Summary

- We see little sign that the year-long slump in the industrial sector will lift in coming months. Commodity tech companies, rail companies, and materials suppliers mostly report tepid demand for their products.

- One bright spot is consumer staples, where major companies report robust outlooks on rising prices and volumes.

- Tech companies plugged into the AI ecosystem are also optimistic.

- The key focus is on five of the ‘Magnificent Seven’ that report this week, including Alphabet, Amazon, Apple, Meta, and Microsoft.

- Other key bellwethers are General Motors, United Parcel Service, Advanced Micro Devices, and Qualcomm.

Market Implications

- A Magnificent Seven stumble will probably represent an opportunity to add to positions.

- Earnings to date appear consistent with 2024 GDP growth in the 1.5-2% range.

What We Learned Last Week

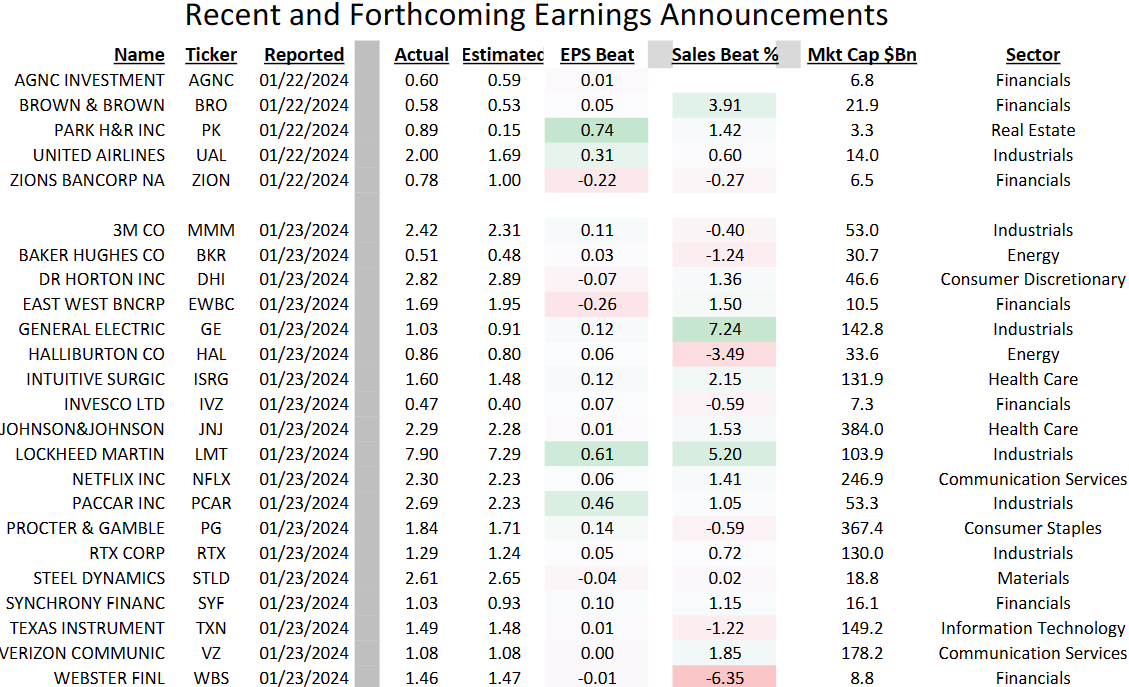

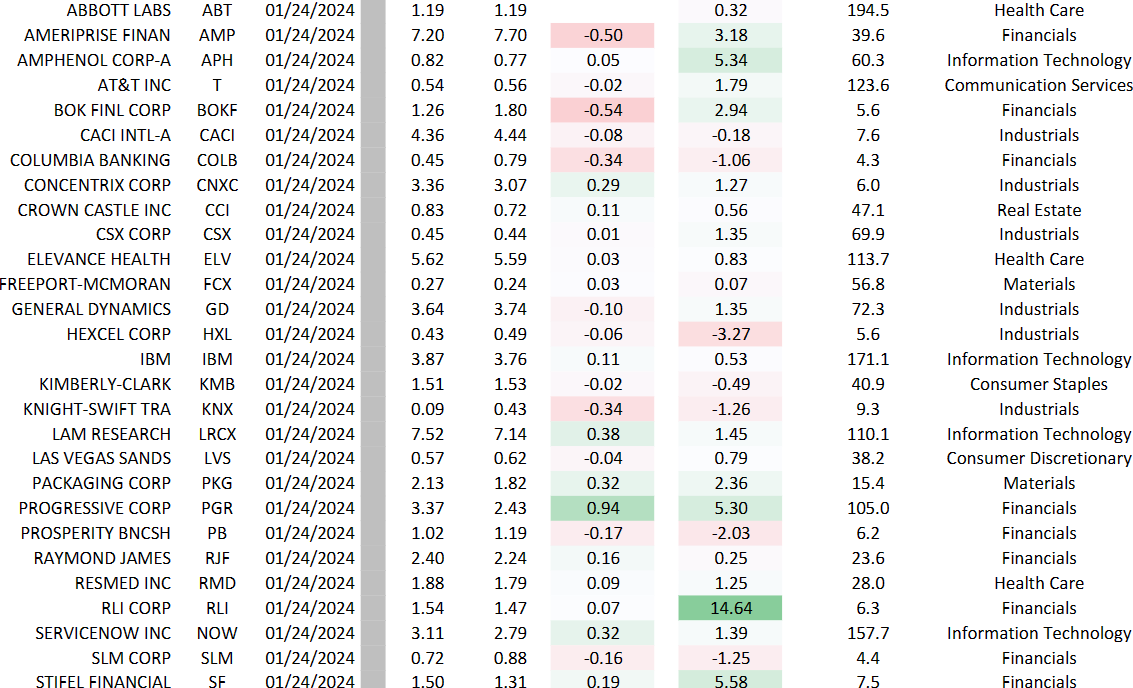

The number one message from a scattershot of company earnings is that industrial America is still in the doldrums. Companies that sell to manufacturing and industrial companies mostly report a tepid outlook in coming months.

