on revenue, earnings, and the outlook for the coming quarter.

It is understandable. Companies often evolve, adjusting their business models, moving into new lines of business incrementally, tweaking their business model here and there, but retaining their essential character. Think Microsoft or Amazon.

Then there is a phenomenon like NVDA. For most of the past 20 years, it specialized in GPU chips for gamers – a big fish but in a decidedly small pond. Then in November 2022, ChatGPT opened everyone’s eyes to the limitless possibilities of AI as a truly transformative technology. Come May 2023, NVDA burst on the scene with a quarterly revenue forecast for the next quarter nearly double the previous quarter.

NVDA catapulted from the niche domain of gamers into the only game in town for hardware to implement generative AI. Its name is now synonymous with AI. And many people probably would not know that NVDA is (was?) in the computer gaming business.

How do you comprehend a company making that kind of transformation overnight?

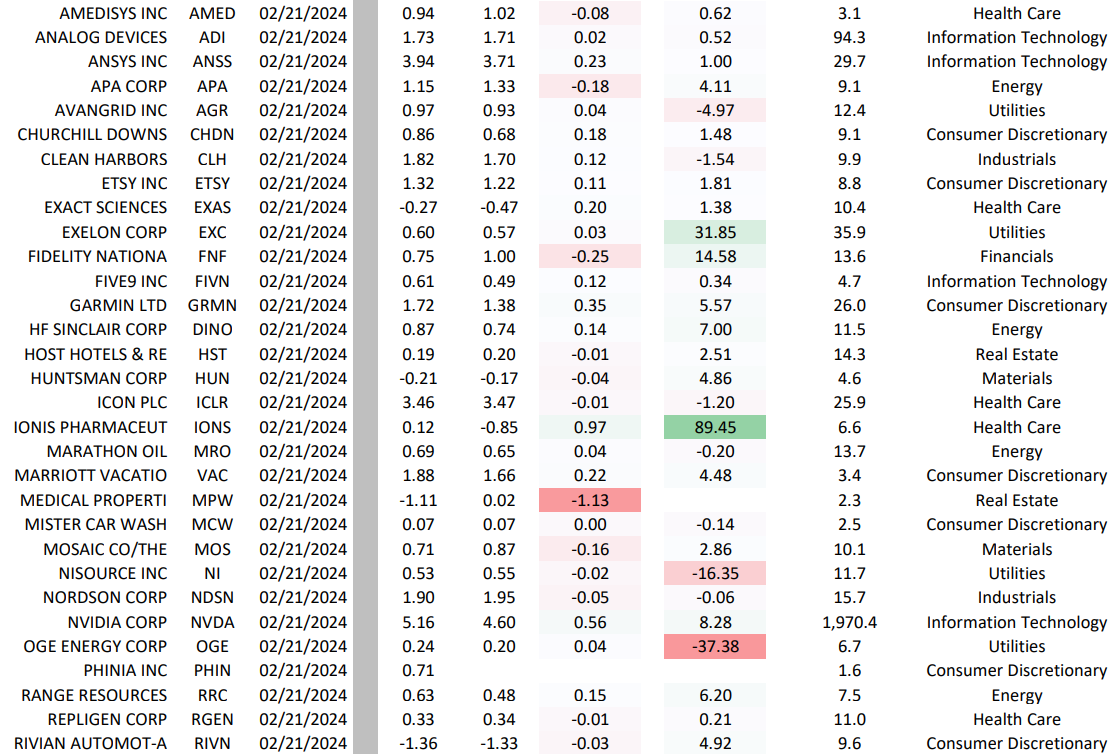

As another measure of how unique NVDA is, look at the performance of various other tech companies last week – many having burnished their AI credentials and prospects (Chart 1). NVDA was up 8% on the week – and 16% from the week’s pre-earning low. Most other companies we track gained one or two percent or largely in line with broad market averages. Apart from Advanced Micro Devices (AMD) and Snowflake (SNOW), there was little halo effect.

Consumer Demand for Experiences Remains Strong – But…

Since pandemic restrictions eased during 2022, people have been making up for lost time, booking travel and entertainment plans – anything to get out the house.

