Summary

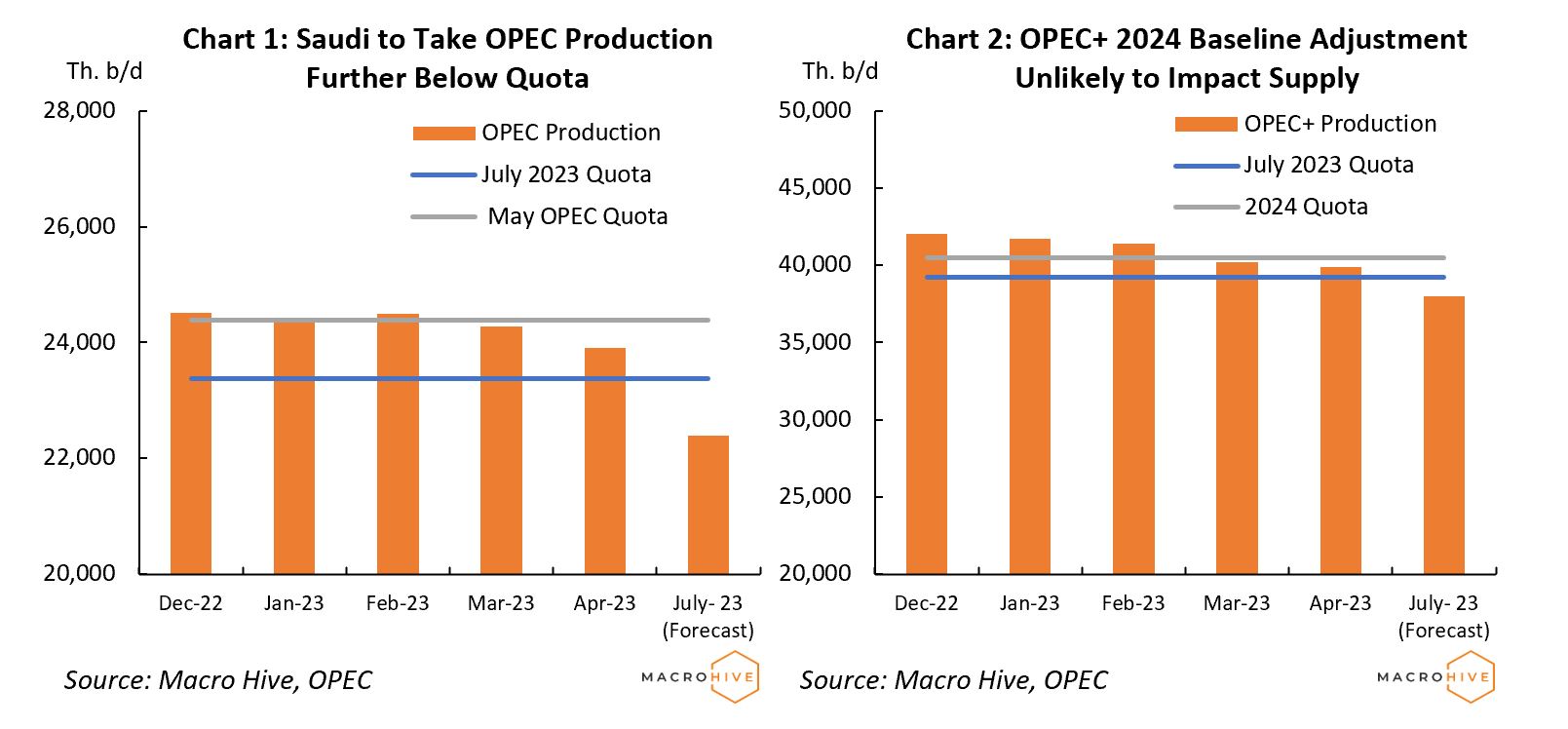

- Saudi Arabia announced they will cut production in July by 1mn b/d, with the potential to extend if required.