- Texas Instruments (TXN) and Intel (INTC), suppliers of commodity semiconductors used in PCs, phones, autos, washing machines, doorbells, blenders, etc – see little sign of rising demand for their products. Their customers are still working off inventories or see limited demand for their products.

- Rail companies CSX (CSX) and Norfolk Southern (NSC) expect only modest increases in revenue and earnings in 2024. There was a pickup in intermodal traffic in December due to holiday shopping activity but it is uncertain whether that will continue. Another issue is declining coal shipments – good news for people concerned about carbon emissions.

- Companies in the materials sector (e.g., Sherwin Williams (SHW), Dow Inc. (DOW), and DuPont de Nemours (DD)) likewise still await a demand resurgence from industrial customers.

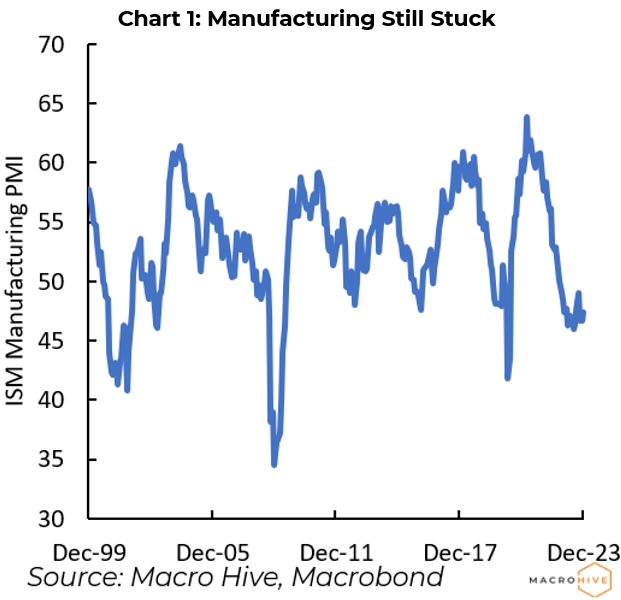

Overall, these anecdotes support the ISM Purchasing Managers Index for manufacturing, which has been below 50 for over a year (Chart 1).