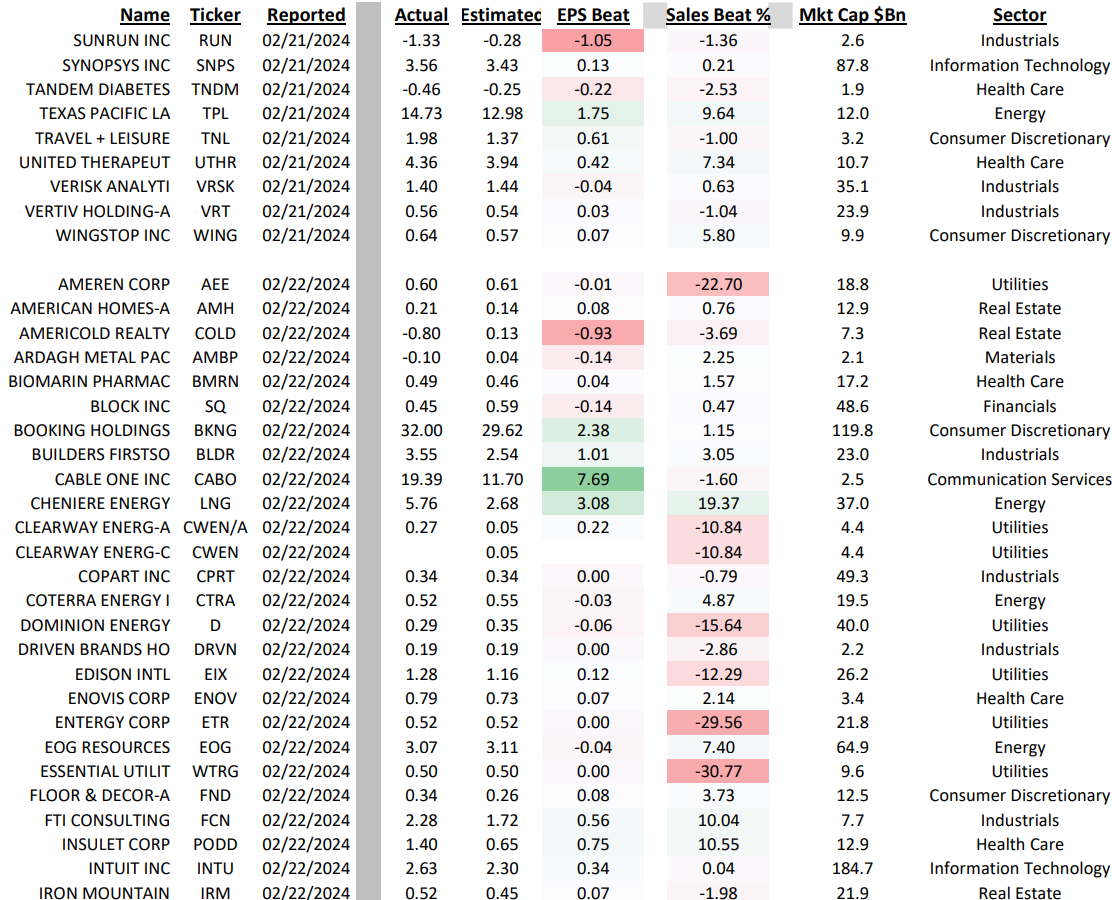

Various companies cater to this demand, such as Expedia (EXPE), Trip Advisor (TRIP), Booking Holding (BKNG), cruise operators (e.g., Carnival Corp. (CCL) and Planet Fitness (PLNT), all reported solid earnings and said demand remains strong. But several posted softer outlooks than analysts projected, triggering selloffs in EXPE, BKNG, CCL, and PLNT, among others. There are several reasons for caution, including the Middle East war, company-specific issues, and simple conservatism. But there is an emerging pattern here.

We think the consumer remains healthy and in a spending mood. Analysts and investors project that the past year’s trends will continue. But instead, travel and entertainment demand appears to be somewhat returning to a pre-pandemic level.

Put another way, the travel/entertainment sector is contributing to GDP growth – but is not a great investment.

Staples Yes, Stuff No – In retail, Walmart (WMT) offered a robust beat and outlook, predicated on further building out its grocery business. It also said demand for consumer discretionary goods remained soft.

The Week Ahead

Thursday sees an inflation update (Leap Year Day!) with the PCE release. Given this is the Federal Reserve (Fed)’s preferred inflation measure, markets can again reassess expectations about when the Fed might start cutting rates. We expect the major indices will struggle breaking out of recent trading ranges until investors gain more conviction that cuts are coming sooner rather than later.

