This article is only available to Macro Hive subscribers. Sign-up to receive world-class macro analysis with a daily curated newsletter, podcast, original content from award-winning researchers, cross market strategy, equity insights, trade ideas, crypto flow frameworks, academic paper summaries, explanation and analysis of market-moving events, community investor chat room, and more.

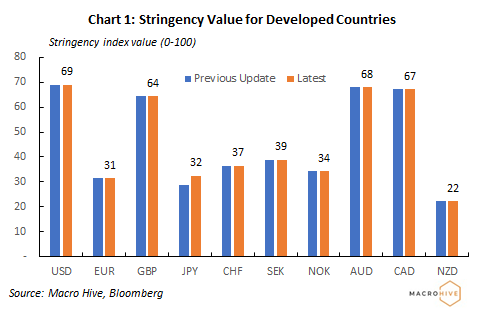

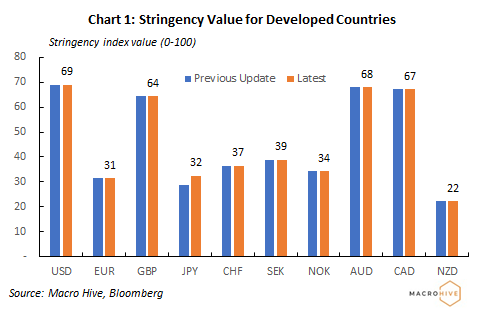

Across developed countries, Japan’s stringency value is the only one to have moved since our last report (Chart 1). The index value, a measure of government action, has moved above the country’s long-term average and comes on the back of a rise in the number of COVID-19 cases. New Zealand and Europe are the lowest scorers on the list.

In developing countries, index values remain high, with an average value of 60.3 (vs 46.4 in developed countries). South Africa’s score has fallen (Chart 2), but remains above the country’s average. Turkey and Malaysia are the only two other countries to have seen a fall in their weekly averages (Chart 3).

For more information, follow our daily COVID Tracker.

Bilal Hafeez is the CEO and Editor of Macro Hive. He spent over twenty years doing research at big banks – JPMorgan, Deutsche Bank, and Nomura, where he had various “Global Head” roles and did FX, rates and cross-markets research.

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)