Fortunately, most of these companies posted beats. But this was due to low expectations and tough cost controls rather than rising business volume.

Green shoots? One notable exception to this trend was Packaging Corp. (PKS), which makes container board. Another was United Rental Inc. (URI), which rents out a wide range of equipment. Both provided solid outlooks for 2024. To some extent, this reflects leadership in their respective sectors. But they could also be small green shoots too. We may get more colour on Thursday when ISM updates its PMI Manufacturing Index.

Manufacturing is a relatively small part of the US economy, so these gloomy outlooks do not spell recession risks on the horizon.

The Winners Are…

One bright spot was the consumer staples sector. Most, including Procter and Gamble (PG), Colgate Palmolive (CL), and McCormick and Co. (MKC), report solid beats and outlooks reflecting rising prices and volume.

Tech companies plugged into the AI ecosystem (e.g., Lam Research (LAM) and Service Now (NOW)) also reported solid beats and outlooks. That highlights the growing divide between the haves and have-nots in the tech sector.

The Week Ahead

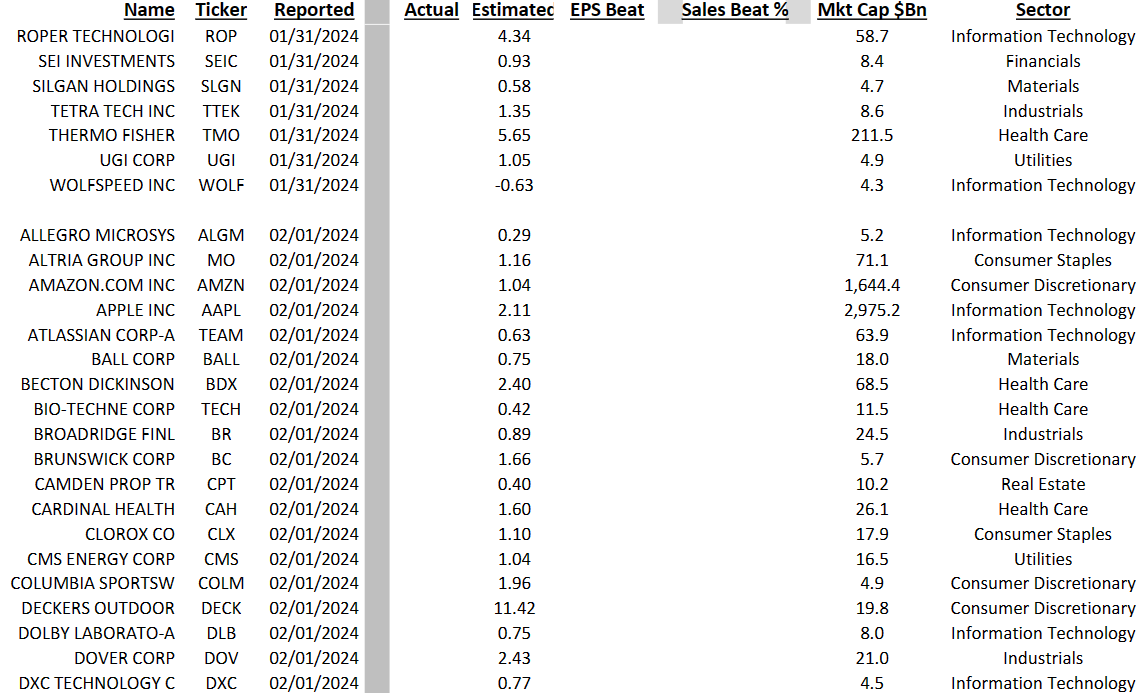

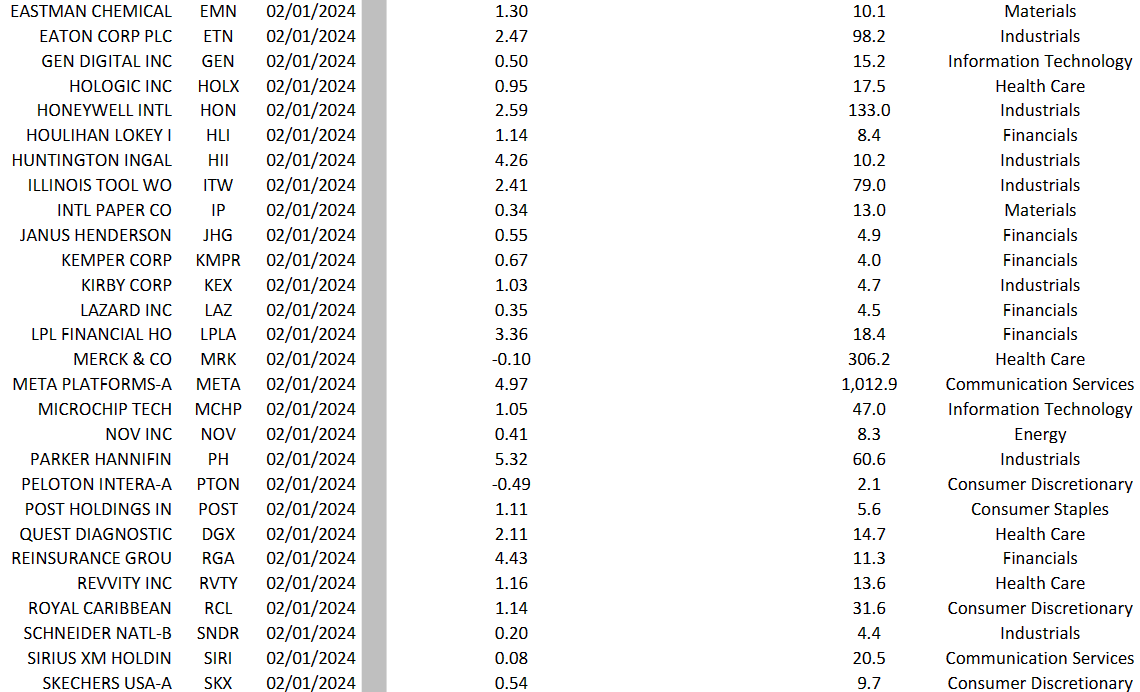

Focus is on the mega-tech sector, as five of the ‘Magnificent Seven’ report – Alphabet (GOOG), Amazon (AMZN), Apple (APPL), Meta (META), and Microsoft (MSFT). Other tech notables are Qualcom (QCOM) and Advanced Micro Devices (AMD). The burning question is whether their earnings and outlooks support the rally in their shares.

