Summary

- AI may be the hottest show in town (after Taylor Swift), but much of ‘Corporate America’ appears in no hurry to book tickets – as in ramping up AI-related investment. That will likely be a 3-5-year process.

- Still, many companies that provide AI infrastructure have handily outperformed the NASDAQ 100 (NDX) index over the past 15 months since ChatGPT debuted. They will likely continue to.

- Surprisingly, Microsoft and Alphabet have only performed roughly in line with the NDX, despite massive investments in AI software.

- Whether they can outperform the index may depend on whether AI simply enhances their legacy businesses or opens new avenues.

Market Implications

- We are bullish on many companies that provide AI infrastructure. We like Nvidia, Advanced Micro Devices, Servicenow, and ASML.

- Many solid companies such as IBM, Oracle, Qualcomm, and Salesforce, will be key players too but may have difficulty outperforming the NDX.

- Investors can also gain exposure to the sector through the ETFs SOXQ and SOXX.

AI Hype Versus Reality

For all the hoopla about AI, there are few signs that companies are actually spending hard dollars to develop or implement the technology, according to The Economist.

So how are companies in and around the AI ecosystem faring? And what are their prospects if companies prove slow to adopt AI technology?

To answer the first question – quite well, thank you.

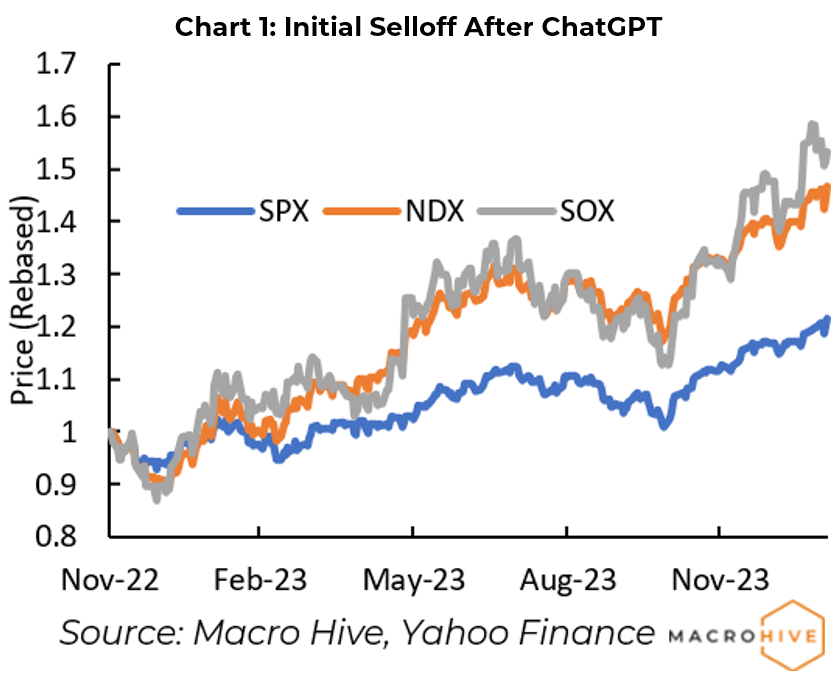

At a broad index level, the NDX has outperformed the S&P 500 (SPX) by 21% since ChatGPT’s release in November 2022, and the Philadelphia Semiconductor Index (SOX) leads NDX 5% (Chart 1).