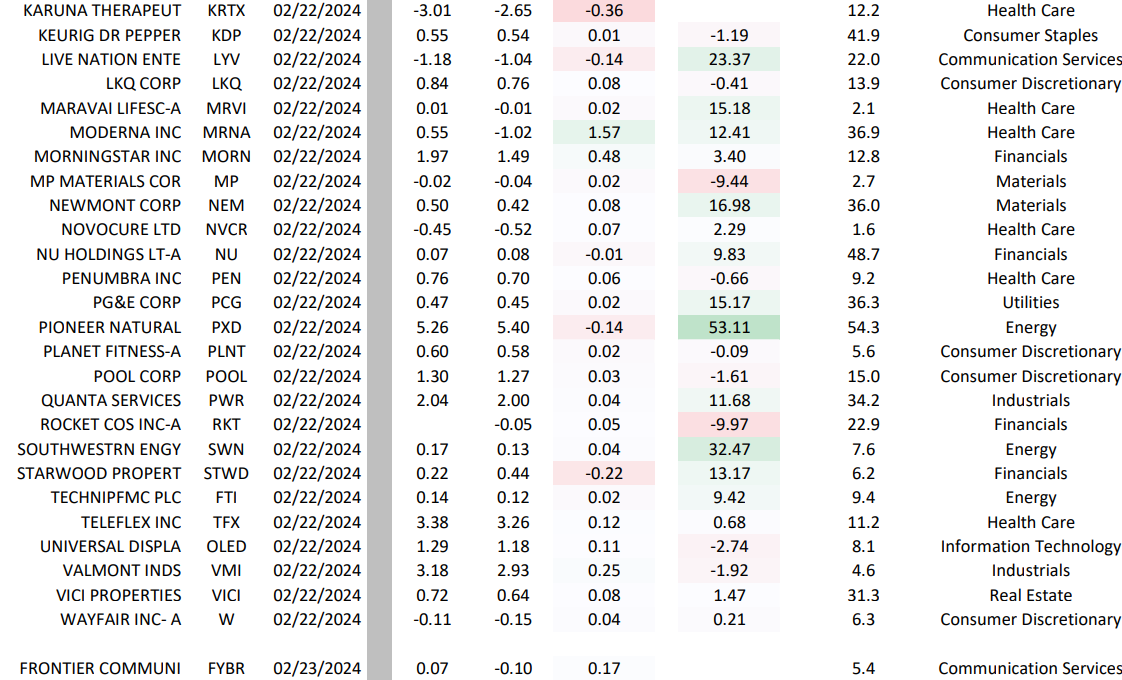

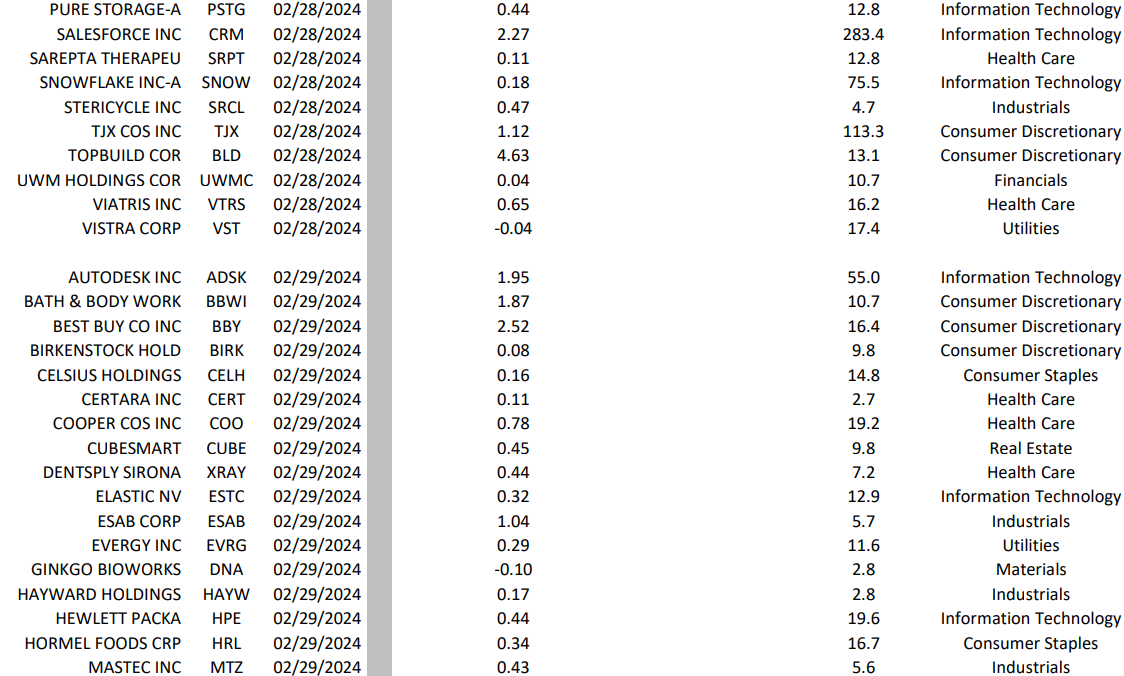

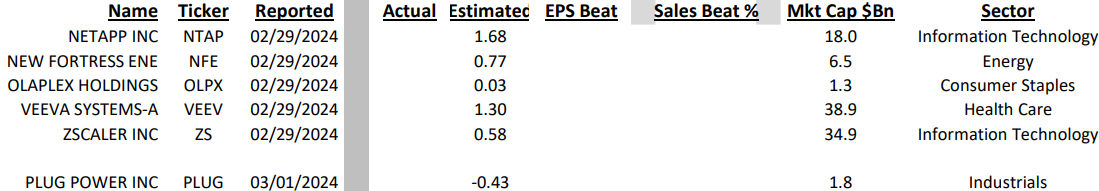

About 125 companies in our Russell 1000 universe report this week. It is a big week for retailers, with Autozone (AZO), Best Buy (BBY), eBay (EBAY), Lowes Co. (LOW), and Macy’s (M), among others, offering their insights. We expect outlooks will towards the soft side.

In tech, Snowflake (SNOW), SalesForce (CRM), and Hewlett Packard Enterprises (HPE) all seek to link their outlooks to AI opportunities. We may also hear that this is more a late 2024 or 2025 development.