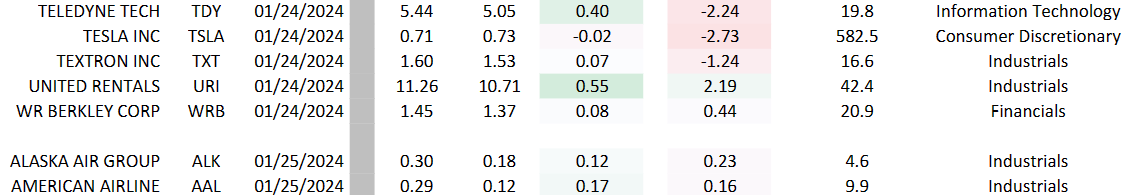

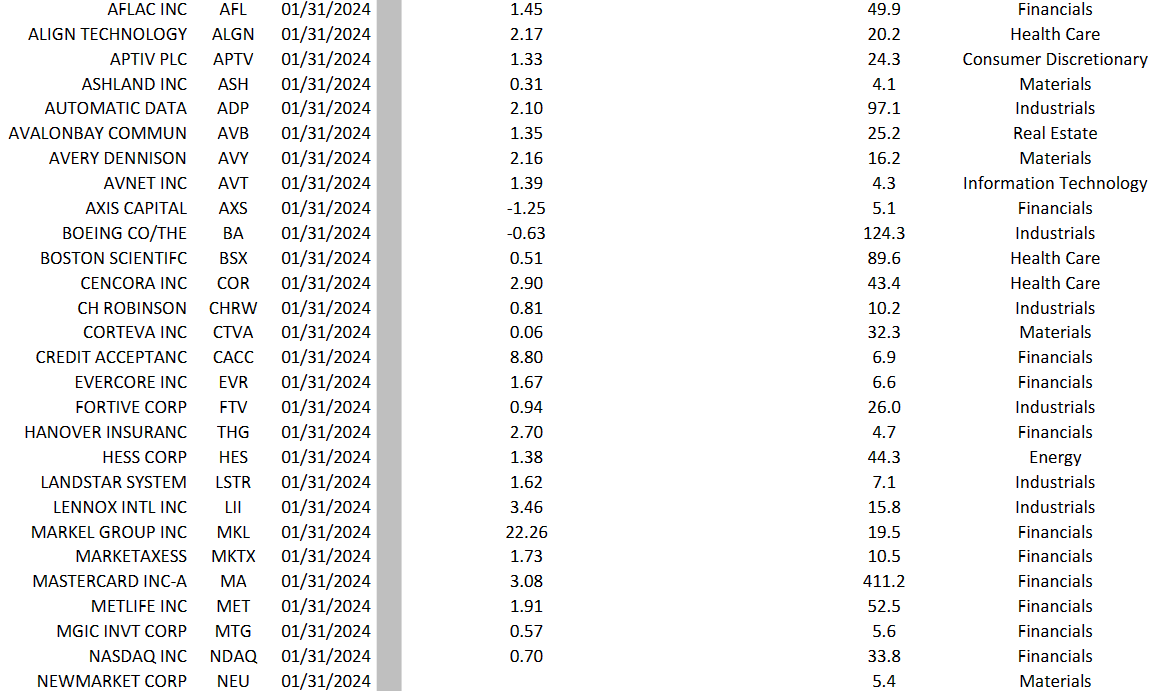

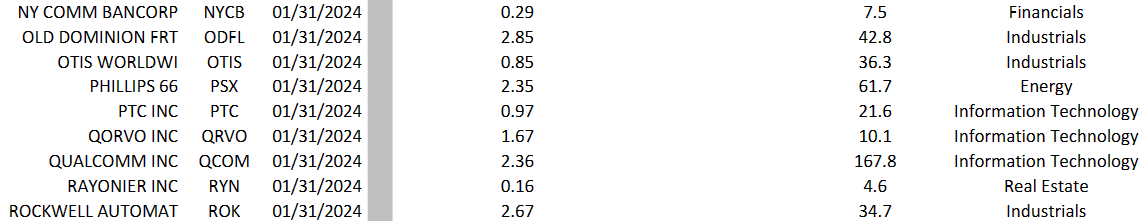

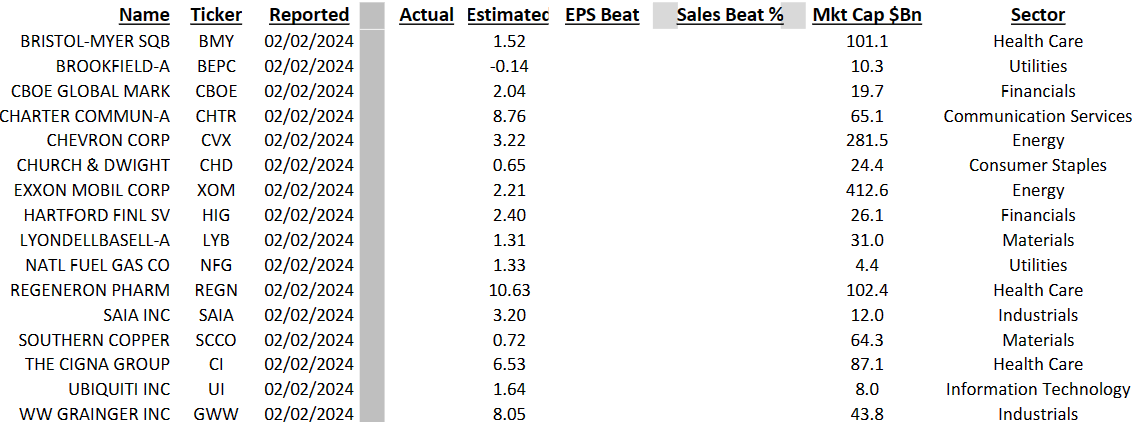

Separately, some 165 companies in our Russell 1000 universe report. Notable names include General Motors (GM), United Parcel Service (UPS), Boeing Co. (BA), Royal Caribbean (RCL), and Exxon Mobil (XOM).