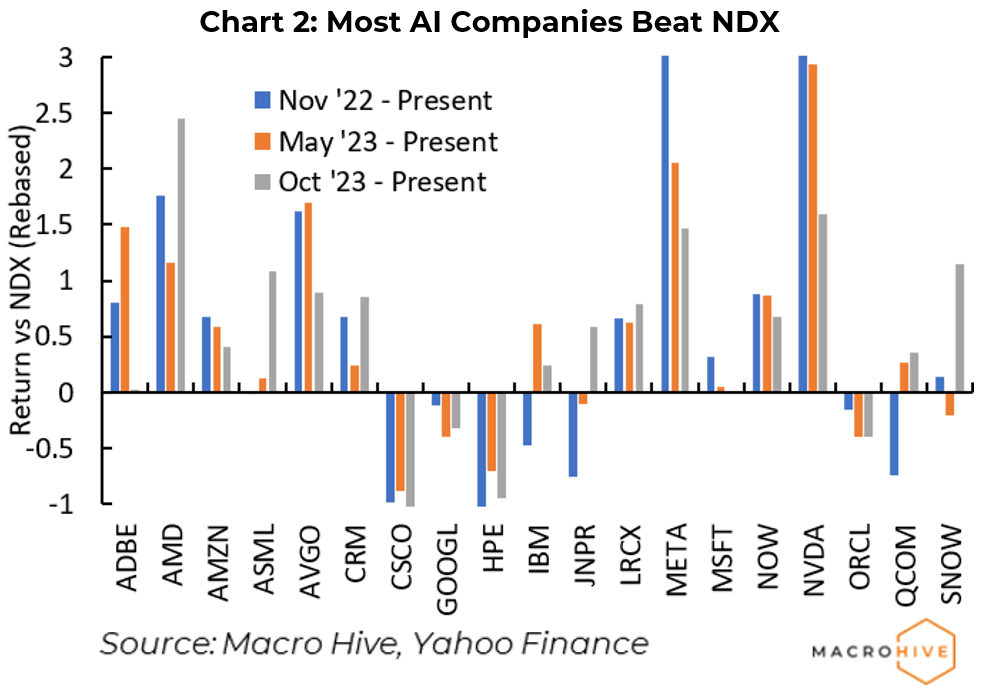

We selected a group of 19 tech companies in the NDX and SPX active in developing AI-related tech – or planning to do so (Table 2). We divide the AI era into three periods:

- 30 November 2022: ChatGPT release date.

- 25 May 2023: Nvidia releases an extraordinary earnings beat and forecast.

- 27 October 2023: the latest tech rally commences.

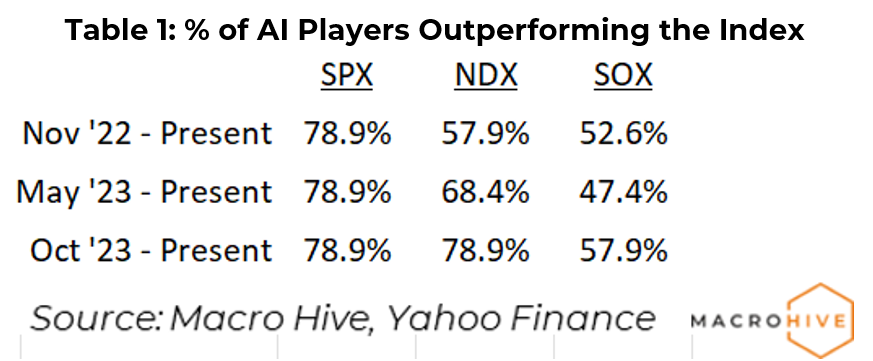

We then look at company equity returns relative to NDX over these periods (Chart 2 and Table 1).[1] Most companies exceeded the SPX and NDX, especially in the most recent period when 79% of our sample outperformed. The laggards are old-line tech companies Cisco (CSCO) and Hewlett Packard Enterprises (HPE), where AI business is still a small part of their product portfolio. Oracle (ORCL) has also struggled, largely because it has overpromised and underdelivered so far.

Two other surprises are Alphabet (GOOGL) and Microsoft (MSFT). They performed only modestly better than NDX over the full study period despite their large and visible investments in AI – MSFT with its large stake in OpenAI and ChatGPT, and GOOGL with Bard.

Hardware vs Software – Many companies providing essential hardware and software to build out AI infrastructure have outperformed.