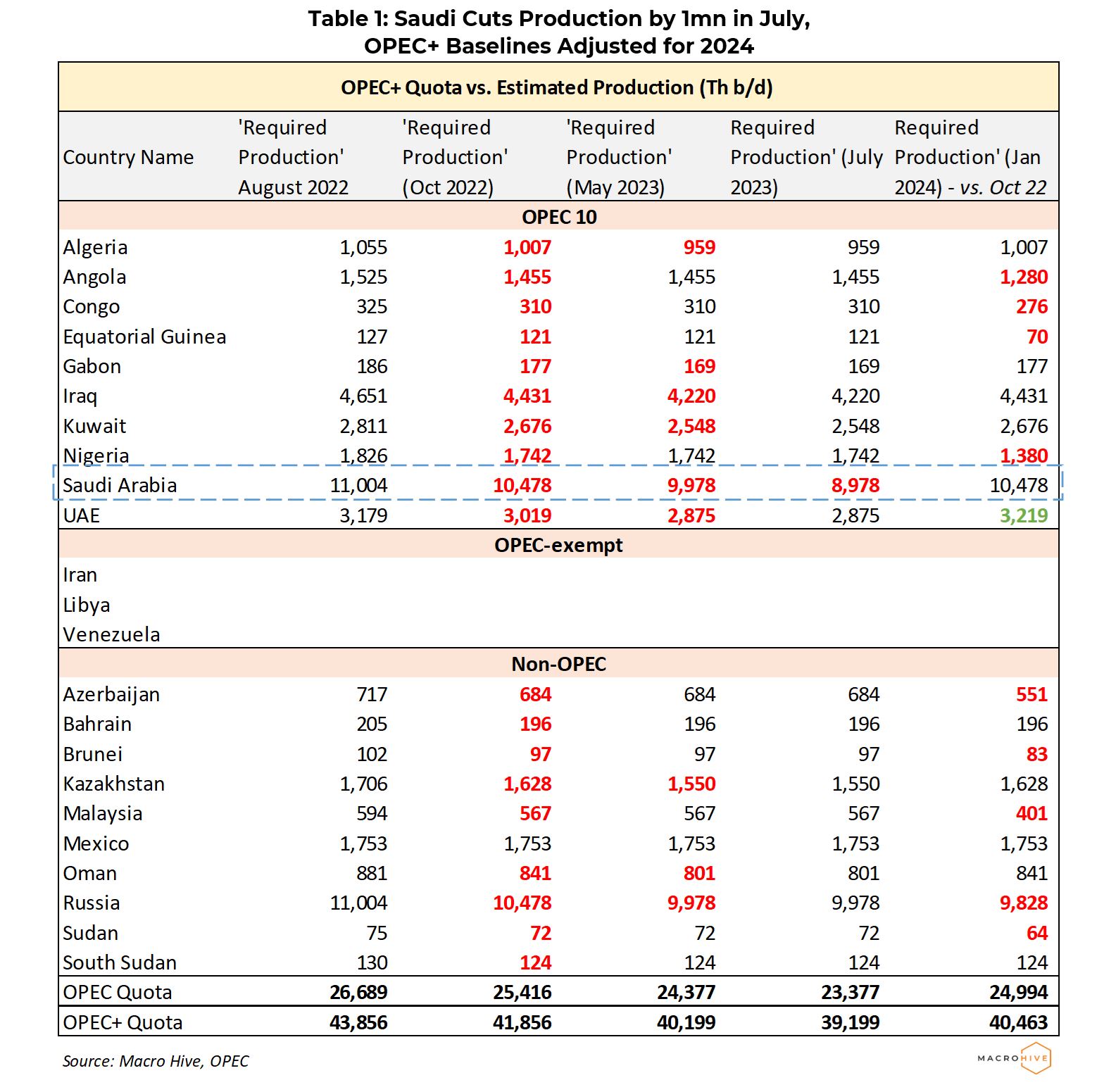

- OPEC+ also agreed to lower the baseline for Russia and select African countries by almost 1.6mn b/d for next year. Meanwhile, it revised the production baseline for the UAE 0.2mn b/d higher. This makes the reduction to the 2024 baseline total 1/4mn b/d.