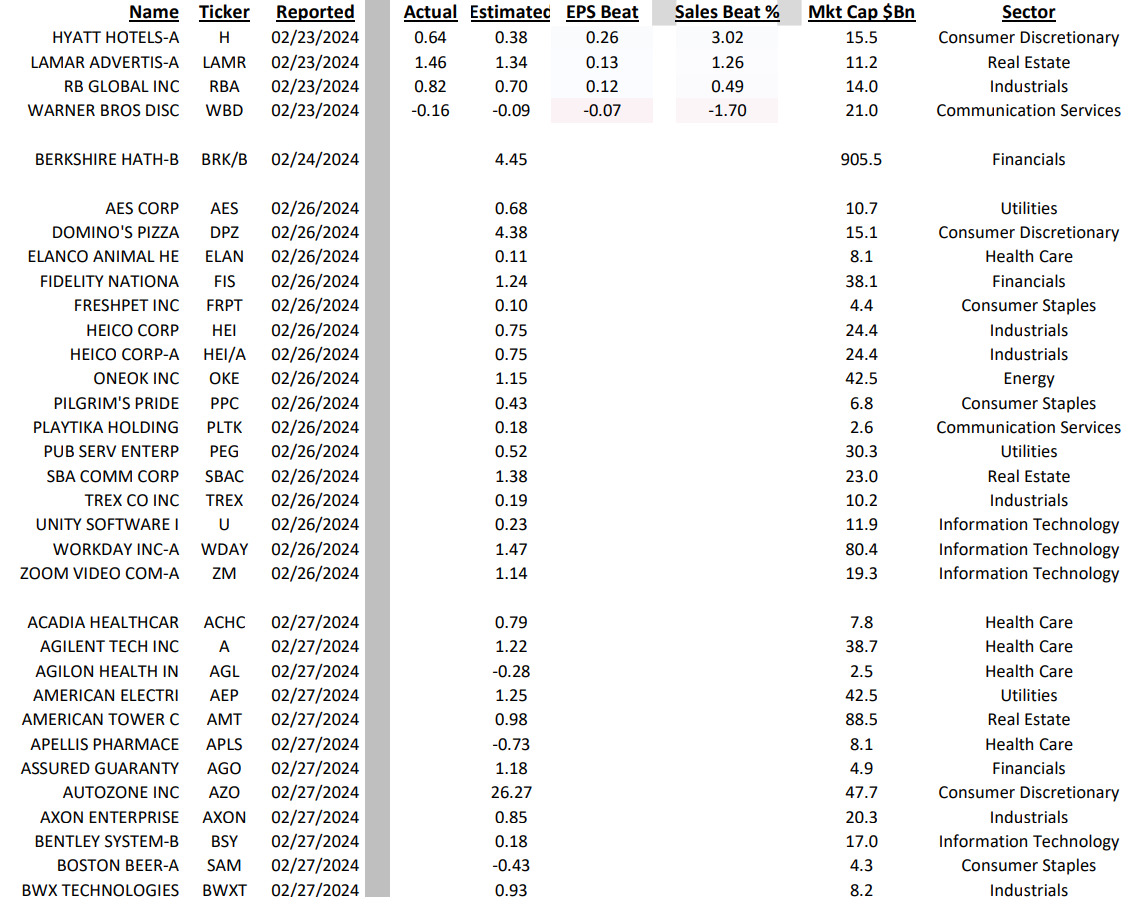

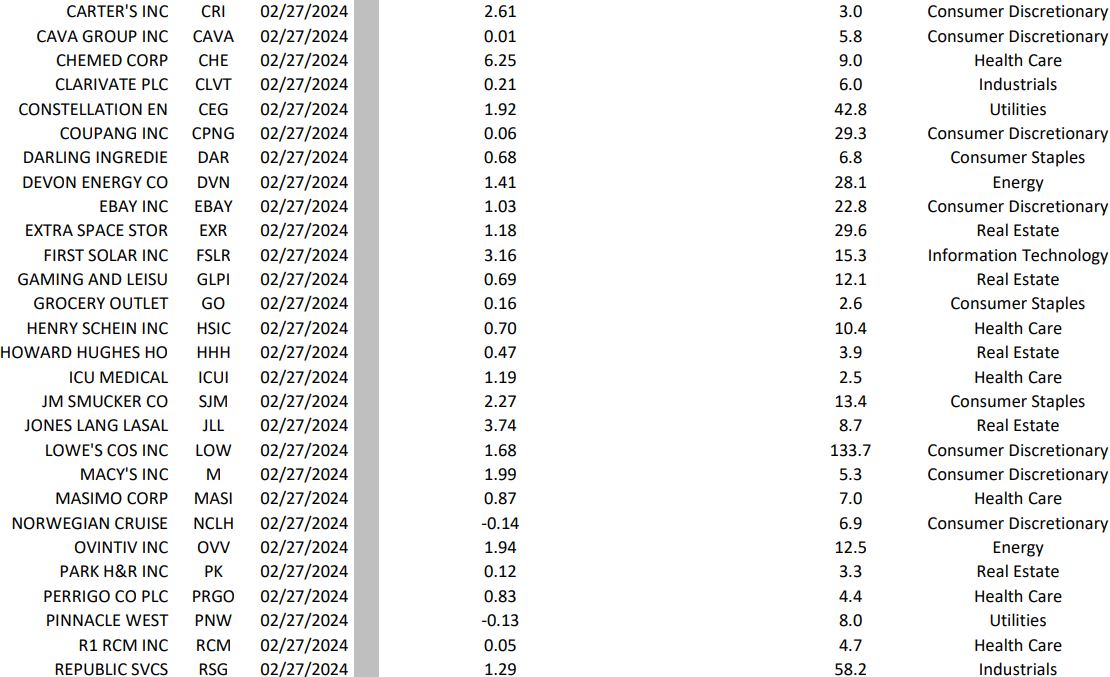

Key earnings reports this week:

Monday

- Domino’s Pizza (DPZ)

- Pilgrim’s Pride (PPC)

- Zoom Video Co. (ZM)

Tuesday

- Agilent Technology (A)

- Autozone (AZO)

- eBay Inc. (EBAY)

- JM Smucker Co. (SJM)

- Lowe’s Co. (LOW)

- Macy’s (M)

- Norwegian Cruise (NCLH)

Wednesday

- Advanced Auto Parts (AAP)

- AMC Entertainment (AMC)

- Monster Beverage (MNST)

- Salesforce Inc. (CRM)

- Snowflake Inc. (SNOW)

- TJX Cos (TJX)

Thursday

- Best Buy Inc. (BBY)

- Hewlett Packard Enterprises (HPE)

Over a 30-year career as a sell side analyst, John covered the structured finance and credit markets before serving as a corporate market strategist. In recent years, he has moved into a global strategist role.