On the other hand, MSFT and GOOGL must prove that they can develop their AI investment and technology into distinct new businesses rather than simply enhancing their legacy businesses. Their market shares are so large that AI may provide security to maintain their edge, but otherwise is of little value add. If their shares were 30% and AI enhancement could raise these to 50% or 75%, that might be a different story.

Meta has also performed extraordinarily well over this period, mostly because it was recovering from an epic selloff in 2022 when CEO Mark Zuckerberg was spending wildly on his ‘Metaverse’ vision. Meta only caught up and surpassed the NDX last Friday, with a 20% jump after reporting earnings – due more to the performance of its core advertising business than the Metaverse and AI.

The Watson Paradox

Remember Watson? That was IBM’s supercomputer with natural language capabilities that beat Jeopardy champion Ken Jennings in 2011. Despite many upgrades, IBM has been unable to meaningfully monetize Watson. Part of the problem was that preparing Watson for Jeopardy turned out to be the easy part. It proved far more difficult and time-consuming than expected to expand Watson’s capabilities into other areas.

But the broader problem may be that investors perceive little value added in machines that can only do what humans do faster.

No one knows what these machines could do once they move beyond the monkey see/monkey do stage. There are claims AI could boost worker productivity 40-50%. What if the true number is more like 4-5%? Or only 0.4-0.5%? In any case, no one knows how long it may take for that to happen.

We are all fascinated by what these machines can do – but currently more in the sense of Dr Samuel Johnson’s trenchant comment about a dog walking on its hind legs. ‘It is not done well; but then one is surprised to see it done at all.’

Investors are a hopeful lot, but a hard-nosed lot too. GOOGL’s stock price dropped 7.7% after its recent earnings release on a small (and probably statistically meaningless) miss in advertising revenue. Bard’s prospects may be alluring – but hard dollars count for a lot more.

AI Integration Will Take Time

In fairness, The Economist article was not bearish on the prospects for AI investing companies. Its point was that this is likely to be a three-to-five-year process before we see a meaningful uptick. There are several reasons for this.

First, it has been barely more than a year since ChatGPT appeared, moving AI out of the realm of science fiction and into the real world for most people. There has not been enough time to understand the possibilities let alone develop robust business plans. Companies are just beginning to add staff to do just that.

Second, AI technology is extraordinarily expensive. NVDA can charge what the market will bear for its graphics chips, and that is why its revenue has more than doubled in the past six months and is projected to grow over 10% quarterly in coming quarters. This compares to MSFT revenue growing about 7% annually. In coming years, there will be more competition and cheaper, more specialized chips on the market.

Lastly, even if a company has a plan and can afford the technology, it must find and hire people with the expertise to carry it out.

Still, there is little question that AI-related investment will come in time.

Is ‘Mr Market’ Jumping the Gun?

If most of ‘Corporate America’ (and likely ‘Corporate Everywhere’) is likely to adopt and adapt to AI, are companies in our sample getting ahead of themselves?