Market Implication

- We believe Saudi’s cuts are marginally bullish for oil as they attempt to enforce a short-term put on the oil market. However, demand concerns are still likely to drive prices ahead.

- The medium-term impact of the changes is negligible, however, as most countries are already struggling to meet their required production target.

- Should growth hold up this year, OPEC could reverse their production cuts as inventory drawdowns force higher prices.

Saudi Arabia Announces Cuts of 1mn b/d in July

OPEC+ concluded its policy meeting yesterday, making several curious changes:

- Saudi Arabia announced they will cut production in July by 1mn b/d (a further 10% decrease from May’s ‘voluntary reduction’), with the potential to extendif required.

- OPEC+ also said it will extend the production cuts agreed last October for the whole of 2024.

- OPEC+ also agreed to lower the baseline for Russia and select African countries by almost 1.6mn b/d for next year. Meanwhile, it revised the production baseline for the UAE 0.2mn b/d higher. This makes the reduction to the 2024 baseline total 1/4mn b/d.

Baseline adjustments in 2024 make sense to us and are so far marginal. However, despite suggesting in our OPEC Preview that Saudi could commit to shorter-term production cuts, we thought this was unlikely.

Beyond Saudi’s July Cuts, the Oil Market Impact Is Limited

We believe yesterday’s convoluted decision has these objectives:

- Saudi Arabia wants to put a floor on the oil price by punishing speculators for driving a price that does not reflect fundamentals.

We believe that Saudi is returning to active market management by committing to these shorter-term cuts.

- Saudi Arabia wants to ensure OPEC forecasts are not undermined by announcing a production cut for longer than one month, but it is willing to extend should the price remain uncomfortably low. Larger production adjustments this year by Saudi and other OPEC members would undermine forecasts, which show supply deficits in Q3 and Q4.

If OPEC forecasts hold, they will need to increase production later this year. This adds to near-term oil market volatility. Further, Saudi committing to production cuts alone incentivises other entities to cheat – i.e., Russia, leading to a loss in market share the longer cuts are extended. While our forecast for global demand is more bearish than OPEC’s, it still results in supply deficits later this year.

- OPEC+ wants to ensure future production cuts maintain credibility by adjusting baseline forecasts to account for countries unable to meet their existing production quota. The UAE have also been unhappy with their existing quota as they have invested heavily to increase spare capacity but production quotas have not been adjusted to reflect this.

We believe an increase of only 0.2mn b/d is unlikely to ease the UAE’s concerns and believe larger adjustments will be necessary in the future.

How will these adjustments impact actual production? Firstly, Saudi’s 1mn b/d production cut is real and will impact global supply when Saudi’s internal energy consumption tends to rise due to summer demand.

Saudi’s commitment to higher oil prices makes them likely to keep restricting supply in July should the oil price not rise sufficiently or until they see larger inventory drawdowns that should in turn impact price over time.

This leans marginally bullish on oil in the nearer term given Saudi Arabia are trying to raise the OPEC put to below $80 on Brent. However, we still believe demand concerns are likely to drive the oil price ahead.

Could the market try to challenge them in the near term? Yes. But if demand holds up, we think this is likely a losing battle.

Also, should oil prices remain below $80 on Brent, Saudi Arabia will take a large hit to revenues over time. For instance, taking the pre-cut oil price of $74 a barrel, this takes Saudi Arabia’s total oil revenues to approximately $770mn a day – assuming all barrels produced are sold into the market. After the production cut, a price exceeding $85 a barrel is required to reach this amount.

The medium-term (Q4 and next year) impact from these changes are negligible for three reasons.

- Should OPEC forecasts hold, it must reverse existing production cuts to prevent global inventories from falling precipitously to dangerous levels in Q4 (call on OPEC).

- OPEC are still underproducing against next year’s revised baseline.

- Should we enter a global recession, larger production cuts are inevitable as demand falls. But further production cuts absent a recession are even less likely given Saudi has already taken a standalone hit to market share.