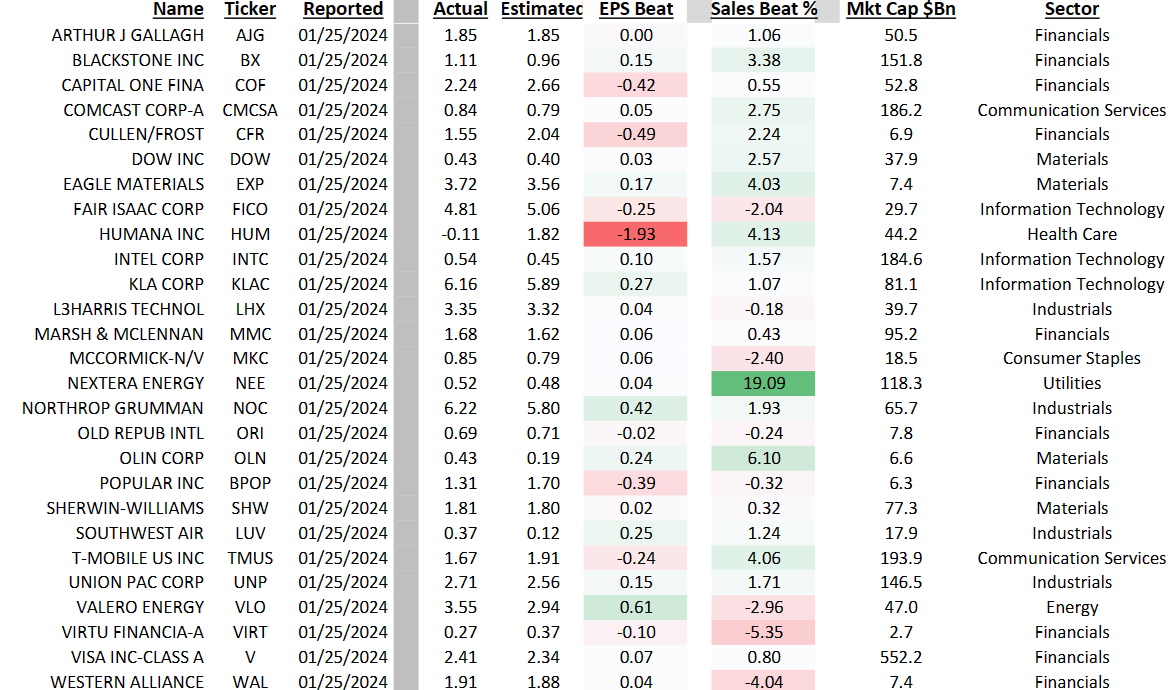

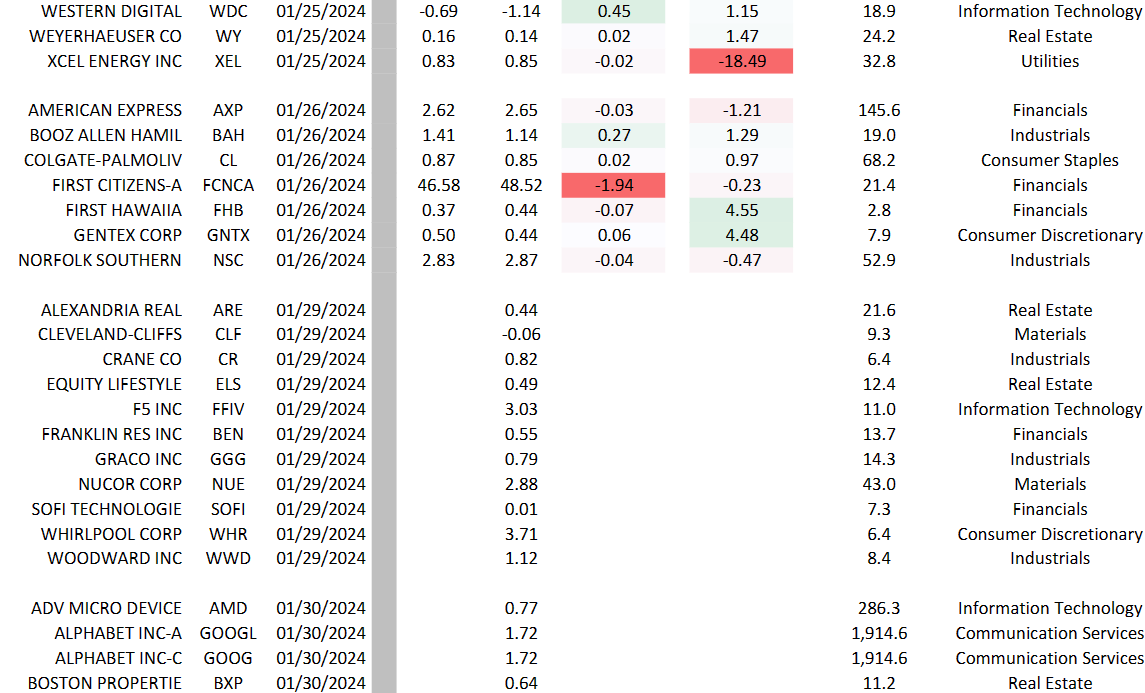

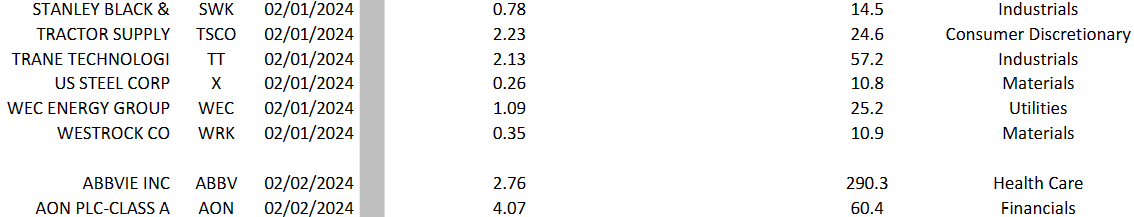

Key company reports this week:

Monday

- Nucor Corp. (NUE)

- Whirlpool Corp. (WHR)

