This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

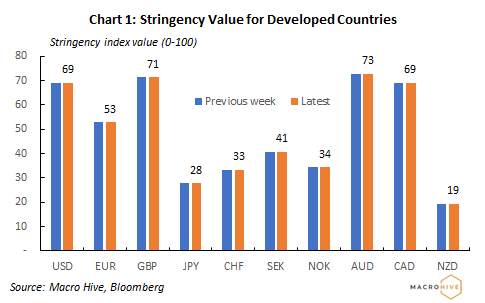

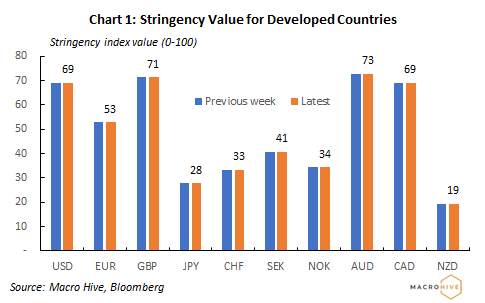

Stringency indices are unchanged across developed and developing countries (Charts 1, 2). The US, UK and Canada remain significantly above their index averages for the pandemic, symbolic of persisting pressures. Australia is the only country on an upward trajectory in its stringency index (Chart 3), which coincides with recent news on a virus surge.

In the developing world, China, the Philippines and Colombia have the largest index values. All South American countries have indices at, or close to, their highest levels. Hong Kong and Taiwan are the only countries with a stringency value below their pandemic average. Hong Kong did, however, announce school closures last Friday, and thus a score rise may ensue.

Thailand and Indonesia have been following a steady decline in their indices. The former has seen infection rates dissipate and have allowed the arrival of up to 200 foreign visitors a day. Indonesia, on the other hand, has struggled to contain the virus and infections have yet to reach their peak.

For more information see Macro Hive’s COVID-19 Tracker.

Bilal Hafeez is the CEO and Editor of Macro Hive. He spent over twenty years doing research at big banks – JPMorgan, Deutsche Bank, and Nomura, where he had various “Global Head” roles and did FX, rates and cross-markets research.

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)