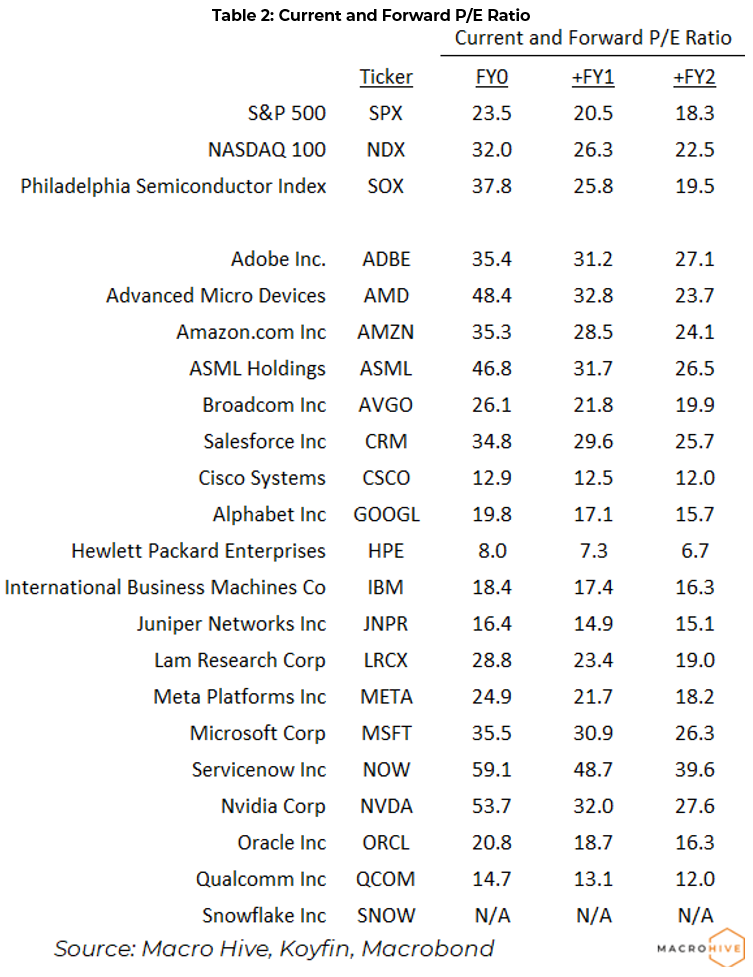

Looking at current and forward P/E ratios, our view now is probably not. Nearly half these companies have P/E ratios below NDX (currently 32) for the current year and the next two years (see Appendix). Highflying NVDA’s current P/E is 53, but that falls to 27 over the next two years given NVDA’s ability to outperform expectations and P/E projections could prove to be high. Other companies with high current P/E ratios are projected to grow into those valuations.

Our sample is mostly established companies building on existing business models. Furthermore, much, if not most, of the current buildout is more to catch up to enable or accommodate existing AI applications. That alone is a large task.

And new growth opportunities will surely emerge as new AI applications are developed (even if most have only a fuzzy idea of what that future is).

All are good reasons to be constructive if not outright bullish on the sector over the medium term. We caution that this sector may be volatile and will underperform in a market downturn. But these should provide attractive buy opportunities.

There are many small companies, private companies, and research laboratories developing AI technology. Many will fail. Some will be acquired at top valuations. The challenge is finding them – then placing your bets.

Where to Invest?

For now, we focus on the major companies in our study universe. Investors may participate in this sector through ETFs or individual stocks. Two ETFs that track the semiconductor sector are SOXQ and SOXX.

At the individual company level, the hottest names are NVDA and Advanced Micro Devices (AMD), with good reason. We also like software vendor Servicenow (NOW) and semiconductor equipment manufacturer ASML.

Companies such as IBM, Oracle (ORCL), Qualcomm (QCOM), and Salesforce (CRM), are all solid plays; we question whether they can outperform the NDX index.

Whether MSFT and GOOGL can break free of the NDX index may depend on whether they are more successful than IBM at monetizing their sizeable AI investments and developing their business models beyond their legacy offerings of the past 20 years.

We have not focused on the commodity semiconductor manufacturers here as they have yet to meaningfully enter the AI space. For now, companies such as Texas Instruments and Intel still face soft demand for their products as customers continue to work off excess inventories.

In addition, there is talk that China could ramp up production of commodity chips to compete with existing manufacturers. These companies may enjoy some unexpected surges when demand recovers, but we see little prospect that they can outperform the NDX sustainably.

Appendix: AI Tech Universe and P/E Ratios

.

Over a 30-year career as a sell side analyst, John covered the structured finance and credit markets before serving as a corporate market strategist. In recent years, he has moved into a global strategist role.

.

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)

- We cut the y-axis off at 3 to not obscure results for most companies. Nvidia (NVDA) and Meta Platforms are up 500% and 430% since November 2022. Meta’s stock was deeply depressed in 2022 due to its heavy (and to-date lackluster) investment in Mark Zuckerberg’s ‘Metaverse’ vision. ↑