Tuesday

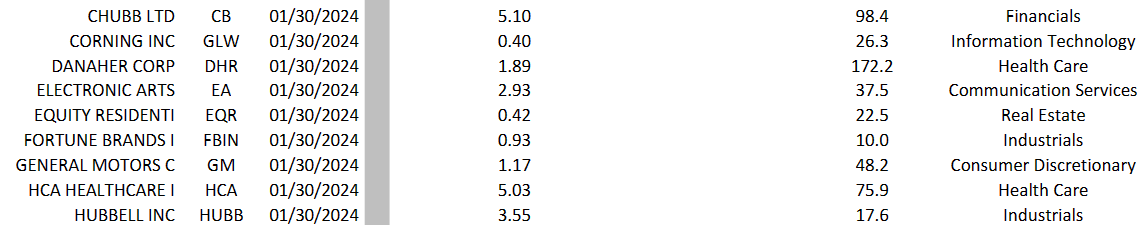

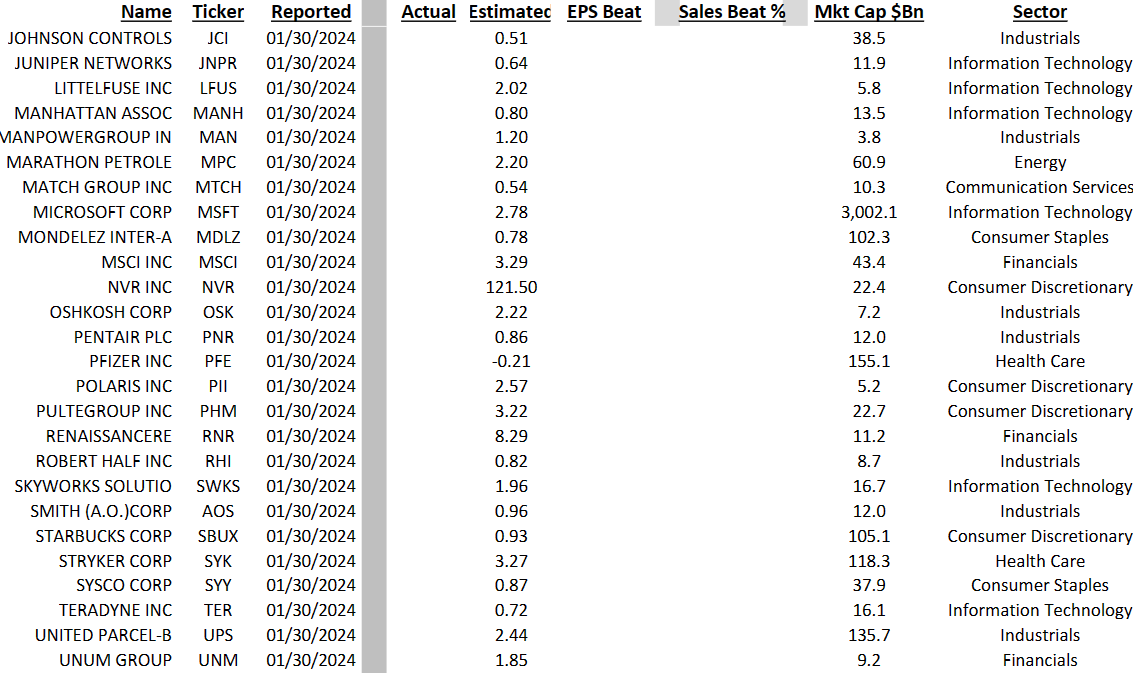

- Advanced Micro Devices (AMD)

- Alphabet (GOOG)

- Corning Glassworks (GLW)

- General Motors (GM)

- Johnson Controls (JCI)

- Microsoft (MSFT)

- Pfizer Inc. (PFE)

- United Parcel Service (UPS)

Wednesday

- Boeing Co (BA)

- Metlife Inc. (MET)

- Qualcomm Inc (QCOM)

Thursday

- Amazon (AMZN)

- Apple Inc. (APPL)

- International Paper (IP)

- Meta Inc. (META)

- Royal Caribbean (RCL)

Friday

- Chevron Corp. (CVX)

- Exxon Mobil (XOM)

Over a 30-year career as a sell side analyst, John covered the structured finance and credit markets before serving as a corporate market strategist. In recent years, he has moved into a global strategist role.